Global and China Lithium Iron Phosphate Material and Battery Industry Report, 2013-2015

-

Apr./2014

- Hard Copy

- USD

$2,600

-

- Pages:118

- Single User License

(PDF Unprintable)

- USD

$2,450

-

- Code:

SJH001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

Power battery cathode materials mainly include lithium cobalt oxide, lithium manganese oxide, multi-element materials and lithium iron phosphate, of which, global market share of lithium cobalt oxide has kept declining over the recent years, while that of both multi-element materials and lithium iron phosphate has got improved to some extent.

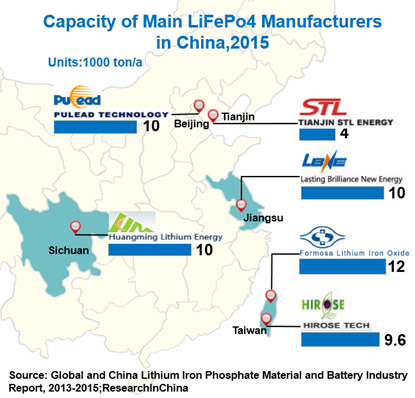

Internationally, lithium iron phosphate manufacturers mainly refer to the U.S.-based A123 and Valence, Canada-based Phostech, Taiwan-based Formosa Lithium Iron Oxide Corp., Aleees and HIROSE TECH. Among them, the first three companies grasp more mature mass-production technology. However, driven by the Asia-Pacific new energy electric vehicle industry, global lithium iron phosphate industry is gradually shifting focus towards Mainland China and Taiwan.

Global lithium iron phosphate sales volume approximated 11 kilotons in 2013, about 52.7% of which came from China, largely because Chinese electric vehicle companies tended to use power battery with lithium iron phosphate as cathode materials.

According to China's Planning for the Development of the Energy-Saving and New Energy Automobile Industry (2012-2020), pure electric vehicles (PEV) and plug-in hybrid electric vehicles (PHEV) strive to reach cumulative output and sales volume of 500,000 by 2015; over five million by 2020, with production capacity of two million. As the most important cathode material of battery power in China, lithium iron phosphate will see a significant increase in demand driven by the new energy automotive industry in the future.

In China, there have been more than 100 companies involved in lithium iron phosphate by the end of 2013, and over ten of them such as Tianjin STL Energy Technology Co., Ltd., Pulead Technology Industry Co., Ltd., Sichuan Huangming Lithium Energy New Materials Co., Ltd., Nanjing Lasting Brilliance New Energy Technology Co., Ltd. and Yantai Zhuoneng Battery Material Co.,Ltd can achieve large-scale production. And, many domestic enterprises based on the promising market prospects have made capacity expansion plans, especially Pulead Technology, Huangming Lithium Energy and Nanjing Lasting Brilliance will raise lithium iron phosphate capacity to 10kt/a each in 2015.

The report focuses on the followings:

Overview of the global lithium iron phosphate industry, including sales volume, market share and major international suppliers;

Overview of the global lithium iron phosphate industry, including sales volume, market share and major international suppliers;

Status quo of China lithium iron phosphate industry, including policies, sales volume, industrial distribution, competition pattern and key suppliers;

Status quo of China lithium iron phosphate industry, including policies, sales volume, industrial distribution, competition pattern and key suppliers;

Supply and demand of China lithium iron phosphate battery industry, including upstream suppliers and downstream customers;

Supply and demand of China lithium iron phosphate battery industry, including upstream suppliers and downstream customers;

Operation and development strategies of 20 lithium iron phosphate material manufacturers (including A123, Valence, Phostech, Aleees, Tianjin STL and Pulead Technology) in Mainland China and Taiwan;

Operation and development strategies of 20 lithium iron phosphate material manufacturers (including A123, Valence, Phostech, Aleees, Tianjin STL and Pulead Technology) in Mainland China and Taiwan;

Operation and development strategies of 11 Chinese lithium iron phosphate battery companies (including BYD, BAK Battery, Tianjin Lishen and Shenzhen Mottcell).

Operation and development strategies of 11 Chinese lithium iron phosphate battery companies (including BYD, BAK Battery, Tianjin Lishen and Shenzhen Mottcell).

1. Overview of LiFePO4 Battery

1.1 Overview

1.1.1 Definition

1.1.2 Merits and Demerits

1.2 Industry Chain

2. Overview of International Market

2.1 Market Position

2.2 Sales Volume

2.3 Major International Suppliers

3. Market of LiFePO4 Materials in China

3.1 Chinese Market

3.1.1 Regional Distribution

3.1.2 Sales Volume

3.1.3 Major Enterprises

3.1.4 Competition Pattern

3.2 Price of LiFePO4 Materials

3.3 Patent Barriers of LiFePO4 Materials

3.3.1 Dispute on Patent

3.3.2 Latest Development

3.4 Policy Impact

4. Industry of LiFePO4 Battery in China

4.1 Supply

4.2 Demand

4.2.1 Electric Car

4.2.2 Electric Tools

4.2.3 Electric Bicycle

4.2.4 Energy Storage Equipment

4.2.5 Communication Industry

5. Key LiFePO4 Materials Manufacturers

5.1 A123 Systems

5.1.1 Profile

5.1.2 Operation

5.1.3 Subsidiaries in China

5.2 Valence

5.2.1 Profile

5.2.2 Operation

5.2.3 Latest Products

5.2.4 Subsidiaries in China

5.3 Phostech

5.3.1 Profile

5.3.2 LiFePO4 Business

5.3.3 Phostech in China

5.4 Formosa Energy & Material Technology Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Capacity

5.5 ALeees

5.5.1 Profile

5.5.2 Operation

5.5.3 LiFePO4 Material Business

5.5.4 Development Dynamic

5.6 Hirose Tech Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Capacity

5.6.4 Competition Vantage

5.7 Tatung Fine Chemicals Co., Ltd.

5.7.1 Profile

5.7.2 LiFePO4 Business

5.8 Tianjin STL Energy Technology Co., Ltd.

5.9 Pulead Technology Industry Co., Ltd

5.9.1 Profile

5.9.2 Subsidiaries

5.9.3 LiFePO4 Battery Business

5.9.4 Projects under Construction

5.10 Shenzhen Bei Terui New Energy Material Co., Ltd

5.10.1 Profile

5.10.2 Operation

5.10.3 Strategy

5.11 Yantai Zhuoneng Battery Material Co., Ltd.

5.11.1 Profile

5.11.2 Operation

5.11.3 Main Clients

5.11.4 R&D Projects in 2011-2012

5.12 Nanjing Lasting Brilliance New Energy Technology Co., Ltd.

5.12.1 Profile

5.12.2 R & D

5.12.3 Development Course

5.13 Sichuan Huangming Lithium Energy New Materials Co., Ltd.

5.13.1 Profile

5.13.2 Cathode Materials

5.14 Hunan Shanshan Toda Advanced Materials Co., Ltd.

5.14.1 Profile

5.14.2 Revenue Structure

5.15 HeFei GuoXuan High-Tech Power Energy Co., Ltd.

5.15.1 Profile

5.15.2 Operation

5.15.3 Market Expansion

5.15.4 Innovation of Technology & Business Model

5.15.5 Strategy

5.16 ShenZhen TianJiao Technology Development LTD.

5.16.1 Profile

5.16.2 Operation

5.17 Others

5.17.1 Xinxiang Huaxin Energy Materials Co., Ltd.

5.17.2 Hunan Haorun Technology Co., Ltd.

5.17.3 NanoChem Systems (Suzhou) Co., Ltd.

5.17.4 Xinxiang Chuangjia Power Supply Material Co., Ltd.

6. Key LiFePO4 Battery Manufacturers

6.1 BYD

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 LiFePO4 Business

6.1.5 Gross Margin

6.1.6 Application Case of Iron Battery of BYD

6.1.7 Anticipation and Prospect

6.2 China BAK Battery

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 LiFePO4 Battery Business

6.3 Tianjin Lishen Battery Joint-Stock Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 More Investment in Motive Power Battery

6.3.4 LiFePO4 Battery Business

6.4 Shenzhen Mottcell Battery Technology Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 History of LiFePO4 Battery

6.4.4 Application Case

6.5 Wanxiang EV Co., Ltd.

6.5.1 Profile

6.5.2 Application Case

6.5.3 Competitive Edge

6.6 CENS Energy-Tech Co., Ltd.

6.6.1 Profile

6.6.2 Application Cases of LiFePO4 Batteries

6.7 Hipower New Energy Group Co., Ltd.

6.7.1 Profile

6.7.2 LiFePO4 Battery Business

6.8 Crown Shuo (Suzhou) New Energy Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Projects

6.9 Pihsiang Energy Technology

6.9.1 Profile

6.9.2 Competitive Edge

6.9.3 Investment

6.10 Qingdao Hongnai New Energy

6.11 Huanyu Power Source Co.,Ltd

6.11.1 Profile

6.11.2 LiFePO4 Battery Business

7 Summary and Forecast

7.1 Industry

7.2 Enterprise

Electric Bicycle Output in China, 2004-2015

China's Wind Power Installed Capacity and PV Installed Capacity, 2006-2013

Number of New Communications Base Stations, Ownership and Battery Demand in China, 2006-2012

History of A123 Systems

Revenue and Gross Profit of A123Systems, FY2007- FY2012

Revenue of Subsidiaries of A123Systems in China

Project Investment of Changzhou Gaobo, 2005-2008

Revenue and Net Profit of Valence, FY2008-FY2012

Operation of Valence’s Subsidiaries in China

History of Phostech

Distribution of Global Customers of Phostech

Patents of Formosa Energy & Material Technology Co., Ltd., 2009-2012

Capacity of Formosa Energy & Material Technology Co., Ltd., 2009-2015

Sales Volume of LiFePO4 Material of Aleees, 2010-2012

Financial Situation of Hirose, 2009-2012

LiFePO4 Capacity Planning of Hirose Tech, 2013-2017

History of LiFePo4 R&D of Tatung Fine Chemicals Co., Ltd.

LiFePo4 Materials and Cells Developed by Tatung Fine Chemicals Co., Ltd.

Revenue of Tatung Fine Chemicals Co., Ltd., 2009-2015

Monthly Revenue from LiFePO4 Material Business of Tatung Fine Chemicals, 2011

Lithium Iron Phosphate Capacity of STL, 2011-2015E

Lithium Iron Phosphate Cathode Material Capacity of Pulead, 2011-2015

Major Production Bases of Shenzhen BTR

Net Income of Shenzhen BeiTerui, 2008-2015

LiFePo4 Development of BeiTerui

Revenue and Lithium Iron Phosphate Capacity of Yantai Zhuoneng, 2011-2015E

Major Customers of Yantai Zhuoneng Battery Material

Development Course of Yantai Zhuoneng

Lithium Battery Business of Ningbo Shanshan, 2013

Revenue and Net Income of Hunan Shanshan, 2009-2015.

Cathode Material Sales Volume of Hunan Shanshan, 2009-2012

Main lithium Iron Phosphate Products of Hunan Shanshan

Revenue and Net Income of GuoXuan High-Tech, 2009-2012

Marketing of Guoxuan High-Tech Major Products

History of Tianjiao Technology

The Main Products Capacity of TianJiao Technology, 2013

Revenue and Net Income of Tianjiao Technology, 2008-2015E

Capacity of Main Products of Xinxiang Huaxin

Revenue and Net Income of BYD, 2008-2013

Revenue Structure of BYD (by Business), 2012-2013

Sales Volume of F3DM of BYD, 2010-2013

Gross Margin of BYD, 2009-2013

Gross Margin of BYD (by Business), 2009-2013

Revenue and Net Income of BYD, 2013-2015E

Revenue of China BAK, FY2009-FY2015

Revenue of China BAK by Product, FY2009-FY2013

Revenue of China BAK by Region, FY2009-FY2013

Revenue Structure of BAK by Region, FY2009-FY2013

R&D Costs and % of Total Revenue of China BAK, FY 2010-FY2013

Revenue of Tianjin Lishen, 2008-2015

History of LiFePo4 Battery of Shenzhen Mottcell

Patents of Shenzhen Mottcell, 2009-2013

LiFePo4 Battery Application of CENS Energy-Tech

HiPower New Energy Group

Development History of LiFePo4 Battery Business of Pihsiang Energy Technology

Chinese and Global Lithium Iron Phosphate Sales Volume and Proportion, 2007-2016E

Capacity of Lithium Iron Phosphate Enterprises in China (including Taiwan), 2012/2015E

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...