Analysts said now is not the time for banking regulators to lower the provision-ratio requirements for commercial lenders since lending is still proceeding at a fast pace and banks are trying to expand credit.

Chinese banking regulators are considering loosening a rule requiring lenders to hold a provision equal to 2.5 percent of their outstanding loans, China Business News reported on Monday, citing anonymous sources.

The money held in the provision is meant to cover losses on non-performing loans.

An official at the China Banking Regulatory Commission said the commission is unlikely to lower the provision-ratio requirement because it remains the best means of curbing financial institutions' desire to lend.

"The adoption of such a rule is meant to regulate credit expansion among banks," said Zhao Xijun, a financial professor at Renmin University of China. He said there is enough lending to keep the economy shored up and he sees no need to change the requirement.

"The problem lies in the fact that capital hasn't been lent to the right industries," Zhao said. "So regulators plan to adopt different standards for various categories of lending while maintaining a general policy for all."

In May 2011, the regulatory commission announced rules that set stricter criteria for lenders' capital adequacy, provisions, leverage and liquidity conditions, and set the 2.5 percent provision ratio.

Large banks were given a grace period of two years to comply with the rule, while small and medium-sized lenders got from five to seven years.

Even so, a formal adoption of the rules was postponed in response to the country's economic conditions and looser monetary policies.

At the same time, the regulatory commission demanded a provision coverage ratio of more than 150 percent - meaning the amount of money in lenders' provisions had to be worth one and a half times that of their gross non-performing assets.

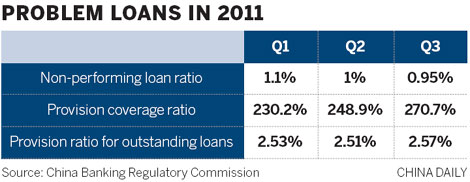

According to data from the regulatory commission, the provision ratio for outstanding loans among lenders reached 2.57 percent by the end of the third quarter last year, up by 0.1 percentage point from the beginning of the year. The provision coverage ratio exceeded 270 percent, 53 percentage points higher than at the beginning of the year.

Guo Tianyong, director of the Central University of Finance and Economics' Research Center for the Chinese Banking Industry, said the 2.5 percent provision ratio will put pressure on banks in the long term. That will especially be true, he said, for small and medium-sized lenders.

Lian Ping, chief economist at the Bank of Communications Co Ltd, said systemically important banks, which are believed to be "too big to fail", will have an easier time under the requirement. Non-systemically important lenders, in contrast, will see their credit costs increase at a faster pace.

Fan Wenzhong, head of the regulatory commission's international department, said the CBRC will adopt the regulation in a flexible way and will take other factors into account when deciding if a bank meets the requirement. Lenders with high-quality assets won't be punished if they do not immediately meet the rule, he said.