China Bus Industry Report, 2016-2020

-

July 2016

- Hard Copy

- USD

$2,500

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ098

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

Affected by multiple factors like the slowdown in macro-economic growth, the slashed local fiscal expenditure and the substitution effect of high-speed rail passenger transport, Chinese bus market declined during 2015-2016. In 2015, China produced 590,900 buses (including chassis) and sold 595,400 ones, down 2.69% and 1.90% year on year respectively. In the first half of 2016, the bus output and sales volume amounted to 255,700 and 253,800 respectively, down 9.44% and 9.48% year on year correspondingly.

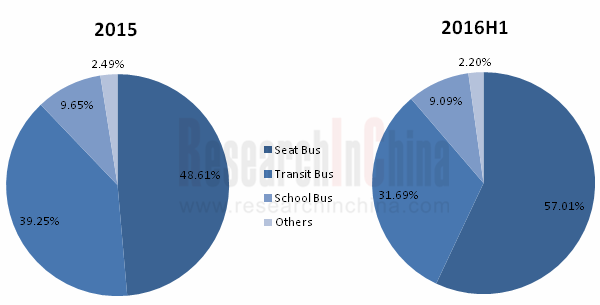

The market segments feature the followings:

Among seat buses, tour buses and light seat buses witness rapid growth. In 2015-2016, the construction of the high-speed railway network led to the contraction of medium and long-distance bus lines and departure frequencies as well as slow growth of medium and large seat buses. At the same time, the tourism market propelled the demand for tour buses which maintained fast growth. Thanks to the national policy on the development of urban and rural integrated transportation, the demand for medium and short-haul light seat buses commuting between urban and rural areas jumped, with the growth rate of as high above 40% in 2015.

Transit buses benefit from the fast-growing new energy. In 2015-2016, transit buses grew radically under the boost of new energy vehicles. From January to May of 2016, China's output of new energy buses (BEV + PHEV) totaled 25,997, a year-on-year surge of 125.65%. Wherein, the output of BEVs (battery electric vehicles) soared by 225.74% year on year, becoming the absolute mainstream. In the future, new energy transit buses will be the highlight of the bus market as the new energy trend becomes more obvious.

Chinese Bus Market Structure, 2015-2016

Source: ResearchInChina

The rising demand for new energy buses has stimulated Chinese bus companies to promote such buses. As the largest large and medium-sized bus manufacturer in China, Yutong Bus sold 20,446 new energy buses in 2015, including 13,885 battery electric buses and 6,561 plug-in buses. In addition, the company obtained China's first fuel cell bus production qualification in 2015, which may facilitate its leading-edge development in the field of fuel cell buses in the future.

Xiamen King Long Motor Group started relatively late in new energy buses, but its three wholly-owned subsidiaries: Higer Bus, Xiamen King Long United Automotive Industry, and Xiamen Golden Dragon Bus hold adequate technical reserves and have robust competitive strength. In 2015, Xiamen King Long Motor Group produced a total of 19,435 new energy buses, and sold 18,434 ones consisting of 12,323 battery electric buses (skyrocketing 1041% year on year) and 6,111 plug-in buses (up 165% year on year). The Group's new energy bus battery and motor systems are purchased from main suppliers such as CATL, Microvast and Jing-Jin Electric Technologies (Beijing), while its electronic control systems are the result of its independent R & D and design.

The report mainly deals with the following:

Market size, market structure, competitive landscape, import and export, and trends of China’s overall bus market (including chassis);

Market size, market structure, competitive landscape, import and export, and trends of China’s overall bus market (including chassis);

Market size, market structure, and competitive landscape of large, medium, and light bus market in China;

Market size, market structure, and competitive landscape of large, medium, and light bus market in China;

Market size, market structure and status quo of seat buses, transit buses, school buses, natural gas buses and other market segments in China;

Market size, market structure and status quo of seat buses, transit buses, school buses, natural gas buses and other market segments in China;

Market Size, competitive landscape, related policies, technology roadmap, and industrial investment of new energy buses in China;

Market Size, competitive landscape, related policies, technology roadmap, and industrial investment of new energy buses in China;

Telematics and active safety technology development of China bus industry;

Telematics and active safety technology development of China bus industry;

China’s bus industry chain, including the supply relationship of main upstream spare parts (transmission, wheel hub, and new energy batteries) and downstream market demand;

China’s bus industry chain, including the supply relationship of main upstream spare parts (transmission, wheel hub, and new energy batteries) and downstream market demand;

Development of Chinese bus manufacturers, including their financial data, bus production and sales, new energy bus business, capacity, cost structure, latest developments, etc.

Development of Chinese bus manufacturers, including their financial data, bus production and sales, new energy bus business, capacity, cost structure, latest developments, etc.

1 Industry Overview

1.1 Product Introduction

1.2 Product Classification

1.3 Policies

2 Overall Bus Market in China

2.1 Market Size

2.2 Market Structure

2.3 Competitive Landscape

2.3.1 Market Share

2.3.2 Performance Comparison

2.4 Import & Export

2.4.1 Overall Market

2.4.2 Market Segment

2.4.3 By Country

2.5 Market Segments

2.5.1 Seat Bus

2.5.2 Transit Bus

2.5.3 School Bus

2.6 Natural Gas Bus

2.7 Bus Active Safety and Telematics

2.7.1 Policy and Planning

2.7.2 Technical Standards

2.7.3 Layout of Enterprises

2.8 Market Trends

2.8.1 Technology Trends

2.8.2 Market Trends

3 Bus Market Segments in China

3.1 Large Bus Market

3.1.1 Market Size

3.1.2 Competitive Landscape

3.1.3 Market Structure

3.2 Medium Bus Market

3.2.1 Market Size

3.2.2 Competitive Landscape

3.2.3 Market Structure

3.3 Light Bus Market

3.3.1 Market Size

3.3.2 Competitive Landscape

3.3.3 Market Structure

4 New Energy Bus Market

4.1 Market Size

4.2 Competitive Landscape

4.3 Policies

4.3.1 Policies on Fiscal Subsidies

4.3.2“Oil Reduction & Electricity Compensation” Policy

4.3.3 Promotion and Assessment Methods

4.4 Technology Roadmap

4.5 Fuel Cell Bus

5 Bus Industry Chain

5.1 Upstream Raw Material Market

5.2 Key Components

5.2.1 Transmission

5.2.2 Wheel Hub

5.2.3 New Energy Battery

5.3 Downstream Demand Market

5.3.1 Passenger Transport

5.3.2 High Speed Rail

5.3.3 Tourism

6 Major Enterprises

6.1 Zhengzhou Yutong Bus Co., Ltd.

6.1.1 Profile

6.1.2 Financial Performance

6.1.3 Operating Revenue Structure

6.1.4 Output and Sales Volume

6.1.5 New Energy Bus

6.1.6 Production Capacity

6.1.7 R&D Costs

6.1.8 Cost Structure

6.1.9 Components & Parts

6.1.10 Dynamics

6.1.11 Prospects

6.2 Xiamen King Long Motor Group

6.2.1 Profile

6.2.2 Financial Performance

6.2.3 Operating Revenue Structure

6.2.4 Operation of Major Subsidiaries

6.2.5 Output and Sales Volume

6.2.6 New Energy Bus

6.2.7 Production Capacity

6.2.8 R&D Costs

6.2.9 Cost Structure

6.2.10 Dynamics

6.2.11 Prospects

6.3 Zhongtong Bus and Holding Co., Ltd.

6.3.1 Profile

6.3.2 Financial Performance

6.3.3 Operating Revenue Structure

6.3.4 Output and Sales Volume

6.3.5 New Energy Bus

6.3.6 R&D Costs

6.3.7 Cost Structure

6.3.8 Dynamics

6.3.9 Prospects

6.4 Beiqi Foton Motor Co., Ltd.

6.4.1 Profile

6.4.2 Financial Performance

6.4.3 Operating Revenue Structure

6.4.4 Output and Sales Volume

6.4.5 New Energy Bus

6.4.6 Production Capacity

6.4.7 R&D Costs

6.4.8 Prospects

6.5 Anhui Ankai Automobile Co., Ltd.

6.5.1 Profile

6.5.2 Financial Performance

6.5.3 Operating Revenue Structure

6.5.4 Output and Sales Volume

6.5.5 New Energy Bus

6.5.6 Production Capacity

6.5.7 R&D Costs

6.5.8 Cost Structure

6.6 Liaoning SG Automotive Group Co., Ltd.

6.6.1 Profile

6.6.2 Financial Performance

6.6.3 Operating Revenue Structure

6.6.4 Output and Sales Volume

6.6.5 New Energy Business

6.6.6 Cost Structure

6.7 Yangzhou Yaxing Motor Coach Co., Ltd.

6.7.1 Profile

6.7.2 Financial Performance

6.7.3 Operating Revenue Structure

6.7.4 Output and Sales Volume

6.7.5 New Energy Bus

6.7.6 R&D Costs

6.7.7 Cost Structure

6.8 BYD Company Co., Ltd.

6.8.1 Profile

6.8.2 Financial Performance

6.8.3 Operating Revenue Structure

6.8.4 Output and Sales Volume

6.8.5 New Energy Bus

6.8.6 Dynamics

6.8.7 Prospects

6.9 Anhui Jianghuai Automobile Co., Ltd.

6.9.1 Profile

6.9.2 Financial Performance

6.9.3 Operating Revenue Structure

6.9.4 Output and Sales Volume

6.9.5 R&D Costs

6.9.6 Cost Structure

6.9.7 Prospects

6.10 Shenyang Jinbei Automotive Co., Ltd.

6.10.1 Profile

6.10.2 Financial Performance

6.10.3 Operating Revenue Structure

6.10.4 Output and Sales Volume

6.10.5 R&D Costs

6.10.6 Cost Structure

6.10.7 Prospects

6.11 Jiangling Motors Co., Ltd.

6.11.1 Profile

6.11.2 Financial Performance

6.11.3 Operating Revenue Structure

6.11.4 Output and Sales Volume

6.11.5 R&D Costs

6.11.6 Prospects

6.12 Dongfeng Motor Corporation

6.12.1 Profile

6.12.2 Financial Performance

6.12.3 Operating Revenue Structure

6.12.4 Output and Sales Volume

6.12.5 R&D Costs

6.12.6 Cost Structure

6.12.7 Prospects

6.13 NAVECO Ltd.

6.13.1 Profile

6.13.2 Output and Sales Volume

6.13.3 Dynamics

6.14 Hebei Baoding Changan Bus Co., Ltd.

6.14.1 Profile

6.14.2 Output and Sales Volume

6.14.3 Dynamics

6.14.4 Operating Goals

6.15 SAIC Maxus Co., Ltd.

6.15.1 Profile

6.15.2 Output and Sales Volume

6.15.3 New Energy Business

6.15.4 Dynamics

6.16 Fujian New Forta Automobile Co., Ltd.

6.16.1 Profile

6.16.2 Output and Sales Volume

Output and Sales Volume of Buses in China, 2005-2020E

Market Structure of Buses in China, 2005-2020E

TOP10 Bus Manufacturers in China, 2014

TOP10 Bus Manufacturers in China, 2015

TOP10 Bus Manufacturers in China, 2016

Revenue of Major Bus Manufacturers in China, 2014-2016

Net Income of Major Bus Manufacturers in China, 2014-2016

Gross Margin of Major Bus Manufacturers in China, 2014-2016

Import & Export Volume and Value of Buses in China, 2009-2015

Import Volume and Value of Buses in China by Type, 2009-2016

Export Volume and Value of Buses in China by Type, 2009-2016

China’s Bus Import Sources, 2015

China’s Bus Import Sources, 2016

China’s Top 10 Bus Export Destinations, 2015

China’s Top 10 Bus Export Destinations, 2016

Sales Volume of Buses in China by Purpose, 2014-2015

Sales Structure of Major Bus Manufacturers in China by Purpose, 2016

Market Structure of Large and Medium-sized Seat Buses in China by Purpose, 2015

Sales Volume of Buses in China by Type, 2014-2015

Sales Volume of School Buses in China, 2009-2015

Natural Gas Bus Sales Volume of Major Enterprises, 2015

Output and Sales Volume of Natural Gas Buses in China, 2014-2016

Intelligent Operation System of Major Bus Manufacturers in China

Output of Large Buses and Chassis in China, 2005-2020E

Sales Volume of Large Buses and Chassis in China, 2005-2020E

TOP10 Large Bus Manufacturers in China, 2014

Market Share of Large Bus Chassis Manufacturers in China, 2014

TOP10 Large Bus Manufacturers in China, 2015

Market Share of Large Bus Chassis Manufacturers in China, 2015

TOP10 Large Bus Manufacturers in China, 2016

Market Share of Large Bus Chassis Manufacturers in China, 2016

Market Structure of Large Buses in China by Purpose, 2014-2015

Output of Medium-sized Buses and Chassis in China, 2005-2020E

Sales Volume of Medium-sized Buses and Chassis in China, 2005-2020E

TOP10 Medium-sized Bus Manufacturers in China, 2014

Market Share of Medium-sized Bus Chassis Manufacturers in China, 2014

TOP10 Medium-sized Bus Manufacturers in China, 2015

Market Share of Medium-sized Bus Chassis Manufacturers in China, 2015

TOP10 Medium-sized Bus Manufacturers in China, 2016

Market Share of Medium-sized Bus Chassis Manufacturers in China, 2016

Market Structure of Medium-sized Buses in China by Purpose, 2014-2015

Market Structure of Medium-sized Buses in China by Length, 2014-2015

Output of Light Buses and Chassis in China, 2005-2020E

Sales Volume of Light Buses and Chassis in China, 2005-2020E

TOP10 Light Bus Manufacturers in China, 2014

Market Share of Light Bus Chassis Manufacturers in China, 2014

TOP10 Light Bus Manufacturers in China, 2015

Market Share of Light Bus Chassis Manufacturers in China, 2015

TOP10 Light Bus Manufacturers in China, 2016

Market Share of Light Bus Chassis Manufacturers in China, 2016

Market Structure of Light Buses in China by Length, 2014-2015

Monthly Output of New Energy Buses in China, 2015-2016

Market Structure of New Energy Buses in China, 2015-2016

Output of New Energy Buses in China, 2011-2020E

TOP10 New Energy Bus Manufacturers in China by Output, 2015

TOP10 New Energy Bus Manufacturers in China by Output, 2016

TOP10 Battery Electric Bus Manufacturers in China by Output, 2015

TOP10 Battery Electric Bus Manufacturers in China by Output, 2016

TOP10 Plug-in Hybrid Electric Bus Manufacturers in China by Output, 2015

TOP10 Plug-in Hybrid Electric Bus Manufacturers in China by Output, 2016

Subsidy Standard for Electric Buses, 2016

Electric Bus Subsidy Standard from China’s Central Government Budget, 2014-2015

Subsidy Standard for Fuel Cell Cars in China, 2016

Cost of Raw Materials of Major Bus Manufacturers in China, 2014-2015

Market Share of Major Commercial Vehicle Transmission Manufacturers in China

Major Suppliers of Commercial Vehicle Transmission in China

Wheel Hub Suppliers of Major Bus Manufacturers in China

Highway Passenger Transportation in China, 2004-2016

High-speed Rail Mileage in China, 2013-2015

Passenger Capacity of High-speed Rail in China, 2013-2015

Total Tourism Revenue in China, 2001-2015

Number of Tourists during the Chinese Golden Week Holiday, 2008-2016

Main Financial Indicators of Yutong Bus, 2010-2016

Operating Revenue Structure of Yutong Bus by Business, 2013-2015

Operating Revenue Structure of Yutong Bus by Region, 2013-2015

Output and Sales Volume of Yutong Bus by Product, 2009-2016

Sales Structure of Yutong Bus, 2015

New Energy Bus Output of Yutong Bus, 2014-2016

New Energy Bus Sales Volume of Yutong Bus, 2012-2015

New Energy Bus Sales Volume of Yutong Bus by Type, 2015

R&D Costs of Yutong Bus, 2009-2015

Product Cost Structure of Yutong Bus, 2013-2015

Revenue, Net Income, and Gross Margin of Yutong Bus, 2015-2020E

Main Financial Indicators of Xiamen King Long Motor Group, 2010-2016

Operating Revenue Structure of Xiamen King Long Motor Group by Region, 2013-2015

Revenue and Net Income of Major Subsidiaries of Xiamen King Long Motor Group, 2013-2015

Bus Output of Subsidiaries of Xiamen King Long Motor Group, 2009-2016

Bus Sales Volume of Subsidiaries of Xiamen King Long Motor Group, 2009-2016

New Energy Bus Output of Xiamen King Long Motor Group, 2014-2016

New Energy Bus Sales Volume of Xiamen King Long Motor Group by Length, 2015

New Energy Bus Sales Volume of Xiamen King Long Motor Group by Purpose, 2015

Percentage of Purchased Key Parts for New Energy Bus of Xiamen King Long Motor Group

R&D Costs of Xiamen King Long Motor Group, 2010-2015

Cost Structure of Xiamen King Long Motor Group, 2013-2015

Revenue, Net Income, and Gross Margin of Xiamen King Long Motor Group, 2015-2020E

Main Financial Indicators of Zhongtong Bus, 2010-2016

Operating Revenue Structure of Zhongtong Bus by Business, 2013-2015

Operating Revenue Structure of Zhongtong Bus by Region, 2013-2015

Output and Sales Volume of Zhongtong Bus, 2009-2016

New Energy Bus Output of Zhongtong Bus, 2014-2016

R&D Costs of Zhongtong Bus, 2012-2015

Cost Structure of Zhongtong Bus, 2013-2015

Revenue, Net Income, and Gross Margin of Zhongtong Bus, 2015-2020E

Main Financial Indicators of Beiqi Foton Motor, 2010-2016

Operating Revenue Structure of Beiqi Foton Motor by Business, 2013-2015

Operating Revenue Structure of Beiqi Foton Motor by Region, 2013-2015

Bus Output and Sales Volume of Beiqi Foton Motor by Type, 2009-2016

New Energy Bus Output of Beiqi Foton Motor, 2014-2016

New Energy Bus Sales Volume of FOTON AUV, 2013-2016

New Energy Bus Orders of FOTON AUV, 2016

R&D Costs of Beiqi Foton Motor, 2010-2015

Revenue, Net Income, and Gross Margin of Beiqi Foton Motor, 2015-2020E

Financial Indicators of Anhui Ankai Automobile, 2010-2016

Operating Revenue Structure of Anhui Ankai Automobile by Business, 2013-2015

Operating Revenue Structure of Anhui Ankai Automobile by Region, 2013-2015

Output and Sales Volume of Anhui Ankai Automobile, 2009-2016

New Energy Bus Output of Anhui Ankai Automobile, 2014-2016

R&D Costs of Anhui Ankai Automobile, 2010-2015

Cost Structure of Anhui Ankai Automobile, 2015

Financial Indicators of SG Automotive Group, 2010-2016

Operating Revenue Structure of SG Automotive Group by Business, 2013-2015

Operating Revenue Structure of SG Automotive Group by Region, 2013-2014

Huanghai Bus Output and Sales Volume of SG Automotive Group, 2009-2016

Huanghai New Energy Bus Output of SG Automotive Group, 2014-2016

Cost Structure of SG Automotive Group, 2013-2015

Financial Indicators of Asiastar, 2010-2016

Operating Revenue Structure of Asiastar by Business, 2013-2015

Operating Revenue Structure of Asiastar by Region, 2013-2015

Output and Sales Volume of Asiastar, 2009-2016

New Energy Bus Output of Asiastar, 2014-2016

New Energy Bus Sales Volume of Asiastar, 2014-2015

Asiastar’s Subsidy Income from New Energy Bus, 2015

R&D Costs of Asiastar, 2010-2015

Cost Structure of Asiastar, 2013-2015

Financial Indicators of BYD, 2010-2016

Operating Revenue Structure of BYD by Business, 2013-2015

Operating Revenue Structure of BYD by Region, 2013-2015

Bus Output and Sales Volume of BYD, 2011-2016

Main New Energy Buses of BYD

New Energy Bus Output of BYD, 2014-2016

New Energy Bus Sales Volume of BYD, 2013-2016

BYD Won the Tender of Shenzhen’s Solution Project for Upgrading 3,024 Battery Electric Buses

Revenue, Net Income, and Gross Margin of BYD, 2015-2020E

Financial Indicators of JAC, 2010-2016

Operating Revenue Structure of JAC by Business, 2013-2015

Operating Revenue Structure of JAC by Region, 2013-2015

Bus Output and Sales Volume of JAC, 2009-2016

R&D Costs of JAC, 2010-2015

Cost Structure of JAC, 2015

Revenue, Net Income, and Gross Margin of JAC, 2015-2020E

Financial Indicators of Jinbei Auto, 2010-2016

Operating Revenue Structure of Jinbei Auto by Business, 2013-2015

Operating Revenue Structure of Jinbei Auto by Region, 2013-2015

Bus Output and Sales Volume of Jinbei Auto, 2009-2015

R&D Costs of Jinbei Auto, 2012-2015

Cost Structure of Jinbei Auto, 2013-2015

Revenue, Net Income, and Gross Margin of Jinbei Auto, 2015-2020E

Financial Indicators of JMC, 2010-2016

Operating Revenue Structure of JMC by Business, 2013-2015

Operating Revenue Structure of JMC by Region, 2013-2014

Bus Output and Sales Volume of JMC, 2009-2016

R&D Costs of JMC, 2010-2015

Revenue, Net Income, and Gross Margin of JMC, 2015-2018E

Financial Indicators of Dongfeng Motor, 2010-2016

Operating Revenue Structure of Dongfeng Motor by Business, 2013-2015

Operating Revenue Structure of Dongfeng Motor by Region, 2013-2015

Bus Output and Sales Volume of Dongfeng Motor, 2009-2015

R&D Costs of Dongfeng Motor, 2010-2015

Cost Structure of Dongfeng Motor, 2013-2015

Revenue, Net Income, and Gross Margin of Dongfeng Motor, 2015-2020E

Bus Output and Sales Volume of SAIC MAXUS, 2011-2016

Capacity of SAIC MAXUS (including New Energy), 2015

Ongoing Projects of SAIC MAXUS, 2015

New Energy Vehicle Output, Sales Volume, and Revenue of SAIC MAXUS, 2015

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...