China Automated Logistics Equipment Industry Report, 2018-2022

-

Jun.2018

- Hard Copy

- USD

$3,500

-

- Pages:172

- Single User License

(PDF Unprintable)

- USD

$3,300

-

- Code:

CYH075

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,900

-

- Hard Copy + Single User License

- USD

$3,700

-

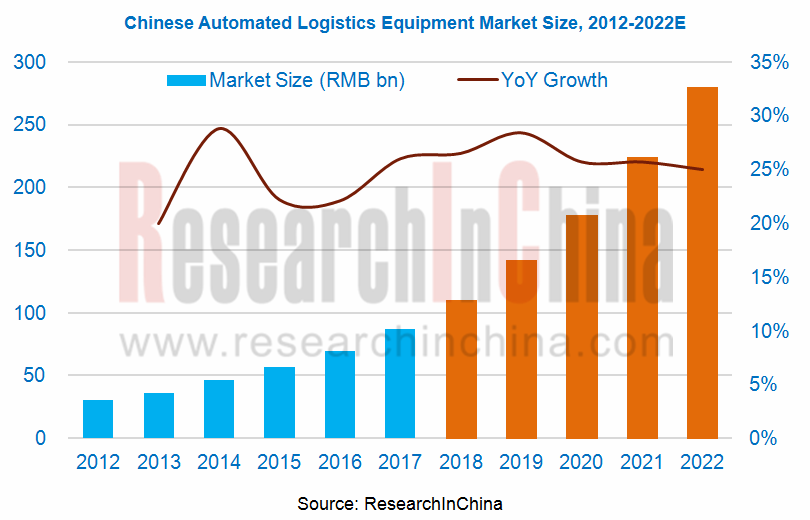

The year 2017 witnessed rapid expansion of automated logistics equipment market in China with the size soaring by 26.0% year-on-year to RMB87.2 billion and expected to exceed RMB100 billion in 2018. Propelled by favorable policies on intelligent automated equipment and swift growth of emerging logistics methods like smart logistics, E-commerce logistics and cold-chain logistics, the market is predicted to maintain an average annual rate of around 25% over the next five years, reaching RMB279.7 billion in 2022.

Product segment: automated sorting & conveying equipment get most popularized, accounting for 35.0% of the Chinese logistics equipment market in 2017, followed by automated stereoscopic warehouse (about 20%). Automated logistics equipment will become more intelligent and integrated, and various new logistics equipment, such as unmanned warehouse, unmanned port, UAV and logistics robot, will come into being thanks to technological innovation.

There comes the robust demand for logistics equipment from E-commerce, pharmaceuticals, clothing, automobile, home appliance, new energy, food, home building material, tobacco and military sectors in recent years. Automobile is the largest market for automated logistics equipment, occupying 18.8% (the equivalent of RMB16.38 billion) of total scale of the Chinese automated logistics equipment market. As more NEV production line projects are approved and more body-in-white production lines are transformed into automated production system, the demand for automated logistics equipment from the Chinese automobile market is expected to rise to RMB52.11 billion in 2022.

Pattern of Enterprises: foreign companies like DAIFUKU (Japan), Schaefer (Germany), Vanderlande (the Netherlands) and Dematic (the United States) are still dominant in China, particularly in high-end fields (E-commerce, airport, etc.). Most of these giants are system integrators that can provide total solutions. By contrast, local Chinese suppliers provide only equipment and focus on downstream industries like tobacco, pharmaceuticals, power system, clothing and food. Typical players are Shanxi Oriental Material Handling, Miracle Automation Engineering, Mesnac, Hubei Sanfeng Intelligent Conveying Equipment and SIASUN Robot & Automation.

In addition, amid bright prospects for automated logistics equipment, major E-commerce tycoons including Alibaba, JD and Suning have made their presence in automated logistics and equipment market, such as “new logistics” launched by Cainiao and “next-generation logistics” put forward by JD. In 2017, JD put the first whole-process unmanned warehouse into use; SF began construction of large logistics UAV headquarters base. Meanwhile, AGV firms represented by Quicktron, Geek+ and Aresbots stepped up their efforts in the field, further intensifying competition in automated logistics equipment market.

China Automated Logistics Equipment Industry Report, 2018-2022 by ResearchInChina underlines the followings:

Chinese automated logistics equipment system market (size, product mix, demand structure, competitive landscape, etc.);

Chinese automated logistics equipment system market (size, product mix, demand structure, competitive landscape, etc.);

Chinese automated logistics equipment market segments (automated stereoscopic warehouse, automated conveying equipment, AGV and forklift) (development, market size, competitive landscape, etc.);

Chinese automated logistics equipment market segments (automated stereoscopic warehouse, automated conveying equipment, AGV and forklift) (development, market size, competitive landscape, etc.);

Automated logistics equipment in major downstream sectors like automobile, tobacco, and pharmaceuticals in China (development, demand, corporate pattern, etc.);

Automated logistics equipment in major downstream sectors like automobile, tobacco, and pharmaceuticals in China (development, demand, corporate pattern, etc.);

Development of and trends in logistics, smart/E-commerce logistics, and cold-chain logistics markets in China

Development of and trends in logistics, smart/E-commerce logistics, and cold-chain logistics markets in China

Operation of nine global automated logistics equipment companies and their development in China;

Operation of nine global automated logistics equipment companies and their development in China;

Operation and development strategies of twelve Chinese automated logistics equipment enterprises.

Operation and development strategies of twelve Chinese automated logistics equipment enterprises.

1. Overview

1.1 Automated Logistics System

1.1.1 Definition

1.1.2 Industry Chain

1.2 Automated Logistics Equipment

1.2.1 Definition and Classification

1.2.2 Development History

2. Development of China’s Automated Logistics Equipment Industry

2.1 Policy

2.2 Market Size

2.3 Product Mix

2.4 Market Demand

2.5 Competitive Landscape

2.6 Development Trend

3. Development of Automated Logistics Equipment Product Segments

3.1 Automated Stereoscopic Warehouse

3.1.1 Overview

3.1.2 Automatic Stereoscopic Warehouse VS General Warehouse

3.1.3 Market Size

3.1.4 Market Demand

3.1.5 Competitive Landscape

3.2 Automated Guided Vehicle (AGV)

3.2.1 Market Size

3.2.2 Demand Structure

3.2.3 Competitive Landscape

3.2.4 Development Trend

3.3 Automated Sorter

3.3.1 Market Size

3.3.2 Product Mix

3.3.3 Competitive Landscape

3.4 Automated Conveyor

3.4.1 Market Size

3.4.2 Demand Structure

3.4.3 Corporate Competition

3.5 Palletizing Robot

3.5.1 Market Size

3.5.2 Competitive Landscape

3.6 Forklift

3.6.1 Output and Sales Volume

3.6.2 Product Competition

3.6.3 Regional Competition

3.6.4 Competition Pattern

3.6.5 Development Trend

4. Demand from Main Downstream Sectors of Automated Logistics Equipment

4.1 Automobile

4.1.1 Development

4.1.2 Demand

4.1.3 Corporate Competition

4.1.4 Development Trend

4.2 Tobacco

4.2.1 Development Overview

4.2.2 Demand

4.3 Pharmaceuticals

4.3.1 Development

4.3.2 Demand

4.3.3 Development Trend

5. Development of China’s Logistics Market

5.1 Development of Logistics Industry

5.2 Development of Intelligent Logistics

5.2.1 Development Overview

5.2.2 Development Trend

5.3 Express Delivery & E-commerce Logistics

5.3.1 Development Overview

5.3.2 Logistics Construction

5.4 Cold-chain Logistics

5.4.1 Development

5.4.2 Development of Cold-chain Logistics-related Equipment

5.5 Warehousing and Logistics Park Construction

5.6 Development Trend

6. Major Global Automated Logistics Equipment Suppliers

6.1 Daifuku

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 SSI Schaefer

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 Swisslog

6.3.1 Profile

6.3.2 Operation

6.3.3 Warehousing & Logistics Business

6.3.4 Development in China

6.4 DEMATIC

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Muratec (Murata Machinery)

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 TGW

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Interroll

6.7.1 Profile

6.7.2 Operation

6.7.4 Development in China

6.8 KNAPP AG

6.8.1 Profile

6.8.2 Operation

6.8.3 Development in China

6.9 Vanderlande

6.9.1 Profile

6.9.2 Operation

6.9.3 Development in China

7. Major Chinese Automated Logistics Equipment Suppliers

7.1 Shanxi Oriental Material Handling Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Projects under Construction

7.1.4 Development Prospects

7.2 Miracle Automation Engineering Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Automated Logistics Equipment Business

7.2.4 Development Prospects

7.3 New Trend International Logis-Tech Co., Ltd

7.3.1 Profile

7.3.2 Operation

7.3.3 Projects under Construction

7.4 MESNAC (002073)

7.4.1 Profile

7.4.2 Operation

7.4.3 Projects under Construction

7.4.4 Automated Logistics Equipment Business

7.5 Anhui Heli Co., Ltd. (600761)

7.5.1 Profile

7.5.2 Operation

7.5.3 Automated Logistics Equipment Business

7.6 Zhejiang Noblelift Equipment Joint Stock Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.5 Projects under Construction

7.6.4 Output and Sales Volume

7.7 Damon

7.7.1 Profile

7.7.2 Operation

7.8 YongLi (300230)

7.8.1 Profile

7.8.2 Operation

7.8.3 Automated Logistics Equipment Business

7.9 Siasun

7.9.1 Profile

7.9.2 Operation

7.9.3 Automated Logistics Equipment Business

7.10 Sanfeng Intelligent Conveying Equipment Co., Ltd. (300276)

7.10.1 Profile

7.10.2 Operation

7.10.3 Automated Logistics Equipment Business

7.11 Guandong Dongfang Precision Science & Technology (002611)

7.11.1 Profile

7.11.2 Operation

7.11.3 Intelligent Warehousing Equipment Business

7.12 KSEC Logistics & Information Industry Co. Ltd.

Subdivision of Automated Logistics System

Constitution of Automated Logistics System

Industrial Chain of Automated Logistics System

Main Automated Logistics Equipment Products

Classification of Automated Logistics

Policies on Automated Logistics Equipment in China, 2008-2018

Market Size of Automated Logistics Equipment in China, 2012-2022E

Market Size of Automated Logistics Equipment in China by Equipment Type, 2013-2022E

Penetration of China’s Automated Logistics Equipment and System in Downstream Sectors

Demand Structure of Automated Logistics Equipment in China by Application, 2013-2022E

Distribution of Major Automated Logistics Equipment Clients in China

Ranking of Top 20 Global Automated Logistics Suppliers by Sales, 2015-2017

Business Domains of Main Automated Logistics Equipment Manufacturers in China, 2018

Leading Enterprises in Automated Logistics Equipment Industry Segments in China

Major Development Trends in Automated Logistics Equipment in China

Classification of Automatic Stereo Warehouse

Development History of Automated Stereoscopic Warehouse in China, 1975-2017

Automated Warehouse VS Conventional Warehouse

Market Size of Automatic Stereo Warehouse in China, 2012-2022E

Automatic Stereo Warehouse Equipment Suppliers (by Sector) in China

Major Automatic Stereo Warehouse Enterprises in China by Sector

Annual Increment and YoY Growth of AGVs in China, 2011-2022E

Demand Structure of Logistics AGV Market by Sector, 2017

Usage Density of Automotive AGVs in Major Countries Worldwide

Market Share of AGVs in China by Enterprise, 2016

AGV Suppliers

Future Development Trend in AGVs

Market Size of Automated Sorters in China, 2013-2022E

Daily Sorting Quantity of Mainstream Express Enterprises in China, 2015

Development Trend in Automated Sorters

Major Automated Sorter Manufactures in China

Market Size of Automated Conveyors in China, 2013-2022E

Demand Structure of Automated Conveyors in China by Sector

Sales Volume and Ownership of Palletizing Robots in China, 2015-2020E

Distribution of Palletizing Robot Manufacturers in China, 2017

Output of Forklifts in China, 2009-2017

Sales Volume and YoY Growth of Forklifts in China, 2012-2022E

Proportion of Exported Forklifts in Total Sales Volume in China, 2007-2017

Sales Volume of Forklifts in China by Product, 2010-2017

Sales Volume Structure of Forklifts in China by Region, 2017

Market Share of Two Major Forklift Companies in China, 2009-2016

Ownership of Automobiles in China, 2012-2022E

Output and Sales Volume of Automobiles in China, 2012-2022E

NEV Production and Sales in China, 2011-2017

Percentage of Logistics Equipment Applied in Automotive Industry by Automobile Manufacturing Process

Main Flows of Automotive Coating Process

Flows of Automotive Automated Production Line

Demand for Automated Logistics Equipment in China’s Automobile Industry, 2013-2022E

Competitive Landscape of Automotive Intelligent Logistics Equipment Market in China

Revenue of Major Automotive Logistics Automation Equipment Suppliers, 2011-2017

New and Updated Automotive Production Lines in China, 2012-2022E

Cigarette Sales in China, 2014-2022E

Intelligent Logistics Solutions for the Tobacco Industry

Demand for Automated Logistics Equipment in China’s Tobacco Industry, 2013-2022E

Total Amount of Goods in China’s Drug Circulation, 2010-2022E

Automated Logistics Equipment Demand from Pharmaceutical Logistics in China, 2013-2022E

China’s Total Social Logistics, 2010-2018E

Market Size of Intelligent Logistics in China, 2010-2022E

Market Size and YoY Growth of Online Retails in China, 2014-2022E

Ratio of Total Social Logistics Costs to GDP in China, 2008-2017

Business Volume of Express Delivery Enterprises above Designated Size in China, 2010-2022E

Major Online Shopping Platforms in China

E-Logistic Index in China, 2015-2018

Development Trend and Distribution Modes of E-commerce Firms in China

Logistics Companies Established by Major E-Commerce Firms in China, 2017

Logistics Construction of Major E-commerce Firms in China, 2018

Logistics Construction Plan of Major Logistics Enterprises in China

Construction of Major Logistics Enterprises in China, 2017

Market Share of Major Logistics Enterprises in China by Business Volume, 206-2017

Market Size of Cold chain Logistics in China, 2015-2022E

Classification of Cold-Chain Clients

Total Capacity of Cold Storage in China, 2010-2017

Capacity Structure of Cold Storage in China by Storage Commodity, 2017

Demand for Cold Storage in China, 2010-2017

Sales Volume of Refrigerated trucks in China, 2017-2022E

Demand for Freezers from Top100 Supermarkets in China, 2016-2017

Ice Machine Sales in China, 2014-2017

Investment in Logistics Parks in China

Top10 National Intelligent Warehouse Logistics Demonstration Bases in China

Development Goals of Daifuku by Region

Business Structure of Daifuku

Revenue and Net Income of Daifuku, FY2010-FY2017

Order Value of Daifuku, FY2014- FY2017

Order Value of Daifuku by Sector and % of Total Revenue, FY2014-FY2017

Sales Value of Daifuku by Sector and % of Total Revenue, FY2014-FY2017

Revenue Structure of Daifuku by Region, FY2013-FY2017

Orders of Daifuku by Region, FY2014-2017

Net Sales and Orders of Daifuku in China, FY2013-FY2017

Presence of Daifuku in China

Revenue of SSI Schaefer, 2012-2017

Business and Product Distribution of Swisslog

Financials of Swisslog, 2014-2017

Order Value, Sales Revenue, and EBIT Margin of Swisslog, 2016-2017

Order Value and Sales Value of Swisslog by Business, 2010-2017

Revenue Structure of Swisslog by Region, 2014

WDS Business Development Strategy of Swisslog

WDS Order Value and Revenue of Swisslog, 2010-2014

WDS Revenue Structure of Swisslog by Business, 2013-2014

WDS Orders of Swisslog by Sector, 2014

Revenue of DEMATIC, 2014-2017

DEMATIC’s Typical Customers in China

Milestones of Dematic Logistics Systems Ltd Suzhou

Revenue of Muratec, 2012-2017

Logistics Solutions of Muratec

Business Layout of Muratec in China

Operation of TGW, FY2010-FY2017

Interroll’s Businesses

Interroll’s Global Layout

Revenue and Net Income of Interroll, 2010-2017

Revenue Breakdown of Interroll by Product, 2010-2017

Revenue Structure of Interroll by Region, 2015-2017

Revenue of KNAPP, 2012-2017

Clients of KNAPP

Major Subsidiaries of KNAPP in China

Main Business of Vanderlande

Revenue and EBIT of Vanderlande, 2012-2016

Order Book of Vanderlande, 2012-2016

Major Products of Shanxi Oriental Material Handling

Revenue and Net Income of Shanxi Oriental Material Handling, 2012-2018

Revenue Structure of Shanxi Oriental Material Handling by Product, 2014-2017

Gross Margin of Shanxi Oriental Material Handling by Product, 2012-2017

Revenue Breakdown of Shanxi Oriental Material Handling by Region, 2012-2015

Revenue Structure of Shanxi Oriental Material Handling by Application, 2012-2014

Projects under Construction of Shanxi Oriental Material Handling, 2018

Revenue and Net Income of Shanxi Oriental Material Handling, 2017-2022E

Revenue and Net Income of Miracle Automation, 2010-2018

Operating Revenue Structure of Miracle Automation by Product, 2015-2017

Operating Revenue Breakdown of Miracle Automation by Region, 2012-2017

Gross Margin of Miracle Automation by Product, 2012-2017

Logistics Automation Equipment Revenue of Miracle Automation by Product, 2012-2017

Revenue and Net Income of Automated Logistics Equipment Subsidiaries of Miracle Automation, 2014-2017

Miracle Automation’s Major Clients in Automotive Logistics Equipment

Major Events of Layout in Automated Logistics & Warehousing of Miracle Automation, 2014-2017

Revenue and Net Income of Miracle Automation, 2017-2022E

Major Solutions of New Trend International Logis-Tech

Major Subsidiaries of New Trend International Logis-Tech, 2017

Revenue and Net Income of New Trend International Logis-Tech, 2013-2018

New Orders of New Trend International Logis-Tech, 2013-2017

Orders in Hand of New Trend International Logis-Tech, 2013-2017

New Orders and Orders in Hand of New Trend International Logis-Tech by Application, 2017

Revenue Breakdown of New Trend International Logis-Tech by Product, 2016-2017

Revenue Breakdown of New Trend International Logis-Tech by Region, 2016-2017

Major Clients of New Trend International Logis-Tech

Projects under Construction of New Trend International Logis-Tech, 2018

Revenue and Net Income of MESNAC, 2010-2018

Operating Revenue Structure of MESNAC by Product, 2013-2017

Operating Revenue Breakdown of MESNAC by Region, 2012-2017

Gross Margin of MESNAC by Product, 2013-2017

Development History of MESNAC Automated Logistics System, 2010-2018

Revenue and Net Income of Anhui Heli, 2012-2017

Output and Sales Volume of Anhui Heli by Product, 2014-2017

Operating Revenue Breakdown of Anhui Heli by Product, 2013-2017

Operating Revenue Breakdown of Anhui Heli by Region, 2013-2017

Gross Margin of Anhui Heli by Product, 2012-2017

Key Subsidiaries of Noblelift Intelligent Equipment

Revenue and Net Income of Zhejiang Noblelift Equipment, 2011-2018

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Product, 2015-2017

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Region, 2013-2017

Gross Margin of Zhejiang Noblelift Equipment Joint Stock by Product, 2015-2017

Major Projects under Construction of Zhejiang Noblelift Equipment Joint Stock, 2018

Capacity, Output and Sales Volume of Zhejiang Noblelift Equipment Joint Stock by Product, 2011-2017

Revenue and Net Income of Damon, 2011-2017

Major Clients of Damon by Sector

Operating Revenue Structure of Damon by Product, 2015-2016

Operating Revenue Breakdown of Damon by Region, 2011-2016

Gross Margin of Damon by Product, 2015-2016

Revenue and Net Income of YongLi, 2012-2018

Revenue Structure of YongLi by Product, 2015-2017

Revenue Breakdown of YongLi by Region, 2013-2017

Gross Margin of YongLi by Product, 2015-2017

Revenue and Net Income of Siasun, 2012-2018

Operating Revenue Structure of Siasun by Product, 2014-2017

Operating Revenue Structure of Siasun by Region, 2014-2017

Gross Margin of Siasun by Product, 2013-2017

Siasun’s Intelligent Logistics Solutions

Revenue and Net Income of Sanfeng Intelligent Conveying Equipment, 2011-2018

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Product, 2012-2017

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Sector, 2013-2017

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Region, 2014-2017

Gross Margin of Sanfeng Intelligent Conveying Equipment by Product, 2012-2017

Intelligent Conveyor Revenue of Sanfeng Intelligent Conveying Equipment, 2012-2017

Strategic Layout of Guangdong Dongfang Precision Science & Technology

Revenue and Net Income of Guangdong Dong Fang Precision Science & Technology, 2012-2018

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Product, 2014-2017

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Region, 2013-2017

Major Events of Layout in Intelligent Packaging Logistics System of Guangdong Dong Fang Precision Science & Technology

Operating Data of Guangdong Jaten Robot & Automation and Ferretto, 2016-2017

Robot Controllers (Brain & Cerebellum) Research Report, 2025

Robot Controller Research: Brain-Cerebellum Integration Becomes a Trend, and Automotive-Grade Chips Migrate to Robots

ResearchInChina has released the Robot Controllers (Brain & Cerebellum) Resea...

Tactile Sensor Research Report, 2025

ResearchInChina has released the "Tactile Sensor Research Report, 2025", which conducts research, analysis and summary on the basic concepts, technical principles, advantages and disadvantages o...

Embodied AI and Humanoid Robot Market Research 2024-2025: Product Technology Outlook and Supply Chain Analysis

Six Trends in the Development of Embodied AI and Humanoid Robots

In 2025, the global humanoid robot industry is at a critical turning point from technology verification to scenario penetration, and t...

Global and China Smart Meters Industry Report, 2022-2027

Meters are widely used in the national economy and are an important part of metering to promote the development of metering. As a legal measuring tool, meters are mainly used in the supply process of ...

China Smart Agriculture and Autonomous Agricultural Machinery Market Report, 2022

Research on smart agriculture and autonomous agricultural machinery: top-level design, agricultural digitization and automation present a potential marketAmid the pandemic, the conflict between Russia...

Global and China Heat Meters Industry Report, 2022-2027

A heat meter is an instrument used to measure, calculate and display the value of heat released or absorbed by water flowing through a heat exchange system, and is mainly used for measuring the heatin...

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...