Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by autonomous driving well. At the same time, mining areas features closed environment, fixed lines, low speed, and point-to-point, marking one of the best scenarios for autonomous driving.

As early as the 1990s, smart mining emerged abroad. Australia is currently the most mature in this aspect. As of February 2020, nearly 80% of approximately 500 autonomous trucks in the world had been in Australia. China has successively introduced policies to promote the development of smart mining, especially the National Development and Reform Commission (NDRC) and other 7 ministries and commissions issued Guidance on Speeding up the Development of Intelligent Coal Mines in 2020 to clearly require that open-pit coal mines should realize unmanned transport by 2025. Driven by relevant policies, autonomous driving will accelerate its implementation in mining.

Science and Technology Enterprises Lead the Development of China's Autonomous Driving in Mining

As the most important part of smart mining, low-speed autonomous driving has now entered the stage of commercial operation on a global scale.

As early as 1994, Caterpillar tested autonomous minecarts in mines in the United States, and Japan-based Komatsu also began testing autonomous transportation system in 2005.

As of April 2020, Komatsu had deployed a total of 221 AHS-equipped vehicles in Australia, North America, and South America, and had fulfilled the automated transportation of more than 3.5 billion tons of materials in 12 years.

Caterpillar has 276 autonomous trucks in operation worldwide, and has transported 2 billion tons of materials with the MineStar System.

Although the domestic mining began to develop autonomous driving relatively late with few players, more than 100 autonomous minecarts have been put into operation as per the disclosed information.

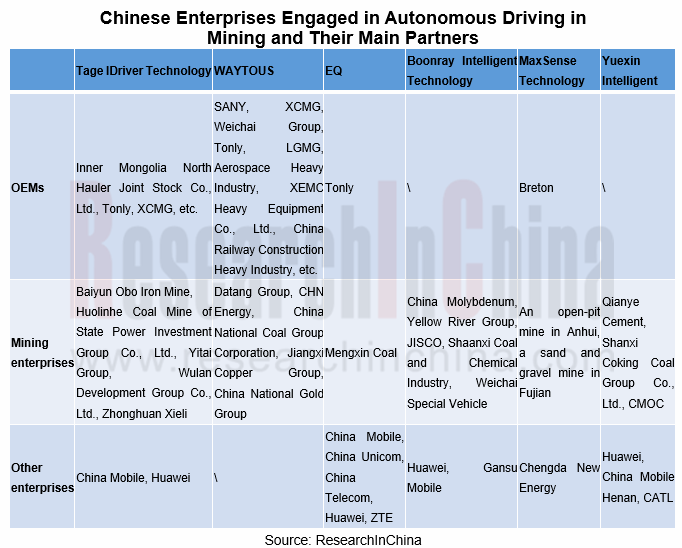

In China, local enterprises mainly dominate autonomous driving in mining, including start-up companies and some OEMs. Among them, startups represented by WAYTOUS, Tage IDriver Technology and EQ are more influential. On the one hand, they cooperate with OEMs to lay out the OEM market, reduce modification costs, and obtain scale advantages in future mass production; on the other hand, they can quickly implement and iterate software and hardware by cooperating with mining enterprises in deploying the AM market.

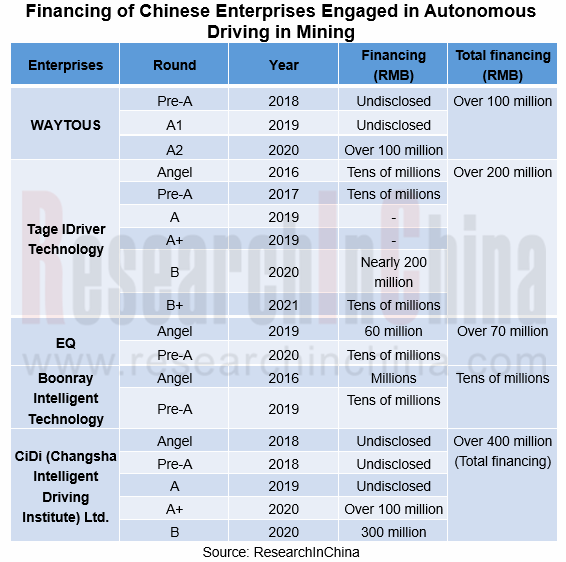

Capital Favors Low-speed Autonomous Driving Market for Mining

At present, the capital market is also very optimistic about low-speed autonomous driving in mining. Most enterprises have completed multiple rounds of financing. Among them, Tage IDriver Technology has fulfilled the B+ round with relatively high total financing amount, while CiDi (Changsha Intelligent Driving Institute) Ltd. has raised more than the highest RMB400 million.

Driven by user demand, policies and capital, the development of autonomous driving in mining is accelerating, and a market worth hundreds of billions of yuan will be formed in the next few years hereby.

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...