In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in December, Quanergy declared bankruptcy.

In September 2023, Bosch halted its work on autonomous driving LiDAR development.

......

"Bad news" about LiDAR continues to roll in, and the industry is worried about the future of LiDAR.

Bosch said that after considering cost of LiDAR technology and market demand, it gave up independent development. But this does not mean that it is not optimistic about LiDAR. Bosch will still retain LiDAR-related equipment to evaluate LiDARs developed by other manufacturers, and integrate them into its own products.

So, where is the future of LiDAR?

01 Chinese LiDARs usher in a small peak period of "mass production and delivery".

As intelligent driving develops in China, especially highway/urban NOA having taken a “fast lane”, much more LiDARs are seen in vehicles.

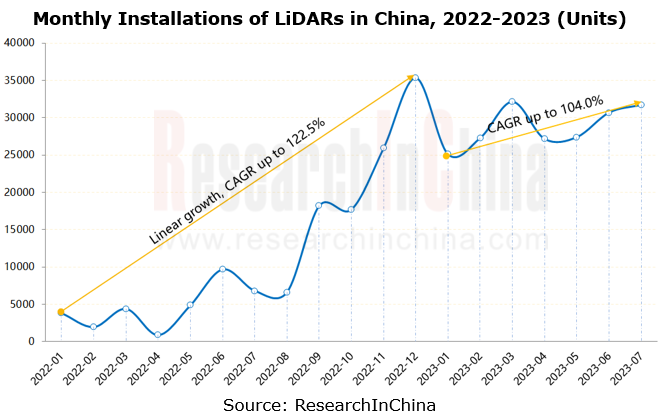

According to the latest data from ResearchInChina, from January to July 2023, 202,000 passenger cars in China were equipped with LiDAR as a standard OEM configuration, rocketing by 523.3% on a like-on-like basis, and it is expected to exceed 350,000 units throughout the year. We predict that in China LiDAR will continue to rise in volatility in the next 2-3 years, and will be installed in over 600,000 cars in 2025.

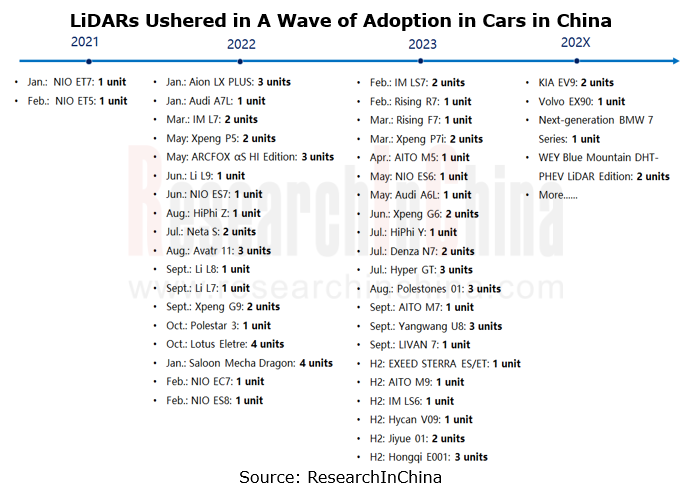

In China, NIO, Xpeng and Li Auto are active promoters of using LiDARs in cars, and have introduced LiDARs into a number of their models, such as NIO ET5/ET7/ES7/ES8/ES6, Li L9/L8 and Xpeng P5/G9/G6. According to incomplete statistics, in 2023 more than 20 new models equipped with LiDARs will be launched on market in China; after 2024, foreign brands like BMW, Mercedes-Benz and Volvo will also join the wave of applying LiDARs in cars.

Despite the overall increasing number of LiDARs installed in vehicles, starting from 2023 the pressure to lower cost in the intelligent driving industry has caused a reduction in the number of LiDARs in some new models, and the number of LiDAR-enabled models. Huawei ADS 2.0, first available to AITO M5, reduces LiDARs to 1 unit, compared with 3 units in ADS 1.0. Differing from L9, Li L8/L7 adopts different configurations: the AD Pro Edition only uses visual sensors, while the AD Max Edition is compatible with other sensors like LiDAR.

In general, how many LiDARs are used? Do multiple ones work better than one? It is inconclusive in the industry. But in the long term, as intelligent driving develops from L2 to L3 and L4, LiDAR will still be an indispensable sensor.

02 The LiDAR market pattern led by “five giants” takes shape.

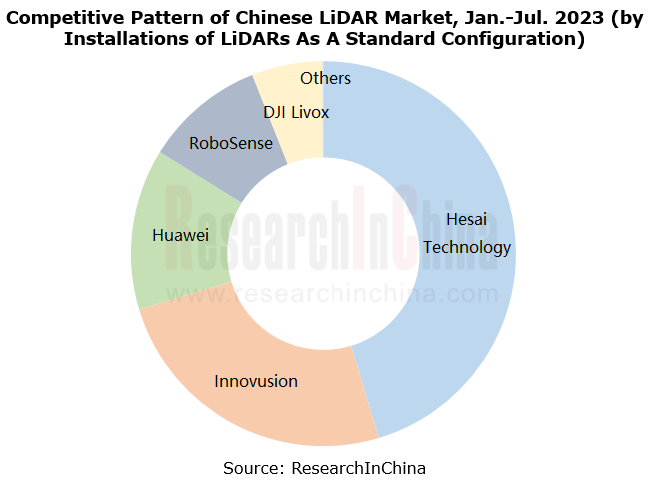

After several rounds of shuffling in the market in China, local LiDAR suppliers are now the first to emerge. Typical companies include Hesai Technology, RoboSense, Innovusion, DJI Livox, Huawei, Benewake, and VanJee Technology.

According to ResearchInChina’s statistics, from January to July 2023, the top five LiDAR companies in Chinese passenger car OEM market were all local suppliers, and Hesai ranked first, with a market share of more than 45%; Innovusion followed, with a market share of 25.0%, mainly serving NIO’s models.

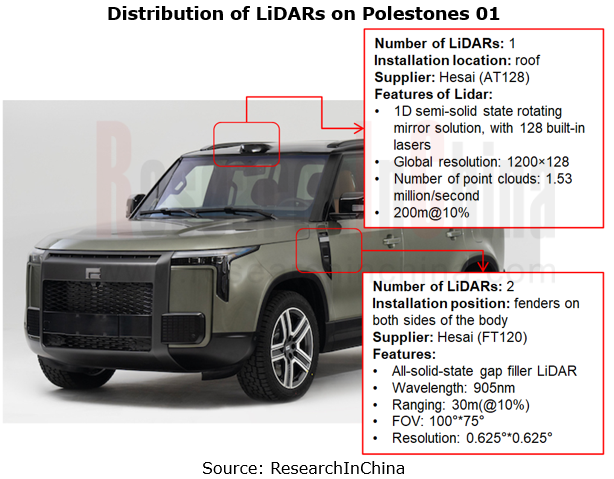

Hesai Technology: Since the mass production of AT128 in 2022, Hesai has secured orders for millions of its LiDARs from over 10 OEMs, of which a total of 100,000 units were delivered in 2022, including 62,000 AT128 LiDARs. The gap filler LiDAR FT120, launched in November 2022, has also acquired orders for over 1 million units, and will be the first to be mass-produced in the second half of 2023.

In February 2023, Hesai was listed on NASDAQ in the US, and raised a total of USD190 million, becoming the first LiDAR stock. In the first half of the year, Hesai delivered 86,940 LiDARs, an annualized spurt of 630.3%, of which 73,889 units were ADAS LiDARs, exceeding the total of the previous year.

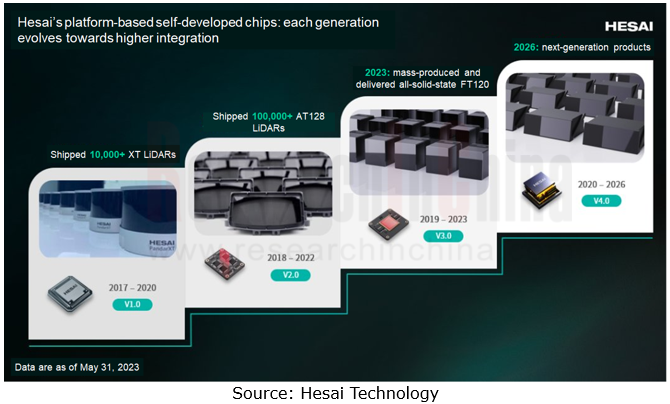

Why is Hesai so far ahead and what is its core strength? Its CEO Li Yifan believes that independent development of chips is Hesai’s competitive edge.

In late 2017, Hesai established a chip department to develop laser driver ICs, analog front-end ICs, digital ICs, and SoCs. It now has completed V1.0, V1.5, V2.0, and V3.0 LiDAR chip architectures, and is developing V4.0, which will be available to the next-generation LiDAR products in 2026.

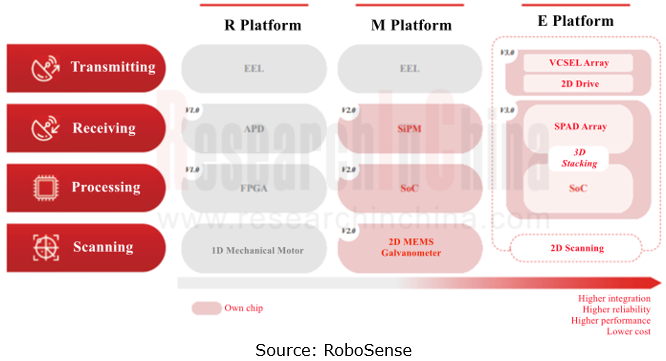

RoboSense: It has built three major LiDAR platforms - M Platform (semi-solid state), E Platform (solid state) and R Platform (mechanical), and is designing and developing next-generation LiDAR platform - F Platform. The M Platform is oriented to ADAS and is based on 2D MEMS galvanometers, with products including M1, M1P and M2.

In March 2023, RoboSense said that it had received OEM mass production designation expected orders for its front LiDAR M1 for 52 vehicle models from 21 automotive automakers and Tier 1 suppliers.

Currently RoboSense has improved its delivery capacity by way of establishing a joint venture (Luxsense, a joint venture co-funded with Luxshare) and self-building production lines (Honghualing and Shiyan factories in Shenzhen). Wherein, the investment in the Phase I of the Luxsense-centric Intelligent Manufacturing Cluster of RoboSense exceeded RMB1 billion, involving construction of nearly 20 automatic production lines with annual capacity of 1 million units and efficiency of "producing one LiDAR every 12 seconds".

In addition to local companies, foreign companies like Luminar and Valeo have also quickened their deployment pace in Chinese market. For example, in April 2023 Luminar announced a partnership with TPK to build and operate an additional high-volume LiDAR factory in China. At the first stage, the new factory will be capable of producing up to 600,000 Luminar LiDAR sensors annually to meet increasing market demand. Of the now more than 20 production vehicle models Luminar is designed into, the majority including Rising R7, Volvo EX90 Excellence and Polestar 3 are also slated for the China market.

03 Solid-state gap filler LiDAR comes as a new track.

When automakers still consider whether to install LiDAR and how many to install, solid-state gap filler LiDAR has "come out of the blue."

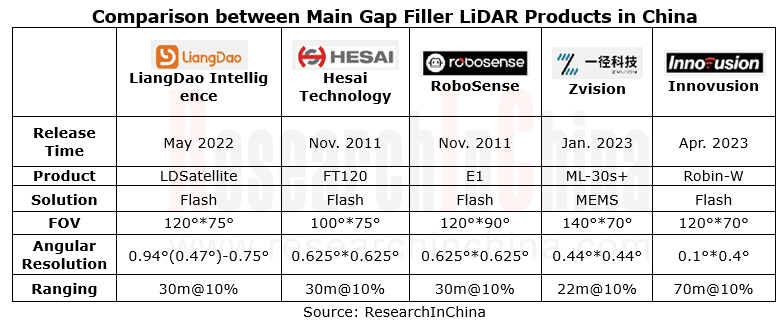

In May 2022, LiangDao Intelligence launched LDSatellite?, its first all-solid-state side gap filler LiDAR which is mass-produced for the OEM market and features an ultra-large FOV of 120°×75°. At the Auto Shanghai, this company also exhibited a DEMO car integrated with front + side gap filler LiDARs.

Later Hesai Technology, RoboSense, Zvision, and Innovusion introduced their gap filler LiDAR as well, all of which are scheduled to be marketed in 2023.

Large FOV is the key to gap filler LiDAR, especially vertical FOV.

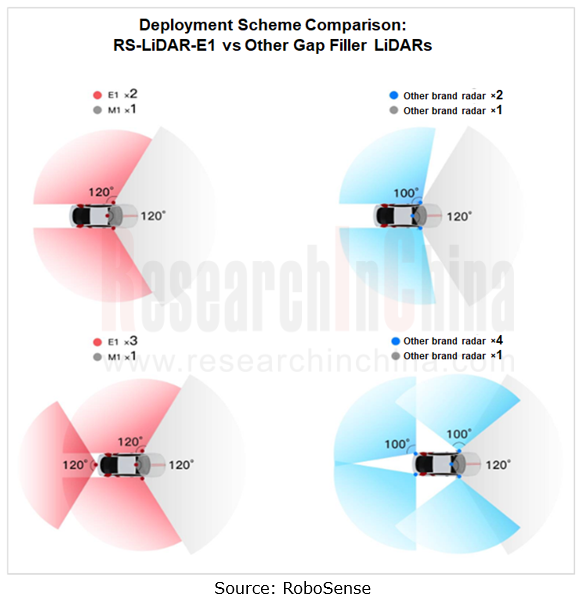

RoboSense’s gap filler LiDAR RS-LiDAR-E1 offers a horizontal FOV of 120°, and a vertical FOV of 90°, with the perception range covering both ground blind spots and side view. 2 E1 LiDARs plus 1 120° FOV main LiDAR provides 360° view coverage. RoboSense believes that a vertical FOV smaller than 90° easily leads to a risk of insufficient perception range.

RoboSense E1 adopts chip structure design, and can slash cost after mass production.

The transmitter IC uses 2D addressable area array VCSEL technology to support flexible scanning modes and improve energy utilization.

The receiver IC uses 3D stacking technology to integrate the SPAD array and high-performance SoC into one chip, simplifying system links and lowering cost.

The driver IC adopts a self-developed area array VCSEL dedicated driver solution, cutting down system cost by more than 50%.

With regard to the progress in installation in vehicles, Hesai Technology’s gap filler LiDAR FT120 is the first to be implemented. In August 2023, Polestones 01 was launched on market. This car packs 3 Hesai LiDARs including 1 AT128 front + 2 FT120 side LiDARs, becoming China’s first model carrying solid-state gap filler LiDARs.

Although gap filler LiDAR costs much less than front LiDAR, it is still more expensive than gap filler sensors such as camera/radar. Moreover, a vehicle generally needs multiple gap filler LiDARs, which is bound to push up the cost. Therefore the wide adoption of gap filler LiDARs in vehicles will take some time.

04 From outside to inside the cabin, LiDAR makes a new leap.

In April 2023, Hesai released ET25, an automotive-grade ultrathin long-range LiDAR which is specially designed to be placed behind the front windshield. With only 25mm in thickness (AT128 is 48mm), this product features 120°x25° FOV, 250m@10% ranging without the windshield (225m@10% behind the windshield), the minimum resolution of 0.05°x0.05°, and power consumption of just 12W.

It is worth noting that ET25 uses a 905nm solution, but with ranging up to 250m@10%, almost on a par with 1550nm solutions. This is mainly credited to Hesai's new-generation transceiver chip with sensitivity several times higher than the previous generation. Li Yifan, CEO of Hesai, says that it is very difficult to miniaturize products without affecting core performance, and this requires extremely excellent semiconductor technology, which is high core strength."

In September 2023, Hesai and FAW built designation cooperation. The next-generation flagship all-electric models under Hongqi brand will be the first to use Hesai’s ET25 LiDAR. The result of the cooperation is expected to be mass-produced and delivered in 2025H1.

In addition to Hesai, Innovusion’s Robin-E also meets the requirements of “entry into cabins". Innovusion has formed strategic partnerships with Fuyao Glass and AGC’s subsidiary Wideye, initially realizing the integration of LiDAR and front windshield. Bao Junwei, Innovusion’s CEO, believes that the introduction of LiDAR into cabins is a trend, but it will not completely replace cabin front radar.

05 Chip localization makes wide adoption of LiDARs in prospect.

From the perspective of system structure, LiDAR chips mainly include transmitter IC, receiver IC and information processor. After years of development, Chinese transmitter VCSEL chips have entered a mature mass production phase, but receiver SPAD chips are monopolized by Sony and ON Semiconductor among others. Chinese SPAD chip companies, including Fortsense, Sophoton, VisionICs Microelectronics Technology, and ADAPS, thus work harder on technology development, having made new breakthroughs.

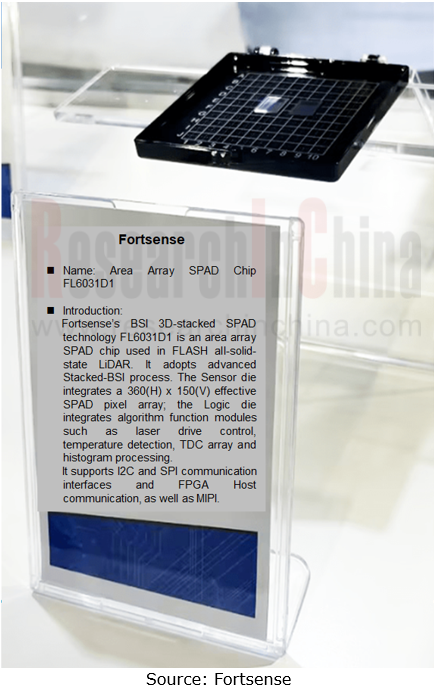

In August 2023, Fortsense released FL6031, an all-solid-state LiDAR area array SPAD chip which adopts the Stacked-BSI process. This product integrates a 360×150 SPAD pixel array with over 50k effective pixels, meeting automotive application requirements. Based on FL6031, Suzhou Photon-Matrix Optoelectronics Technology and Wuhan VanJee Optoelectronics Technology have completed the demo development of all-solid-state LiDARs.

The information processor, namely, LiDAR master chip, is mainly FPGA for time sequence control, waveform algorithm processing, and other functional modules control. The typical vendors are Xilinx and Altera. The FPGA chips for automotive LiDAR products of RoboSense, Innovusion, and DJI all come from Xilinx.

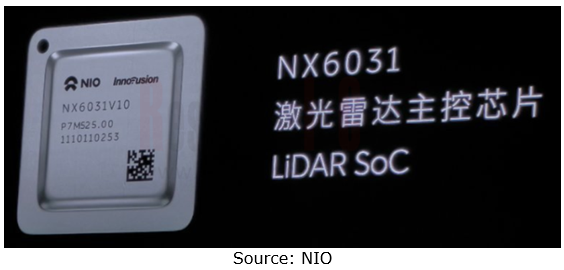

In September 2023, NIO introduced its self-developed LiDAR master chip "Yang Jian" (chip model: NX6031). The chip packs eight 9-bit analog-to-digital (AD) samples, and delivers sampling frequency of up to 1GHz per channel, allowing for efficient capture of laser echo signals. Mass production is scheduled in October 2023.

NIO says that its purpose of self-developing chips is "gross profit" and it hopes to exchange recent R&D investment for long-term gross profit. This chip can save hundreds of yuan. In the future, the mass production and application of "Yang Jian" is expected to drag down the cost of LiDAR.

Overall, LiDAR is at a critical moment when it faces survival and profit on one hand, and cost reduction and mass adoption on the other. Both OEMs and suppliers are going through a white war. Who win and who lose will probably be known in a few years.

Bao Junwei said, “as ever more production cars pack LiDAR, the answer will become clear as to whose LiDAR in cars is real strength and whose is a deception; in the next one or two years, many automakers may feel painful because the LiDARs they choose may be more in name than in reality, or risk a change in strategy.”