China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes in key vehicle models launched in 2023, the cockpit interaction solutions of suppliers, and the multimodal interaction fusion trends.

By sorting out the interaction modes and functions of new models rolled out in the previous year, it can be seen that active, anthropomorphic and natural interaction has become the main trend. In terms of interaction mode, in single-modal interaction, the control scope of mainstream interactions such as touch and voice has expanded from inside to outside cars, and the application cases of novel interactions like fingerprint and electromyography in cars have begun to increase; in multimodal fusion interaction, multiple fusion interactions, for example, voice + head posture/face/lip language, and face + emotion/smell, are being available to cars, aiming to create more active and natural human-vehicle interaction.

1. Single-modal interaction develops in depth.

Haptic interaction: cockpits more tend to have large and multiple screens. The wider application of smart surface materials in cockpits also allows for extension of the haptic sensing scope to doors, windows, seats and other components, and haptic feedback technology is gradually introduced;

Haptic interaction: cockpits more tend to have large and multiple screens. The wider application of smart surface materials in cockpits also allows for extension of the haptic sensing scope to doors, windows, seats and other components, and haptic feedback technology is gradually introduced;

Voice interaction: enabled by large AI models, the voice interaction function becomes more intelligent and emotional. The introduction of lip movement recognition, voiceprint recognition and other technologies into cars brings higher accuracy of voice interaction and expands the control scope from inside to outside cars;

Voice interaction: enabled by large AI models, the voice interaction function becomes more intelligent and emotional. The introduction of lip movement recognition, voiceprint recognition and other technologies into cars brings higher accuracy of voice interaction and expands the control scope from inside to outside cars;

Visual interaction: the scope of face/gesture recognition based on visual technology begins to expand to body recognition, including head posture, arm movements, and body actions, etc.;

Visual interaction: the scope of face/gesture recognition based on visual technology begins to expand to body recognition, including head posture, arm movements, and body actions, etc.;

Olfactory interaction: the olfactory interaction function, which was originally often used to purify the air and remove odors, can now enable cockpit sterilization and disinfection, and supports the linkage of the fragrance system with cockpit scenes/seasons.

Olfactory interaction: the olfactory interaction function, which was originally often used to purify the air and remove odors, can now enable cockpit sterilization and disinfection, and supports the linkage of the fragrance system with cockpit scenes/seasons.

Case 1: car control by voice extends from inside to outside cars.

Typical models: Changan Nevo A07, Jiyue 01

Typical functions: voice outside the car to control doors, windows, parking assist, etc.

Changan Nevo A07 adopts iFlytek's latest technology XTTS 4.0. The voice of the car voice assistant is more natural and anthropomorphic, and can express multiple emotions such as happiness, regret, and confusion. It supports saying towards the outside of the car (the content can be user-defined). In addition, the trunk, windows, music, air conditioning, pull-out/parking and other functions can also be controlled by voice outside the car.

Changan Nevo A07 adopts iFlytek's latest technology XTTS 4.0. The voice of the car voice assistant is more natural and anthropomorphic, and can express multiple emotions such as happiness, regret, and confusion. It supports saying towards the outside of the car (the content can be user-defined). In addition, the trunk, windows, music, air conditioning, pull-out/parking and other functions can also be controlled by voice outside the car.

Equipped with "SIMO" voice assistant, Jiyue 01 supports fully offline voice control in all zones, and allows for online voice interaction in the full process with weak network or without network. It enables recognition in 500 milliseconds and response in 700 milliseconds. Outside the car, the voiceprint recognition technology allows the driver and passengers to voice to operate air conditioning audio, lights, windows, doors, rear tailgate, charging cover and other functions, and supports voice parking outside the car.

Equipped with "SIMO" voice assistant, Jiyue 01 supports fully offline voice control in all zones, and allows for online voice interaction in the full process with weak network or without network. It enables recognition in 500 milliseconds and response in 700 milliseconds. Outside the car, the voiceprint recognition technology allows the driver and passengers to voice to operate air conditioning audio, lights, windows, doors, rear tailgate, charging cover and other functions, and supports voice parking outside the car.

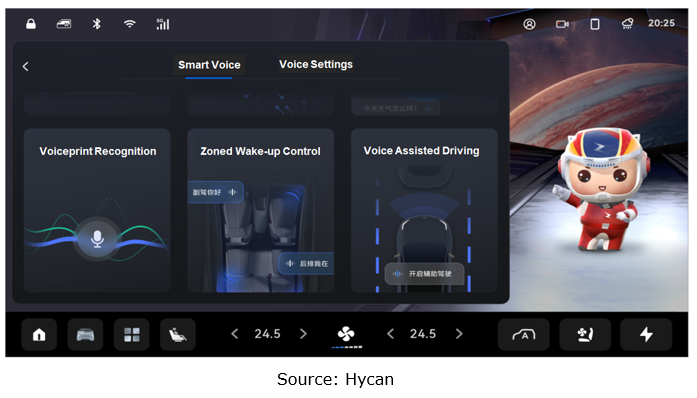

Case 2: voiceprint recognition finds wider application.

Typical models: Li L7, Hycan A06/V09

Typical functions: identify drivers and passengers to provide targeted services

All Li Auto’s L series models support voiceprint recognition function. After passengers register their voiceprints, "Lixiang Classmate" can identify who the passenger is, call the nicknames designated by different passengers, and perform vehicle control according to the positions of different passengers memorized via their voiceprint.

All Li Auto’s L series models support voiceprint recognition function. After passengers register their voiceprints, "Lixiang Classmate" can identify who the passenger is, call the nicknames designated by different passengers, and perform vehicle control according to the positions of different passengers memorized via their voiceprint.

The voiceprint recognition VOICE ID of Hycan A06/V09 can clearly identify valid users and commands, and will become the entrance to HYCAN ID, allowing users to access rich smart ecosystems and use 100+ entertainment applications. Moreover based on voiceprint recognition technology, the system will actively block other disturbing sounds to improve the accuracy of recognition at the driver’s seat.

The voiceprint recognition VOICE ID of Hycan A06/V09 can clearly identify valid users and commands, and will become the entrance to HYCAN ID, allowing users to access rich smart ecosystems and use 100+ entertainment applications. Moreover based on voiceprint recognition technology, the system will actively block other disturbing sounds to improve the accuracy of recognition at the driver’s seat.

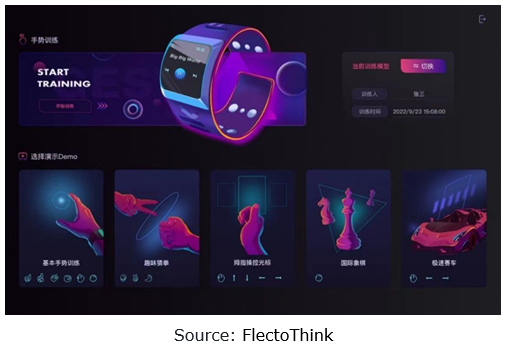

Case 3: myoelectric interaction comes into commercial use in cars.

Typical model: Voyah Passion

Typical function: micro-gesture control inside and outside the car

In April 2023, Voyah Passion and FlectoThink introduced a myoelectric interaction fusion solution enabled through a myoelectric bracelet. A multi-channel myoelectric sensor and a high-precision amplifier that are installed inside the bracelet can collect rich myoelectric signals in real time and generate algorithms, and transmit them to the computing terminal to generate a personalized AI gesture model, which is then integrated with Voyah’s vehicle platforms. By connecting the bracelet with in-car Bluetooth, users can control the car with micro-gestures, including 60+ gestures to control the trunk and windows, for example. Additionally the bracelet can also be seamlessly connected to the car gaming system. The gesture recognition feature of the myoelectric bracelet allows users to control characters of games (e.g., Subway Surfers) more naturally and intuitively.

2. Multimodal fusion creates active interaction.

Currently multimodal fusion enabled by automakers includes but is not limited to voice + lip motion recognition, voice + face recognition, voice + gesture recognition, voice + head posture, face + emotion recognition, face + eye tracking, and fragrance + face + voice recognition. Wherein multimodal voice interaction is mainstream, and supports models mentioned above, like Changan Nevo A07, Jiyue 01, Li L7, and Hycan A06/V09.

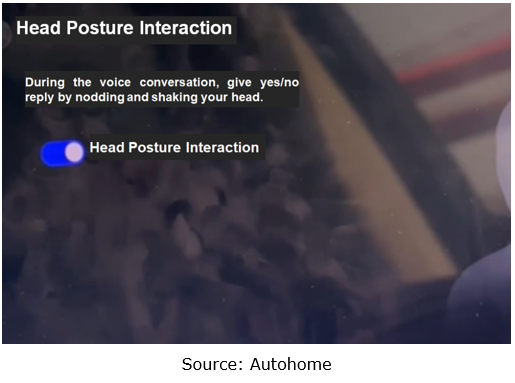

Case 1: voice + head posture interaction: WEY Blue Mountain DHT PHEV combines voice and head posture, offering a simple and intuitive interaction mode.

When the driver engages in a voice conversation, the camera in the cockpit of Blue Mountain captures the driver's head movements, and allows the driver to give yes/no reply by nodding/shaking head. For example, when voicing to control navigation, the driver can select a planned route scheme by nodding/shaking head.

Case 2: face + emotion recognition: LIVAN 7 and ARCFOX Kaola among other models integrate emotion recognition technology into the face recognition function to provide active interaction and enhance interaction experience.

The multimodal intelligent recognition Face-ID system of LIVAN 7 supports lip movement recognition and emotion recognition, and can remember the personalized settings of vehicle functions such as voice, seats, rearview mirrors, ambient light and trunk, that correspond to the associated accounts. It can also select the appropriate music according to the user’s expression.

Directly facing the rear row, the camera on the B-pillar of ARCFOX Kaola can monitor a child in real time. For example, when the child smiles, a snapshot will be taken automatically and sent to the center console screen; when the child cries, soothing music will be automatically played and the surface of the smart seat will make a respiratory rhythm to calm him/her down. In addition, the camera can also be linked with the in-car radar to determine whether the child is asleep or not. If the child is asleep, the sleep mode will be automatically opened, the seat ventilation will be turned on, the air-conditioning temperature will be adjusted appropriately, and the audio and ambient lighting will be linked, producing a rhythmic effect.

Case 3: face + smell: NIO EC7, LIVAN 7 and other models realize the linkage between the driver monitoring system and the fragrance system to improve driving safety.

When NIO EC7 detects the driver's tiredness, it will automatically release a refreshing fragrance to ensure driving safety;

When the camera on the A-pillar of LIVAN 7 detects a drowsy driver, it will automatically release a refreshing fragrance and give a voice prompt.

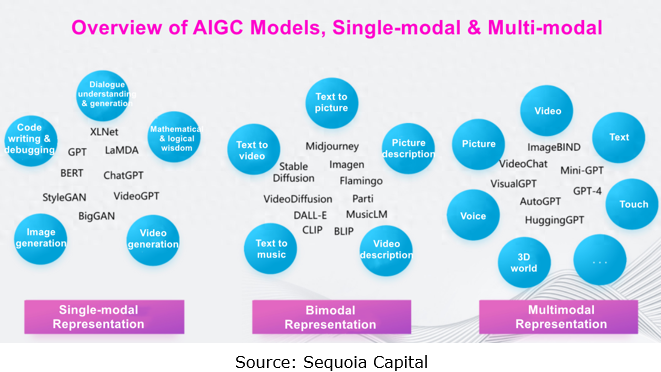

3. Foundation models and multimodal fusion will facilitate the introduction of AI Agent into cars.

Large AI models are evolving from the single-modal to the multi-modal and multi-task fusion. Compared with the single-modal that can only process one type of data such as text, image and speech, the multimodal can process and understand multiple types of data, including vision, hearing and language, thus better understanding and generating complex information.

As multimodal foundation models continue to develop, their capabilities will also be significantly improved. This improvement gives AI Agent higher capabilities of perception and environment understanding to achieve more intelligent, automatic decisions and actions, and also creates new possibilities for its application in automotive, providing a broader prospect for future intelligent development.

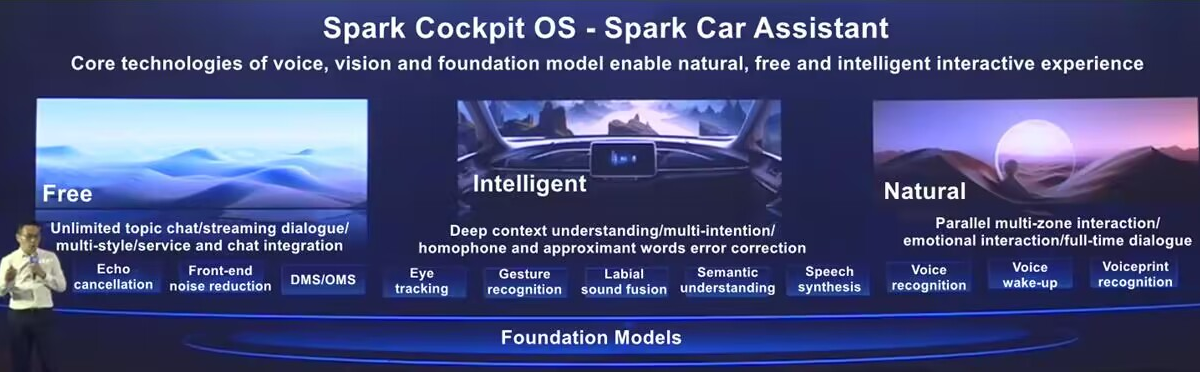

The Spark Cockpit OS developed by iFlytek based on the Spark Model supports multiple interaction modes such as voice, gesture, eye tracking and DMS/OMS. The Spark Car Assistant enables multi-intent recognition by deep understanding of the context, providing more natural human-machine interaction. The iFlytek Spark Model, first mounted on the model EXEED Sterra ES, will bring five new experiences: Vehicle Function Tutor, Empathy Partner, Knowledge Encyclopedia, Travel Planning Expert, and Physical Health Consultant.

AITO M9, to be launched in December 2023, has HarmonyOS 4 IVI system built in. Xiaoyi, the intelligent assistant in HarmonyOS 4, has been connected to Huawei Pangu Model, which includes natural language model, visual model, and multi-modal model. The combination of HarmonyOS 4 + Xiaoyi + Pangu Model further enhances ecosystem capabilities such as cooperation of devices, and AI scenarios, and provides diverse interaction modes, including voice recognition, gesture control, and touch control, using multimodal interaction technology.

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...