Global and China Fluorite Industry Report, 2014-2016

-

May 2014

- Hard Copy

- USD

$2,600

-

- Pages:123

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

PQ007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

Of extensive use, fluorite is widely applied in fields of metallurgy, building materials, fluorine chemical industry, etc. In 2013, global fluorite reserves attained about 240 million tons, mainly distributed in a few countries like South Africa, Mexico, China and Mongolia, wherein China’s fluorite reserves accounted for about 10% of the world's total.

China is the uppermost fluorite producing country in the world with fluorite output approximating 4.3 million tons in 2013, accounting for 64% of the world’s total. However, due to the overquick exploration, fluorite reserves in China become increasingly deficient. Thus the government takes active measures to protect fluorite resources, including execution of fluorite exploration volume limit and industry entry. Especially, after Ministry of Industry and Information Technology released two batches of production line lists in conformity with Fluorite Industry Access Standards successively in 2012 and 2013, fluorite output in China had presented a downward trend. It is estimated that China’s fluorite output will slip to 2.85 million tons in 2016, proportion thereof down to 44.3% or so of the global total.

Against the background of a predicted decreasing fluorite output, China’s fluorite demand will mainly count on fluorite import and technology of fluorine extraction from phosphate. Fluorite equivalent in phosphate ore (by calcium fluoride) in China reached 265.8 million tons, equal to 11 times current fluorite reserves in China, which provides a sound material basis for China’s fluorite substitution. However, it still takes time to realize large-scale fluorite substitution due to immature production process of fluorine extraction from phosphate.

Multiple fluorite enterprises in the world are strengthening their integration of upstream and downstream industry chain of fluorite resources for achieving higher added value of products, and avoiding unfavorable price influence of fluorite market, etc.

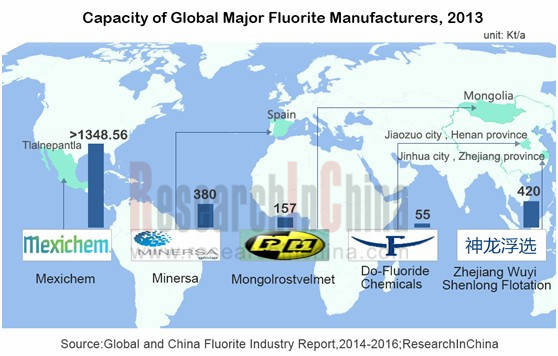

Mexichem is an enterprise with comparatively abundant fluorite resource reverses, fluorite capacity thereof in 2013 reaching at least 1,348 kt/a. Currently, it is devoted to production of Fluoropolymers and Fluoroelastomers with higher added value.

As the second largest acid fluorite producer, Minersa achieves acid fluorite capacity of around 380 kt/a. Via its subsidiary Derivados del Flúor (DDF), Minersa has got through fluorite-fluorine chemical industry chain. DDF is the top producer and distributor of European inorganic fluorides and its products are extensively utilized in areas of refrigerant, air-conditioning system, chemical building, etc.

Main fluorite manufacturers in China include Centralfluor Industries Group, Inc., Zhejiang Wuyi Shenlong Flotation Co., Ltd., etc., and fluorite capacity of them respectively attains 550 kt/a and 420 kt/a. Whereas, comparatively speaking, China’s fluorite enterprises are big but not strong and poor in downstream industry extension. While enterprises oriented to fluorine chemical industry, such as Sinochem Lantian Co., Ltd., Zhejiang Juhua Co., Ltd., Do-Fluoride Chemicals Co., Ltd., etc., accelerate improving fluorite-fluorine chemical industry chain layout. Taking Do-Fluoride Chemicals Co., Ltd. as an example, despite of the small fluorite capacity of only 55kt/a, the company has completed its “fluorite-lithium hexafluorophosphate-lithium ion battery” industry chain layout and become one of the major suppliers of lithium hexafluorophosphate (capacity of 2,200 t/a) in the world.

The report includes the following aspects:

Global fluorite reserves, supply and demand analysis;

Global fluorite reserves, supply and demand analysis;

Reserves, competition pattern, supply & demand, import & export, and industry policies in China fluorite industry;

Reserves, competition pattern, supply & demand, import & export, and industry policies in China fluorite industry;

Influence of fluorite downstream market segments (such as building materials, fluorine chemical, iron and steel industry) on fluorite development;

Influence of fluorite downstream market segments (such as building materials, fluorine chemical, iron and steel industry) on fluorite development;

Operation, fluorite business and development trends of six global and nine Chinese fluorite players.

Operation, fluorite business and development trends of six global and nine Chinese fluorite players.

1 Overview of Fluorite

1.1 Introduction

1.2 Application

1.3 Mining Process

2 Global Fluorite Industry

2.1 Supply

2.1.1 Reserves

2.1.2 Output

2.1.3 Global Trade Structure

2.1.4 Fluorite Output of Major Countries

2.2 Consumption

2.2.1 Consumption Structure

2.2.2 Fluorite Consumption in Developed Countries

3 China Fluorite Industry

3.1 Supply

3.1.1 Reserves

3.1.2 Characteristics of Fluorite Ore

3.1.3 Output

3.1.4 Producers

3.2 Demand

3.2.1 Building Materials Industry

3.2.2 Fluorine Chemical Industry

3.2.3 Iron and Steel Industry

3.3 Fluorite Price

3.4 Industrial Policy

3.5 Extraction of Fluoride from Phosphorite

4 Fluorite Import and Export in China

4.1 Fluorite with Calcium Fluoride Content>97%

4.2 Fluorite with Calcium Fluoride Content≤97%

4.3 Summary

5 Major Global Fluorite Enterprises

5.1 Mexichem

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Fluorine Chemical Business

5.1.5 Fluorite Resources

5.2 SepFluor

5.2.1 Profile

5.2.2 Operation

5.2.3 Fluorite Business

5.3 Mongolrostsvetmet

5.3.1 Profile

5.3.2 Fluorite Business

5.3.3 Fluorite Projects

5.4 Minersa Group

5.4.1 Profile

5.4.2Fluorite Business

5.4.3 Fluorine Chemical Business

5.5 Vanoil Energy

5.5.1 Profile

5.5.2Operation

5.5.3 Fluorite Business

5.6 Rusal (Yaroslavsk)

5.6.1 Profile

5.6.2 Fluorite Business

6 Major Chinese Fluorite Enterprises

6.1 Sinochem Lantian

6.1.1 Profile

6.1.2 Operation

6.1.3 Fluorine Chemical Business

6.1.4 Fluorite Resources

6.2 China Kings Resources Group

6.2.1 Profile

6.2.2 Fluorite Resources

6.3 Centralfluor Industries Group

6.3.1 Profile

6.3.2 Fluorite Resources

6.3.3 Fluorine Chemical Business

6.4 Shenlong Flotation

6.4.1 Profile

6.4.2 Operation

6.4.3 Fluorite Resources

6.5 Shen Zhou Mining & Resources

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Fluorite Business

6.5.5 Fluorite Resources

6.6 Juhua

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Gross Margin

6.6.5 R&D Investment

6.6.6 Clients and Suppliers

6.6.7 Fluorite Resources

6.6.8 Fluorine Chemical Business

6.6.9 Forecast and Outlook

6.7 DO-Fluoride

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Gross Margin

6.7.5 R&D Investment

6.7.6 Clients and Suppliers

6.7.7 Fluorite Resources

6.7.8 Fluorine Chemical Business

6.7.9 Forecast and Outlook

6.8 Zhejiang Yongtai Technology

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Gross Margin

6.8.5 R & D

6.8.6 Clients and Suppliers

6.8.7 Fluorite Resources

6.8.8 Forecast and Outlook

6.9 Thaihot Group

6.9.1 Profile

6.9.2 Operation

6.9.3 Revenue Structure

6.9.4 Gross Margin

6.9.5Fluorite and Fluorine Chemical Business

6.9.6 Forecast and Outlook

7. Summary and Forecast

7.1 Summary

7.2 Forecast

Classification of Fluorite (by Calcium Fluoride Content)

Application of Fluorite

Fluorite Reserves of Major Countries in the World, 2013

Global Fluorite Output and Growth Rate, 2007-2013

Fluorite Output of Major Countries in the World, 2009-2013

Fluorite Reserve-Production Ratio of Major Countries in the World, 2013

Global Fluorite Consumption Structure (by Field), 2013

Global Fluorite Consumption Structure (by Region), 2013

Fluorite Consumption Structure of the United States, Western Europe and Japan (by Field), 2013

Fluorite Sources of Major Developed Countries in Europe and America

Fluorite Deposit Distribution in China

Number of Fluorite Mines in Some Provinces and Regions of China

China’s Fluorite Output and YoY Growth Rate, 2007-2013

Capacity of Major Fluorite Manufacturers in China, 2013

Fluorite Resources Control of Chinese Listed Fluorine Chemical Companies, 2013

Apparent Consumption of Fluorite and YoY Growth in China, 2007-2013

Downstream Fluorite Consumption Structure in China, 2013

Capacity of Major Fluorite Manufacturers Worldwide, 2013

Revenue of Major Fluorite Manufacturers in China, 2013-2014

Net Income of ajor Fluorite Manufacturers in China, 2013-2014

Global Fluorite Output and Growth Rate, 2012-2016E

Fluorite Output of Major Countries in the World, 2009-2013

Import & Export Volume of Fluorite in China, 2012-2016E

Apparent Consumption and Growth Rate of Fluorite in China, 2012-2016E

Global Fluorite Trade Volume (in terms of Calcium Fluoride content), 2013

Global Fluorite Export Market Structure (in terms of Calcium Fluoride content), 2013

Global Fluorite Import Market Structure (in terms of Calcium Fluoride content), 2013

Application of Fluorite in Building Materials Industry

China's Cement Output and YoY Growth, 2006-2013

Import & Export Volume of Hydrofluoric Acid in China, 2006-2013

Import & Export Value of Hydrofluoric Acid in China, 2006-2013

Import & Export Average Price of Hydrofluoric Acid in China, 2006-2013

China's Flat Glass Output and YoY Growth Rate, 2006-2013

Value Adding Path of Fluorine Chemical Products

Hydrofluoric Acid Capacity, Output and Operating Rate in China, 2006-2013

China’s Hydrofluoric Acid Export Destinations and Export Volume, 2009-2012

China’s Hydrofluoric Acid Export Destinations and Export Value, 2009-2012

Export Volume, Value and Average Price of Aluminum Fluoride in China, 2010-2013

Export Volume, Value and Average Price of Cryolite in China, 2006-2013

Ex-factory Price of Anran Fluorite in Zhejiang, 2011-2014

Fluorite Industrial Policies in China, 1999-2013

Quota on Fluorite Mining in China, 2010-2011

Production Lines in Compliance with Fluorite Industry Access Standards" (first batch)

Production Lines in Compliance with Fluorite Industry Access Standards" (2nd batch)

Fluorine Resources in Chinese Fluorite and Phosphorite, 2013

Policies about Extraction of Fluorine from Phosphorite in China, 2010-2012

Import and Export Volume of Fluorite with Calcium Fluoride Content>97% in China, 2007-2013

Import and Export Unit Price of Fluorite with Calcium Fluoride Content>97% in China, 2007-2013

Source Distribution of Fluorite with Calcium Fluoride Content>97% Imported by China (by Import Volume), 2013

Destination Distribution of Fluorite with Calcium Fluoride Content>97% Exported by China (by Export Volume), 2013

Import and Export Volume of Fluorite with Calcium Fluoride Content≤97% in China, 2007-2013

Import and Export Unit Price of Fluorite with Calcium Fluoride Content≤97% in China, 2007-2013

Source Distribution of Fluorite with Calcium Fluoride Content≤97% Imported by China (by Import Volume), 2013

Destination Distribution of Fluorite with Calcium Fluoride Content≤97% Exported by China (by Export Volume), 2013

Fluorite Import and Export Volume in China, 2007-2013

Import and Export Unit Price of Fluorite in China, 2007-2013

Net Sales and Net Income of Mexichem, 2009-2013

Net Sales Structure of Mexichem (by Product), 2009-2012

Net Sales Structure of Mexichem (by Region), 2009-2013

Fluorine Chemical Subsidiaries of Mexichem, 2013

Net Sales and Operating Income of Mexichem’s Fluorine Chemical Industrial Chain, 2009-2013

Extension of Mexichem’s Fluorine Chemical Industrial Chain

Assets and Liabilities of SepFluor, FY2011-FY2013

Other Revenue and Net Income of SepFluor, FY2011-FY2013

Fluorite Capacity of Mongolrostsvetmet (by Fluorite Production Units and Fluorite Type))

Fluorite Production Units of Mongolrostsvetmet

Fluorite Quality Parameters of Mongolrostsvetmet

Net Loss of Vanoil, FY2010-FY2013

Revenue and Net Income of Fluormin, 2010-2013

Subsidiaries of Sinochem Lantian

Revenue and Net Income of Sinochem Lantian, 2009-2012

Revenue Structure of Sinochem Lantian (by Product), 2009-2012

Capacity of Fluorine Chemical Products of Kings Fluoride Industry, 2013

Capacity of Main Products of Centralfluor Industries Group, 2012

Companies Invested by China Kings Resources Group

Main Products and Capacity of China Kings Resources Group, 2013

Fluorite Mines and Energy/Chemical Companies of Centralfluor Industries Group

Fluorite Resources of Centralfluor Industries Group, 2012

Fluorine Chemical Capacity Distribution of Centralfluor Industries Group (by Producer and Product)

Financial Indicators of Shenlong Flotation, 2008-2009

Main Fluorite Products and Their Applications of Shenlong Flotation

Output of Fluorite Products of Shenlong Flotation, 2009-2010

Main Subsidiaries and Main Business of Shen Zhou Mining & Resources

Ownership of Major Subsidiaries of Shen Zhou Mining & Resources, 2012

Revenue and Net Income of Shen Zhou Mining & Resources, 2009-2012

Revenue of Shen Zhou Mining & Resources (by Product), 2010-2012

Revenue Structure of Shen Zhou Mining & Resources (by Product), 2010-2012

Fluorite Revenue and Net Income of Shen Zhou Mining & Resources, 2009-2012

Name List, Revenue Contribution and Proportion of Top 3 Clients of Shen Zhou Mining & Resources in Fluorite Business, 2011

Fluorite Lump Ore Output and Its Proportion in Total Output of Shen Zhou Mining & Resources, 2008-2011

Fluorite Powder Output and Its Proportion in Total Output of Shen Zhou Mining & Resources, 2008-2011

Average Selling Prices of Fluorite Lump Ore and Fluorite Powder of Shen Zhou Mining & Resources, 2008-2011

Distribution of Fluorite Resources of Shen Zhou Mining & Resources, 2012

Classification of Fluorite Resources of Xiang Zhen Mining

Revenue and Net Income of Juhua, 2008-2014

Revenue of Juhua (by Product), 2010-2013

Revenue Structure of Juhua (by Product), 2010-2013

Revenue of Juhua (by Region), 2010-2012

Revenue Structure of Juhua (by Region), 2010-2012

Gross Margin of Juhua’s Main Products, 2008-2014

R&D Investment and Its Proportion to Total Revenue of Juhua, 2008-2013

Fluorine Chemical-related Projects and Investment of Juhua as of end of 2013

Revenue Contribution and Proportion of Juhua’s Top 5 Clients, 2009-2013

Name List, Revenue Contribution and Proportion of Juhua’s Top 5 Clients, 2013

Juhua’s Purchase Amount and Proportion for Top 5 Suppliers, 2009-2013

Name List, Procurement Amount and Proportion of Juhua’s Top 5 Suppliers, 2012

Fluorine Powder Revenue of Juhua, 2012-2013

Subsidiaries of Juhua in Fluorine Chemical Field, 2013

Revenue and Net Income of Juhua, 2010-2016E

Revenue and Net Income of DO-Fluoride, 2008-2014

Revenue of DO-Fluoride (by Product), 2010-2013

Revenue of DO-Fluoride (by Region), 2010-2013

Gross Margin of DO-Fluoride’s Main Products, 2008-2014

R&D Investment and Its Proportion to Total Revenue of DO-Fluoride , 2012-2013

Investment Progress of Fluorine Chemical Project of DO-Fluoride, as of the end of 2013

Revenue Contribution and Proportion of DO-Fluoride’s Top 5 Clients, 2009-2013

DO-Fluoride’s Purchase Amount and Proportion for Top 5 Suppliers, 2009-2013

Fluorite Mines Invested by DO-Fluoride

DO-Fluoride and Related Fluorite Companies (as of 2013)

Major Products and Operation of Fluorine Chemical Subsidiaries of DO-Fluoride, 2013

Revenue and Net Income of DO-Fluoride, 2010-2016E

Revenue and Net Income of Zhejiang Yongtai Technology, 2008-2014

Revenue of Zhejiang Yongtai Technology (by Product), 2010-2013

Revenue of Zhejiang Yongtai Technology (by Region), 2010-2013

Gross Margin of Main Products of Zhejiang Yongtai Technology, 2008-2014

R & D Expenses and Proportion in Total Revenue of Zhejiang Yongtai Technology, 2008-2013

Revenue Contribution and Proportion of Zhejiang Yongtai Technology’s Top 5 Clients, 2009-2013

Name List, Revenue Contribution and Proportion of Top 5 Clients of Zhejiang Yongtai Technology, 2012

Zhejiang Yongtai Technology’s Purchase Amount and Proportion for Top 5 Suppliers, 2009-2013

Name List, Procurement Amount and Proportion of Zhejiang Yongtai Technology’s Top 5 Suppliers, 2012

Revenue and Net Income of Zhejiang Yongtai Technology, 2012-2016E

Revenue and Net Income of Thaihot Group, 2008-2014

Revenue of Zhejiang Yongtai Technology (by Product), 2010-2013

Revenue of Thaihot Group (by Region), 2010-2013

Gross Margin of Main Products of Thaihot Group, 2008-2014

Revenue and Net Income of Zhejiang Yongtai Technology, 2012-2016E

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...