C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.

The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entered a large-scale verification cycle.

C-V2X has basically beaten DSRC in the global standard competition:

?United States: In 2023, it was made clear that C-V2X should be deployed throughout the country. By 2034, C-V2X will cover 100% of national highways and 75% of urban intersections, and a C-V2X boarding plan was formulated to mainly handle traffic accidents.

?Europe: Although the status of C-V2X is not clear, the European Union has indicated that each country can choose C-V2X according to its own judgment on technology, so that C-V2X and ITS-G5 coexist as two technical standard systems in Europe.

?South Korea: In December 2023, it officially announced to abandon DSRC technology and adopt LTE-V2X as the only Internet of Vehicles communication technology.

In 2024, China officially launched the pilot application of "vehicle-road-cloud integration” of intelligent connected vehicles, with the pilot period from 2024 to 2026:

?It will gradually improve the connectivity rate of vehicles, and 100% of pilot vehicles will be equipped with C-V2X and digital identity certificate carriers;

?In public areas such as city buses, official vehicles, and taxis, existing vehicles are encouraged to install C-V2X; 50% of new vehicles should be fitted with C-V2X.

?Pilot cities are advocated to install C-V2X in new production vehicles with L2 and higher-level autonomous driving functions.

According to ResearchInChina’s statistics, more than 270,000 Chinese passenger cars (accounting for 1.2%) were equipped with C-V2X by OEMs in 2023. It is expected that large-scale installation will occur from 2026 to 2027, with optimistic predictions that the OEM installation rate can exceed 9%.

The basic logic behind the increasing OEM penetration rate of C-V2X:

?The 2024 version of C-NCAP officially includes V2X in the evaluation scope. C-V2X can ensure that OEMs score more points in the field of active safety for new cars. This rule will be implemented from July 2024;

?The pilot application policy of "vehicle-road-cloud integration” of intelligent connected vehicles has been enforced, and C-V2X has entered the development stage of large-scale urban operation and scenario verification;

?BYD, Volkswagen, Audi and the like have begun to deploy C-V2X technology in new models, and GAC, FAW Hongqi, Ford and other OEMs that dabbled in the field of C-V2X earlier are actively promoting the evolution of C-V2X technology to the second stage;

?C-V2X empowers intelligent transportation and more and more application scenarios that reach consumers who are more willing to pay for C-V2X as they feel better, which will then push OEMs to install C-V2X. For example, during the implementation of urban NOA, the prediction of traffic light status, real-time road conditions, driving risks and other information in the city has become very important. Based on the C-V2X system, accurate roadside data is provided to the vehicle, which is conducive to the development of urban NOA;

?The integration of C-V2X is getting higher and higher, and the installation cost of OEMs continues to decline. C-V2X will be more integrated into the 5G intelligent cockpit or the 5G communication module to help improve its OEM installation rate;

?With the higher and higher "C-V2X roadside equipment coverage rate" and "automotive terminal penetration rate", the development node from quantitative change to qualitative change will appear.

C-V2X chips/modules are developing towards high performance and high integration.

Only a few suppliers who can provide C-V2X chips in the world, such as Qualcomm, Autotalks, Morningcore Technology, Huawei and ZTE. Among them, Qualcomm has a leading position in the field of C-V2X chips.

Qualcomm said in 2023 that it would acquire Autotalks. Through the acquisition, the production-ready, dual mode, Autotalks standalone safety solutions will be incorporated into Qualcomm Technologies’ expanding Snapdragon? Digital Chassis product portfolio in a bid to help accelerate the development and adoption of V2X solutions to improve traffic efficiency and help with driver and road user safety. In March 2024, the anticipated acquisition by Qualcomm of Autotalks was abandoned due to regulatory inspections, including investigations by the European Commission, UK, and Israeli antitrust regulators.

From the technical layout of major suppliers, C-V2X chip technology is becoming more and more integrated in its evolution to the second stage.

Qualcomm: There are three sets of C-V2X chip platforms: 9150 chipset, 9250 chipset and 2150 chipset. In addition, Qualcomm's 5G SA415/SA515M platform can choose to plug in V2X functions.

Qualcomm’s latest 5G platform features a highly integrated V2X solution, which includes an application processor, ITS stack, Aerolink Security, message signing, up to 2500 message verification per second, PC5/Uu modem connectivity, Wi-Fi 6 and BT 5.1 connectivity, MF-GNSS, and controller area network (CAN) support. In addition, Qualcomm's fourth-generation cockpit platform is pre-integrated with Qualcomm’s Snapdragon Automotive 5G platform supporting C-V2X technology.

Mass production and application: Based on the Snapdragon? Auto 5G Modem-RF Gen 2, HARMAN Ready Connect 5G TCU launched in February 2024 represents a significant advancement in upgradeability and scalability.

Autotalks: The C-V2X chipset has evolved to the third-generation TEKTON3 and SECTON3, which are suitable for the first and second phases of C-V2X. Autotalks is working with Hyundai Mobis to develop MTCU (Multi-functional Telematics Control Unit) connectivity modules (based on Autotalks' third-generation chipset) which will debut in 2024. Models equipped with Autotalks' third-generation chipset will be launched in 2025.

At present, C-V2X is developing in the direction of high integration. In the future, C-V2X will exist in an integrated form on vehicles, while independent modules may be mainly used in roadside communication components.

ZTE: The ZM9300, a full-stack self-developed 5G/V2X automotive module series launched in the second half of 2023, uses 3GPP Rel-16 technology and is developed based on ZTE’s full-stack self-developed automotive 5G Modem chip platform. At present, the module has landed in the automotive communication terminal platform project of GAC R&D Center which will unveil the first production model in 2024.

ZTE launched Y2002, the industry's first CVIS integrated equipment, which boasts a powerful AI chip based on the previous Y2001 and integrates RSU with roadside edge calculation.

The computing power of Y2002 hits 100TOPS. It can access 16 cameras, 8 radars, and 2 LiDARs.

?

C-V2X may give priority to autonomous driving application scenarios such as C-AEB, L2+ urban NOA, and navigation maps.

One of the main reasons for the slow development of C-V2X is that the business model is unclear and consumers are not willing to pay the bill. In order to improve consumers' willingness to pay, roadside infrastructure coverage and application scenario construction are crucial, especially in the fields of autonomous driving application scenarios such as C-AEB, L2+ urban NOA and navigation maps.

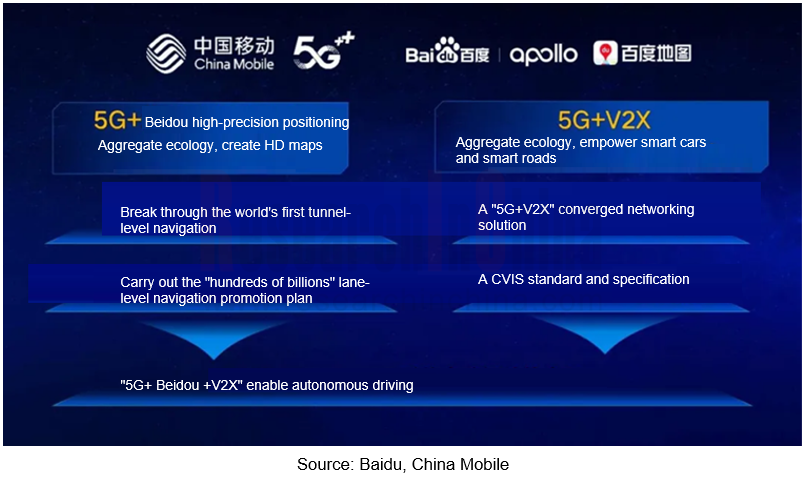

Baidu and China Mobile have jointly released the "5G+Beidou+V2X" intelligent transportation plan, created a "5G+V2X" integrated networking solution, and promoted "5G+Beidou High Precision+V2X" applications that empower autonomous driving.

ISMARTWAYS has launched a traffic light service. The massive traffic light data accumulated in the early stage is safely processed and pushed to OEMs who then push it to car owners as a value-added service, including traffic light countdown reminder, green light start reminder, Green Light Optimal Speed Advisory (GLOSA), red light warning and other functions.

At the beginning of 2024, China Mobile put forward the concept of "four integrations": 5G+V2X communication integration, car-road computing power integration, car+city+cloud integration and people+car+home integration. China Mobile believes that the road-network-vehicle basic communication construction must be integrated and unified to jointly improve the coverage, and the roadside equipment coverage is of great significance for the large-scale promotion of C-V2X.

C-V2X and CVIS Industry Research Report, 2024 by ResearchInChina highlights the following:

The promotion policy, standard trends, market size, market structure and so on of China C-V2X industry;

The promotion policy, standard trends, market size, market structure and so on of China C-V2X industry;

Mass production and application of C-V2X by OEMs and governments;

Mass production and application of C-V2X by OEMs and governments;

C-V2X installation modes, technical layout of OEMs, installation cases, etc.

C-V2X installation modes, technical layout of OEMs, installation cases, etc.

Key technologies of C-V2X, including chips, module, roadside, cloud, network communication, HD maps, information security and so on;

Key technologies of C-V2X, including chips, module, roadside, cloud, network communication, HD maps, information security and so on;

The latest technical layout and solution layout of main C-V2X terminal and system solution suppliers;

The latest technical layout and solution layout of main C-V2X terminal and system solution suppliers;

Technology evolution and main products of major C-V2X chip and module vendors.

Technology evolution and main products of major C-V2X chip and module vendors.

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...