China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Research Report, 2022” conducts analysis and research from three aspects: the installation status of mainstream interaction modes, the application of mainstream vehicle models’ interaction modes, and cockpit interaction solutions of suppliers.

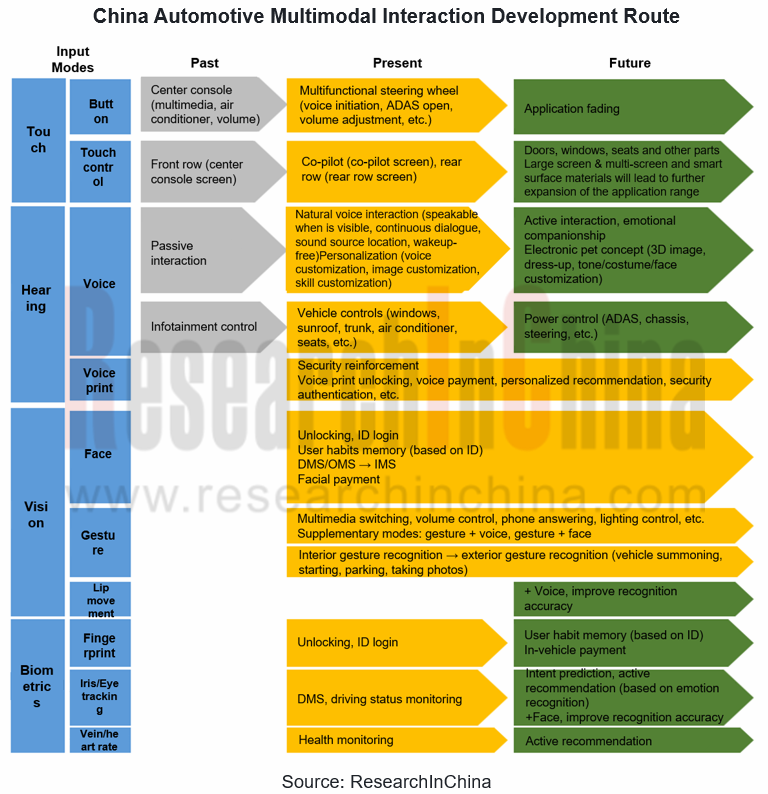

1. Guided by the "third space" concept, multimodal interaction is being deeply applied to intelligent cockpit with five main features.

(1) With the trend of large screen, multi-screen and smart surface materials, touch interaction has gradually expanded its application range

The large screen of center console makes touch control the mainstream interaction mode. For example, Mercedes-Benz EQS and XPeng P7 have almost no physical buttons on the center console, but all done by touch.

Multi-screen cockpits make touch range from the front to the rear, from the center console / co-pilot infotainment extended to the doors, windows, seats and other components. For example, Li Auto L9 eliminates the traditional instrument panel and replaces it with a small TouchBar above the steering wheel; in addition, it also carries a co-pilot screen and rear audio/video screen to achieve five-screen interaction.

(2) Voice interaction evolves from passive to active, personalized and emotional demands will be met

See-and-speak, continuous dialogue, voice source location, wake-up free and other voice technology has been widely equipped in the new cars launched in 2022, the voice interaction mode tends to be more natural.

Personalized experience is currently the focus of the voice function, and intelligent EV brands such as NIO/XPeng/Li Auto are mainly optimized in voice customization, image customization, skill customization, etc.

In the future, the concept of emotional companionship and electronic pets is expected to be realized with the help of voice function.

(3) Face recognition algorithm promotes DMS, OMS and IMS scale installation

Face recognition-based ID login and user habit presets have been implemented in NIO ET7/ET5, XPeng P7/G9, AITO M5/M7, Neta S, and Voyah Dreamer. Among them, AITO can automatically login to Huawei account through face recognition, linking schedule, navigation information, call records, music and video membership rights, third-party application data, and automatic switching of driving information to achieve information flowing.

Face payment function application is still relatively small, which has been installed on Toyota Harrier Premium Edition, and XPeng P7 will be achieved it through OTA upgrade.

Face recognition-based DMS, OMS, and IMS are being installed on a large scale and will promote in-cockpit camera equipment.

(4) Gesture recognition function is single, installed as a complementary interaction mode

Currently, gesture recognition mainly applied to multimedia switching, volume control, phone answering, lighting control, etc., mainly installed as a supplementary interaction mode.

In the future, gesture recognition is expected to be combined with ADAS functions to achieve vehicle summoning, starting and parking based on exterior visual perception.

(5) Fingerprint, iris, vein, heart rate and other biometric applications in the car are still in the exploration stage

Fingerprint is expected to be applied in user ID recording and in-vehicle payment scenarios.

Iris/eye tracking will enhance the accuracy of in-cockpit monitoring such as DMS, and have imagination space in the future in intention prediction and active recommendation.

Vein/heart rate, etc., will be applied under the concept of in-vehicle health.

2. Multimodal recognition and large & multi-screen, AR-HUD, AR/VR, ambient light, high-quality audio and other hardware interaction to be enhanced, immersive cockpit experience continues to grow

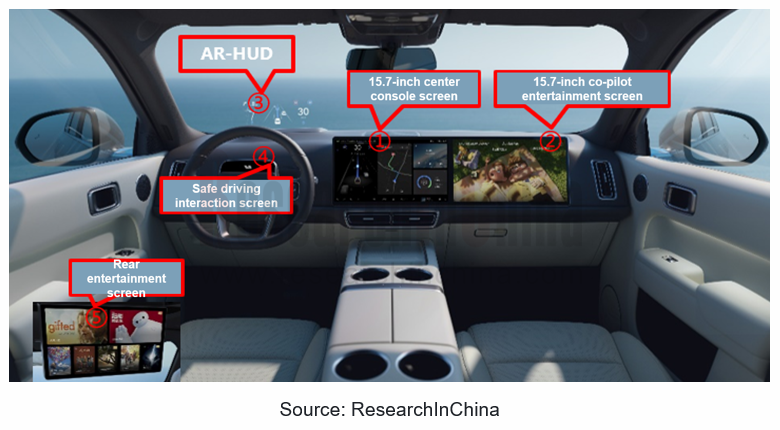

(1) Li Auto L9, creating a multimodal interaction experience through five-screen, voice and gestures

Features of Li Auto L9 interaction:

Replaces the traditional instrument screen with HUD + safe driving interaction screen.

Enhances the audiovisual experience through 15.7-inch center console screen + 15.7-inch co-pilot screen + HUD + safe driving interaction screen + 15.7-inch rear entertainment screen with 3K HD resolution and high color reproduction on the automotive screen.

6-voice-zone recognition interaction (AISpeech ) + self-developed speech engine (in cooperation with Microsoft) + 3D ToF sensor (gesture interaction, cockpit monitoring), to achieve multimodal interaction.

Voice + gesture integration, such as point at the sunshade and say "open this", that is, open the sunshade.

Connect to Nintendo Switch via Type-C and rear entertainment screen to create cockpit gaming scenarios.

Two Qualcomm Snapdragon 8155 chips, 24GB RAM + 256G high-speed storage, and dual-5G operator switching to provide computing power and network support.

(2) NIO, Li Auto, Audi and others take the lead in AR/VR glasses installation for an immersive cockpit experience

Jointly developed with NREAL, the NIO AR glasses can project a 6m viewing distance and 201-inch-equivalent screen (optional price RMB 2,299). VR glasses are jointly developed with NOLO, and equipped with ultra-thin Pancake optical lenses for binocular 4K display.

Li Auto AR glasses are provided by Leiniao Technology, a subsidiary of TCL, and the product was available on Li Auto Store from August 2022. Leiniao Air adopts the polarization Birdbath + MicroOLED technology solution and is directly connected to the rear audio and video system of Li Auto L9. Plugging the cable at the legs of the glasses into Li Auto's rear-row DP jack provides users with a 140-inch giant screen (4m distance) viewing experience.

Audi VR glasses will be first launched in USA in 2023. The hardware is supported by HTC and integrated into Holoride Pioneers' Pack in-vehicle entertainment system for games and video scenarios.

3. Chip, algorithm and system integrator work together to create active cockpit interaction based on multimodal interaction

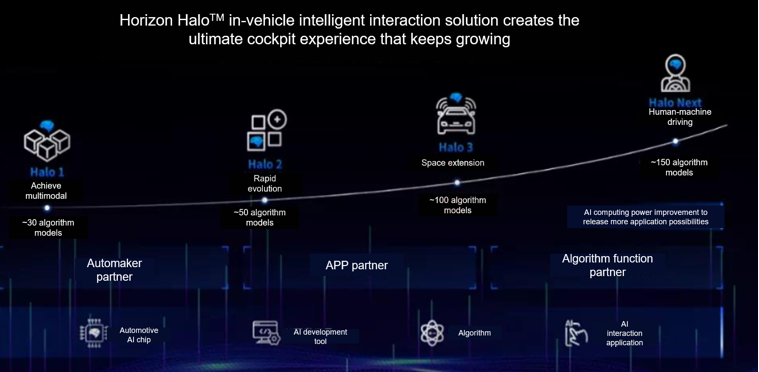

(1) Chip companies, represented by Horizon, integrate multimodal interaction into intelligent driving solution

Horizon Halo, a cockpit solution built by Horizon based on Journey 2 and Journey 3, can integrate vision, voice and other sensor data to achieve active interaction. Among them, Halo 3.0 can provide a complete set of AI solutions including DMS, face detection, behavior detection, gesture recognition, child behavior detection, multimodal voice interaction and other functions for front and rear row users.

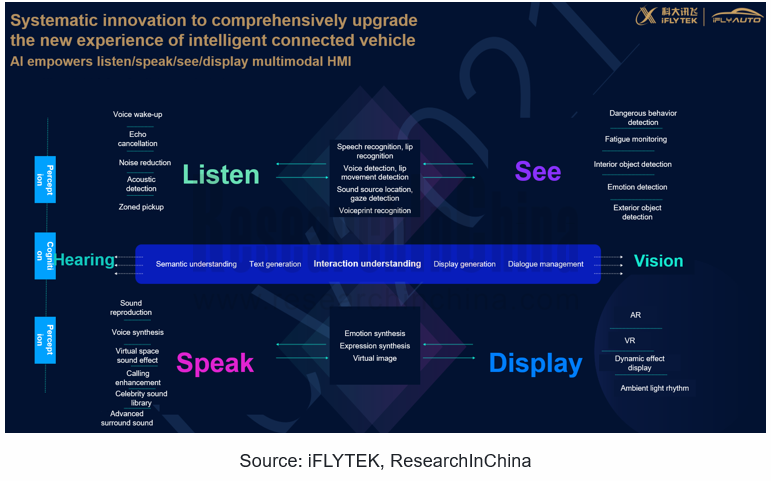

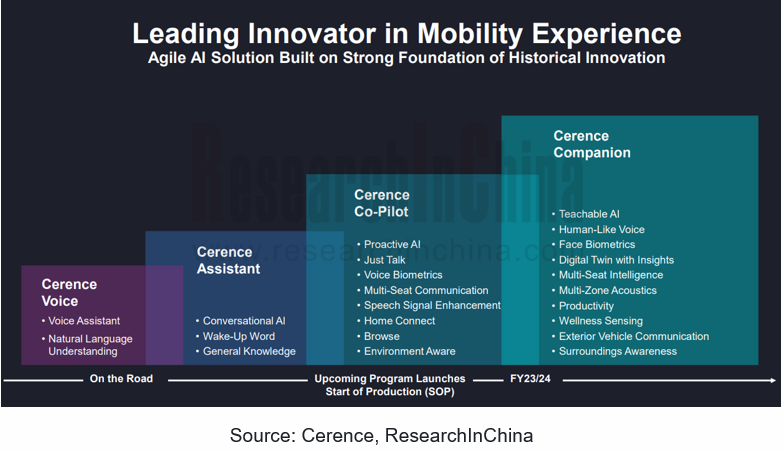

(2) iFLYTEK, Cerence, etc. entered with voice, and SenseTime, ArcSoft, etc. entered with vision to achieve the integration of superior modes with other modes to create an overall cockpit solution

iFLYTEK builds a multimodal system based on "listening, speaking, seeing and displaying" all-link technology, realizing that the vehicle can process the fusion of voice, image, live body and other information throughout the car-using cycle of getting on - driving - getting off, so as to understand passengers' information more actively and deeply, and thus actively care for them, push relevant contents/services, and change vehicle settings to explore disruptive interaction experience.

Based on its strengths in voice, Cerence will integrate vehicle data (fatigue monitoring, mobile phone interconnection, entertainment system, air conditioner, fuel, charging, seat, GPS, air quality) with in-vehicle multimodal interaction (voice, speech synthesis, text input, eye tracking, gesture recognition, emotion recognition, biometrics) to create immersive cockpit interaction in the future.

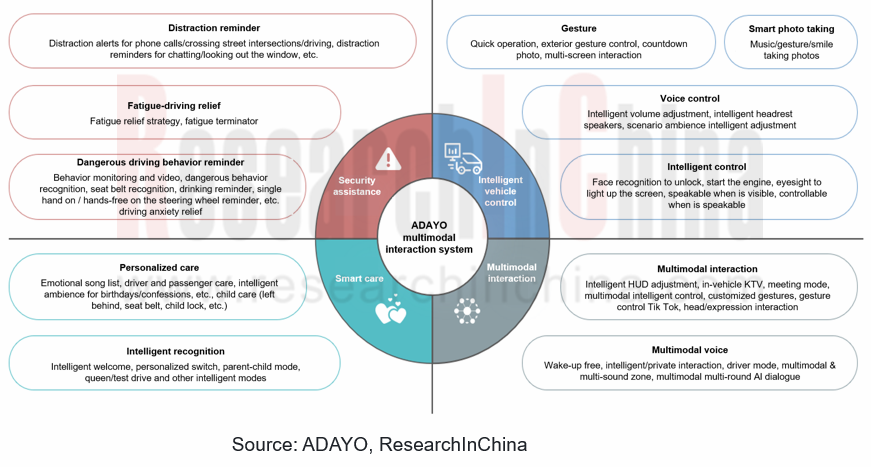

(3) ADAYO, Desay SV and other Tier1, combining multimodal interaction with scenarios to create a personalized cockpit experience

Based on high computing power AI chip, through visual, auditory, touch, multimodal front-fusion, multimodal rear-fusion and other recognition technologies, ADAYO multimodal interaction system can realize 4 major categories and 70+ human-machine interaction scenarios, including voice + gesture to open the window or air conditioner, see-and-speak, greeting when getting into the car, soothing children crying, voice control, face start engine, eye control to light up screen, driver behavior monitoring and dangerous behavior reminder, etc., providing users with active emotional multimodal interaction scenario experience and meeting the personalized needs of thousands of users.

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...