Global and China Financial Leasing Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$3,200

-

- Pages:195

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

JAF014

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

The top 50 countries in 2017 reported the growth in new business volume of 16.6%, rising from US$1,099.77 billion in 2016 to a remarkable US$1,282.73 billion in 2017. Three regions, North America, Europe and Asia, account for more than 95% of world volume. New business volume exceeded the previous year’s global total by US$182.96 billion. The Asian region experienced truly exceptional growth of 58.9% largely bolstered by an uplift in new business of US$59 billion in China. Europe recorded a growth rate of 32.7% and North America experienced 9.3% growth over the previous year. Australia/New Zealand was up 1% and South America up 23.2%. By contrast, Africa recorded a fall from last year’s figure of 15.8%.

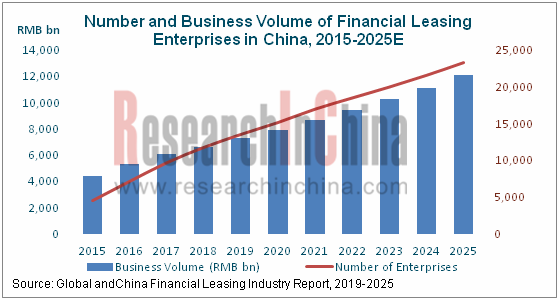

Financial leasing, a financial service bolstering real economy growth, helps companies make use of their idle assets and reduce liabilities. The boom of the industry comes with the growing number of enterprises in recent years. By the end of 2018, there had been a total of some 11,777 financial leasing firms in China, an addition of 2,101 or 21.7% over the previous year and showing a CAGR of 51.6% compared with 80 in 2006. The figure is predicted to reach 23,000 in 2025.

The growing number of financial leasing companies produces more business volume. By the end of 2018, financial leasing contract value had totaled RMB6.65 trillion in China, RMB570 billion or 9.38% more than the size of RMB6.08 trillion at the end of 2017. Yet, the high growth rate of business volume is on the wane and beginning to stabilize. It is estimated that China’s financial leasing business volume will be approximately RMB12 trillion in 2025.

In China, financial leasing agencies fall into three types in terms of their regulators: banking leasing companies, domestic-funded financial leasing companies and foreign-funded financial leasing companies. They largely vary in time of emergence, approval authority, nature, regulatory strength and business range. Among the three types of financial leasing firms, banking leasing companies are supervised by China Banking & Insurance Regulatory Commission which has not approved a new one since 2018 due to mergers among this kind of agencies. As of December 2018, there had been 69 banking leasing firms approved.

Approving domestic-funded financial leasing companies to carry out pilot business was still under way in free-trade areas in Tianjin, Shaanxi, Shenyang and Guangdong in 2018. As of December 2018, there had been 397 domestic-funded financial leasing firms in total approved, increasing by 117 or 41.8% compared with the previous year when 280 were approved.

The number of foreign-funded financial leasing companies continued to rise in Tianjin, Guangdong, Shanghai, Liaoning and Shaanxi. As of December 2018, there had been 11,311 of such firms in China, an increase of 1,984 or 21.3% from 9,327 at the end of 2017.

As of December 2018, financial leasing businesses spread all over China, but the overwhelming majority clustered in the southeastern coastal areas, especially the 10 provinces and municipalities (i.e., Guangdong, Shanghai, Tianjin, Liaoning, Beijing, Fujian, Jiangsu, Zhejiang, Shandong and Shaanxi) accommodating at least 95% financial leasing firms.

As of December 2018, of the top fifty financial leasing companies by registered capital, Tianjin Bohai Leasing Co., Ltd. came to the top spot with the registered capital of RMB22.101 billion, and ICBC Leasing Co., Ltd. and Ping An International Financial Leasing Co., Ltd. leaped to the second and third places with RMB18 billion and RMB13.241 billion, respectively.

Global &China Financial Leasing Industry Report, 2019-2025 highlights the following:

Global financial leasing development, and status quo of financial leasing in major countries;

Global financial leasing development, and status quo of financial leasing in major countries;

China financial leasing industry (policy and economic conditions);

China financial leasing industry (policy and economic conditions);

China financial leasing market (size, competitive pattern, funding channels, profit model and development trend);

China financial leasing market (size, competitive pattern, funding channels, profit model and development trend);

China financial leasing market segments (aviation, shipping, construction machinery, medical equipment, printing equipment, rail transportation equipment, automobile, agricultural machinery, electric power, etc.);

China financial leasing market segments (aviation, shipping, construction machinery, medical equipment, printing equipment, rail transportation equipment, automobile, agricultural machinery, electric power, etc.);

China financial leasing regional markets (Tianjin, Beijing, Guangdong, Shanghai, etc.);

China financial leasing regional markets (Tianjin, Beijing, Guangdong, Shanghai, etc.);

Chinese financial leasing companies (10 banking leasing companies, 8 domestic-funded financial leasing companies and 10 foreign-funded financial leasing companies) (operation, financial leasing business, funding channels, development strategy, etc.).

Chinese financial leasing companies (10 banking leasing companies, 8 domestic-funded financial leasing companies and 10 foreign-funded financial leasing companies) (operation, financial leasing business, funding channels, development strategy, etc.).

1. Overview of Financial Leasing

1.1 Definition and Characteristics

1.2 Business Forms

1.3 Industry Chain

2. Global Financial Leasing Development

2.1 Overview

2.2 Major Countries

2.2.1 USA

2.2.2 Japan

2.2.3 Germany

3. Environments for Financial Leasing Development in China

3.1 Policy

3.2 Economy

3.2.1 GDP Growth Rate

3.2.2 Fixed Asset Investments

3.2.3 Capital Supply

4. Financial Leasing Development in China

4.1 Development History

4.2 Industrial Scale

4.2.1 Types and Number of Enterprises

4.2.2 Business Volume

4.2.3 Registered Capital

4.3 Competitive Landscape

4.3.1 by Region

4.3.2 by Enterprise

4.3.3 by Application

4.3.4 by Business Form

4.4 Financing Channels

4.4.1 Overview

4.4.2 Financial Leasing ABS

4.5 Profit Model

4.6 Development Trend

5. Development of Financial Leasing in Key Industries in China

5.1 Aviation Industry

5.1.1 Industrial Development

5.1.2 Status Quo of Financial Leasing

5.1.3 Major Aircraft Leasing Companies

5.1.4 Financial Leasing of Major Airlines

5.2 Shipping Industry

5.2.1 Industrial Development

5.2.2 Ship Leasing Modes

5.2.3 Status Quo of Financial Leasing

5.2.4 Major Ship Leasing Companies

5.3 Automobile Industry

5.3.1 Industrial Development

5.3.2 Status Quo of Financial Leasing

5.3.3 Automobile Financial Leasing Market Segments

5.3.4 Major Automobile Leasing Companies

5.4 Railway Transportation Equipment

5.4.1 Industrial Development

5.4.2 Status Quo of Financial Leasing

5.5 Construction Machinery

5.5.1 Industrial Development

5.5.2 Status Quo of Financial Leasing

5.5.3 Major Leasing Companies

5.6 Medical Equipment

5.6.1 Industrial Development

5.6.2 Status Quo of Financial Leasing

5.6.3 Major Leasing Companies

5.7 Printing Equipment

5.7.1 Industrial Development

5.7.2 Status Quo of Financial Leasing

5.8 Others

5.8.1 Agricultural Machinery

5.8.2 Electric Power

6. Development of Financial Leasing in Major Regions of China

6.1 Tianjin

6.2 Guangdong

6.3 Beijing

6.4 Shanghai

7. Key Banking Leasing Enterprises in China

7.1 ICBC Leasing Co. Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Financial Leasing Services

7.1.4 Financing Channels

7.1.5 Development Strategy

7.2 China Development Bank Financial Leasing Co. Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Financial Leasing Services

7.2.4 Financing Channels

7.3 Bank of Communications Financial Leasing Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Financial Leasing Services

7.3.4 Financing Channels

7.4 Kunlun Financial Leasing Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Financial Leasing Services

7.4.4 Development Strategy

7.5 Minsheng Financial Leasing Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Financial Leasing Services

7.5.4 Financing Channels

7.5.5 Development Strategy

7.6 Industrial Bank Financial Leasing Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Financial Leasing Services

7.6.4 Financing Channels

7.6.5 Development Strategy

7.7 CCB Financial Leasing Co. Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Financial Leasing Services

7.7.4 Financing Channels

7.8 CMB Financial Leasing Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 Financial Leasing Services

7.8.4 Financing Channels

7.9 China Huarong Financial Leasing Co., Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 Financial Leasing Services

7.9.4 Financing Channels

7.10 Taiping & Sinopec Financial Leasing Co., Ltd.

7.10.1 Profile

7.10.2 Operation

7.10.3 Financial Leasing Services

7.10.4 Financing Channels

8. Key Domestic-funded Financial Leasing Enterprises in China

8.1 Tianjin Bohai Leasing Co., Ltd.

8.1.1 Profile

8.1.2 Operation

8.1.3 Financial Leasing Services

8.1.4 Financing Channels

8.1.5 Subsidiary - Wanjiang Financial Leasing Co., Ltd.

8.1.6 Subsidiary - Hengqin International Leasing Co., Ltd.

8.2 Changjiang Leasing Co., Ltd.

8.2.1 Profile

8.2.2 Operation

8.2.3 Financial Leasing Services

8.3 Pu Hang Leasing Co., Ltd.

8.3.1 Profile

8.3.2 Operation

8.3.3 Financial Leasing Services

8.4 Guotai Leasing Limited Company

8.4.1 Profile

8.4.2 Operation

8.4.3 Financial Leasing Services

8.4.4 Financing Channels

8.5 ALL Trust Leasing Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Financial Leasing Services

8.6 AVIC International Leasing Co., Ltd

8.6.1 Profile

8.6.2 Operation

8.6.3 Financial Leasing Services

8.6.4 Financing Channels

8.6.5 Development Strategy

8.7 Fenghui Leasing Co., Ltd.

8.7.1 Profile

8.7.2 Operation

8.7.3 Financial Leasing Services

8.7.4 Financing Channels

8.8 JIC Leasing Co., Ltd.

8.8.1 Profile

8.8.2 Operation

8.8.3 Financial Leasing Services

8.8.4 Financing Channels

9. Key Foreign-funded Financial Leasing Companies in China

9.1 International Far Eastern Leasing Co., Ltd.

9.1.1 Profile

9.1.2 Operation

9.1.3 Financial Leasing Services

9.1.4 Financing Channels

9.2 Ping An International Financial Leasing Co., Ltd.

9.2.1 Profile

9.2.2 Operation

9.2.3 Financial Leasing Services

9.2.4 Financing Channels

9.3 Shandong Chenming Financial Leasing Co., Ltd.

9.3.1 Profile

9.3.2 Operation

9.3.3 Financial Leasing Services

9.4 Zhongyin Financial Leasing Co., Ltd.

9.4.1 Profile

9.4.2 Operation

9.4.3 Financial Leasing Services

9.5 China Universal Leasing Co., Ltd.

9.5.1 Profile

9.5.2 Operation

9.5.3 Financial Leasing Services

9.6 Haitong UniTrust International Leasing Corporation

9.6.1 Profile

9.6.2 Operation

9.6.3 Financial Leasing Services

9.7 Others

9.7.1 Zhongjin International Financial Leasing (Tianjin) Co., Ltd.

9.7.2 Xinxin Financial Leasing Co., Ltd.

9.7.3 CCCC Financial Leasing Co., Ltd.

9.7.4 CM International Financial Leasing Co., Ltd.

10. Summary and Forecast

10.1 Market

10.2 Enterprises

Main Features of Financial Leasing Services

Difference between Financial Leasing and Operating Leasing

Main Forms of Financial Leasing Services

Contrast between Direct Leasing and Sale-leaseback

Financial Leasing Industry Chain

Global Financial Leasing Turnover, 2010-2017

Global Financial Leasing Turnover (by Region), 1999-2017

Global Financial Leasing Turnover Structure (by Region), 2017

Global Financial Leasing Turnover and Penetration Rate (by Country / Region), 2017

Equipment Financial Leasing Market Size in the United States, 2011-2020E

Financial Leasing Sectors in the United States, 2017

Structure of Financial Leasing Enterprises in the United States

Financial Leasing Turnover in Japan, 2010-2018

Leasing Business Structure (by Application) in Japan, 2018

Policies on China’s Financial Leasing Industry, 2014-2018

Policies about Financial Leasing in Major Provinces and Municipalities of China, 2015-2018

Growth Rate of China’s GDP, 2015-2025E

China’s Fixed Asset Investments, 2015-2025E

China’s Currency Supply, 2010-2019

Number and Business Volume of Financial Leasing Enterprises in China, 2015-2025E

Financial Leasing Penetration Rate in China, 2010-2019

Comparison between Three Types of Financial Leasing Companies

Number of Financial Leasing Enterprises in China (by Type), 2010-2019

Business Volume of China’s Financial Leasing Services (by Corporate Type), 2010-2019

Registered Capital of Financial Leasing Enterprises in China (by Corporate Type), 2010-2019

Distribution of Banking Leasing Companies in China (by Region), end of Jun 2019

Distribution of Foreign-funded Financial Leasing Companies in China (by Region), end of 2018

Distribution of Domestic-funded Pilot Financial Leasing Companies in China (by Region), end of 2018

Top 10 Financial Leasing Enterprises in China, end of 2018

Top 10 Banking Leasing Companies in China, end of 2018

Top 10 Foreign-funded Banking Leasing Companies in China, end of 2018

Top 10 Domestic-funded Pilot Banking Leasing Companies in China, end of 2018

China’s Financial Leasing Assets (by Sector), 2018

China’s Financial Leasing Assets (by Sector), 2017

China’s Financial Leasing Assets (by Sector), 2018

China’s Financial Leasing Business Structure, 2014-2018

Comparison between Different Financial Leasing Channels

Number and Amount of Financial Leasing ABS Issued in China, 2010-2018

Term of Operation and Capital of Original Owners of Financial Leasing and Banking Leasing, 2006-2018

Lease Debt ABS by Leasing Type, 2006-2018

Average Offering Scale and Period of Financial Leasing and Banking Leasing, 2006-2018

Offering Scale of Top10 Original Owners (RMB100 mln), 2006-2018

Number of Offerings of Top10 Original Owners, 2006-2018

Top10 Financial Leasing ABS Issuers by Amount, 2018

Structure of AAA and Secondary Average Stratification in Financial Leasing and Banking Leasing, 2014-2018

Main Production Indexes of Global Air Transport Industry, 2010-2018

Main Production Indexes of Air Transport Industry in China, 2011-2018

Number of Civilian Transport Aircraft in China, 2010-2018

Top10 Civilian Transport Aircraft Fleets in China, 2018

Aircraft Financial Leasing Models in Major Countries

Proportion of Leased Aircraft Worldwide, 1970-2020E

Distribution of Orders for China’s C919 at the End of Jun 2019

Top10 Aircraft Leasing Companies Worldwide, 2018

BOC Aviation’s Fleet, 2017-2018

Revenue Structure of BOC Aviation, 2018

Revenue Structure of Bohai Capital Holding, 2018

Fleets of Aircraft Leasing Companies in China, 2012-2018

Revenue Structure of Aircraft Leasing Companies in China, 2018

Revenue Structure of China Development Bank Financial Leasing, 2015-2018

Financial Lease Revenue Structure of China Development Bank Financial Leasing by Business, 2015-2018

Operating Lease Revenue Structure of China Development Bank Financial Leasing by Business, 2015-2018

Fleet of Air China at the End of 2018

Fleet of China Eastern Airlines at the End of 2018

Fleet of China Southern Airlines at the End of 2018

Fleet of Hainan Airlines at the End of 2018

Fleet of Spring Airlines at the End of 2018

Main Production Indexes of Shipbuilding Industry in China, 2011-2019

Advantages and Disadvantages of Several Ship Lease Financing Forms in China

China’s Ship Financial Leasing Market Share, 2014 & 2018

China’s Automobile Output, 2015-2025E

China’s Automobile Ownership, 2015-2025E

Comparison between Financial Loan and Financial Leasing of Automobiles

Penetration Rate of Automobile Financial Leasing in Main Countries, 2018

China’s Used Car Trading Volume and YoY Growth Rate, 2011-2019

Classification of Automobile Financial Leasing Companies in China

Major Automobile Financial Leasing Companies in China

Classification of Railway Transport Equipment

China’s Fixed Asset Investments in Railways, 2015-2025E

China’s Investments into Railway Locomotives & Vehicles, 2015-2025E

Operating Revenue and YoY Growth of Construction Machinery Industry in China, 2015-2025E

Top15 Construction Machinery Enterprises in China by Revenue, 2018

Construction Machinery Financial Leasing Turnover in China, 2015-2025E

Major Construction Machinery Financial Leasing Companies in China

Chinese Medical Equipment Market Size, 2015-2025E

Core Industry Chain of Medical Leasing

Financial Leasing Value of Medical Equipment and Penetration Rate in China, 2015-2025E

Major Medical Equipment Financial Leasing Companies in China

Fixed Asset Investments in Printing Industry in China, 2015-2025E

Main Economic Indicators of Printing Equipment Manufacturing in China, 2018

Main Economic Indicators of Agricultural Machinery Industry in China, 2011-2019

Major Agricultural Machinery Financial Leasing Companies in China

Investments in Electric Power in China, 2011-2019

Installed Power-generation Capacity in China by Energy, 2013-2018

Number of Financial Leasing Enterprises and YoY Growth in Tianjin, 2018

Registered Capital of Financial Leasing Enterprises and YoY Growth in Tianjin, 2018

Business Volume of Financial Leasing and YoY Growth in Tianjin, 2018

Top 10 Financial Leasing Enterprises in Tianjin, end of 2018

Planning of Guangdong’s Three Major Districts for Financial Leasing Services

Top 10 Financial Leasing Enterprises in Guangdong, end of 2018

Top 10 Financial Leasing Enterprises in Beijing, end of 2018

Top 10 Financial Leasing Enterprises in Shanghai, end of 2018

Main Operational Indicators of ICBC Leasing, 2010-2018

Main Economic Indicators of China Development Bank Financial Leasing, 2013-2018

Total Assets and Revenue of China Development Bank Financial Leasing’s Main Business Segments, 2018

Financial Leasing Value and Proportion of China Development Bank Financial Leasing, 2013-2018

Turnover and Proportion of China Development Bank Financial Leasing (by Business), 2016-2018

Main Operational Indicators of Bank of Communications Financial Leasing, 2014-2018

Balance of Leasing Assets of Bank of Communications Financial Leasing, 2011-2018

Financial Leasing Business Structure of Bank of Communications Financial Leasing (by Industry), 2016-2018

Main Economic Indicators of Kunlun Financial Leasing, 2014-2019

Balance of Leasing Assets of Kunlun Financial Leasing (by Business), 2014-2018

Top 5 Industries of Kunlun Financial Leasing by Financial Leasing Assets, 2016-2018

Customer Concentration of Kunlun Financial Leasing’s Financial Leasing Services, 2016-2018

Equity Structure of Minsheng Financial Leasing, 2018

Main Economic Indicators of c, 2014-2019

Top 5 Industries with Financial Leasing Assets of Minsheng Financial Leasing, 2016-2018

Customer Concentration of Minsheng Financial Leasing’s Financial Leasing Services, 2014-2018

Main Economic Indicators of Industrial Bank Financial Leasing, 2014-2018

Leasing Projects of Industrial Bank Financial Leasing, 2014-2018

Financial Leasing Services of Industrial Bank Financial Leasing (by Sector), 2016-2018

Main Economic Indicators of CCB Financial Leasing, 2014-2018

Structure of CCB Financial Leasing’s Leasing Assets (by Sector), end of 2018

Main Economic Indicators of CMB Financial Leasing, 2014-2018

Total Leasing Assets of CMB Financial Leasing (by Business), 2018

Structure of CMB Financial Leasing’s Receivables from Financial Leasing (by Sector), 2016-2018

Main Economic Indicators of China Huarong Financial Leasing, 2018

Receivables of China Huarong Financial Leasing from Financial Leasing, 2017-2018

Receivables of China Huarong Financial Leasing from Financial Leasing (by Sector), 2017-2018

Receivables of China Huarong Financial Leasing from Financial Leasing (by Region), 2017-2018

Main Economic Indicators of Tianjin Bohai Leasing, 2014-2018

Major Subsidiaries of Bohai Leasing

Main Existing Projects of Tianjin Bohai Leasing’s Headquarters, as of the end of Mar 2019

Distribution of Leasing Projects of Tianjin Bohai Leasing’s Headquarters, as of the end of Mar 2019

Financing Channels Structure of Tianjin Bohai Leasing, 2017-2019

Financial Leasing Project Contract Balance of Wanjiang Financial Leasing (by Sector), 2015-2017

Financial Leasing Project Contract Balance of Wanjiang Financial Leasing (by Region), 2015-2017

Project Contracts of Hengqin International Leasing, 2017-2018

Main Economic Indicators of Changjiang Leasing, 2014-2018

Main Economic Indicators of Pu Hang Leasing

Main Economic Indicators of Guotai Leasing, 2014-2019

Revenue Structure of Guotai Leasing, 2016-2018

Leasing Revenue Structure of Guotai Leasing, 2016-2018

Receivables of Guotai Leasing from Financial Leasing (by Sector), 2016-2018

Main Economic Indicators of ALL Trust Leasing, 2015-2018

Shareholder Structure of AVIC International Leasing, end of Jun 2019

Main Economic Indicators of AVIC International Leasing, 2014-2019

Structure of AVIC International Leasing’s Leasing Assets (by Leasing Mode), 2014-2019

Structure of AVIC International Leasing’s Leasing Assets (by Sector), 2014-2019

Structure of AVIC International Leasing’s Main Financing Sources, end of Mar 2019

Main Economic Indicators of Fenghui Leasing, 2015-2018

Revenue of Fenghui Leasing (by Business), 2017-2018

Cost and Gross Margin of Fenghui Leasing (by Business), 2017-2018

Financial Leasing Value of Fenghui Leasing, 2017-2018

Structure of Fenghui Leasing’s Existing Assets for Financial Leasing (by Sector), 2017-2018

Sources of Fenghui Leasing’s Funds, as of the end of 2018

Main Economic Indicators of JIC Leasing, 2014-2019

Financial Leasing Capital Disbursement of JIC Leasing, 2016-2019

Financial Leasing Asset Balance of JIC Leasing, 2016-2019

Operation of Leasing Business of JIC Leasing by Leasing Model, 2014-2019

Financial Leasing Receivable of JIC Leasing by Region, 2016-2019

Main Economic Indicators of International Far Eastern Leasing, 2014-2019

Operating Revenue Structure of International Far Eastern Leasing, 2016-2019

Operational Cost Structure of International Far Eastern Leasing, 2016-2019

Financial Leasing Services of International Far Eastern Leasing, 2014-2019

Financial Leasing Receivable Structure of International Far Eastern Leasing by Industry, 2016-2019

Financing Source Structure of International Far Eastern Leasing, 2018

Main Economic Indicators of Ping An International Financial Leasing, 2014-2019

Leasing Business Asset Balance Structure of Ping An International Financial Leasing by Sector, 2016-2018

Leasing Business Asset Balance Structure of Ping An International Financial Leasing by Region, 2016-2018

Main Economic Indicators of Shandong Chenming Financial Leasing, 2016-2019

Main Economic Indicators of Zhongyin Financial Leasing, 2015-2018

Main Economic Indicators of China Universal Leasing, 2014-2019

Revenue Structure of China Universal Leasing by Business, 2016-2018

Net Financial Leasing Receivable of China Universal Leasing by Industry, 2016-2018

Distribution of New Leasing Contracts of China Universal Leasing by Region, 2016-2018

Main Economic Indicators of Haitong UniTrust International Leasing, 2014-2018

Revenue Structure of Haitong UniTrust International Leasing by Business, 2016-2018

Total Net Financial Leasing Receivable Structure of Haitong UniTrust International Leasing by Leasing Model, 2014-2018

Disbursement Structure of Haitong UniTrust International Leasing’s Leasing Business by Leasing Model, 2014-2018

Leasing Asset Balance Structure of Haitong UniTrust International Leasing by Industry, 2018

Financial Leasing Services and Market Penetration Rate in China, 2016-2025E

Number of Financial Leasing Enterprises in Major Regions of China, 2018

Comparison of Economic Indicators of Major Financial Leasing Companies in China, 2018

Comparison of Economic Indicators of Major Domestically-funded Leasing Companies in China, 2018

Global and China Mobile Payment Industry Report, 2019-2025

Global mobile payment market springs up as smartphones prevail, “internet plus” spreads and technology advances. Globally in 2017, people in the three countries China, Norway and Britain most favored ...

Global and China Financial Leasing Industry Report, 2019-2025

The top 50 countries in 2017 reported the growth in new business volume of 16.6%, rising from US$1,099.77 billion in 2016 to a remarkable US$1,282.73 billion in 2017. Three regions, North America, Eur...

China Third-Party Payment Industry Report, 2019-2025

Third-party payment is comprised of traditional payment and emerging fin-tech services, of which payment services fall into five kinds, i.e., mobile POS (Point of Sale) payment, mobile payment, intern...

Global and China Financial POS Terminal Industry Report,2015-2018

POS terminals joined UnionPay cumulatively totaled 15.935 million units by the end of 2014, a year-on-year increase of 49.9%, of which 5.3029 million units were added in 2014, up 50.9% from the previo...

China Financial Leasing Industry Report, 2015

Although China’s economic growth saw continuous downturn, China financial leasing industry has maintained fast growth since 2014, with total turnover approximating RMB 3,420 billion as of the end of M...