Beijing college student He Rongxi goes to the Jade Palace Hotel in Haidian district at least twice a month with her parents because she likes the beefsteaks the buffet serves in the hotel's cafe.

They spend 354 yuan ($56) each time through group buying coupons from sozhe.com to have a big dinner at the buffet and eat as many steaks as they like, He said.

He's family is not an isolated example. Since last June, when pork prices rose at least 50 percent, Beijing housewife Wang Lu buys at least 1 kilogram of fresh beef flank each time she goes shopping at eastern Beijing's Ito Yokado supermarket.

"Beef is not as tender as pork is but we have got used to that," Wang said. "Beef contains less fat and tastes good, and the most important thing is that the price of beef has been comparatively stable."

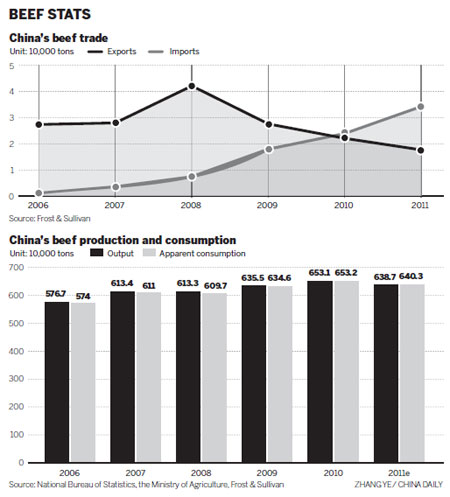

Chinese people's diets are experiencing an unprecedented change as they eat more beef than ever before. China has already become a net beef importer because its domestic production cannot meet the stronger-than-ever appetite for beef, United States' consulting company Frost & Sullivan said in its latest report.

The average price increased $3,205 a ton for China's boneless frozen and fresh beef imports during 2001 and 2011, according to chinafarming.com.

According to the Ministry of Agriculture, the Chinese mainland's beef production was estimated to reach nearly 6.39 million tons in 2011, but apparent consumption on the market for this kind of meat was more than 6.4 million tons last year. Apparent consumption is composed of production plus net imports, sometimes also adjusted for changes in inventories. It infers the total that is used in the country for any purpose.

In 2011, the mainland bought 33,900 tons of beef products from abroad, an increase of 10,200 tons from the previous year. Meanwhile, it also sold 17,700 tons of the meat products to Russia, the Middle East and Hong Kong, representing a drop of 4,400 tons from 2010. Major beef suppliers for Chinese consumers were Australia and New Zealand, according to Frost & Sullivan.

"Beef imports will not be more than 1 percent of the total market demand in China over the next five years," said Alex Zhang, senior consultant, China, Frost & Sullivan.

Zhang predicted that over the next 10 years the country's per capita beef consumption will still lag far behind two other Asian economic powerhouses - Japan and South Korea. He said his estimates are based on the current annual growth of 1.8 percent in China's per capita beef consumption.

China's per capita beef consumption was 4.63 kilograms in 2011, as compared with 13.7 kg in South Korea and 9.7 kg in Japan last year, said G. H. Huang, research director of BRIC Consultants Ltd, quoting figures from China's National Bureau of Statistics and the United States Department of Agriculture.

However, the Frost & Sullivan report predicted that along with the improvement in Chinese people's living standards, their demand for beef and beef products will grow stronger. The nation's current per capita beef consumption leaves a great room for growth, said Zhang of the consulting company.

In December, the average price of fresh beef was 39.78 yuan a kilogram in the Chinese market, representing a sharp increase of 110 percent from the same period in 2006. In contrast, the urban residents' per capita income rose 85 percent over the past six years, according to the National Bureau of Statistics.

"Beef is expected to occupy an increasing part of the proportion now taken by pork and chicken in Chinese people's daily diet in the years to come, as the grass-fed animal's meat contains more protein, low fat and rich unsaturated fatty acids," said the Frost & Sullivan report.

Industrial experts said that the Chinese government is expected to formulate preferential policies to prop up a rapid development of fine-bred livestock farms in the country to ensure an adequate supply of high quality beef products and stimulate market demand to grow faster.

Only 1 percent of China's 47.17 million slaughtered cattle were done in finely equipped manufacturing companies in 2010, leaving the majority dealt with separately by household-sized private businesses across the countryside.

As a result, quite a few cattle farms haven't yet to undergo necessary inspections and monitoring to ensure their beef production meets relevant international quality and hygiene standards, according to the Frost & Sullivan report.

The most profitable parts of the beef industry are the slaughtering, processing and marketing. The five biggest profit earners in the industry are all located in North China.

They are Haoyue Group in Changchun, Inner Mongolia Kerchin Cattle Industry Co, Dalian Xuelong Industrial Group, Hebei Fucheng Wufeng Food Co in Sanhe and Tianjin DawnRun Beef Group.

Haoyue in Changchun, Jilin province, slaughters 500,000 cattle annually, producing various meat products totaling 100,000 tons a year.

Kerchin Cattle owns a grassland of 120,000 mu (8,000 hectares) in Inner Mongolia autonomous region, with 12,000 cattle. The company now boasts it is producing organic beef products to meet high-end market demand.

Xuelong now slaughters more than 30,000 cattle a year for beef production in Dalian, Liaoning province.

Fucheng Wufeng in Sanhe, Hebei province, saw its sales exceed 500 million yuan in 2010, of which the beef business made up 260 milion yuan. It slaughters more than 100,000 cattle annually, producing 9,000 tons of beef products, 20,000 tons of animal feed and 30,000 tons of organic fertilizer.

Tianjin DawnRun Beef acquired 80 percent of the shares of the Beidahuang Beef Industry Co in Heilongjiang province in November 2010. It is believed to be the first merger and acquisition in the country's beef producing industry and made the company a national beef producing business.