Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active suspension, and researches chassis control strategies, chassis domain controller products & planning of suppliers and OEMs.

As one of core technologies of vehicle intelligence, intelligent chassis can not only satisfy the requirements of high-level autonomous driving, but also bring safer and more comfortable driving experience to occupants and provide hardware support for vivid imagination of future intelligent cockpit. At this stage, intelligent chassis is composed of sub-components such as brake-by-wire, steer-by-wire and active suspension, and controls the chassis through digital signals to realize active adjustment at six degrees of freedom in lateral, longitudinal, and vertical directions, and provide bearings for vehicle autonomous driving system, cockpit system, and power system.

According to this report, intelligent chassis shows three major trends.

Trend 1: Chassis single-system integration continues to increase

Chassis single-system integration is mainly X-by-wire system integration, of which brake-by-wire system integration is the most typical.

For steering system, the mainstream core actuator is still EPS (electric power steering), while steer-by-wire systems are less used. In the future, the key development trend of steer-by-wire system is integration of steer-by-wire structure and mechanical redundant structure.

For steering system, the mainstream core actuator is still EPS (electric power steering), while steer-by-wire systems are less used. In the future, the key development trend of steer-by-wire system is integration of steer-by-wire structure and mechanical redundant structure.

Mainly based on air suspension, active suspension further adds sensors and electronic control systems for active adjustment of its height, stiffness and damping according to actual road conditions, so as to enables fine system control in driving/parking state and improve driving comfort.

Mainly based on air suspension, active suspension further adds sensors and electronic control systems for active adjustment of its height, stiffness and damping according to actual road conditions, so as to enables fine system control in driving/parking state and improve driving comfort.

Representative route of brake-by-wire integration is EHB integrated with ABS/ESP, often known as One Box solution that features high integration and low cost and can meet autonomous driving requirements in combination with RBU (redundant brake unit), having been the most marketable X-by-wire product at this stage.

Representative route of brake-by-wire integration is EHB integrated with ABS/ESP, often known as One Box solution that features high integration and low cost and can meet autonomous driving requirements in combination with RBU (redundant brake unit), having been the most marketable X-by-wire product at this stage.

In terms of brake-by-wire integration, leading companies such as Bethel Automotive, Tongyu Automotive and TruGo Tech have already released relevant products.

Bethel Automotive's wire-controlled brake system (WCBS), a One Box solution, integrates vacuum booster, electronic vacuum pump, master cylinder, ESC and EPB, and features high integration, light weight, quick braking response and low overall costs. WCBS (OneBox) came into mass production in June 2021, and was mass-produced for more than 20 models in 2022.

Bethel Automotive's wire-controlled brake system (WCBS), a One Box solution, integrates vacuum booster, electronic vacuum pump, master cylinder, ESC and EPB, and features high integration, light weight, quick braking response and low overall costs. WCBS (OneBox) came into mass production in June 2021, and was mass-produced for more than 20 models in 2022.

Tongyu Automotive's Electronic Hydraulic Braking System with Integrated Electrical Parking Brake (EHB-EPBi) integrates the EPB control module into the EHB controller to reduce components and lower costs. As of October 2023, Tongyu Automotive has shipped more than 100,000 units of EHB-EPBi products. In addition, its integrated brake-by-wire (iEHB) product integrates five functional modules, namely, EHB, ESC, redundant EPB, intelligent tire monitoring and chassis domain control, which enables such functions as basic braking, brake-by-wire, park-by-wire, and stability control. Tongyu Automotive iEHB has been designated exclusively by OEMs and will be production-ready in late 2023.

Tongyu Automotive's Electronic Hydraulic Braking System with Integrated Electrical Parking Brake (EHB-EPBi) integrates the EPB control module into the EHB controller to reduce components and lower costs. As of October 2023, Tongyu Automotive has shipped more than 100,000 units of EHB-EPBi products. In addition, its integrated brake-by-wire (iEHB) product integrates five functional modules, namely, EHB, ESC, redundant EPB, intelligent tire monitoring and chassis domain control, which enables such functions as basic braking, brake-by-wire, park-by-wire, and stability control. Tongyu Automotive iEHB has been designated exclusively by OEMs and will be production-ready in late 2023.

TruGo Tech's Electric Hydraulic Booster Integrated (EHBI), a One Box solution, integrates functions of ABS, ESC, E-booster, and EPB, and supports multi-sensor fusion, providing vehicles with good pedal feeling and emergency braking capability. EHBI (Onebox), officially launched in October 2022, combines over 30 intelligent functions such as booster control, cooperative brake energy recovery, wheel anti-lock braking control and body stability control.

TruGo Tech's Electric Hydraulic Booster Integrated (EHBI), a One Box solution, integrates functions of ABS, ESC, E-booster, and EPB, and supports multi-sensor fusion, providing vehicles with good pedal feeling and emergency braking capability. EHBI (Onebox), officially launched in October 2022, combines over 30 intelligent functions such as booster control, cooperative brake energy recovery, wheel anti-lock braking control and body stability control.

Trend 2: Chassis intra-domain integration enables cooperative XYZ control

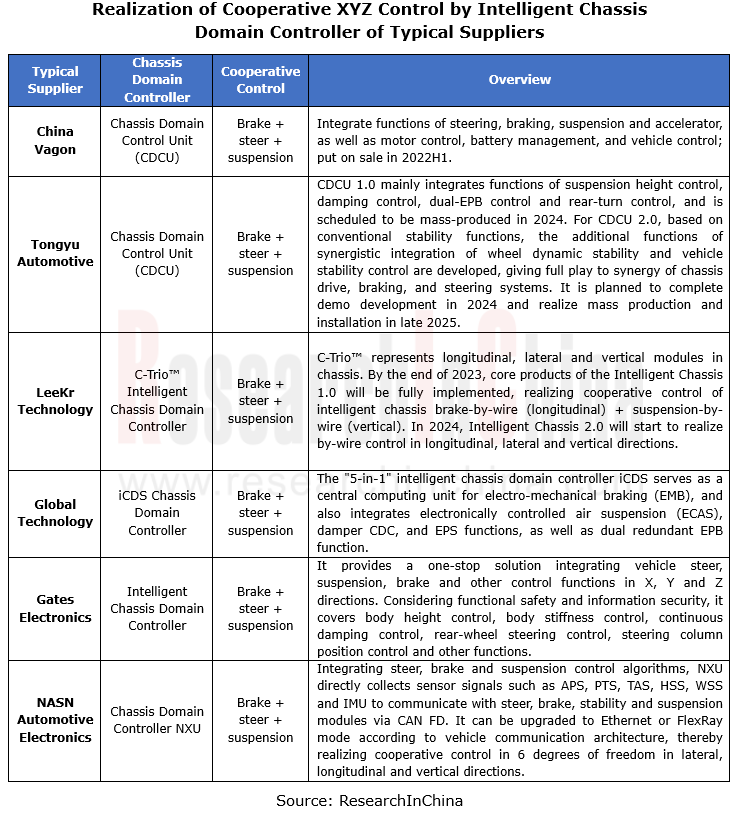

Under the cooperative control by the chassis domain controller, fusion control of brake, steer, suspension and other X-by-wire systems allows for quicker dynamic response, shorter pressure build-up time, fine-grained precision brake-by-wire, steer-by-wire, and precision adjustment of electronic suspension parameters (flexibly adjusting damping, stiffness, height, and vibration control), and it can constantly and actively learn road conditions and environmental patterns to continuously improve chassis comfort performance.

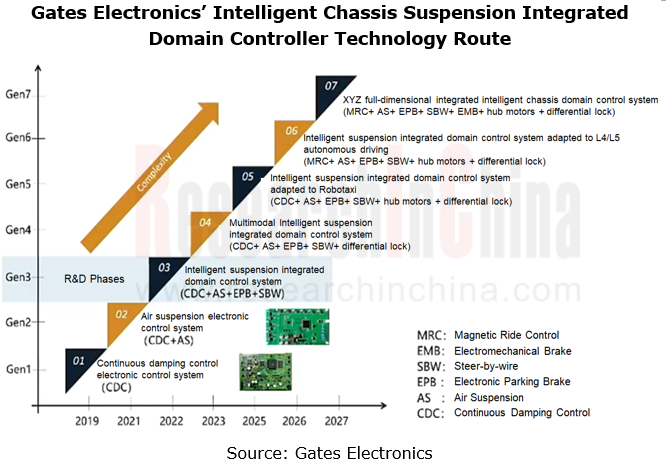

For example, according to Gates Electronics' chassis integrated domain controller technology route, the Gen3 realizes integration of suspension (CDC), air suspension (AS), steer-by-wire (SBW) and EPB (electronic parking brake); the Gen5 adds hub motors; the Gen7 adds EMB (brake-by-wire).

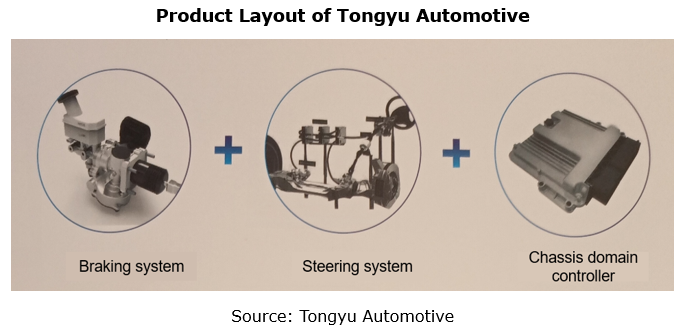

As a representative supplier in the field of intra-domain integration, Tongyu Automotive makes product layout covering three major areas: intelligent braking system, steer-by-wire system and chassis domain controller. Tongyu Automotive is headquartered in Shanghai, and has two production bases in Jiading District of Shanghai and Yichun City of Jiangxi, with annual capacity of 1.5 million sets. As of October 2023, Tongyu Automotive has shipped nearly 400,000 sets of EHB systems, supporting over 100 vehicle models of over 80 well-known customers. After realizing mass adoption of X-by-wire systems in vehicles, Tongyu Automotive has started further developing EMB, steer-by-wire and chassis domain controller, heading in the direction of chassis intra-domain integration.

Trend 3: Cross-domain integration of chassis domain with other domains brings bigger imaginable space to SDV

Chassis intelligence includes not only intra-domain integration, but also cross-domain integration (with intelligent driving domain, body domain, power domain, etc.).

For example, China’s first full-stack self-developed intelligent chassis controller (ICC) NIO introduced in June 2022 centralizes core components of conventional chassis, including more than 100 component controllers such as suspension, damper, and EBP, into one domain controller at perception and decision levels, which is intelligently called and controlled by software algorithms. ICC is adaptable to autonomous driving, and makes a quick response to the predictions and decisions made by intelligent driving systems, improving vehicle comfort. For instance, in a NAD scenario, the intelligent driving domain fusion control system can simultaneously control the vehicle's 4WD distribution, brake-by-wire, variable suspension and other functions, effectively improving the vehicle's dynamic performance. NIO ICC has already been mass-produced for NT2.0 models, such as ET7, ET5, and ES7.

Li L9 is equipped with Li Auto's self-developed central domain controller. All the hardware, systems and software of this controller are completely self-developed by Li Auto. The controller integrates functions of range-extended electric system, air-conditioning system, chassis system and seat control system. Li Auto’s LEEA2.0 is three-domain architecture (central control domain + autonomous driving domain + intelligent cockpit domain), of which the central control domain contains power, body and partial chassis functions.

At the Auto Shanghai 2023, Continental first introduced its cross-domain vehicle control High Performance Computer (HPC), which is the first step in cross-domain integration of vehicle dynamic control functions. In addition to the original body control and gateway functions, this solution also integrates chassis control applications, and cross-domain vehicle control functions such as damping control, adaptive air suspension and chassis tuning. Continental's central dynamic control software acts as the command center that coordinates all vehicle motion actuators for longitudinal, lateral and vertical control. It is modular and scalable, serving as a unified interface that decouples driving functions from specific actuators and vehicle configurations.

In the future chassis cross-domain integration era, ECU and other control hardware as well as software algorithms all will be integrated into the chassis domain controller or the central computing unit, under which OEMs will tend to master their own control module technology. NIO, Li Auto and other OEMs with strong R&D strength have already held by way of self-development, and voices of conventional chassis suppliers are being weakened. In short, the chassis industry will see a big reshuffle in the intelligent transformation.

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...