Global and China MO Source Industry Report, 2017-2021

-

Aug.2017

- Hard Copy

- USD

$2,700

-

- Pages:92

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZHP064

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

MO source (also known as high-purity metal organic compound) is a key raw material for producing semiconductor microstructure materials by use of MOVCD technology. Main products include trimethyl gallium, trimethyl indium, etc.

Global MO source demand reached 58.5 tons in 2016, a 4.1% increase from the year before. The main reasons for the growth recovery after a drop in 2015 stood out: firstly, downstream demand picked up; secondly, MOCVD ownership escalated, and capacity utilization and operating rate of plants grew steadily. Global MO source demand will keep an estimated CAGR of around 7.6% during 2017-2021.

As the world’s biggest MO source producer and consumer, China takes up over 1/3 of global total capacity and consumes above 50% of MO source products. China’s demand for MO source achieved about 30.7 tons in 2016, with a CAGR of 31.6% during 2010-2016, outperforming the global average, thanks to local governments’ purchase subsidy polices for MOCVD equipment over the five years to 2015. In spite of a slower increase after subsidy halt, demand will still grow at an average of roughly 10% a year during 2017-2021 as downstream players continue expansion of their capacity.

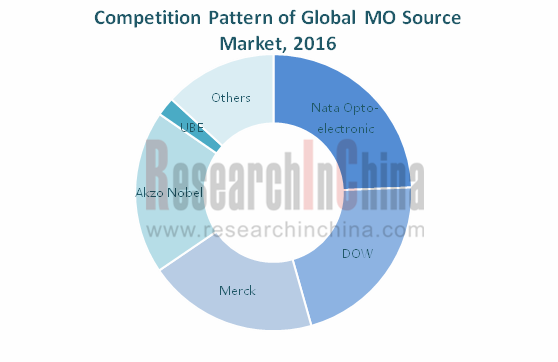

Global MO source industry still presents an oligopoly pattern due to high technical barriers. Key manufacturers include DOW (the U.S.), Merck (Germany), AKZO Nobel (the Netherlands), Nata Opto-electronic (China) and Ube Industries (Japan). In 2016, CR5 boasted a concentration of above 85%, of which Nata Opto-electronic occupied the first place firmly with a market share of 1/4.

By upstream sectors, gallium and indium are the main raw materials of MO source, and China has largest gallium and indium reserves in the world, with marked superiorities in source. China’s cost advantage keeps prominent for price of gallium and indium remained low and seldom surged over the years.

As for downstream sectors, over 80% of MO source is used in LED, mostly for LED chip manufacturing. In recent years, companies in Mainland China narrowed their gap with Taiwan and performed far better in price, delivery and market reaction as they improved capacity and technology. As a result, China’s LED chip industry developed fast, registering a CAGR of 23.9% during 2010-2016.

Besides LED, MO source also finds application in solar cell, phase change memory and semiconductor laser.

Solar cell: new-generation solar cells like MO source-based gallium arsenide solar cell and amorphous silicon thin film solar cell, are in small use in China on account of difficult production technology and high production costs, but will be more applied in the future as technology improvement lowers production costs.

Semiconductor laser: China’s semiconductor laser market expanded rapidly despite late start and small market size, with CAGR of output value hitting 17.2% during 2010-2016, higher than the global average.

Global and China MO Source Industry Report, 2017-2021 highlights the following:

Overview of MO source industry (definition, classification, application, industry chain, industry characteristics, etc.);

Overview of MO source industry (definition, classification, application, industry chain, industry characteristics, etc.);

Global MO source industry (overview, supply, demand, market structure, etc.);

Global MO source industry (overview, supply, demand, market structure, etc.);

China’s MO source industry (development environment, supply, demand, competition pattern, market price, etc.);

China’s MO source industry (development environment, supply, demand, competition pattern, market price, etc.);

Market size, market structure, competition pattern, price, etc. of MO source upstream sectors (gallium, indium, etc.) and downstream sectors (LED, solar cell, phase change memory, semiconductor laser, RFIC chip, etc.);

Market size, market structure, competition pattern, price, etc. of MO source upstream sectors (gallium, indium, etc.) and downstream sectors (LED, solar cell, phase change memory, semiconductor laser, RFIC chip, etc.);

9 MO source producers worldwide (operation, MO source business, etc.).

9 MO source producers worldwide (operation, MO source business, etc.).

1. Overview of MO Source Industry

1.1 Introduction

1.2 Classification and Application

1.3 Industry Chain

1.4 Industry Characteristics

1.4.1 High Concentration

1.4.2 Slowing Growth

2. Development of Global MO Source Industry

2.1 Overview

2.2 Supply

2.3 Demand

2.3.1 Quantity Demanded

2.3.2 Demand Structure

2.3.3 Factors Influencing Demand

2.4 Market Pattern

2.4.1 United States

2.4.2 Taiwan

2.4.3 South Korea

2.4.4 Europe

2.4.5 Japan

3. Development of MO Source Industry in China

3.1 Development Environment

3.1.1 Policy

3.1.2 Trading

3.1.3 Technology

3.2 Supply

3.2.1 Capacity

3.2.2 Market Structure

3.3 Demand

3.4 Price

4. MO Source Industry Chain

4.1 Upstream Sectors

4.1.1 Gallium

4.1.2 Indium

4.2 Downstream LED Industry

4.2.1 LED

4.2.2 MOCVD and LED Chip

4.2.3 LED Packaging

4.2.4 LED Application

4.2.5 Competition Pattern

4.3 Other Downstream Sectors

4.3.1 New Solar Cell

4.3.2 Phase Change Memory

4.3.3 Semiconductor Laser

4.3.4 RFIC Chip

5. Key Enterprises Worldwide

5.1 DOW

5.1.1 Profile

5.1.2 Operation

5.1.3 MO Source Business

5.1.4 Business in China

5.2 Merck

5.2.1 Profile

5.2.2 Operation

5.2.3 MO Source Business-SAFC Hitech

5.2.4 Business in China

5.3 AKZO Nobel

5.3.1 Profile

5.3.2 Operation

5.3.3 MO Source Business

5.3.4 Business in China

5.4 Sumitomo Chemical

5.4.1 Profile

5.4.2 Operation

5.4.3 MO Source Business

5.4.4 Business in China

5.5 Albemarle

5.5.1 Profile

5.5.2 Operation

5.5.3 MO Source Business

5.5.4 Business in China

5.6 Chemtura

5.6.1 Profile

5.6.2 Operation

5.6.3 MO Source Business

5.6.4 Business in China

5.7 Lake LED Materials

5.7.1 Profile

5.7.2 MO Source Business

5.8 UBE

5.8.1 Profile

5.8.2 Operation

5.8.3 MO Source Business

5.9 Nata Opto-electronic

5.9.1 Profile

5.9.2 Operation

5.9.3 Production and Sales

5.9.4 Key Projects

Applications of MO Source

Industrial Chain of MO Source

Proportion of MO Source in LED Production Process

Global MO Source Supply, 2010-2021E

Demand of MOCVD Standalone for MO Source

Global MO Source Demand, 2010-2021E

Global MO Source Demand Structure by Industry, 2010-2017

Global LED Backlight Penetration Rate by Field

Global TV LED Backlight Output Value, 2012-2017

Output Value and Growth Rate of Global HB LED Products, 2010-2017

Number of Newly Added MOCVD Machines and Ownership Worldwide, 2010-2021E

Global MOCVD Ownership Structure by Region, 2016

Global MO Source Capacity Structure by Region, 2016

Global MO Source Market Competitive Landscape, 2016

Number of Newly Added MOCVD Machines in Taiwan, 2009-2017

Major Vendors in South Korea LED Industry

Number of Newly Added MOCVD Machines in South Korea, 2009-2017

Production Bases and Major Customers of MO Source in Japan

Distribution of Japanese LED Industry

Policies about MO Source Industry in China, 2011-2017

Capacity of MO Source in China, 2010-2021E

Capacity Structure of MO Source in China by Product, 2010-2021E

Competitive Landscape of Chinese MO Source Companies, 2017

MOCVD Procurement of China's Local Governments, 2010-2015

Demand for MO Source in China, 2010-2021E

Average Price of MO Source Products in China, 2009-2017

Distribution of Global Gallium Reserves

Metal Gallium Output in China, 2014-2021E

Metal Gallium Import and Export in China, 2014-2016

Monthly Average Price of Gallium at Home and Abroad, 2014-2016

Industrial Gallium Price Trend in China, 2017

Global Indium Output, 2015-2016

Output and Sales Volume of Indium in China, 2009-2016

Global Indium Consumption Structure, 2016

Indium Consumption Structure in China, 2016

Refined Indium Import and Export in China, 2011-2016

Indium Price Trend in China, 2013-2017

LED Industry Chain

Driving Factors of LED Industry

Total Output Value and Growth Rate of Global LED Industry, 2010-2021E

Total Output Value and Growth Rate of China's LED Industry, 2010-2021E

LED Application Structure in China, 2016

Major M & A Cases in the LED Industry, 2016

Ownership and Growth Rate of MOCVD Machines in China, 2010-2021E

MOCVD Capacity Utilization and Operating Rate in China, 2012-2016

Competitive Landscape of Global MOCVD Market, 2016

Equipment Distribution of MOCVD Enterprises in China by Quantity, 2016

Output Value and Growth Rate of LED Epitaxial Chips in China, 2010-2021E Capacity of Major LED Chip Vendors in China, 2016

Output Value and Growth Rate of China's LED Packaging Industry, 2010-2021E

Output Value and Growth Rate of China's LED Application Industry, 2011-2021E

LED Display Application Output Value in China, 2011-2016

LED Backlight Application Output Value in China, 2011-2016

LED Lighting Application Output Value in China, 2011-2016

Business of Key LED Companies in China

Classification of Solar Photovoltaic Cells

Performance Comparison between Thin-film Batteries and Crystalline Silicon Batteries

Global Solar Cell Output and Growth Rate, 2010-2021E

Global Solar Cell Output Structure by Product, 2010-2021E

Capacity of Global Major Thin-film Solar Cell Vendors, 2016

Solar Cell Output and Growth Rate in China, 2011-2021E

Capacity of Major Solar Cell Vendors in China, 2016

Solar Cell Export Value Structure in China (by Country / Region), 2016

Performance Comparison of Different Types of Solar Cells

Output of GaAs Solar Cell in China, 2010/2015/2020

Memory Development Process

Global Laser Revenue by Product,2012-2016

Output Value of Semiconductor Lasers in China, 2010-2017

Unit Price of Mobile Phone RF Modules

Sales and Net Income of Dow, 2010-2017

Revenue Structure of Dow by Business, 2016

Production Bases of Dow Electronic Materials

Revenue of Dow's Consumer Solutions Segment by Region, 2016

Revenue of Dow's Consumer Solutions segment by Business, 2016

Sales and Net Income of Merck, 2009-2017

Revenue Structure of Merck by Business, 2016

Revenue Growth of Merck’s Main Business, 2015-2016

Revenue Structure of Merck by Region, 2016

Revenue of Merck’s Performance Materials, 2015-2016

Revenue Structure of Merck’s Performance Materials by Region, 2016

MO Source Production Bases of SAFC Hitech

Revenue and Net Income of AKZO Nobel, 2009-2017

Revenue Structure of AKZO Nobel by Business, 2012-2017

Revenue Structure of AKZO Nobel by Region, 2016

Major Brands of AKZO Nobel’s Functional Chemicals

Revenue of AKZO Nobel's Functional Chemicals, 2012-2016

Revenue Structure of AKZO Nobel's function Chemicals by end-user, 2016

Revenue and Growth Rate of AKZO Nobel in China, 2010-2016

Production Bases of Functional Chemical Products of AKZO Nobel in China

Revenue and Net Income of Sumitomo Chemical, FY2009- FY2017

Revenue of Sumitomo Chemical by Business, FY2015-FY2016

Branch Companies of Sumitomo Chemical and Their Primary Business

Albemarle’s Global Layout

Revenue and Net Income of Albemarle, 2010-2017

Revenue of Albemarle by Product, 2015-2016

Albemarle’s Layout in China

Chemtura’s Global Layout

Sales and Net Income of Chemtura, 2009-2016

Revenue of Chemtura by Business, 2016

Main Business of Lake LED Materials

Main MO Source Products of Lake LED Materials

Main Affiliates of UBE Industries

Revenue and Operating Income of UBE Industries, FY2009- FY2016

Revenue of UBE Industries by Business, FY2007- FY2016

Revenue of UBE Industries by Region, FY2016

Main MO Source Products of UBE Industries

MO Source Applications of UBE Industries

Equity Structure of Nata Opto-electronic, 2017

Revenue and Net Income of Nata Opto-electronic, 2009-2017

Revenue of Nata Opto-electronic by Product, 2009-2016

Revenue of Nata Opto-electronic by Region, 2009-2016

Gross Margin of Nata Opto-electronic by Product, 2009-2015

Sales Volume and Unit Price of Nata Opto-electronic, 2010-2016

Capacity and Output of Nata Opto-electronic’s Main Products, 2016

Key Projects of Nata Opto-electronic, 2016

Capacity of Nata Opto-electronic, 2010-2016

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...