Global and China Industrial Robot Report, 2014-2017

-

Feb.2015

- Hard Copy

- USD

$2,500

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,250

-

- Code:

BXM078

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,700

-

With increasing demand for industrial automation and intelligentization, global industrial robot industry flourishes, hitting a record high in 2013 with annual sales and ownership arriving at 178,000 units and 1.332 million units, up 12.0% and 7.9% year on year, respectively.

Global industrial robot capacities are concentrated in Japan, about 60% of the global total, while sales markets are mainly in Japan, the U.S., Germany, South Korea and China, which held a combined share of 70.2% in 2013.

China industrial robot industry sprouted in 2003, sped up from 2010, and overtook Japan as the world’s largest consumer market in 2013 for the first time. According to China Robot Industry Alliance (CRIA) statistics, industrial robot sales volume in China in 2013 was 36,560 units, or 1/5 of the global total, and is expected to reach 45,000 units in 2014 and around 100,000 units in 2017.

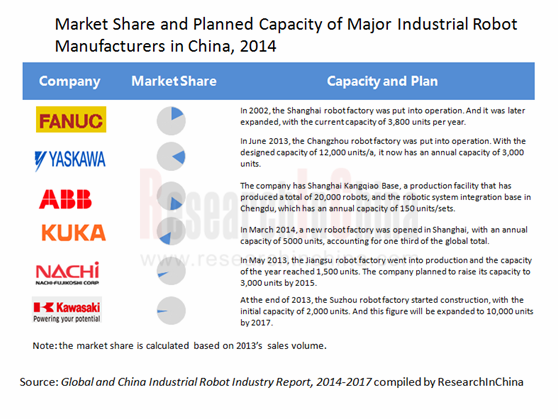

In spite of this, the Chinese industrial robot market is still dominated by foreign companies, which sold more than 27,000 units of industrial robots in China in 2013, 74% of total sales volume, of which ABB, FANUC, Yasukawa Electric and KUKA occupied 65% or so, and nearly monopolized high-end fields like industrial robot manufacturing and welding.

In addition, China’s industrial robot density (the number of robots used by every 10,000 workers) is much lower than that in developed countries, standing at only 30 in 2013, well below the global average of 62, in stark contrast to 437 in South Korea, 323 in Japan and 282 in Germany around the same time.

Being optimistic about the Chinese market due to multiple factors of positive policies, replacement of manpower by robot, industrial transformation and upgrading and increasing downstream demand, companies at home and abroad are stepping up efforts to make presence in China industrial robot industry.

ABB:Continues to enhance its exposure in the Chinese market and has introduced 10 robots; in 2014, ABB Engineering entered into an agreement with Zhongyeda Electric on cooperation in robot field.

YASKAWA Electric: In Jun. 2013, Yaskawa (China) Robotics Co., Ltd., a new factory with total investment of USD48 million went into production, and manufactured mainly industrial robot and robotic systems, with designed annual capacity of 12,000 robots and 3,000 units for the time being.

KUKA Robotics: In Mar. 2014, the robot plant located in Shanghai started operation, with designed annual capacity of 5,000 units, one third of KUKA Robotics’ total output.

Kawasaki Heavy Industries: Kawasaki Precision Machinery (Suzhou) Ltd. began construction in Dec. 2013, and is scheduled to be put into production in Apr. 2015, with initial capacity of 2,000 units, manufacturing mainly robots for automobile welding and parts handling. It is expected that the capacity will be lifted to 10,000 units by 2017.

SIASUN Robot & Automation: A leader among local Chinese robot companies; posted revenue of RMB407 million from industrial robot business in 2013, a year-on-year jump of 35.6%. In Mar. 2014, the company first realized industrialization of semiconductor robot; in Jul. of the same year, the SIASUN Robot northern headquarters worth RMB3.623 billion were settled in Qingdao National High-tech Industrial Development Zone.

Anhui Efort Equipment: In Dec. 2013, the “industrial robot” industrial park project with investment of RMB2.2 billion started building, and is planned to go into operation at the end of 2015, developing annual capacity of 10,000 industrial robot bodies, core parts and peripheral equipment. In Nov. 2014, the company cooperated with Italian CMA to enhance spray painting robot business.

Global and China Industrial Robot Industry Report, 2014-2017 by ResearchInChina focuses on the following:

Global industrial robot market size, market structure, major companies;

Global industrial robot market size, market structure, major companies;

Policy environment and technological environment for industrial robot industry in China;

Policy environment and technological environment for industrial robot industry in China;

Chinese industrial robot market size, market structure, investment situation and development prospect;

Chinese industrial robot market size, market structure, investment situation and development prospect;

Operation, industrial robot business and future strategies of 10 major global industrial robot companies and 14 major Chinese companies.

Operation, industrial robot business and future strategies of 10 major global industrial robot companies and 14 major Chinese companies.

1. Overview of Industrial Robot

1.1 Definition and Classification

1.1.1 Robot

1.1.2 Industrial Robot

1.3 Application and Classification

1.4 Industrial Chain

1.4.1 Upstream

1.4.2 Midstream

1.4.3 Downstream

2. Global Industrial Robot Industry

2.1 Market Size

2.2 Market Structure

2.2.1 By Region/Country

2.2.2 By Industry

2.2.3 By Application

2.3 Major Companies

3. Environment for Industrial Robot Industry in China

3.1 Policy Environment

3.1.1 National Policy

3.1.2 Regional Policy

3.2 Technological Environment

4. Development of Industrial Robot in China

4.1 Development History

4.2 Status Quo of Market

4.2.1 Market Size

4.2.2 Market Structure

4.3 Status Quo of Company

4.3.1 Major Companies

4.3.2 Investment Situation

4.4 Development Prospect

5. Major Chinese Industrial Robot Companies

5.1 SIASUN Robot & Automation

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Industrial Robot Business

5.1.6 Development Strategy

5.2 Shanghai STEP Electric

5.2.1 Profile

5.2.2 Operation

5.2.3 Industrial Robot Business

5.2.4 R&D

5.3 Shenzhen Jasic Technology

5.3.1 Profile

5.3.2 Operation

5.3.3 Industrial Robot Business

5.4 MESNAC

5.4.1 Profile

5.4.2 Operation

5.4.3 Industrial Robot Business

5.5 Shanghai Triowin Automation Machinery

5.5.1 Profile

5.5.2 Operation

5.5.3 Industrial Robot Business

5.6 Harbin BOSHI Automation

5.6.1 Profile

5.6.2 Operation

5.6.3 Industrial Robot Business

5.7 GSK CNC Equipment

5.7.1 Profile

5.7.2 Industrial Robot Business

5.8 Anhui Efort Intelligent Equipment

5.8.1 Profile

5.8.2 Industrial Robot Business

5.9 STSrobotics

5.9.1 Profile

5.9.2 Industrial Robot Business

5.10 Other

5.10.1 Suzhou Boshi Robotics Technology

5.10.2 Changzhou Mingseal Robotic Technology

5.10.3 HUAHENG Welding

5.10.4 Harbin Haier & HIT Robot Technology

5.10.5 Tangshan Kaiyuan Group

6. Major Global Industrial Robot Companies

6.1 FANUC

6.1.1 Profile

6.1.2 Operation

6.1.3 Industrial Robot Business

6.2 YASKAWA Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Industrial Robot Business

6.3 KUKA

6.3.1 Profile

6.3.2 Operation

6.3.3 Industrial Robot Business

6.4 ABB

6.4.1 Profile

6.4.2 Operation

6.4.3 Industrial Robot Business

6.5 OTC

6.5.1 Profile

6.5.2 Operation

6.5.3 Industrial Robot Business

6.6 Comau

6.6.1 Profile

6.6.2 Operation

6.6.3 Industrial Robot Business

6.7 NACHI

6.7.1 Profile

6.7.2 Operation

6.7.3 Industrial Robot Business

6.8 Kawasaki Heavy Industries

6.8.1 Profile

6.8.2 Operation

6.8.3 Industrial Robot Business

6.9 Hyundai Heavy Industries

6.9.1 Profile

6.9.2 Business in China

6.10 St?ubli

6.10.1 Profile

6.10.2 Business in China

7. Summary and Forecast

7.1 Market

7.2 Company

Industrial Robot System Diagram

Advantages of Industrial Robot

Cost Structure of 50KG Industrial Robot in China

Global Industrial Robot Shipments, 2008-2017E

Global Industrial Robot Ownership, 2011-2017E

Global Industrial Robot Shipments by Region, 2012-2017E

Global Industrial Robot Ownership by Region, 2012-2017E

Global Industrial Robot Shipments by Industry, 2011-2013

Global Industrial Robot Market Structure by Field, 2009-2012

Major Companies in Global Industrial Robot Industrial Chain

Revenue of Global Major Four Industrial Robot Manufacturers, 2013

Planning for the Development of Industrial Robot Industry in Major Countries

Related Planning for Industrial Robot Industry in China, 2010-2014

Major Industrial Robot Industrial Park and Planning Target in China, 2014

Major Industrial Robot Research Institutes and Representative Products in China

Technological Gap between China and Foreign Countries in Key Parts for Industrial Robot

Sales Volume of Industrial Robot in China, 2005-2017E

Industrial Robot Ownership in China, 2005-2017E

Sales Volume Breakdown of Industrial Robot in China by Mechanical Structure, 2013

Sales Volume Breakdown of Industrial Robot in China by Industry, 2013

Sales Volume Breakdown of Industrial Robot in China by Field, 2013

Sales Volume Breakdown of Industrial Robot in China by Field, 2006-2010

Related Companies in China Industrial Robot Industrial Chain

Sales Volume Structure of Industrial Robot in China by Nature of Company, 2012-2013

Competitive Landscape of Industrial Robot Companies in China, 2012

Major Local Chinese Industrial Robot Companies

Main Industrial Robot Investment Projects in China, 2013-2015E

Industrial Robot Density in Major Countries, 2014

China’s Automobile Output, 2008-2017E

Revenue and Net Income of SIASUN Robot & Automation, 2008-2014

Revenue Breakdown of SIASUN Robot & Automation by Product, 2010-2014

Operating Revenue Breakdown of SIASUN Robot & Automation by Region, 2010-2014

Gross Margin of SIASUN Robot & Automation by Product, 2010-2014

Revenue from and Gross Margin of Industrial Robot Business of SIASUN Robot & Automation, 2009-2014

Progress of R&D into Robot of SIASUN Robot & Automation, 2013-2014

Operating Revenue and Gross Margin of Shanghai STEP Electric, 2013-2014

Main Industrial Robots of Shanghai STEP Electric

R&D Costs and % of Total Revenue of Shanghai STEP Electric, 2011-2014

Operating Revenue Breakdown of Shenzhen Jasic Technology by Product, 2012-2014

Revenue and Net Income of MESNAC, 2008-2014

Operating Revenue Breakdown of MESNAC by Product, 2012-2013

Main Products and Customers of Shanghai Triowin Automation Machinery

Revenue and Net Income of Shanghai Triowin Automation Machinery, 2012-2014

Revenue Breakdown of Shanghai Triowin Automation Machinery by Product, 2013-2013

Handling Robot Series of Shanghai Triowin Automation Machinery

Industrial Robot Sales Volume of Shanghai Triowin Automation Machinery, 2009-2017E

Revenue and Net Income of Harbin BOSHI Automation, 2009-2014

Revenue and Gross Margin Breakdown of Harbin BOSHI Automation by Product, 2012-2014

Main Product Lines of Anhui Efort Intelligent Equipment

Main Industrial Robot Series of Suzhou Boshi Robotics Technology

Main Industrial Robot Series of Changzhou Mingseal Robotic Technology

Main Industrial Robot Series of HUAHENG Welding

Main Product Series of Harbin Haier & HIT Robot Technology

Industrial Robot Series of Main Subsidiaries of Tangshan Kaiyuan Group

Development History of FANUC

Net Revenue and Net Income of FANUC, FY2009-FY2014

Revenue Breakdown of FANUC by Business, FY2010-FY2014

Global Network of FANUC, 2014

Revenue Breakdown of FANUC by Region, FY2012-FY2013

Shanghai-FANUC Robotics Co., Ltd.

Main Customers in China for FANUC’s Industrial Robots

Net Revenue and Net Income of YASKAWA Electric, FY2009-FY2014

Revenue Breakdown of YASKAWA Electric by Business, FY2009-FY2014

Revenue Breakdown of YASKAWA Electric by Region, FY2009-FY2014

Revenue and Operating Income from Robot Business of YASKAWA Electric, FY2006-FY2013

Industrial Robot Companies of YASKAWA Electric in China

Main Industrial Robot Series of YASKAWA Shougang Robot

Global Business of KUKA

Orders, Revenue and EBIT of KUKA, 2008-2013

Main Financial Indexes of KUKA Robotics Division, 2009-2014

Main Financial Indexes of KUKA Systems Division, 2009-2014

Orders Structure of KUKA Robotics by Application, 2009-2013

Orders, Revenue and Net Income of ABB, 2009-2014

Orders Structure of ABB by Business and Region, 2011-2013

Revenue Structure of ABB by Business and Region, 2011-2013

Net Revenue and Net Income of OTC, FY2010-FY2015E

Revenue of OTC by Segment, FY2010-FY2015E

Subsidiaries of OTC in China and Contacts

Global Business of Comau

Robots of Comau

Business Structure of Nachi

Net Revenue and Net Income of Nachi, 2010-2014

Revenue Breakdown of Nachi by Product, 2009-2013

Overseas Revenue of Nachi, 2010-2014

Development Planning of Nachi for 2016

Organizational Chart of Kawasaki Heavy Industries

Revenue and Net Income of Kawasaki Heavy Industries, FY2009-FY2014

Net Revenue Breakdown of Kawasaki Heavy Industries by Business, FY2012-FY2014

Robot Production Bases of Kawasaki Heavy Industries

Industrial Robots of Kawasaki Robotics (Tianjin)

Robot Controllers (Brain & Cerebellum) Research Report, 2025

Robot Controller Research: Brain-Cerebellum Integration Becomes a Trend, and Automotive-Grade Chips Migrate to Robots

ResearchInChina has released the Robot Controllers (Brain & Cerebellum) Resea...

Tactile Sensor Research Report, 2025

ResearchInChina has released the "Tactile Sensor Research Report, 2025", which conducts research, analysis and summary on the basic concepts, technical principles, advantages and disadvantages o...

Embodied AI and Humanoid Robot Market Research 2024-2025: Product Technology Outlook and Supply Chain Analysis

Six Trends in the Development of Embodied AI and Humanoid Robots

In 2025, the global humanoid robot industry is at a critical turning point from technology verification to scenario penetration, and t...

Global and China Smart Meters Industry Report, 2022-2027

Meters are widely used in the national economy and are an important part of metering to promote the development of metering. As a legal measuring tool, meters are mainly used in the supply process of ...

China Smart Agriculture and Autonomous Agricultural Machinery Market Report, 2022

Research on smart agriculture and autonomous agricultural machinery: top-level design, agricultural digitization and automation present a potential marketAmid the pandemic, the conflict between Russia...

Global and China Heat Meters Industry Report, 2022-2027

A heat meter is an instrument used to measure, calculate and display the value of heat released or absorbed by water flowing through a heat exchange system, and is mainly used for measuring the heatin...

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...