NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025

Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. After deeply studying the most typical high-end electric vehicles in the Chinese market (including NIO ET5/ET7, Xpeng P7, Aion LX Plus, Aion V Plus, ARCFOX αT, IM L7, Xpeng G9, Xpeng P5, Audi Q5 e-tron, Voyah FREE, Li L9, Li L8, Volkswagen ID.6 CROZZ, AITO M7, ZEEKR 001 and so on), ResearchInChina issued a series of research reports such as NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report 2022, Xpeng G9 Intelligent Function Deconstructive Analysis Report 2022, Li L9/L8 Intelligent Function Deconstructive Analysis Report 2022, and Aion LX Plus/V Plus Intelligent Function Deconstructive Analysis Report 2022. This series of reports mainly studies the specific configuration, parameter comparison, user evaluation, suppliers and the like of dozens of intelligent functions in the realms of intelligent driving, intelligent cockpits, intelligent chassis and intelligent electrification, etc.

NIO, Xpeng, Li Auto, AITO, Aion, etc. are typical enterprises of intelligent electric vehicles, and have piqued the interest of domestic and foreign traditional automakers and emerging automakers in Chinese market. Studying their representative models is helpful to grasp the development direction of the new four modernizations (electrification, connectivity, intelligence and sharing) of automobiles.

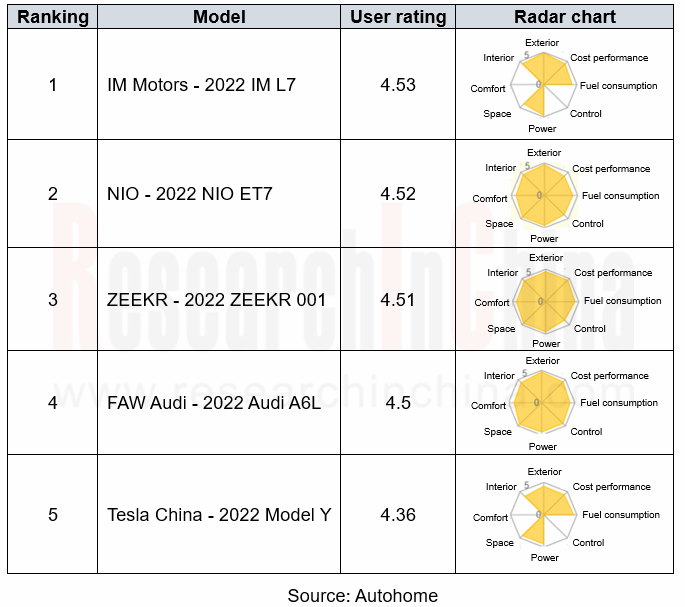

According to Autohome’s leaderboard by word-of-mouth, the 2022 NIO ET7 ranked second by user rating, with similar scores in appearance, interior, comfort, power, control, etc. and without obvious weaknesses.

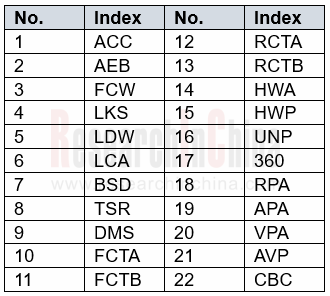

ADAS Functions of NIO ET5/ET7

NIO ET5/ET7 has realized or will realize 22 ADAS functions by means of 33 perception hardware (including seven 8-megapixel high-definition cameras, four 3-megapixel surround-view cameras, a high-precision LiDAR, five radars, 12 ultrasonic radars, two high-precision positioning units, CVIS perception and a DMS camera) and four NVIDIA Drive Orin chips (with the computing power of 1016TOPS).

Through detailed comparison, we can know the functional differences between ET5/ET7, the previous ES6/ES8, and competing models. For example, AEB of NIO ET5/ET7 cannot be retriggered within approximately 30 seconds after the first trigger, which is longer than that of ES8/ES6 (20 seconds). The AEB application range of NIO ET5/ET7 (4-150km/h) is wider than that of ES8/ES6 (8-85km/h). The AEB of Li L9 can produce the maximum speed reduction of 70km/h, followed by ET5/ET7 (60km/h) and ES8/ES6 (40km/h).

In terms of sensor types, NIO ET5/ET7 uses cameras and LiDAR to participate in the implementation of AEB, while ES8/ES6 only adopts cameras. Xpeng P7 exploits cameras and radar for AEB, whereas Li L9 leverages cameras, radar and LiDAR.

Even for a relatively "simple" function like AEB, there are many scenarios where AEB doesn't work well. The AEB of ET7 will not respond to the following objects: oncoming vehicles, sideways vehicles, animals, traffic lights, walls, roadblocks (cones, etc.), and other non-vehicle objects.

Without object recognition, the AEB of ET5/ET7 fails to perform as expected:

AEB does not respond to objects in the blind zones of sensors, such as objects located at the corners, sides, and rear of the vehicle.

? When the vehicle is approaching or passing a curve, AEB may misselect or miss objects.

? When the vehicle is on a slope, AEB may lose objects or misjudge the distance with the objects.

? When only part of the body of a vehicle in an adjacent lane cuts in front of the vehicle (especially when a large vehicle such as a bus or truck cuts in), AEB may not recognize it in time

? When the vehicle suddenly appears behind the front vehicle, or other vehicles suddenly cut in or out in front of the vehicle, AEB may not recognize the situation in time.

? When the front vehicle has a relatively large angle, AEB may not recognize it in time.

? When the front vehicle only partially overlaps with the vehicle, AEB may recognize it in time.

Situations where road conditions and weather affect the collision mitigation capability of the AEB of ET5/ET7:

? Roads with water, mud, potholes, ice and snow; roads with speed bumps; roads with obstacles.

? Traffic with many pedestrians, bicycles, electric vehicles or animals.

? Complex and changing traffic conditions, such as busy intersections, freeway ramps, congested roads, etc.

? Winding roads, sharp turns, ramps, bumpy roads.

? Tunnel entrances and exits. Therefore, despite being fully armed with 33 sensors, NIO ET5/ET7 still needs a lot of improvement in ADAS software.

Cockpit Functions of NIO ET5/ET7

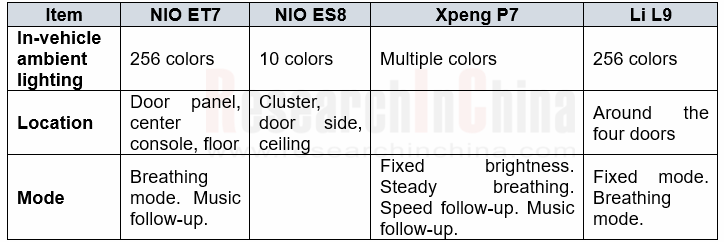

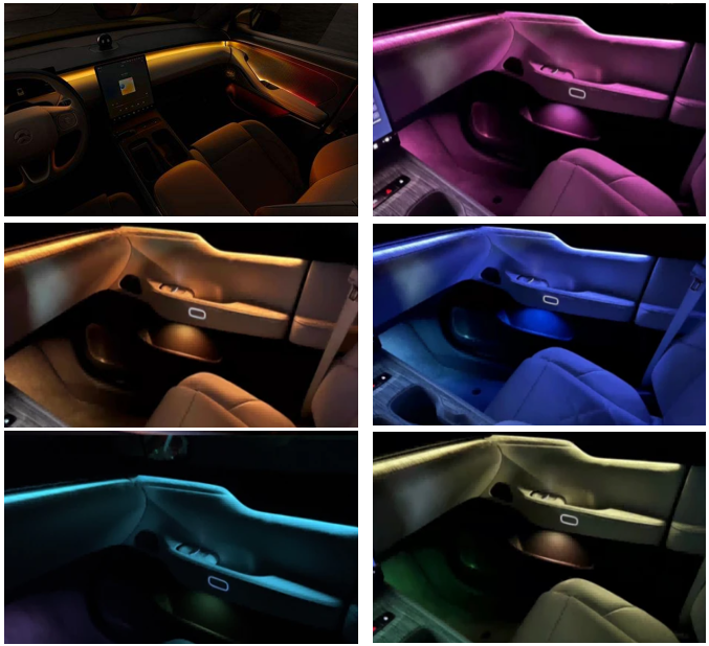

NIO ET5/ET7 boasts a lot of innovations in smart cockpit, including ambient lighting, AI assistants, intelligent voice, intelligent fragrance, AR glasses, UWB keys, face recognition, wireless charging and so on. For instance, ET5/ET7 is equipped with 256-color digital light curtain ambient lighting featuring 256*256 color combinations. The ambient lighting extends to the sound cover, and the scattering diamond arrangement combined with the function of "rhythmic light cluster" can further enhance the immersive experience. At the same time, the ambient lighting can be intelligently controlled, with welcome mode, music follow-up, driving mode, speed follow-up, fragrance theme, in-vehicle temperature adjustment, rest mode, etc. The ambient lighting inside the vehicle is also linked with side door opening warnings. When any door is about to be opened, the ambient lighting beside the corresponding side door will appear red.

In August 2022, NIO released Banyan 1.1.0, adding the function of ambient lighting changing with music. After the function is turned on, the three-layer ambient lighting in the vehicle will change in real time according to the music decibel synchronously, and the light color will also alter according to the settings. If the user chooses to follow the album cover, the ambient light will change color intelligently according to the main color of the album cover. Currently, the function can be available in NIO Immersion Sound, NIO Radio, QQ Music, etc. The function will be continuously optimized after the launch.

Intelligent Chassis of NIO ET5/ET7

NIO ET5/ET7 is equipped with NIO's self-developed chassis domain controller ICC, air suspension and CDC dynamic damping control. The suspension has a height of -10mm/0/40mm with adjustable damping. According to different driving modes and vehicle speeds, the softness, hardness and height of the suspension can be automatically adjusted to ensure the driving experience of the vehicle under various road conditions.

The chassis domain controller ICC of NIO ET7 has nine features: redundant control, shock absorber control, ASIL-D, electronic parking control, air spring height control, cybersecurity, OTA, automotive high-speed communication and AUTOSAR software architecture. NIO ICC can comprehensively design and adjust the chassis comfort, maneuverability and drivability. So far, it has integrated redundant parking, suspension, shock absorbers and other control functions. It also supports high-level autonomous driving scenarios with cross-domain integration. Through FOTA updates, it can be iterated flexibly and quickly.

The "4D intelligent body control" system of NIO's intelligent chassis predicts the potholes in front of the vehicle through sensors and technologies such as cameras, LiDAR, HD maps, and cloud big data, and then controls the chassis to make the vehicle pass through the potholes smoothly.

For NIO users, the chassis experience of ET5/ET7 is much better than that of the first-generation model (866): "After updating the system 1.10, the suspension looks much better, it is not as wobbly as before, and the vehicle is stable when passing the speed bump like a high-end car. When running on the freeway at over 100km/h, it will automatically lower the body to make driving more stable.”

However, some users are not satisfied with the chassis. According to the comments of Autohome users, "ET7 equipped with air suspension has three hardness levels: "soft, standard and hard", offering good experience for all road conditions. The soft suspension performs well on the paved road, so that the occupants can hardly feel the slight vibration at the joint of the road. But on non-paved roads, the obvious shaking and vibration give people a sense of dizziness.

Supplier Relationship

In the R&D of intelligent vehicles, the relationship between OEMs and suppliers has undergone upheavals. International traditional Tier1 suppliers often provide closed systems (black boxes), while smart car OEMs intend to be deeply involved in the R&D of core systems, and require suppliers to provide sufficient openness and rapid iterative support, which brings opportunities to local suppliers. The emergence of local suppliers is apparently attributed to enough openness (gray boxes or white boxes) and fast iteration support.

By the end of 2021, NIO had hired over 15,000 employees, including 4,809 R&D staffers. NIO plans to double the number of R&D personnel by the end of 2022, that is,over 9,000. As of November 2022, NIO’s autonomous driving business team had boasted more than 1,000 members, the autonomous driving chip R&D team 500, the battery R&D team over 400 and the mobile phone R&D team 300 or more. Although there are a large number of R&D personnel, NIO relies heavily on the support of suppliers.

Regarding chassis domain controllers, NIO didn't start from scratch. It is very important to learn from the successful experience and technology accumulation of suppliers. Before NIO launched ICC, Jingwei Hirain Technologies had gained many years of project experience in the field of chassis domain controllers.

The chassis domain controller developed by Jingwei Hirain Technologies independently integrates shock absorber damping control, air spring height control and electronic parking redundancy control, and simplifies the chassis control system structure. Besides the above functions, it can also integrate rear wheel steering, electronic stabilizer bars, steering column position control, etc. Jingwei Hirain Technologies participated in the R&D and supply of NIO’s intelligent chassis domain control, and helped the debut of NIO ET7 and ES7.

The R&D cooperation mode between NIO and the LiDAR supplier Innovusion deserves more attention. NIO took advantage of its own R&D advantages in vehicle engineering and electronic and electrical fields to lead the design of LiDAR motherboard. Generally, Tier1 suppliers are responsible for R&D, and then OEMs carry out vehicle certification and other work. In this mode, it takes Tier1 suppliers one or two years to accomplish R&D, let alone vehicle certification which costs a long time. Moreover, it is difficult for OEMs to conduct in-depth customization. NIO adopts a brand-new cooperation mode, which means that it is deeply involved in the development of the main board circuit and exterior design of LiDAR which is then better integrated with the vehicle. Thus, the development cycle will be greatly shortened, and the reliability of the supply chain can be improved.

The new cooperation mode can bring many benefits. Firstly, it can greatly shorten the R&D time. Secondly, the advantages of both parties can be brought into full play, and the supply chain, reliability and cost control can be greatly improved. Finally, LiDAR can be tailored to a specific vehicle model and integrated into the exterior design. Both parties should jointly formulate LiDAR reliability standards. Before LiDAR gets on vehicles, it should undergo impact tests, hot/cold tests, temperature and humidity alternation + frost tests, environmental tests, chemical reagent resistance tests and light tests.

NIO Service

The most impressive thing about NIO is NIO Service. In September 2022, NIO Service was upgraded. The service center will start digital intelligent operation to fulfill intelligent workshops. Users can check the service progress in real time through NIO App, and the service process is clearly visible, providing more transparent services. As of September 2022, NIO had laid out more than 240 service centers across the country. It will continue to speed up the layout of service networks to provide more users with convenient services.

In addition, NIO will launch the second-generation mobile service vehicle which can carry out various maintenance operations on site to provide users with door-to-door services. Compared with the first generation, the service capacity of the second-generation mobile service vehicle is improved by 60%. In addition to quick maintenance services such as tire replacement, tire repair, tire dynamic balance, brake pad replacement, air conditioning filter replacement, etc., the second-generation mobile service vehicle will provide emergency charging services. Through the NIO App, users can check the track and service process of technicians in real time.

Besides, NIO Service will apply an AR remote diagnosis solution, abandon the way traditional equipment handles faults, but use a variety of AI algorithms, AR virtual superposition, cloud computing and other technologies to realize auxiliary maintenance functions such as diagnostic assistance, process records and AR maintenance manuals, thereby improving maintenance efficiency. The service guard system can monitor and predict vehicle problems, give warnings and provide online services remotely through signals.

After a lot of software and hardware are added to any intelligent vehicle, many problems may occur. In recent years, the most complaints from users are often about smart software and hardware. NIO is no exception. A NIO ET7 user concluded, "Because there are many electronic devices, the probability of bugs increases badly. There were a few times when the microphone did not pick up sound, making voice control impossible. Although it does not affect driving, the experience is not good enough. Minimalism results in few necessary physical buttons, and some functions have to be found in the setting interface, which is relatively complicated. ”

NIO is experiencing rapid growth by virtue of R&D dividends, and China's automotive market pattern will see upheavals

Through the detailed analysis on dozens of intelligent functions of ET5/ET7, the comparison with competing models, the interpretation of NIO's R&D, suppliers, production, marketing and operation, as well as user feedback, ResearchInChina believes that NIO has become a force that can't be ignored in the Chinese intelligent electric vehicle market. Nearly RMB50 billion in cash, a 9,000-person R&D team, the upgrading of the NT2.0 platform and the accelerated launch of new models will promote NIO's sales volume to hit 500,000-700,000 vehicles in 2025 with the sales reaching RMB150-200 billion.

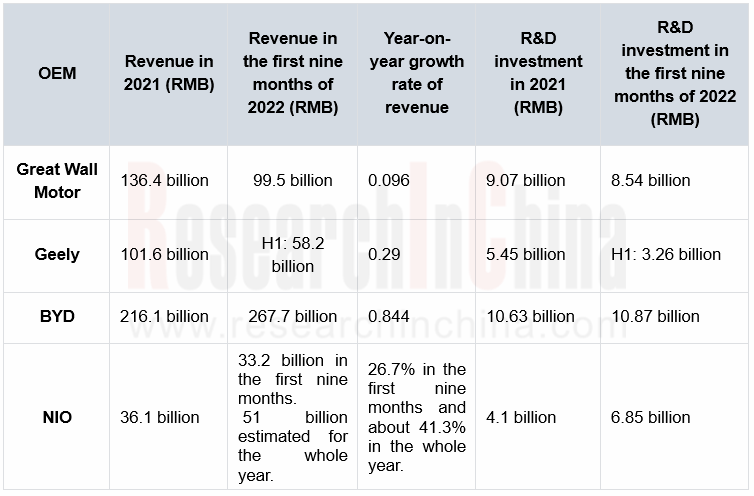

It is worth noting that Great Wall Motor earned RMB136.4 billion in revenue in 2021 while Geely secured the revenue of RMB101.6 billion, which indicates that the world is changing faster than everyone expects. NIO's R&D investment was equivalent to 75.2% of that of Geely in 2021, but the former surpassed the latter in the first three quarters of 2022 when NIO's revenue was only 33.4% of Great Wall Motor's, but its R&D investment equaled to 80.2% of Great Wall Motor's.

It is the continuous high R&D investment that has enabled NIO to reap R&D dividends from the second half of 2022 and enter the development stage where the performance skyrockets. With the rise of emerging automakers such as NIO, China's automotive market pattern will see upheavals.