Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

-

Sept.2023

- Hard Copy

- USD

$3,000

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

YPX007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.

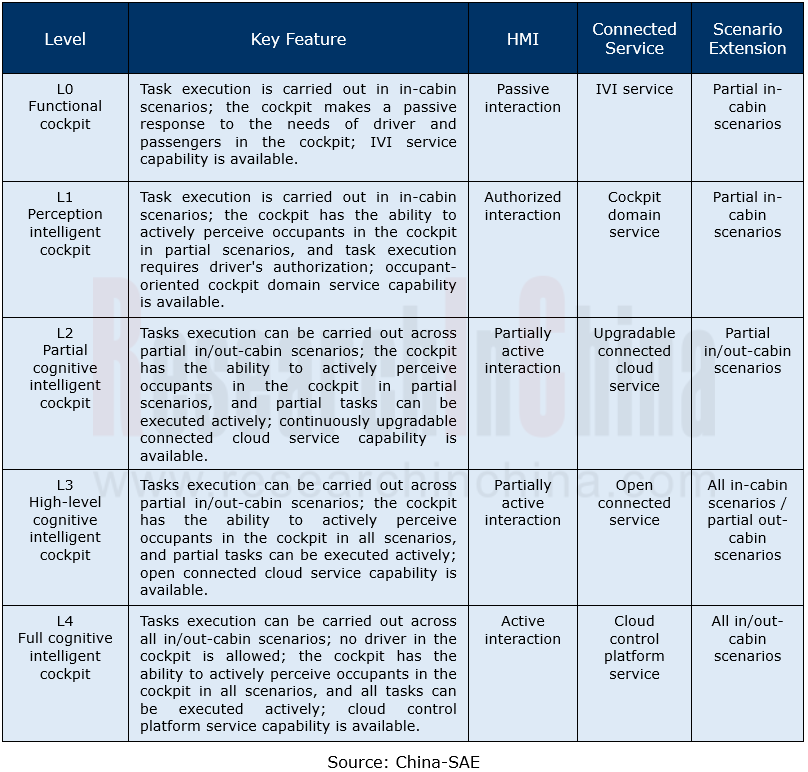

On May 17, 2023, the “White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation” prepared by China-SAE together with industry professionals was officially released. It defines five levels of intelligent cockpits from L0 to L4.

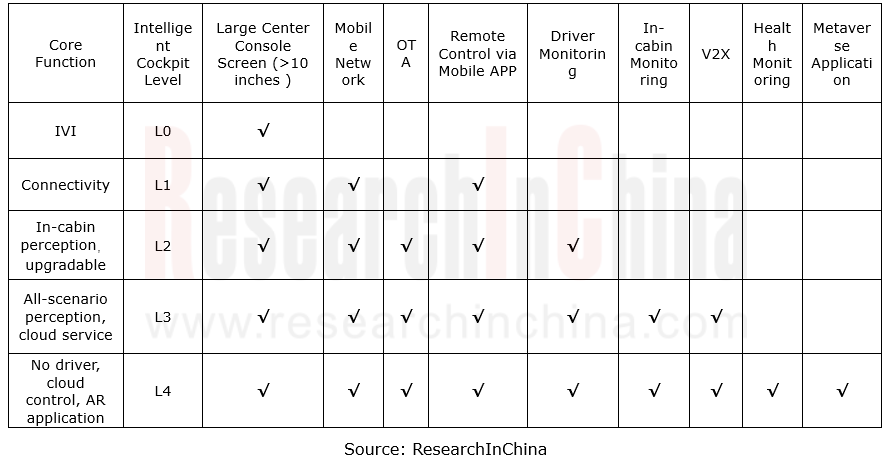

Referring to China-SAE's automotive intelligent cockpit levels and combining cockpit functions of mainstream vehicle models on market, ResearchInChina presents the intelligent cockpit levels in the form of specific function parameters, and divides intelligent cockpit into 4 levels.

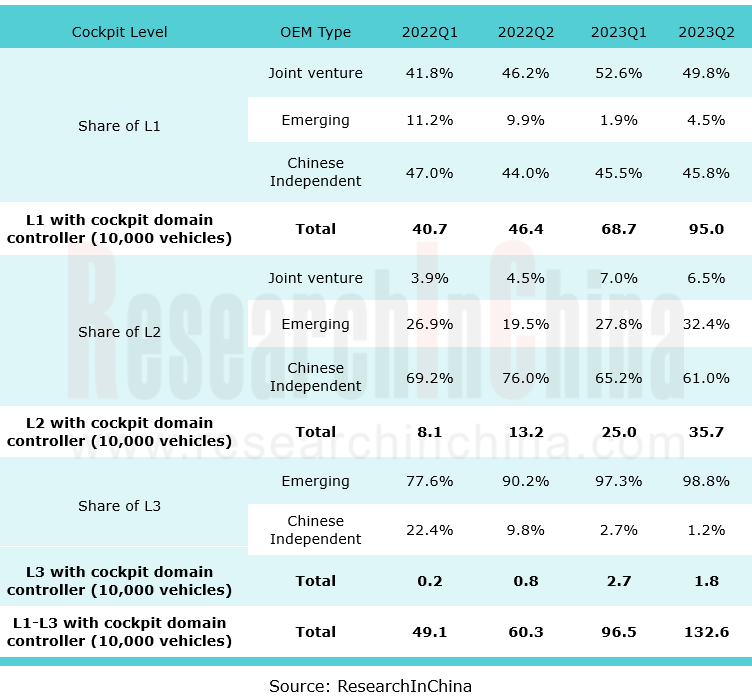

This Report only studies vehicle models with both L1+ intelligent cockpit functions (including L1, L2, L3 and L4) and cockpit domain controllers.

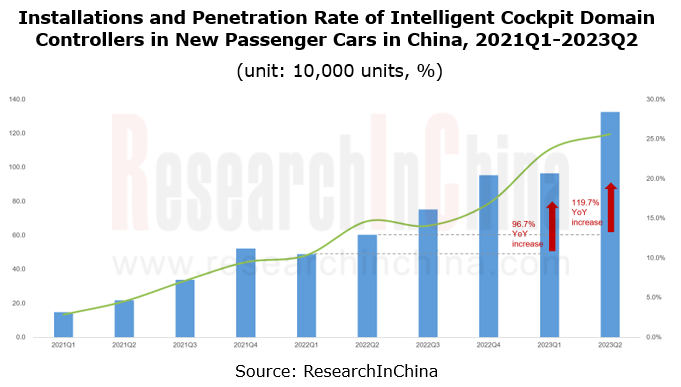

According to ResearchInChina, from 2021Q1 to 2023Q2, the installations of intelligent cockpit domain controllers in passenger cars in China showed an overall upward trend. In 2023Q1, the installations surged by 96.7% on an annualized basis to 964,800 units, and the installation rate was 23.7%; in 2023Q2, the installations reached 1,325,700 units, soaring by 119.7%, and the installation rate was 25.6%.

Currently, cockpit domain controller and intelligent driving domain controller are very similar in hardware architecture, both being the SoC+MCU solution. The core of cockpit domain controller is cockpit SoC, and single-chip multi-system solutions prevail at present. In 2023Q2, single-SoC solutions swept 92.6%, largely from Qualcomm and AMD; dual-SoC solutions made up 7.4%, mainly Qualcomm 8155.

From the sales of models of differing intelligent cockpit levels, it can be seen that in 2023Q2, the sales of models equipped with L1 intelligent cockpit with cockpit domain controller reached 950,000 units, jumping by 104.7% from the prior-year period, of which joint venture and Chinese independent automakers each occupied more than 40%; the sales of models with equipped with L2 intelligent cockpit with cockpit domain controller were 357,000 units, a like-on-like spurt of 170.5%, of which Chinese independent automakers accounted for 61%, and emerging car brands shared 32.4%; the sales of models equipped with L3 intelligent cockpit with cockpit domain controller were 1,8000 units, of which emerging car brands swept 98.8%.

Different types of OEMs vary greatly not only in layout of intelligent cockpit level but also in selection of cockpit domain control chip for vehicle models in different price range.

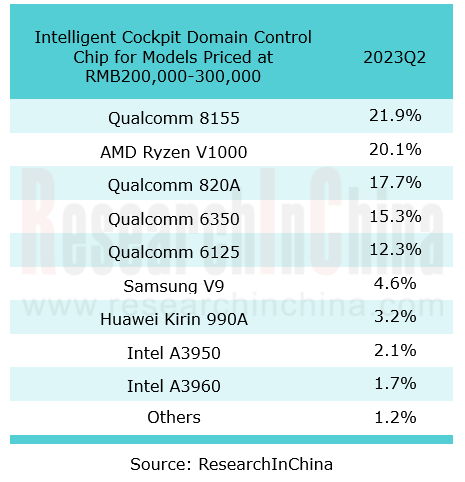

When it comes to intelligent cockpit chips, people often think that the vast majority of master chips for models with an intelligent cockpit are Qualcomm SA8155P. Actually, ResearchInChina's statistics shows that in models priced at RMB100,000-200,000, Qualcomm SA8155P boasts the highest share, but only 38%. In the intelligent cockpit domain control master chip market for models in the price ranges of RMB200,000-300,000 and RMB300,000-500,000, Qualcomm SA8155P makes up 21.9% and 31.2%, respectively.

The huge development potential of intelligent cockpits and the high differentiation in market segments bring market opportunities to latecomers of intelligent cockpit chips and domain controllers as well.

This Report provides in-depth analysis of intelligent cockpit domain controller and master chip market segments via a detailed and accurate database, and also demonstrates the industry development trends through expert interviews. Intelligent cockpit domain controller and SoC players and participants can also know the competitive pattern of the industry in this Report, and thus find their niche.

Intelligent Cockpit Levels Defined in the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation"

Intelligent Cockpit Levels Defined by ResearchInChina: Referring to the "White Paper on Automotive Intelligent Cockpit Levels and Comprehensive Evaluation" and Presenting in the Form of Specific Parameters

1 Overall Data Trends

1.1 Overall Installation of Cockpit Domain Controller

1.1.1 Installations of Cockpit Domain Controller, 2021Q1-2023Q2

1.1.2 Installations of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

1.1.3 Penetration Rate of Cockpit Domain Controller (by Price Range), 2021Q1-2023Q2

1.1.4 Installations and Penetration Rate of Cockpit Domain Controller (by OEM Type), 2021Q1-2023Q2

1.1.5 Installations and Penetration Rate of Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

1.1.6 TOP 15 Passenger Car Brands in China by Installations of Cockpit Domain Controller, and Their Penetration Rate, 2023Q2

1.1.7 TOP 15 Passenger Car Models in China by Installations of Cockpit Domain Controller, 2023Q2

1.2 Installation by Cockpit Level

1.2.1 Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller

1.2.2 Sales of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type)

1.2.3 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by OEM Type), 2023Q2

1.2.4 Sales Structure of Vehicle Models of Differing Cockpit Levels with Cockpit Domain Controller (by Energy Type), 2021Q1-2023Q2

1.2.5 Sales Structure of Vehicle Models of Differing Cockpit Levels (by Energy Type), 2023Q2

1.3 Market Share of Cockpit Domain Controller Vendors

1.3.1 TOP 10 Cockpit Domain Controller Vendors, 2023Q2

1.3.2 TOP 10 Cockpit Domain Controller Vendors for Chinese Independent OEMs, 2023Q2

1.3.3 TOP 10 Cockpit Domain Controller Vendors for Joint Venture OEMs, 2023Q2

1.4 Market Share of Cockpit Domain Controller SoC Vendors

1.4.1 Market Share of Cockpit Domain Controller SoC Vendors, 2023Q2

1.4.2 Market Share of Cockpit Domain Controller SoCs by Type, 2023Q2

1.4.3 Market Share of Qualcomm 8155 SoC, 2023Q2

1.4.4 Cockpit Domain Controller SoC Market Share of Chinese Independent OEMs, 2023Q2

1.4.5 Cockpit Domain Controller SoC Market Share of Joint Venture OEMs, 2023Q2

1.5 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB100,000-200,000

1.5.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000

1.5.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by OEM Type)

1.5.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB100,000-200,000 (by Energy Type)

1.5.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB100,000-200,00

1.5.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB100,000-200,000

1.5.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB100,000-200,000

1.6 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB200,000-300,000

1.6.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000

1.6.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by OEM Type)

1.6.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB200,000-300,000 (by Energy Type)

1.6.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB200,000-300,000

1.6.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB200,000-300,000

1.6.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB200,000-300,000

1.7 Market Data of Intelligent Cockpits for Vehicle Models Priced at RMB300,000-500,000

1.7.1 Sales and Penetration of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000

1.7.2 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by OEM Type)

1.7.3 Sales Structure of Different Intelligent Cockpit Levels for Vehicle Models Priced at RMB300,000-500,000 (by Energy Type)

1.7.4 Share of Cockpit Domain Controllers Vendors for Vehicle Models Priced at RMB300,000-500,000

1.7.5 Share of Cockpit Domain Controller Master Chip Vendors for Vehicle Models Priced at RMB300,000-500,000

1.7.6 Market Share of Cockpit Domain Controller Master Chips (by Type) for Vehicle Models Priced at RMB300,000-500,000

2 Data and Dynamics of Cockpit Domain Controller Companies

2.1 FindDreams Technology

2.1.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.2 Megatronix

2.2.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.3 Continental

2.3.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.3.2 Latest Dynamics

2.4 Desay SV

2.4.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.4.2 Latest Dynamics

2.5 Yanfeng Visteon

2.5.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.5.2 Latest Dynamics

2.6 Harman

2.6.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.7 Bosch

2.7.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

2.8 Panasonic

2.8.1 Cockpit Domain Controller Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3 Data and Dynamics of Cockpit Domain Controller SoC Vendors

3.1 Qualcomm

3.1.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.1.2 Qualcomm SA8155P to Be Installed in BMW Models

3.1.3 Cooperation between Qualcomm and Leapmotor

3.1.4 Leapmotor’s Qualcomm-based Cockpit-driving Integrated Solution

3.2 AMD

3.2.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.3 Intel

3.3.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.4 Renesas

3.4.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.5 Samsung

3.5.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.5.2 Latest Dynamics

3.6 NVIDIA

3.6.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.6.2 Latest Dynamics

3.7 MediaTek

3.7.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.8 Huawei

3.8.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.9 TI

3.9.1 Cockpit Domain Controller SoC Installation, Share Trend and Supply Relationships, 2021Q1-2023Q2

3.10 Dynamics of Other Cockpit SoC Players

3.10.1 UNISOC

3.10.2 SiEngine

4 Forecast Data and Trends

4.1 Forecast Data

4.1.1 Cockpit Domain Controller Installations and Penetration Rate, 2021Q1-2024Q4E

4.1.2 Cockpit Domain Controller Installations and Penetration Rate by Vendor Type, 2021Q1-2024Q4E

4.1.3 Cockpit Domain Controller Installations and Penetration Rate by Cockpit Level, 2021Q1-2024Q4E

4.1.4 Cockpit Domain Controller Installations by Price, 2021Q1-2024Q4E

4.1.5 Cockpit Domain Controller and SoC Market Size, 2021Q1-2024Q4E

4.2 Trends

4.2.1 Purchase Prices of Current Mainstream Cockpit SoCs and Domain Controllers Based on the SoCs

4.2.2 Advantages and Shortcomings of Current Mainstream Cockpit SoCs

4.2.3 MCU Purchase Price, Chinese Alternative Solutions and Integration

4.2.4 Development Trends of Cockpit Domain Controller and SoC

4.2.5 Views on Cockpit-driving Integration Trend of Central Computing Platforms

4.3 Qualcomm SA8255P May Once Again Sweep up the Intelligent Cockpit Market

4.3.1 Comparison between Qualcomm SA8255P, 8155 and 8295

4.3.2 Functional Safety Design of SA8255P

4.3.3 Further Comparison between SA8255P and 8295P

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:Passenger car wireless charging (principle, standards, and Qi2.0 protocol);Passenger car mobile phone ...

Automotive Smart Exteriors Research Report, 2024

Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence?

The Automotive Smart Exteriors Research Report, 2024 ...

Automotive Fragrance and Air Conditioning System Research Report, 2024

Research on automotive fragrance/air purification: With surging installations, automotive olfactory interaction is being linked with more scenarios.

As users require higher quality of personalized, i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2024

Multi-Domain Computing Research: A Summary of Several Ideas and Product Strategies for Cross-Domain Integration

1. Several ideas and strategies for cross-domain integration of OEMs

With the increasi...

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.

1. Foreign ADAS Tier 1 suppliers fall behind relatively in deve...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...