China Polyether Monomer (MPEG/APEG/TPEG) Industry Report, 2015-2018

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:105

- Single User License

(PDF Unprintable)

- USD

$2,250

-

- Code:

HK065

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

Polyether monomer in the Chinese market mainly refers to methoxy polyethylene glycol (MPEG), allyloxy polyethylene glycol (APEG), tresylated polyethylene glycol (TPEG) and isobutylene alcohol polyoxyethylene ether (HPEG). The field in which polyether monomer finds most application comes to polycarboxylate superplasticizer, whilst a small amount of polyether monomer gets used in daily chemical and pharmaceutical chemical additives and the like. .

In the early development of Chinese polycarboxylate superplasticizer, polyether monomer was represented by MPEG and APEG. From 2009 onwards, the gradual localization of initiator materials reduces the prices of TPEG and HPEG significantly, so that TPEG and HPEG have become mainstream products on the polycarboxylate superplasticizer market. In 2014, TPEG and HPEG seized 95% share of the Chinese superplasticizer market in terms of application.

In the fast-growing Chinese polycarboxylate superplasticizer market, the growth in demand is mainly attributed to the jumping downstream demand and the substitution for the second-generation superplasticizer in recent years. In 2014, polycarboxylate superplasticizer has become a mainstream product in Chinese superplasticizer market, because it accounts for 67.1% of the total superplasticizer demand.

In 2007-2014, China’s polycarboxylate superplasticizer sales volume presented a CAGR of 41.9%, hitting 4.801 million tons in 2014; the demand for polyether monomer approximated 750,000 tons. Driven by the development of China’s economy and infrastructure construction, the demand for polycarboxylate superplasticizer is expected to maintain the growth rate of about 15% in the next few years, which will further propel the demand for polyether monomer.

As epoxy ethane, the main raw material of polyether monomer, cannot be transported over long distances, China’s polyether monomer production is concentrated in main epoxy ethane producing areas, namely East China, Northeast China and North China (particularly East China where most manufacturing enterprises are located).

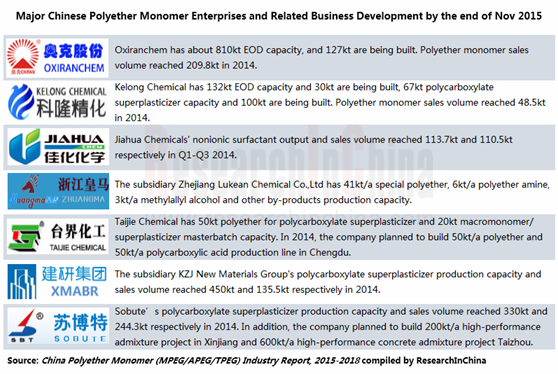

Large Chinese polyether monomer manufacturers -- Liaoning Oxiranchem, Liaoning Kelong Fine Chemical, Zhejiang Huangma, Shanghai Taijie and Jiahua Chemical enjoyed a combined market share of over 60% (in the polycarboxylate superplasticizer market) in 2014. As the world's largest producer of high-performance concrete superplasticizer polyether, Liaoning Oxiranchem sold 210,000 tons of polyether monomer in 2014 and it is building the epoxy ethane derivative capacity of 127,000 tons.

In the polycarboxylate superplasticizer market, there are more than 1,000 manufacturers in China, but most of them are small enterprises focusing on compounding, whereas merely less than 20 ones of them master systematic and mature polycarboxylate superplasticizer concentrate and pumping agent synthesis technologies. In 2014, the top 9 Chinese polycarboxylate superplasticizer companies obtained the market share of 17.1%, especially Jiangsu Sobute and Xiamen Academy of Building Research Group witnessed the highest sales volume of 204,300 tons and 135,500 tons respectively.

China Polyether Monomer Industry Report, 2015-2018 by ResearchInChina contains the followings:

Status quo, market supply & demand, competition pattern, prospects, etc. of Chinese polyether monomer industry;

Status quo, market supply & demand, competition pattern, prospects, etc. of Chinese polyether monomer industry;

Supply & demand, competitive landscape and prices of upstream raw materials such as epoxy ethane, methanol, acrylic acid and the like;

Supply & demand, competitive landscape and prices of upstream raw materials such as epoxy ethane, methanol, acrylic acid and the like;

Operation, polyether monomer business, prospects, etc. of 3 foreign polyether monomer companies and 6 Chinese counterparts;

Operation, polyether monomer business, prospects, etc. of 3 foreign polyether monomer companies and 6 Chinese counterparts;

Operation, superplasticizer business, prospects, etc. of 4 polycarboxylate superplasticizer companies in China.

Operation, superplasticizer business, prospects, etc. of 4 polycarboxylate superplasticizer companies in China.

1. Overview of Polyether Monomer

1.1 Classification and Application

1.2 Industry Chain

2. Development of Polyether Monomer in China

2.1 Status Quo

2.2 Competition Pattern

2.3 Market Price

2.4 Outlook and Forecast

3. Development and Influence of Polyether Monomer Upstream in China

3.1 EO

3.1.1 Market Supply and Demand

3.1.2 Competition Pattern

3.1.3 Market Price

3.2 Methanol

3.2.1 Market Supply and Demand

3.2.2 Market Price

3.3 Acrylic Acid (AA)

3.3.1 Market Supply and Demand

3.3.2 Competition Pattern

3.3.3 Market Price

3.4 Enol

4. Development and Influence of Polyether Monomer Downstream in China

4.1 Polycarboxylate Superplasticizer

4.1.1 Market Supply and Demand

4.1.2 Competition Pattern

4.1.3 Market Price

4.2 Surfactant

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export

5. Major Foreign Polyether Monomer Enterprises

5.1 The DOW Chemical Company

5.1.1 Profile

5.1.2 Operation

5.1.3 Operation of High-Performance Materials and Chemicals Division

5.1.4 Polyether Monomer Business

5.1.5 Development in China

5.2 Clariant International Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Polyether Monomer Business

5.2.4 Business in China

5.3 Lotte Chemical Corporation

5.3.1 Profile

5.3.2 Operation

5.3.3 Polyether Monomer Business

5.3.4 Business in China

6. Major Chinese Polyether Monomer Enterprises

6.1 Liaoning Oxiranchem,Inc.

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D

6.1.6 Polyether Monomer Business

6.1.7 Outlook and Forecast

6.2 Liaoning Kelong Fine Chemical Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R&D

6.2.6 Clients and Suppliers

6.2.7 Polyether Monomer and Superplasticizer Business

6.2.8 Prospects

6.3 Zhejiang Huangma Technology Co., Ltd.

6.3.1 Profile

6.3.2 Polyether Monomer Business

6.3.3 R&D

6.4 Shanghai Taijie Chemical Co., Ltd.

6.4.1 Profile

6.4.2 Polyether Monomer Business

6.5 Jiahua Chemicals Inc.

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Gross Margin

6.5.5 R&D

6.5.6 Major Clients

6.5.7 Polyether Monomer Business

6.6 Nanjing Well Chemical Corp., Ltd.

6.6.1 Profile

6.6.2 Polyether Monomer Business

7. Major Chinese Polycarboxylate Superplasticizer Enterprises

7.1 Jiangsu Sobute New Materials Co., Ltd.

7.1.1 Profile

7.1.2 R&D

7.1.3 Superplasticizer Business

7.2 Xiamen Academy of Building Research Group Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 R&D

7.2.6 Superplasticizer Business

7.2.7 Prospects

7.3 Shandong HuaweiJiancai Building Materials Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Superplasticizer Business

7.4 Shanxi Kaidi Building Materials Co., Ltd.

7.4.1 Profile

7.4.2 Superplasticizer Business

Comparison between Advantages and Disadvantages of Various Polyether Monomers in Superplasticizer Field

Polyether Monomer (MPEG/TPEG/APEG) Industry Chain

Share of Three Polyether Monomers in Chinese Polycarboxylate Superplasticizer Market, 2010-2014

China's Volume of Polyether Monomer Used in Superplasticizer, 2008-2015

Polyether Monomer Related Capacity and Expansion of Major Chinese Enterprises, 2014-2015

Price Trend of Polyether Monomer in China, 2011-2015

China's Volume of Polyether Monomer Used in Superplasticizer, 2014-2018E

China's EO and Commercial EO Capacity (by Company/Region), as of End Nov. 2015

China's EO Apparent Consumption, 2006-2015

China's EO Consumption Structure (by Product), 2014

China's EO Capacity Distribution (by Enterprise), as of Nov. 2015

China's EO Capacity Distribution (by Region), as of end of Nov. 2015

Top Ten EO Enterprises’ Capacity and Proportion in China, as of End of Nov. 2015

Average Market Price of EO (Industrial First-grade) in China, 2007-2015

China's Methanol Capacity, 2007-2015

China's Refined Methanol Output, 2007-2015

China's Refined Methanol Output Structure (by Region), 2014

China's Methanol Import/Export Volume and Foreign-trade Dependence, 2008-2015

Average Market Price of Methanol (First Grade) in China, 2006-2015

Supply & Demand of AA&AE in China, 2008-2015

China's AA&AE Capacity (by Enterprise/Product), as of End of Nov. 2015

Market Price of AA&AE (by Product) in China, 2011-2015

China's Polycarboxylate Superplasticizer Consumption, 2007-2015

Sales Volume and Market Share of Top 9 Polycarboxylate Superplasticizer Manufacturers in China, 2014

Sales and Unit Price of Top 9 Polycarboxylate Superplasticizer Manufacturers in China, 2014

China's AEO Output and Growth Rate, 2006-2015

China's Apparent Consumption and Self-sufficiency Rate of Surfactant AEO, 2008-2015

China's Output of Synthetic Washing Powder and Detergent, 2008-2015

China's Import/Export Volume of Non-ionic Surfactant, 2008-2015

China's Import/Export Unit Price of Non-ionic Surfactant, 2008-2015

Distribution of China's Non-ionic Surfactant Import Sources (by Import Volume), Jan.-Oct. 2015

Distribution of China's Non-ionic Surfactant Export Destinations (by Export Volume), Jan.-Oct. 2015

Revenue and Net Income of Dow, 2011-2015

Sales Structure of Dow (by Division), 2014-2015

Sales and EBITDA of Dow's High Performance Materials & Chemicals Division, 2012-2015

Sales Structure of Dow's High Performance Materials & Chemicals Division (by Product), 2014

Revenue and Net Income of Clariant, 2011-2015

Business Introduction of Clariant by Division

Revenue Structure of Clariant (by Business), 2013-2015

Revenue and EBITDA of Clariant - Care Chemicals, 2012-2015

Revenue and EBITDA of Clariant - Natural Resources, 2012-2015

Main Subsidiaries of Clariant in China, 2014

Business of Clariant's Main Subsidiaries in China, 2014

Revenue and Net Income of LOTTE, 2011-2015

Business Segments and Main Products of LOTTE

Revenue Structure of LOTTE (by Business), 2014

Main Products and Capacity of LOTTE as of 2014

LOTTE's Projects Planned and Under Construction, 2015

Sales and Net Income of LOTTE's Main Subsidiaries in China, 2014

Revenue and Net Income of Liaoning Oxiranchem, 2011-2015

Revenue Breakdown of Liaoning Oxiranchem (by Product), 2013-2015

Revenue Structure of Liaoning Oxiranchem (by Product), 2013-2015

Revenue Breakdwon of Liaoning Oxiranchem (by Region), 2012-2014

Revenue Structure of Liaoning Oxiranchem (by Region), 2012-2014

Gross Margin of Liaoning Oxiranchem (by Product), 2011-2015

R&D Costs and % of Total Revenue of Liaoning Oxiranchem, 2013-2015

R&D Projects of Liaoning Oxiranchem, 2014

Business Positioning Map of Liaoning Oxiranchem

Output and Sales Volume of Liaoning Oxiranchem's Polyether Monomer, 2011-2014

Introduction to EO Deep Processing Related Subsidiaries of Liaoning Oxiranchem, 2014

Revenue and Net Income of EO Deep Processing Related Subsidiaries of Liaoning Oxiranchem, 2014

Progress of Liaoning Oxiranchem's Key Construction Projects as of June. 30, 2015

Capacity of Liaoning Oxiranchem's EO Derivatives, as of Nov.2015

Revenue and Net Income of Liaoning Oxiranchem, 2015-2018E

Revenue and Net Income of Kelong Fine Chemical, 2011-2015

Revenue Breakdown of Kelong Fine Chemical (by Product), 2013-2015

Revenue Structure of Kelong Fine Chemical (by Product), 2013-2015

Revenue Breakdown of Kelong Fine Chemical (by Region), 2013-2015

Revenue Structure of Kelong Fine Chemical (by Region), 2013-2015

Gross Margin of Kelong Fine Chemical (by Product), 2013-2015

R&D Costs and % of Total Revenue of Kelong Fine Chemical, 2013-2015

Kelong Fine Chemical's Revenue from Top 5 Clients and % of Total Revenue, 2012-2014

Name List and Revenue Contribution of Kelong Fine Chemical's Top 5 Clients, 2014H1

Kelong Fine Chemical's Procurement from Top 5 Suppliers and % of Total Procurement, 2012-2014

Name List and Procurement Contribution of Kelong Fine Chemical's Top 5 Suppliers, 2014H1

Output, Capacity and Capacity Utilization of Kelong Fine Chemical's EO Derivatives, 2011-2014

Output and Sales Volume of Kelong Fine Chemical's Polyether Monomer, 2011-2014

Crystalline Silicon Cutting Fluid Output and Sales Volume of Kelong Fine Chemical, 2011-2014

Output, Capacity and Capacity Utilization of Kelong Fine Chemical's Polycarboxylate Superplasticizer Products, 2011-2014

Output and Sales Volume of Kelong Fine Chemical's Polycarboxylate Superplasticizer Concentrates, 2011-2014

Polycarboxylate Superplasticizer Output and Sales Volume of Kelong Fine Chemical, 2011-2014

Average Selling Price of Kelong Fine Chemical's Main Products, 2011-2014

Fundraising Projects of Kelong Fine Chemical, 2014

Revenue and Net Income of Kelong Fine Chemical, 2015-2018E

MPEG Products of Huangma Chemical

APEG Products of Huangma Chemical

MPEGMA Products of Huangma Chemical

MPEG Products of Taijie Chemical

APEG Products of Taijie Chemical

Revenue and Net Income of Jiahua Chemicals, 2011-2014

Revenue Breakdown of Jiahua Chemicals (by Product), 2011-2014

Revenue Structure of Jiahua Chemicals (by Product), 2011-2014

Revenue Breakdown of Jiahua Chemicals (by Region), 2011-2014

Revenue Structure of Jiahua Chemicals (by Region), 2011-2014

Main Business and Gross Margin (by Product) of Jiahua Chemicals, 2011-2014

R&D Costs and % of Total Revenue of Jiahua Chemicals, 2011-2014

Jiahua Chemicals' Revenue from Top 5 Clients and % of Total Revenue, 2011-2014

Name List and Revenue Contribution of Jiahua Chemicals' Top 5 Clients, Jan.-Sep.2014

Jiahua Chemical’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2014

Name List and Procurement Contribution of Jiahua Chemicals’ Top 5 Suppliers, Jan.-Sep. 2014

Capacity and Capacity Utilization of Jiahua Chemicals' Non-ionic Surfactant, 2011-2014

Sales Volume and Unit Price of Jiahua Chemicals' Non-ionic Surfactant, 2011-2014

Related Products and Capacity of WELL Chemical's 10KT Terminated Ether Project

MPEG Products of WELL Chemical

Allyl Alcohol Ether Products of WELL Chemical

Product Application of Sobute New Materials (Model)

Revenue and Net Income of Xiamen Academy of Building Research Group, 2011-2015

Revenue Breakdown of Xiamen Academy of Building Research Group (by Product), 2013-2015

Revenue Structure of Xiamen Academy of Building Research Group (by Product), 2013-2015

Revenue Breakdown of Xiamen Academy of Building Research Group (by Region), 2013-2015

Revenue Structure of Xiamen Academy of Building Research Group (by Region), 2013-2015

Gross Margin of Xiamen Academy of Building Research Group (by Product), 2013-2015

R&D Costs and % of Total Revenue of Xiamen Academy of Building Research Group, 2013-2015

Revenue and Gross Margin of Xiamen Academy of Building Research Group 's Admixtures, 2011-2014

Sales Volume of Xiamen Academy of Building Research Group 's Admixtures, 2010-2014

Revenue and Net Income of Xiamen Academy of Building Research Group 's Admixture Subsidiaries, 2015H1

Revenue and Net Income of Xiamen Academy of Building Research Group, 2015-2018E

Revenue and Operating Income of Huawei Yinkai, 2010-2014

Revenue Breakdown of Huawei Yinkai (by Product), 2010-2014

Revenue Structure of Huawei Yinkai (by Product), 2010-2014

Revenue Breakdown of Huawei Yinkai (by Region), 2011-2013

Revenue and Gross Margin of Huawei Yinkai's Polycarboxylate Superplasticizer, 2010-2014

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...