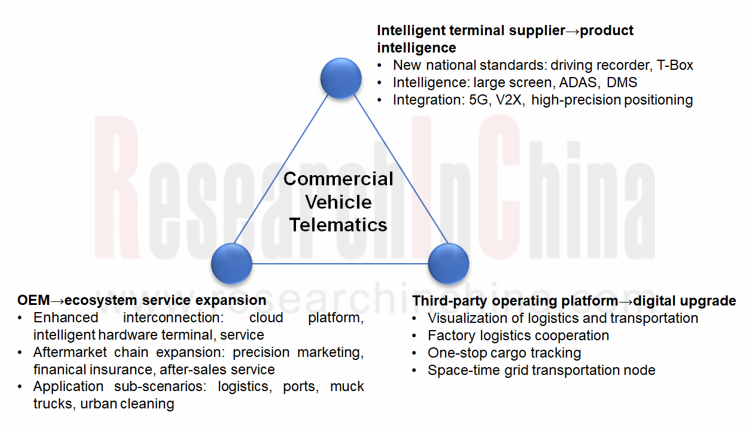

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry continues upgrade. Intelligent terminal suppliers, telematics platforms of OEMs, and third-party operating platforms realize business expansion and digital upgrade on the strength of their own advantages.

1. As terminal product standards are upgraded, leading companies stick with intelligent expansion.

Driven by factors such as upgraded China Phase VI Emission Standards and new national standards, commercial vehicle products like driving recorder and T-Box enter the upgrade phase in 2022. Leading suppliers are the first to launch new products to respond to the update needs of OEMs in a timely manner.

?In addition to meeting China Phase VI Emission Standards, commercial vehicle T-Box is heading in the direction of high computing power, integration, and modularization. Hopechart IoT and Yaxon Network among others have launched products that integrate 5G, C-V2X and high-precision positioning modules to support more abundant telematics applications.

?As concerns commercial vehicle driving recorder, the new national standard "GB/T 19056-2021 Vehicle Travelling Data Recorder" came into effect on July 1, 2022. Compared with the previous generation of products, such functions as audio and video recording, WiFi communication, wireless public network communication, automatic timing, and driver identification are added, and the positioning requirements are also further enhanced. The likes of Hopechart IoT, INTEST and Qiming Information Technology have completed the research and development of the new national standard-compliant products to meet the market demand.

Terminal device bellwethers are expanding their intelligence business centering on intelligent needs of commercial vehicles. For example, for commercial vehicles, Hopechart IoT has built a product system of five major hardware devices: driving recorder, ADAS terminal, center console screen, T-Box and camera. These products keep upgrading in accordance with new standards and requirements. The company completed pre-research and inspection of the new national standard-compliant driving recorder products in the first half of 2022, which are expected to be mounted on heavy duty vehicles first. Its T-Box used for telematics management and heavy truck exhaust monitoring is connected to CAN buses, and supports OTA updates. Its vehicle center console screens are led by 7 to 15-inch large displays.

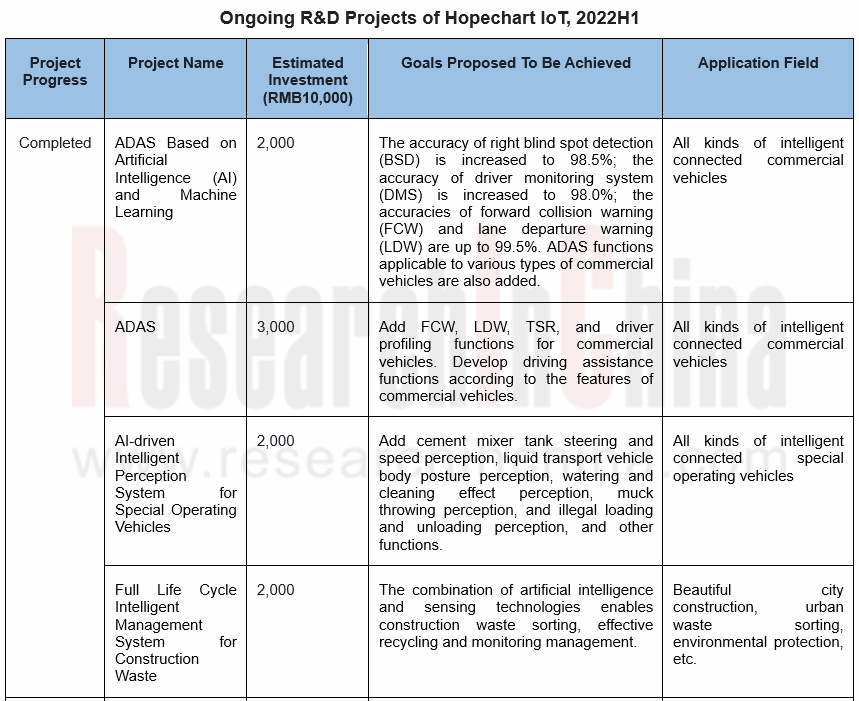

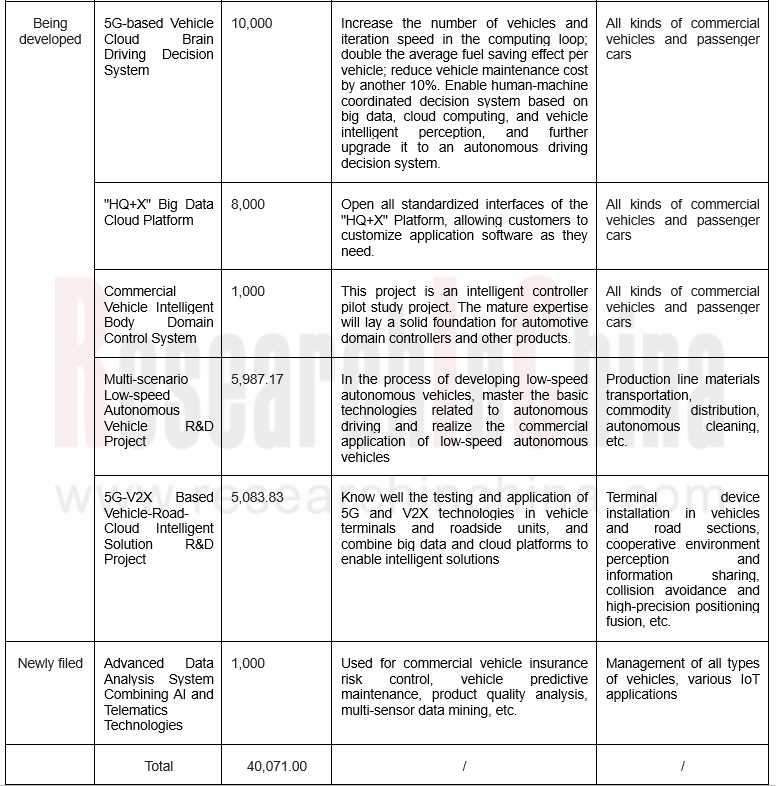

In the first half of 2022, Hopechart IoT developed ADAS, DMS, commercial vehicle controller, big data cloud platform and other projects through a RMB400 million investment plan. The application fields will also extend from commercial vehicles to passenger cars.

2. OEMs expand service scope to create ecosystem solutions.

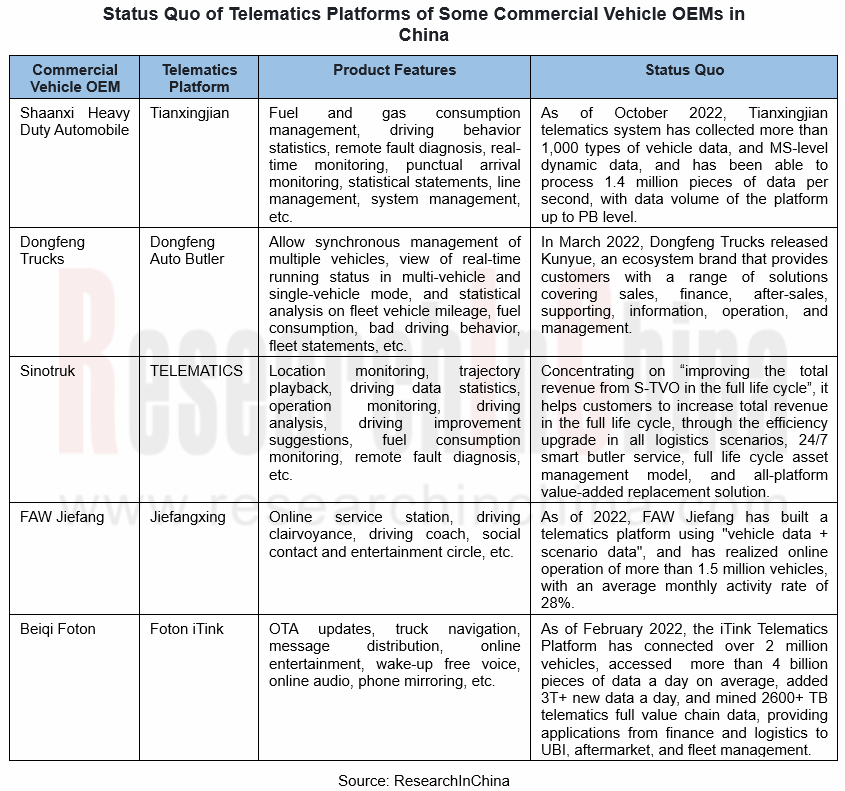

To expand the value chain, commercial vehicle OEMs are integrating ecological resources and building system solutions, with products as the core. Besides such functions as vehicle monitoring, fleet management, and driving behavior analysis, OEMs start extension to the aftermarket chain covering precision marketing, financial insurance, and after-sales service, and realize refined management according to application scenarios.

In Sinotruk’s case, it achieves "higher total revenue from S-TVO in the full life cycle" by starting from the links of logistics efficiency upgrade, butler services, asset management and platform added value.

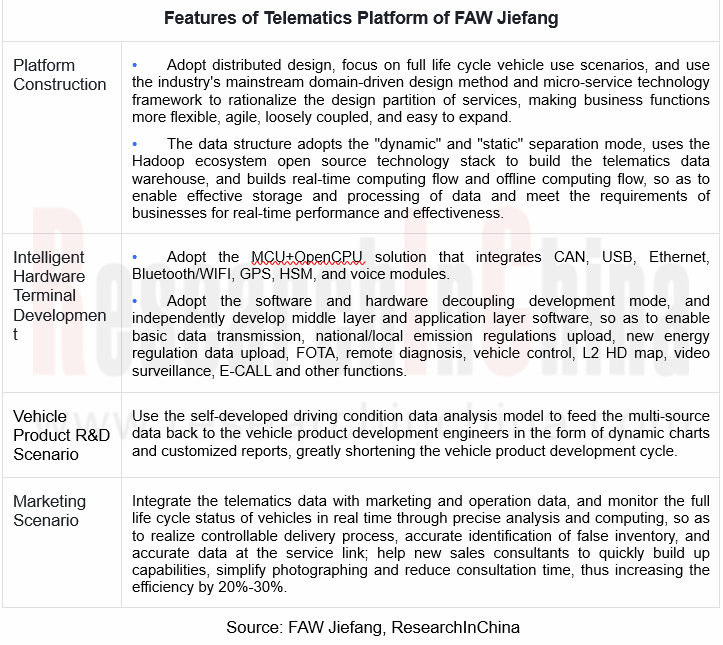

In 2022, FAW Jiefang boasts a telematics installation rate of 100%, and realizes interconnection between cloud platforms, intelligent hardware terminals, and service points of contact. In the next three years, the company will focus its efforts on product competitive edge enhancement, industrial application of big data, and large-scale ecosystem development.

In March 2022, Dongfeng Trucks released the ecosystem brand "Kunyue". In addition to product sales, it provides customers with a range of solutions such as finance, after-sales, supporting, information, operation, and management. The brand has made three breakthroughs:

① Build a big data platform for digital transformation in R&D, supply, manufacture, marketing, and service models, and explore the "product + operation + ecosystem" business model;

② In the operation of application sub-scenario ecosystem, build "battery swap logistics operation solution" and "smart port operation solution";

③ Launch "Sunshine Connection" online freight platform to enable interconnection between online freight platforms.

3. Third-party operating platforms are dedicated to digital upgrade of sub-scenarios.

Third-party operating platforms provide general or customized services for general or specific customers. Their service contents cover multiple functions such as map navigation, logistics tracking, and supervision and management. Third-party operating platforms have matured with their own features.

For example, G7, a platform operated by Beijing Huitong Tianxia Wulian Technology Co., Ltd., has connected 1.8 million vehicles, and a wide range of road logistics production factors like trucks, trailers, gasoline stations and logistics parks. It can obtain all road freight big data such as vehicle trajectories, driving behaviors, energy consumption, and park management, in a bid to achieve economic benefits such as efficiency improvement and cost reduction.

For OEMs, vehicle owners and drivers, logistics companies, aftermarket service providers, financial insurance companies, and carriers, Zhonghuan Satellite Navigation Communication Co., Ltd. facilitates the intensive, intelligent and digital upgrade of the logistics industry. The company has launched intelligent connection service solutions for more than 10 commercial vehicle manufacturers and served more than 1.4 million vehicles.

Taking government supervision as the starting point, Sinoiov cooperates with the Ministry of Communications and the Ministry of Public Security among others to obtain relevant data permissions, and provides related data application services, based on which Sinoiov has established a national road freight platform. While providing regulatory services for governments, it also offers an array of platform services to road freight companies, and provides financial services according to scenarios.

Third-party operating platforms have the ability to integrate information and data of different automakers, companies, and vehicles. Enabling cross-platform services through connected data according to the needs of each sub-scenario has become the key direction of digital upgrade.

For example, in 2022, Sinoiov together with over 3,000 ecosystem partners built digital logistics integrated solutions by relying on the massive logistics big data of "people, vehicles, goods, and companies" and combining its own strengths in Beidou space-time application, logistics AI, and telematics. Its solutions have been used by manufacturers and fast moving consumer goods companies, including HBIS Group, SD Steel Rizhao Co., Ltd., BBMG Corporation, Yili, Mengniu Dairy, and Liby, to achieve the goals of factory warehousing, transportation and distribution integration, whole order fulfillment process visualization, transport capacity resources integration and precipitation, freight cost reduction, and higher settlement efficiency, helping companies realize digital logistics upgrade.

In the future, based on digitization empowering the general forms of road freight, Sinoiov will more deeply participate in restructuring of business formats in certain market segments, and catalyze new products with lower costs and higher efficiency in the industry.

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...