China Water-based Coating Industry Report, 2014-2018

-

Aug.2015

- Hard Copy

- USD

$2,250

-

- Pages:92

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZLC022

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,450

-

So far, China has become the world's largest coating production and consumption country. In 2014, China’s coating output reached 16,482 kt, accounting for 38% of the global total and consisting of 5,357 kt of construction coatings and 11,125 kt of industrial coatings (including 1,780 kt of automobile coatings).

Despite rapid development, China’s coating industry is still at the initial stage, with a low penetration rate compared with developed countries. In 2014, China’s water-based coating production approximated 1,648 kt, occupying 10% of total coatings, and the market size totaled around RMB46.48 billion. Driven by good policies, especially the Notice of Taxation on Battery and Coating Consumption issued by the State Administration of Taxation, China’s water-based coatings are expected to develop at a fast pace, and the penetration rate will be improved.

China’s water-based coating market is now dominated by international brands represented by BASF, Axalta and AkzoNobel. Moreover, these major international brands are still expanding their water-based coating capacities in China to further enhance competitiveness.

In January 2014, Axalta invested USD50 million in the construction of a 25 kt/a quality water-based coatings plant in Shanghai. The plant was to be put into operation in 2015. In November 2014, Akzo Nobel Swire Paints (Chengdu) Ltd started its water-based coating project, and the first phase worth RMB360 million is to be completed in 2015. In May 2015, BASF announced to invest RMB1.06 billion in expanding a 79.5 kt/a automotive coating project, including 9.5 kt/a waterborne colored paint, 5 kt/a solvent-based undercoat, 25 kt/a varnish, and 40 kt/a diluent, expected to go into operation in 2017.

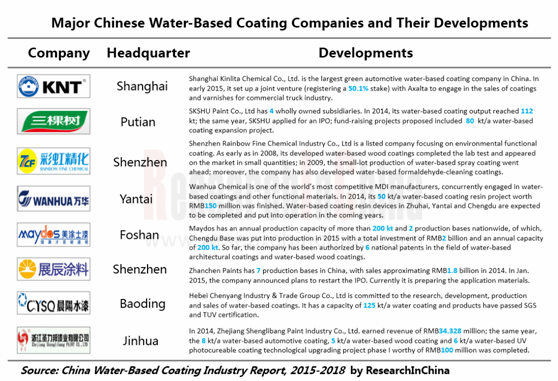

In contrast, the Chinese water-based coating manufacturers are less competitive, with the representative enterprises including Shanghai Kinlita Chemical Co., Ltd. (KNT), SKSHU Paint Co., Ltd, Shenzhen Rainbow Fine Chemical Industry Co., Ltd. and Zhanchen Paints Co., Ltd.

As one of the leading water-based coating producers in China, KNT successfully launched 1-generation two-component cathodic electrodeposited coating in 1998, making it the only enterprise with proprietary brand that mass produces cathodic electrodeposited coatings (with an annual output of over 10 kt). In 2015, KNT, together with a subsidiary of Axalta, established a joint venture, in which a 50.1% stake is held by KNT. The new joint venture is mainly engaged in sales of paints and coatings for commercial trucks.

SKSHU has 4 wholly-owned subsidiaries, whose products cover a full range of coating products, including home-decoration coatings, construction coatings, and carpentry paints. In 2014, the company’s water-based coating output totaled 112.5 kt, which generated revenue of about RMB680 million. In the same year, SKSHU filed for an IPO and raised funds to expand an 80 kt/a water-based coating project.

Zhanchen Paints has 7 major production bases nationwide. Up until now, it has obtained 235 rights of invention patent and invention patent application, and has participated in formulating and revising 19 national coating industry standards. In 2014, the company’s revenue approached RMB1.8 billion. In January 2015, the company announced to resume the IPO program, and it is now preparing for the application materials.

China Water-based Coating Industry Report, 2015-2018 is mainly concerned with the following:

Development of global water-based coating industry, including development status market size, etc.;

Development of global water-based coating industry, including development status market size, etc.;

Development of China’s water-based coating industry, including development status, related policies, market size, import and export, competition pattern, etc.;

Development of China’s water-based coating industry, including development status, related policies, market size, import and export, competition pattern, etc.;

Forecast and outlook of China’s water-based coating industry, operation of major enterprises, as well as development of upstream and downstream sectors;

Forecast and outlook of China’s water-based coating industry, operation of major enterprises, as well as development of upstream and downstream sectors;

Operation and water-based coating business of top 10 players in China.

Operation and water-based coating business of top 10 players in China.

1 Overview

1.1 Definition

1.2 Characteristics

2 Development of Global Water-based Coating Industry

2.1 Status Quo

2.2 Market Size

3 Development of China’s Water-based Coating Industry

3.1 Status Quo

3.2 Policies

3.3 Market Size

3.4 Import and Export

3.4.1 Import

3.4.2 Export

3.5 Competition Pattern

4 Development of Upstream and Downstream Sectors of China’s Water-based Coating Industry

4.1 Upstream Sectors

4.1.1 Titanium Dioxide

4.1.2 Resin

4.2 Downstream Sectors

4.2.1 Construction

4.2.2 Automobile

4.2.3 Furniture

5 Major Enterprises

5.1 Shanghai Kinlita Chemical Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Supply and Marketing

5.1.6 R&D and Investment

5.1.7 Water-based Coating Business

5.1.8 Forecast and Outlook

5.2 Shenzhen Rainbow Fine Chemical Industry Co., Ltd

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Supply and Marketing

5.2.6 R&D and Investment

5.2.7 Water-based Coating Business

5.2.8 Forecast and Outlook

5.3 SKSHU Paint Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 R&D and Investment

5.3.6 Supply and Marketing

5.3.7 Water-based Coating Business

5.3.8 Forecast and Outlook

5.4 Wanhua Chemical Group Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 R&D and Investment

5.4.6 Water-based Coating Business

5.4.7 Forecast and Outlook

5.5 Guangdong Maydos Building Materials Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Water-based Coating Business

5.5.6 Forecast and Outlook

5.6 Chongqing Sanxia Paints Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Supply and Marketing

5.6.6 R&D

5.6.7 Water-based Coating Business

5.6.8 Forecast and Outlook

5.7 Zhanchen Paints Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.8 Hebei Chenyang Industry & Trade Group Co., Ltd.

5.8.1 Profile

5.8.2 Water-based Coating Business

5.8.3 Chenyang Waterborne Paint

5.9 Zhejiang Shenglibang Paint Industry Co., Ltd.

5.9.1 Profile

5.9.2 Operation

5.9.3 Development

5.9.4 Water-based Coating Business

5.10 Carpoly Chemical Group Co., Ltd.

5.10.1 Profile

5.10.2 Operation

5.10.3 Water-based Coating Business

6 Forecast and Outlook

6.1 Outlook of Water-based Coating Industry

6.1.1 Prospects

6.1.2 Trends

6.2 Business Operation Comparison

6.2.1 Revenue

6.2.2 Net Income

6.2.3 Gross Margin

Characteristics of Water-based Coating vs. Solvent-based Coating

Structure of Water-based Coating vs. Solvent-based Coating

Advantages and Disadvantages of Water-based Coating

Comparison of Various Water-based Coatings

Global Coating Market Size, 2011-2014

Global Coatings Demand Structure by Sector, 2014

Revenue of Top 10 Global Coating Enterprises, 2014

Global Coating Output and YoY Growth, 2011-2014

China’s Coating Output and YoY Growth, 2006-2015

Apparent Consumption and YoY Growth of Coatings in China, 2006-2014

China’s Coating Output by Type, 2006-2014

Product Mix of China’s Coating Industry by Type, 2006-2014

Output and YoY Growth of Automobile Coatings in China, 2006-2014

China’s Water-based Coating Output, YoY Growth, and % of Total Coatings, 2009-2014

China’s Policies on Coating Industry, 2009-2015

Market Size of China’s Coating Industry, 2009-2014

Product Demand Structure of China’s Coating Industry by Sector, 2014

China’s Water-based Coating Market Size and YoY Growth, 2009-2014

Import Volume and Value of Coating, Printing Ink, Pigment, etc. in China, 2010-2014

Import Volume and Value of Acrylic Water-based Coating in China, 2010-2014

Import Volume and Value of Other Water-based Coatings in China, 2010-2014

Export Volume and Value of Coating, Printing Ink, Pigment, etc. in China, 2010-2014

Export Volume and Value of Acrylic Water-based Coating in China, 2010-2014

Export Volume and Value of Other Water-based Coatings in China, 2010-2014

Output and YoY Growth of Titanium Dioxide in China, 2009-2014

Output and YoY Growth of Synthetic Resin and Copolymer in China, 2009-2014

Output and YoY Growth of Polypropylene Resin in China, 2009-2015

Output and YoY Growth of PVC Resins in China, 2009-2015

Total Output Value and YoY Growth of China’s Construction Industry, 2009-2015

China’s Housing Floor Space and YoY Growth, 2009-2014

Ownership and YoY Growth of Automobiles in China, 2009-2015

Output and YoY Growth of Automobiles in China, 2009-2015

Revenue and Growth Rate of Chinese Automobile Enterprises, 2011-2015

Revenue and Growth Rate of Chinese Furniture Manufacturers, 2011-2015

Output and YoY Growth of China’s Furniture Industry, 2009-2015

Revenue and Net Income of KNT, 2010-2015

Revenue Breakdown of KNT by Product, 2010-2014

Revenue Structure of KNT by Product, 2010-2014

Revenue Breakdown of KNT by Region, 2010-2014

Revenue Structure of KNT by Region, 2010-2014

Gross Margin of KNT, 2010-2015

Gross Margin of KNT by Product, 2010-2014

Output, Sales Volume, and Inventory of KNT, 2011-2014

KNT’s Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2014

KNT’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2014

R&D Costs and % of Total Revenue of KNT, 2010-2014

Revenue and Net Income of KNT, 2014-2018E

Revenue and Net Income of Rainbow Fine Chemical, 2010-2015

Revenue of Rainbow Fine Chemical by Product, 2010-2014

Revenue Structure of Rainbow Fine Chemical by Product, 2010-2014

Revenue of Rainbow Fine Chemical by Region, 2010-2014

Revenue Structure of Rainbow Fine Chemical by Region, 2010-2014

Gross Margin of Rainbow Fine Chemical, 2010-2015

Gross Margin of Rainbow Fine Chemical, 2010-2014

Rainbow Fine Chemical’s Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2014

Rainbow Fine Chemical’s Revenue from Top 5 Clients and % of Total Revenue, 2010-2014

Output and Sales volume of Rainbow Fine Chemical by Sector, 2013-2014

R&D Costs and % of Total Revenue of Rainbow Fine Chemical, 2010-2014

Revenue and Net Income of Rainbow Fine Chemical, 2014-2018E

SKSHU’s Major Subsidiaries

Revenue and Net Income of SKSHU, 2011-2014

SKSHU’s Revenue by Product, 2011-2013

Revenue Structure of SKSHU by Product, 2011-2013

SKSHU’s Revenue by Region, 2011-2013

SKSHU’s Revenue Structure by Region, 2011-2013

SKSHU’s Gross Margin, 2011-2013

SKSHU’s Gross Margin by Product, 2011-2013

Gross Margin of SKSHU by Region, 2011-2013

R&D Costs and % of Total Revenue of SKSHU, 2011-2013

SKSHU’s Proposed Fund-raising Projects and Their Investment

SKSHU’s Output and Sales by Product, 2011-2013

Number of SKSHU’s Distributors, 2011-2013

SKSHU’s Procurement from Top 5 Suppliers and % of Total Procurement,2011-2013

SKSHU’s Revenue from Top 10 Clients and % of Total Revenue, 2011-2013

SKSHU’s Water-based Coating Capacity, 2011-2013

Water-based Coating Revenue and Growth Rate of SKSHU, 2011-2014

Revenue and Net Income of SKSHU,2014-2018E

Development Goal and Main Products of Wanhua Chemical Business Division

Revenue and Net Income of Wanhua Chemical, 2010-2015

Revenue of Wanhua Chemical by Product, 2010-2014

Revenue Structure of Wanhua Chemical by Product, 2010-2014

Revenue of Wanhua Chemical by Region, 2010-2014

Revenue Structure of Wanhua Chemical by Region, 2010-2014

Gross Margin of Wanhua Chemical, 2010-2014

Gross Margin of Wanhua Chemical by Product, 2010-2014

Gross Margin of Wanhua Chemical by Region, 2010-2014

R&D Costs and % of Total Revenue of Wanhua Chemical, 2011-2014

Revenue and Net Income of Wanhua Chemical, 2014-2018E

Revenue and Net Income of Maydos, 2012-2014

Revenue of Maydos by Product, 2012-2014

Revenue Structure of Maydos by Product, 2012-2014

Gross Margin of Maydos, 2012-2014

Revenue and Net Income of Maydos, 2014-2018E

Revenue and Net Income of Sanxia Paints, 2010-2015

Revenue of Sanxia Paints by Region, 2010-2014

Revenue Structure of Sanxia Paints by Region, 2010-2014

Gross Margin of Sanxia Paints, 2010-2015

Sanxia Paints’ Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2014

Sanxia Paints’ Revenue from Top 5 Clients and % of Total Revenue, 2011-2014

Sanxia Paints’ Output, Sales Volume, and Inventory, 2011-2014

R&D Costs and % of Total Revenue of Sanxia Paints, 2011-2014

Revenue and Net Income of Sanxia Paints, 2014-2018E

Zhanchen Paints’ Subsidiaries

Zhanchen Paints’ Major Products and Production Scale

Total Assets, Total Liabilities, Revenue and Net Income of Shenglibang Paint Industry, 2013-2014

Capacity of Shenglibang Paint Industry by Product, 2014

China’s Coating Output, 2014-2018E

Market Size of China’s Coating Industry, 2014-2018E

Output and YoY Growth of China’s Water-based Coating and % of Total Coatings, 2014-2018E

Market Size and YoY Growth of Water-based Coating in China, 2014-2018E

Revenue of Major Chinese Water-based Coating Enterprises, 2010-2015

Net Income of Major Chinese Water-based Coating Enterprises, 2010-2015

Net Profit Margin of Major Chinese Water-based Coating Enterprises, 2010-2015

Gross Margin of Major Chinese Water-based Coating Enterprises, 2010-2015

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...