Global and China Low-E Glass Industry Report, 2015-2018

-

Dec.2015

- Hard Copy

- USD

$2,400

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

ZHP031

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

Low-E glass, a new type of energy-saving glass, is mainly used in the field of building energy conservation. Chinese Government has introduced policies to support the development of the building energy efficiency industry since the 1990s, which propels the advancement of Low-E glass. The annual Low-E glass capacity jumps from 25 million m2 in 2005 to 660 million m2 in 2015, presenting a CAGR of 38.7%.

Although China’s Low-E glass capacity grows rapidly, the constraint of production technologies (especially online coating technology) leads to a low capacity utilization rate. In 2014, China’s Low-E glass output ascended 11.9% year on year to 150 million m2, while the capacity utilization rate was only 25.1%. In 2015, the capacity utilization rate is expected to hit 25.8% amid the stable glass market. In addition, China's Low-E glass penetration rate is less than 15%, still lagging far behind 80% in Europe, Japan, South Korea, the United States and other developed countries.

In the past two years, the adjustment in real estate market has incurred fluctuations in the Low-E glass price. For example, the price of 6mm single-silver Low-E glass dropped from RMB210 /weight case in 2012 to RMB120/weight case in mid-2015.

The world's leading Low-E glass manufacturers include the US-based PPG, Japan-based NSG and AGC, France-based Saint-Gobain, China-based CSG, Taiwan Glass Group, Kibing Group and so on. These players have taken measures in response to falling commodity prices and downward market trends, like PPG develops higher value-added new products; Taiwan Glass Group and Kibing Group set up new production bases in target markets.

PPG is enthusiastic about R & D of new-type Low-E glass. In September 2014, it launched SOLARBAN67 featured with excellent flexibility, transparency and other merits; in August 2015, it collaborated with Walker Glass to develop new-type high-performance anti-bird-strike solar control Low-E glass.

Following Japan NSG, Taiwan Glass Group is the world's second producer boasting Low-E glass plants. Its production base is located in Changbin, Taiwan. At the end of 2015, a Low-E glass factory consisting of a Low-E laminated glass production line and two Low-E vacuum glass production lines in Shenyang invested by USD240 million is expected to be completed and put into production.

CSG Holding has Low-E glass production bases in Tianjin, Dongguan, Wujiang, Xianning and Chengdu. It shows strong competitiveness in the high-end Low-E glass market -- its triple-silver Low-E glass seizes about 30% shares of the international market and 60% shares of Chinese market.

In May 2015, Kibing Group decided to invest RMB1.17 billion in a 600t/d Low-E online coated glass production line and a 600t/d high-end diversified glass production line in Negeri Sembilan, Malaysia to meet the market demand in Southeast Asia, Central Asia, the Middle East and other regions.

Global and China Low-E Glass Industry Report, 2015-2018 focuses on the followings:

Development environments, market size, penetration rate and others of global Low-E glass industry;

Development environments, market size, penetration rate and others of global Low-E glass industry;

Policies, technologies, etc. of China’s Low-E glass industry;

Policies, technologies, etc. of China’s Low-E glass industry;

Supply, demand, competition pattern, market prices, applications, etc. of China’s Low-E glass industry;

Supply, demand, competition pattern, market prices, applications, etc. of China’s Low-E glass industry;

Operation, revenue structure, Low-E glass business, etc. of 4 foreign and 13 Chinese Low-E glass manufacturers.

Operation, revenue structure, Low-E glass business, etc. of 4 foreign and 13 Chinese Low-E glass manufacturers.

1. Overview of Low-E Glass Industry

1.1 Definition and Classification

1.2 Energy-saving Effect

2. Status of Global Low-E Glass Industry

2.1 Development History

2.2 Building Energy-saving Policies of Main Countries

2.2.1 Germany

2.2.2 USA

2.2.3 Japan

2.3 Market Status

3. Operating Environment for China Low-E Glass Industry

3.1 Policy Environment

3.2 Social Environment

3.3 Technological Environment

4. Low-E Glass Supply in China

4.1 Production Cost

4.2 Supply

4.2.1 Capacity

4.2.2 Output

4.3 Competition

5. Low-E Glass Demand in China

5.1 Application

5.2 Demand

5.2.1 Revenue

5.2.2 Volume

5.3 Price

6. Key Global Players

6.1 PPG Industries

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Low-E Glass Business

6.1.5 Business in China

6.2 Nippon Sheet Glass (NSG)

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Low-E Glass Business

6.2.5 Business in China

6.3 Asahi Glass Co. (AGC)

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Low-E Glass Business

6.3.5 Business in China

6.4 Saint-Gobain

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Low-E Glass Business

6.4.5 Business in China

7. Key Players in China

7.1 CSG Holding

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 R&D and Investment

7.1.6 Low-E Glass Business

7.2 Taiwan Glass Group

7.2.1 Profile

7.2.2 Operation

7.2.3 Low-E Glass Business

7.2.4 TG Changjiang Glass Co., Ltd.

7.2.5 TG Chengdu Glass Co., Ltd.

7.2.6 TG Anhui Glass Co., Ltd.

7.2.7 TG Xianyang Glass Co., Ltd.

7.3 Xinyi Glass

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Low-E Glass Business

7.4 Shanghai Yaohua Pilkington Glass Group Co., Ltd. (SYP Group)

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 R&D and Investment

7.4.6 Low-E Glass Business

7.5 China Glass

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Gross Margin

7.5.5 Low-E Glass Business

7.6 AVIC Sanxin

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Gross Margin

7.6.5 Low-E Glass Business

7.7 Zhuzhou Kibing Group

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.7.5 Low-E Glass Business

7.8 Shandong Jinjing Science & Technology Stock Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Gross Margin

7.8.5 Low-E Glass Business

7.9 Others

7.9.1 Grand Engineering Glass (ZhongShan) Co., Ltd.

7.9.2 Suzhou Huadong Coating Glass Co., Ltd.

7.9.3 Weihai Blue Star Glass Holding Co., Ltd

7.9.4 China Yaohua Glass Group Corporation

7.9.5 Intex Glass (Xiamen) Co., Ltd.

8. Summary and Forecast

8.1 Market

8.2 Enterprise

Classification of Energy-efficient Glass

Classification of Low-E Glass

Difference between Offline and Online Low-E Glass

Applicability of Low-E Glass by Main Varieties

Optothermal Parameters of Major Classes

Comparison of Energy-saving Effect of Glasses

Development History of Global Low-E Glass

Building Energy-saving Policies in Germany

German Standards for Limiting Window Heat Transfer Coefficient

Building Energy-saving Policies in the U.S.

Residential and Commercial Building Energy Efficiency Improvement Trends in the U.S., 1975-2015

Building Energy-saving Policies in Japan

Global Low-E Glass Output and Growth Rate, 1990-2018E

Popularity of Low-E Architectural Glass in Major European Countries

Popularity of Low-E Glass in Major Countries Worldwide, 2014

Main Low-E Glass Manufacturers Abroad

Building Energy-saving Policies and Regulations in China, 2011-2015

New Energy-saving Building Area in China, 2010-2018E

Energy-saving Effects of Different Glass Structures

Cost Structure of Low-E Glass Manufacturing (e.g. Imported Equipment)

Unit Cost of Low-E Glass Processing

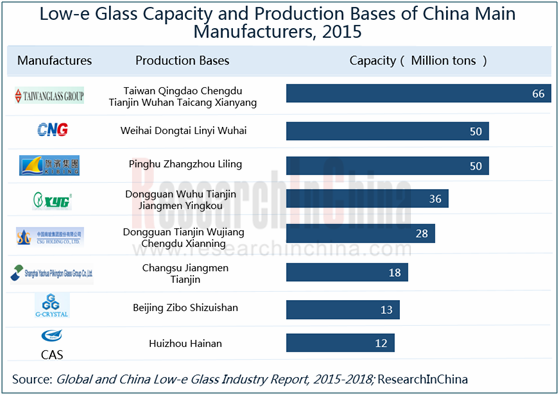

Low-E Glass Capacity of Major Enterprises in China, 2015

Low-E Glass Capacity of China, 2006-2018E

Some Low-E Glass Production Lines Adopting Homemade Equipment in China

Capacity Structure of Low-E Glass in China (by Province/City), 2014

Output and Growth Rate of Low-E Glass in China, 2006-2018E

Competition Pattern in Chinese Low-E Glass Market, 2015

Revenue of Major Low-E Glass Enterprises in China, 2008-2015

Total Energy Consumption Structure in China

Residential Building Energy Consumption Structure in Northern China

Revenue of China Low-E glass Industry, 2006-2018E

Demand for Building Glass and Low-E Glass in China, 2006-2018E

6mm Low-E Glass Price in China, 2014-2015

Distribution of PPG Factories (by Region), 2015

Revenue and Net Income of PPG, 2008-2015

Revenue Structure of PPG (by Business), 2009-2015

Revenue Breakdown of PPG (by Region), 2011-2014

Low-E Glass Business Structure of PPG

Glass Revenue and Net Income of PPG, 2007-2015

Low-E Glass-related Cooperation of PPG in China

Global Productivity Distribution of NSG, 2015

Revenue and Net Income of NSG, FY2009-FY2016E

Development Plan of NSG, 2016E

Revenue Structure of NSG (by Business), FY2009-FY2016E

Revenue Structure of NSG (by Region), FY2013-FY2015

Revenue Structure of NSG’s Main Products (by Region), FY2015

Revenue and Operating Income of NSG’s Architectural Glass Business, FY2009-FY2016E

Distribution of NSG’s Major Subsidiaries in China, 2015

Glass Production Lines of AGC (by Region)

Revenue and Net Income of AGC, 2008-2015

AGC’s Productivity Distribution, 2015

Revenue Structure of AGC (by Product), 2010-2015

Revenue Structure of AGC (by Region), 2011-2014

Main Products and Services of AGC’s Glass Business

Revenue and Growth Rate of AGC’s Glass Business, 2009-2015

Revenue of AGC’s Glass Business (by Region), 2013-2015

Major Subsidiaries of AGC in China (by Product), 2015

Marketing Network of AGC in China

Staff Distribution of Saint-Gobain, 2014

Revenue and Net Income of Saint-Gobain, 2009-2015

Revenue Structure of Saint-Gobain (by Business), 2009-2015

Revenue Structure of Saint-Gobain (by Region), 2009-2015

Flat Glass Products of Saint-Gobain, 2015

Revenue and Operating Income of Saint-Gobain’s Flat Glass Business, 2009-2015

Sales and Growth Rate of Saint-Gobain’s Sales in China, 2002-2015

Major Glass Enterprises of Saint-Gobain in China, 2015

Equity Structure of CSG, 2015

Global Marketing Network of CSG

Revenue and Net Income of CSG, 2007-2015

Revenue Structure of CSG (by Product), 2008-2015

Revenue Structure of CSG (by Region), 2008-2015

Gross Margin of CSG (by Product), 2008-2015

Main Architectural Glass-related Projects of CSG, 2015

Revenue and Growth Rate of CSG’s Architectural Glass Business, 2008-2015

Revenue of CSG’s Major Architectural Glass Subsidiaries, 2012-2015

Low-E Glass Capacity of CSG (by Product/Region), 2015

Distribution of Production Bases of Taiwan Glass Group, 2015

Revenue and Net Income of Taiwan Glass Group, 2008-2015

Distribution of Flat Glass Production Bases of Taiwan Glass Group, 2015

Capacity of Low-E Glass Production Lines of Taiwan Glass Group (by Factory), 2015

Production Lines of TG Changjiang Glass, 2015

Production Lines of TG Anhui Glass

Equity Structure of Xinyi Group, 2015

Revenue and Net Income of Xinyi Group, 2007-2015

Revenue Structure of Xinyi Glass (by Product), 2007-2015

Revenue Structure of Xinyi Glass (by Region), 2007-2015

Gross Margin of Xinyi Glass (by Product), 2008-2015

Architectural Glass Sales Network of Xinyi Glass in China

Capacities of Major Low-E Glass Production Lines of Xinyi Glass, 2015

Marketing Network of SYP Group in China

Equity Structure of SYP Group, 2015

Revenue and Net Income of SYP Group, 2007-2015

Revenue Structure of SYP Group (by Product), 2008-2015

Revenue of SYP Group (by Region), 2006-2015

Gross Margin of SYP Group (by Product), 2006-2015

Proposed Projects of SYP Group, 2015

Low-E Glass Capacity of SYP Group, 2015

Equity Structure of China Glass, 2015

Revenue and Net Income of China Glass, 2007-2015

Revenue Structure of China Glass (by Product), 2010-2015

Revenue of China Glass (by Region), 2008-2014

Gross Margin of China Class (by Product), 2010-2014

Revenue of China Coated Glass, 2010-2015

Capacity of Low-E Glass Production Lines of China Glass, 2015

Equity Structure of AVIC Sanxin, 2015

Revenue and Net Income of AVIC Sanxin, 2007-2015

Revenue and Net Income of AVIC Sanxin’s Subsidiaries, 2014

Revenue Structure of AVIC Sanxin (by Product), 2008-2015

Revenue of AVIC Sanxin (by Region), 2008-2015

Gross Margin of AVIC Sanxin (by Product), 2008-2015

Revenue and Growth Rate of AVIC Sanxin’s Special Glass Business, 2008-2015

Low-E Glass Production Lines of AVIC Sanxin, 2015

Equity Structure of Kibing Group, 2015

Global Marketing Network of Kibing Group

Revenue and Net Income of Kibing Group, 2008-2015

Revenue Structure of Kibing Group (by Product), 2008-2015

Revenue of Kibing Group (by Region), 2008-2015

Gross Margin of Kibing Group (by Product), 2008-2015

Capacities of Low-E Glass Products of Kibing Group, 2015

Equity Structure of Shandong Jinjing Science & Technology, 2015

Revenue and Net Income of Shandong Jinjing Science & Technology, 2006-2015

Revenue and Percentage of Shandong Jinjing Science & Technology (by Product), 2008-2015

Revenue of Shandong Jinjing Science & Technology (by Region), 2008-2015

Gross Margin of Shandong Jinjing Science & Technology (by Product), 2008-2015

Capacities of Low-E Glass Products of Shandong Jinjing Science & Technology, 2015

Low-E Glass Projects under Construction of Shandong Jinjing Science & Technology, 2015

Equity Structure of Huadong Coating Glass, 2015

Revenue and Net Income of Blue Star Glass, 2007-2015

Equity Structure of China Yaohua Glass Group Corporation, 2015

Main Products and Subsidiaries of China Yaohua Glass Group Corporation

Global Marketing Network of Intex Glass

Global and China Low-E Glass Output, 2013-2018E

Capacity and Demand Growth Rate of Low-E Glass in China, 2007-2018E

Revenue Growth Rate of Major Worldwide Low-E Glass Manufacturers, 2008-2015

Top 10 Low-E Glass Manufacturers in China (by Capacity), 2015

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...