Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and the expected development cycle of SOTIF functions shortens, the launch of new vehicle models in the competition among automakers is inseparable from a mass of tests. Wherein, the simulation test has been widely adopted by Chinese and foreign automakers. Ideally, about 80% to 90% of the autonomous driving algorithm tests are completed through simulation platforms, 9% to 20% in test fields, and 1% on actual roads.

1. The iteration of simulation tools accelerates, and the 3D realistic and visual simulations provide ever higher test confidence.

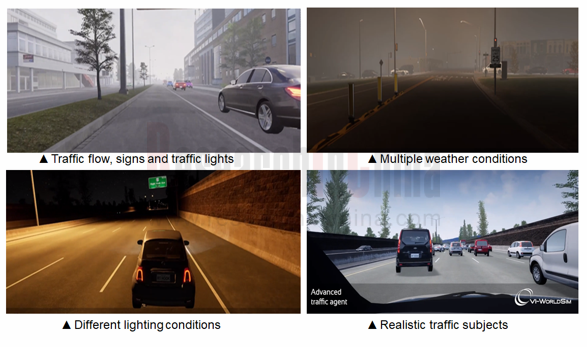

Macroscopic, mesoscopic, and microscopic simulation tools and technologies advance. Especially the increasingly refined functions of microscopic simulation tools enable more flexible control over traffic flow simulation, simulate and reproduce road environment, weather conditions (including extreme weathers, e.g., rain, snow, heavy fog and light intensity) and extreme working conditions (accident trigger, etc.), control the simulation settings of various sensors (radar, LiDAR, camera, etc.) and reconstruct scene variants.

All types of simulation companies expedite the iteration of their simulation software, and keep expanding and verifying corner cases, long-tail scenarios and hard examples. They continuously narrow down various abnormal scenarios that may appear in the function development and even expected function development by automakers, and output high-fidelity 3D visualization results to verify the bugs of different models and algorithms of auto companies, for higher confidence in their simulation tools.

A simulated road environment needs to define multiple components, such as roads (lane lines, pavement materials, etc.), traffic signs, traffic lights, traffic participants (motor vehicles, non-motor vehicles, pedestrians, etc.), elements around the road (green belts, stations, buildings, etc.) and weather conditions (day, night, sun, rain, etc.). A variety of sensor models and user-defined sensors can be used to detect these objects. In general, static scenes are constructed by collecting actual environmental information combined with existing HD maps, or the needed environmental elements are artificially created.

Scenario simulation sensors include camera, LiDAR, radar, ultrasonic radar, GPS/BDS, IMU, V2X and other modules, of which the camera simulation needs to simulate multiple complex real weather conditions, automatically adjust the weather, and support camera simulation in different weather and light conditions; the LiDAR simulation referring to the scanning modes of real LiDAR, simulates the emission of each real ray, intersects with all objects in the scene, and generates real point cloud data.

2. Realize the comprehensive testing and verification of ADAS/ADS digitalization through unlimited coverage of scenario variants.

The scenarios in the real world are infinitely rich, extremely complex, and unpredictable. It is very hard to completely reproduce these scenarios in a virtual environment. How to use limited test scenarios to map an infinitely rich world is the key to effective testing and verification of autonomous driving. The simulation test based on scenario library is an important route to solving the problem of insufficient autonomous driving road test data. The higher the real-world coverage of the test scenarios in the scenario library, the higher the accuracy of the simulation test results.

In autonomous driving simulation, ASAM’s OpenX Standards have gained extensive attention from all over the world. The standards cover five parts: OpenDRIVE, OpenSCENARIO, OSI, OpenLABEL, and OpenCRG. Wherein, OpenDrive defines the description method of static scenarios; the OpenSCENARIO-defined contents involve the description of dynamic scenes, location and speed of the car owner, and information of other traffic participants; OpenCRG focuses on the description of physical information related to road surfaces, and is mainly used for friction between tires and the ground.

The simulation test is to simulate dangerous working conditions, including a great many harsh weather environments, complex road traffic, and typical traffic accidents. The parameter reorganization scene is to parameterize the existing simulation scenes, and complete the random generation or automatic reorganization of simulation scenes, featuring infinity, scalability, batching, and automation. The purpose of the parameter reorganization scene is to supplement the uncovered, unknown scenes, such as natural driving, standards and regulations, and dangerous working conditions, so as to well cover blind spots in autonomous driving function tests.

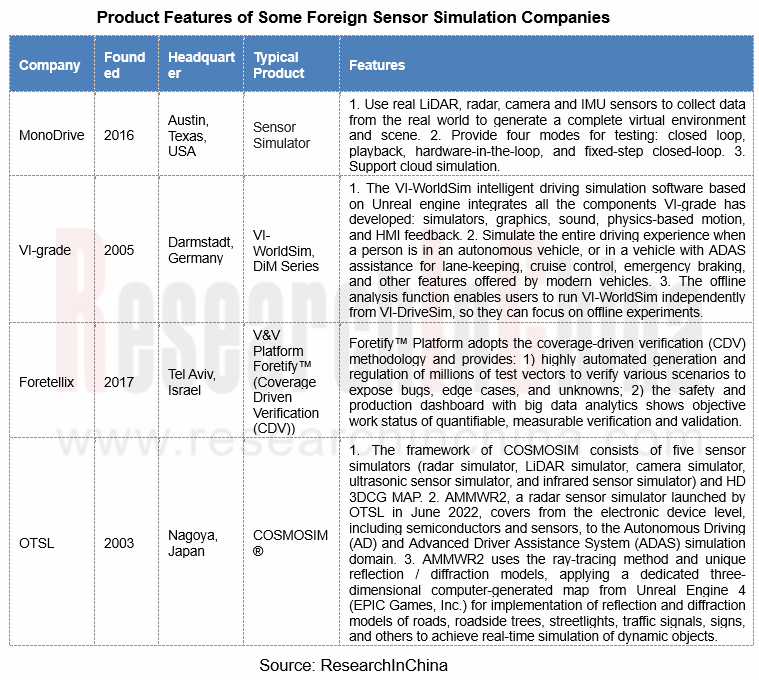

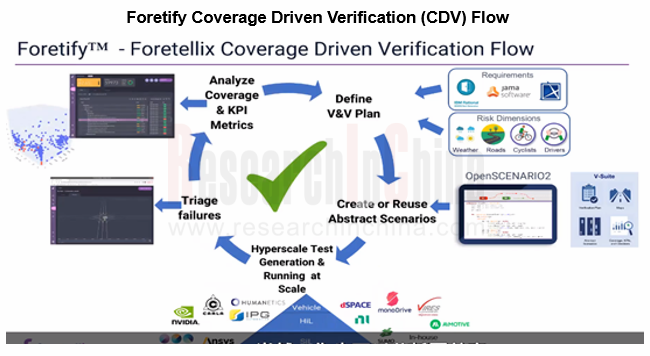

When verifying uncovered, unknown scenarios, Israel’s Foretellix provides a verification and validation platform Foretify using the Coverage-Driven Verification (CDV) Methodology (on the one hand, highly automated generation and regulation of millions of test vectors to verify various scenarios; on the other hand, the safety and production dashboard with big data analytics shows objective work status of quantifiable, measurable verification and validation). The Foretify solution can detect system bugs, edge cases and unknowns in the early stage of development, help prevent costly recalls due to design defects (some of which are fatal), and port scenarios to different maps and ODD. Its current customers include Denso, Valeo, NVIDIA, Mobileye and Volvo.

3. Foreign autonomous driving simulation companies continue to expand cooperation with Chinese companies, and make steady progress in localization services.

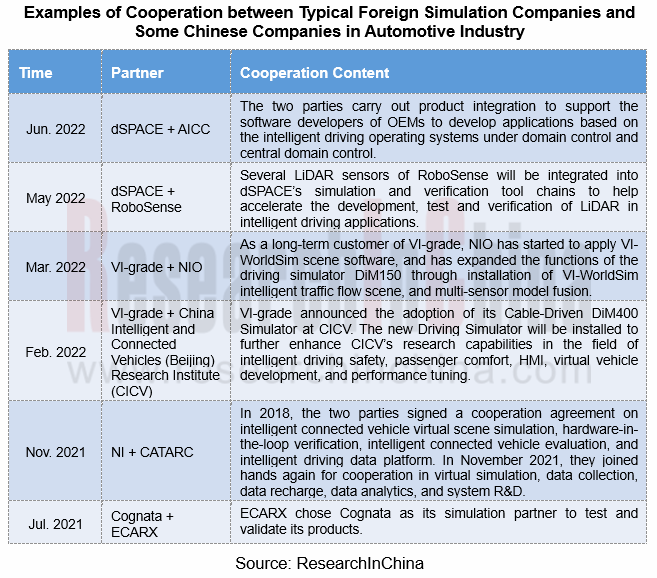

Foreign autonomous driving simulation companies are working harder on layout in the Chinese market. For example, Germany’s PTV Group, France’s ESI Group, and Israel’s Cognata have established subsidiaries in China to facilitate simulation business expansion. Among them, PTV has covered over 600 customers in more than 90 cities of China. In addition, NI, dSPACE, VI-grade and the likes go on deepening their partnerships with Chinese automakers and solution providers such as Automotive Intelligence and Control of China (AICC) and RoboSense.

1 Overview of Autonomous Driving Simulation and Layout of Foreign Companies

1.1 The International Organization for the Standardization of Autonomous Driving Simulation: ASAM

1.1.1 ASAM Standard Domains

1.1.2 ASAM Project Roadmap: Non-Simulation Domains

1.1.3 ASAM Project Roadmap: OpenX

1.1.4 ASAM’s OpenX Standards (1)

1.1.4 ASAM’s OpenX Standards (2)

1.1.5 ASAM’s New Standards for ADAS (1)

1.1.5 ASAM’s New Standards for ADAS (2)

1.1.5 ASAM’s New Standards for ADAS (3)

1.1.5 ASAM’s New Standards for ADAS (4)

1.2 Partnerships between Foreign OEMs & Autonomous Driving Simulation Platforms

1.3 Integrated Simulation Platform

1.3.1 Comparison of Foreign Integrated Simulation Platforms

1.3.2 Recent Developments in Foreign Integrated Simulation Platforms

1.4 Vehicle Dynamics Simulation

1.4.1 Foreign Vehicle Dynamics Benchmarking Companies

1.5 Traffic Scene Simulation (Traffic Flow Simulation)

1.5.1 Classification of Traffic Scene Simulations

1.5.2 Foreign Traffic Scene Simulation Benchmarking Companies (1)

1.5.2 Foreign Traffic Scene Simulation Benchmarking Companies (2)

1.6 Virtual Scene Simulation

1.6.1 Road Environment Simulation & Weather Environment Simulation

1.6.2 Foreign Virtual Scene Simulation Benchmarking Companies (1)

1.6.2 Foreign Virtual Scene Simulation Benchmarking Companies (2)

1.7 Sensor Simulation

1.7.1 LiDAR & Ultrasonic Radar Simulation

1.7.2 Radar Simulation

1.7.3 Sensor Simulation Benchmarking Companies

1.8 Simulation System Interface

1.8.1 Classification of Simulation System Interfaces

1.8.2 Hardware-in-the-loop Simulation

1.8.3 Hardware-in-the-loop Simulation

1.8.4 Foreign Hardware-in-the-Loop Simulation Benchmarking Companies

2 Foreign Integrated Simulation Platforms

2.1 ANSYS

2.1.1 Profile

2.1.2 Distribution of Products (1)

2.1.2 Distribution of Products (2)

2.1.3 Strengthen Simulation Capabilities through Investment and Acquisition (1)

2.1.3 Strengthen Simulation Capabilities through Investment and Acquisition (2)

2.1.4 Expansion in ADAS and Autonomous Driving Simulation: Acquisitions

2.1.5 Autonomous Driving Simulation Toolchain

2.1.6 ANSYS SCADE

2.1.7 Ansys SCADE Suite

2.1.8 ANSYS VRXPERIENCE (1)

2.1.8 ANSYS VRXPERIENCE (2)

2.1.9 ANSYS SPEOS Optical Simulation (1)

2.1.9 ANSYS SPEOS Optical Simulation (2)

2.1.9 ANSYS SPEOS Optical Simulation (3)

2.1.9 ANSYS SPEOS Optical Simulation (4)

2.1.10 ANSYS Simulation Planning: Application of 5G in Autonomous Vehicles

2.1.11 ANSYS SPEOS 2022 R1 Update

2.1.12 ANSYS 2021 R1 Update

2.1.13 ANSYS 2022 R2 Update

2.1.14 Distribution of Partners

2.1.15 Dynamics in Cooperation

2.2 Siemens

2.2.1 Profile

2.2.2 Autonomous Vehicle Solutions

2.2.3 Expansion in ADAS and Autonomous Driving Simulation: Acquisitions

2.2.4 PreScan

2.2.5 Sensor Models

2.2.6 Supported Sensor Types and Some Scenarios

2.2.7 Autonomous Driving Simulation and Detailed Functions (1)

2.2.7 Autonomous Driving Simulation and Detailed Functions (2)

2.2.7 Autonomous Driving Simulation and Detailed Functions (3)

2.2.8 Release Updates

2.2.9 Autonomous Driving Simulation and Detailed Functions: Application Cases

2.2.10 PAVE360

2.2.11 Supported Customers

2.2.12 Dynamics in Cooperation

2.3 NVIDIA

2.3.1 Profile

2.3.2 Simulation Cloud Platform: DRIVE Constellation

2.3.3 Autonomous Vehicle Simulation Platform: Drive Sim

2.3.4 Neural Reconstruction Engine (NRE)

2.3.5 Computing Module DRIVE AGX Pegasus: NVIDIA DRIVE AGX XAVIER

2.3.5 Computing Module DRIVE AGX Pegasus: NVIDIA DRIVE PX PEGASUS

2.3.6 NVIDIA DRIVE PX Pegasus AI Computing Platform

2.3.7 DRIVE AV Safety Force Field

2.3.8 Cooperation Events

2.4 CARLA

2.4.1 Profile

2.4.2 Basic Architecture

2.4.3 Product Features

2.4.4 Carla 0.9.11

2.4.5 Release Updates, 2020-2021 (1)

2.4.5 Release Updates, 2020-2021 (2)

2.4.5 Release Updates, 2020-2021 (3)

2.5 AVSimulation (LG)

2.5.1 Profile

2.5.2 Simulation Software: SCANeR

2.5.3 Simulation Software: SCANeR Studio 1.9

2.5.4 Simulation Software: SCANeR Studio 2021.1/2022.2

2.5.5 Cooperation Events

2.6 SVL Simulator (LG)

2.6.1 Open Source Simulation Solution: LGSVL

2.6.2 SVL Simulator 2021.3

2.7 AirSim (Microsoft)

2.7.1 Open Source Simulation Solution: AirSim

2.7.2 AirSim Release Update

3 Foreign Vehicle Dynamics Simulation Platforms

3.1 CarMaker (IPG Automotive)

3.1.1 Profile

3.1.1 Main Products

3.1.2 Dynamics Simulation Software: CarMaker (1)

3.1.2 Dynamics Simulation Software: CarMaker (2)

3.1.2 Dynamics Simulation Software: CarMaker (3)

3.1.2 Dynamics Simulation Software: CarMaker (4)

3.1.3 Application of CarMaker in ADAS Development

3.1.4 CarMaker Application Cases

3.1.5 Cooperation Events

3.2 CarSim (Mechanical Simulation)

3.2.1 Dynamics Simulation Software: CarSim (1)

3.2.1 Dynamics Simulation Software: CarSim (2)

3.2.1 Dynamics Simulation Software: CarSim (3)

3.2.2 Dynamics Simulation Software: CarSim 2021.0

3.2.2 Dynamics Simulation Software: CarSim 2022.1

3.3 VI-Grade

3.3.1 Profile

3.3.2 Real-time Vehicle Dynamics Simulation Tool: VI-CarRealTime

3.3.3 Driving Simulators: DiM

3.3.3 Driving Simulators: DiM 150/250

3.3.4 Virtual Proving Ground

3.4 AVL

3.4.1 Profile

3.4.2 AVL CRUISE

3.4.3 AVL Smart ADAS Analyzer

3.4.4 ADAS Vehicle-in-the-Loop Solution: AVL DRIVINGCUBE?

3.4.5 Cooperation Events

3.5 Simpack (Dassault Systemes)

3.5.1 Products

3.5.2 Simpack Automotive Application (1)

3.5.2 Simpack Automotive Application (2)

3.5.3 SIMPACK 2023 Updates

3.6 TESIS DYNAware (Vector)

3.6.1 TESIS and Its Products

3.6.2 TESIS DYNAware

3.6.3 DYNA4

3.6.3 Application Scenarios of DYNA4 (1)

3.6.3 Application Scenarios of DYNA4 (2)

3.6.3 DYNA4 Simulation Scenes

3.6.4 DYNA4 R7 Updates

3.7 MATLAB/Simulink (MathWorks)

3.7.1 Products

3.7.2 Automotive Solutions (1)

3.7.2 Automotive Solutions (2)

3.7.3 Design 3D Scenes for Automated Driving Simulation: RoadRunner

3.7.3 Design 3D Scenes for Automated Driving Simulation: Functions of RoadRunner

3.7.4 Build ADAS Functions with MATLAB and Simulink (1)

3.7.4 Build ADAS Functions with MATLAB and Simulink (2)

3.7.5 Vehicle Dynamics Blockset (1)

3.7.5 Vehicle Dynamics Blockset (2)

3.7.6 Automated Driving Toolbox (1)

3.7.6 Automated Driving Toolbox (2)

3.7.6 Automated Driving Toolbox (3)

3.7.6 Automated Driving Toolbox (4)

3.7.7 MATLAB and Simulink R2022b

4 Foreign Scene Simulation Platforms

4.1 PTV-VISSIM

4.1.1 Profile of PTV

4.1.1 Main Products of PTV

4.1.2 Simulation Solution: Vissim (1)

4.1.2 Simulation Solution: Vissim (2)

4.1.2 Simulation Solution: Vissim (3)

4.1.3 Vissim Driving Behavior - Car-Following Model (1)

4.1.3 Vissim Driving Behavior - Car-Following Model (2)

4.1.3 Vissim Driving Behavior - Car-Following Model (3)

4.1.4 Microscopic, Mesoscopic and Hybrid Macro-meso Simulation Models of PTV Vissim

4.1.5 Vissim Platooning

4.1.6 Application of Vissim in Autonomous Driving (1)

4.1.6 Application of Vissim in Autonomous Driving (2)

4.1.7 New Features of Vissim (1)

4.1.7 New Features of Vissim (2)

4.1.7 New Features of Vissim (3)

4.1.8 Co-simulation between PTV Vissim and Third-party Software

4.2 TSIS-CORSIM

4.2.1 Introduction

4.2.2 Features and Modeling

4.2.3 TSIS-CorSim 2023 (1)

4.2.3 TSIS-CorSim 2023 (2)

4.2.3 TSIS-CorSim 2023 (3)

4.2.3 TSIS-CorSim 2023 (4)

4.2.3 TSIS-CorSim 2023 (5)

4.2.3 TSIS-CorSim 2023 (6)

4.3 Paramics

4.3.1 Introduction

4.3.2 Paramics Discovery (1)

4.3.2 Paramics Discovery (2)

4.3.2 Paramics Discovery (3)

4.3.3 Paramics Discovery 25 (1)

4.3.3 Paramics Discovery 25 (2)

4.3.4 Enabled Projects and Customers

4.4 Transmodeler

4.4.1 Introduction

4.4.2 Overview of Features

4.4.3 Advantages (1)

4.4.3 Advantages (2)

4.4.3 Advantages (3)

4.4.3 Advantages (4)

4.4.4 Features

4.4.5 TransModeler Integrates Traffic Planning and Operation Management

4.4.6 Application

4.4.6 Application in Projects (1)

4.4.6 Application in Projects (2)

4.4.6 Application in Projects (3)

4.4.6 Application in Projects (4)

4.4.7 Release of Chinese Version

4.4.8 TransModeler SE

4.4.9 Comparison between TransModeler SE and TransModeler

4.4.10 Digital Twin Traffic Simulation: BrightMap + TransModeler

4.5 AIMSUN

4.5.1 Introduction

4.5.2 Aimsun Framework Model and Hybrid Simulation

4.5.3 Aimsun Next Modeling Tool

4.5.4 New Features in Aimsun Next 22 (1)

4.5.4 New Features in Aimsun Next 22 (2)

4.5.4 New Features in Aimsun Next 22 (3)

4.5.4 New Features in Aimsun Next 22 (4)

4.5.4 New Features in Aimsun Next 22 (5)

4.5.4 New Features in Aimsun Next 22 (6)

4.5.5 Aimsun Application Fields: Mobility Planning for Cities, Highways and Regions

4.5.6 Aimsun Application Fields: Real-time Transportation Management

4.5.7 Aimsun Application Fields: Connected and Autonomous Vehicles (1)

4.5.7 Aimsun Application Fields: Connected and Autonomous Vehicles (2)

4.5.7 Aimsun Application Fields: Connected and Autonomous Vehicles (3) – Cases

4.6 SUMO

4.6.1 Introduction

4.6.2 Main Functional Modules

4.6.3 Main Features

4.6.4 Application Fields

4.7 ESI Pro-SiVIC

4.7.1 Profile of ESI

4.7.2 Acquisition History of ESI Group

4.7.3 Distribution of Products of ESI Group

4.7.4 ESI Pro-SiVIC

4.7.5 Advantages of ESI Pro-SiVIC (1)

4.7.5 Advantages of ESI Pro-SiVIC (2)

4.7.6 Application Fields of ESI Pro-SiVIC

4.7.7 Main Operation Processes and Element Libraries of ESI Pro-SiVIC

4.7.8 Customer Cases of ESI Pro-SiVIC

4.8 rFpro

4.8.1 Introduction

4.8.2 Simulation Software (1)

4.8.2 Simulation Software (2)

4.8.3 Digital Road Models (1) - Overview

4.8.3 Digital Road Models (2) - Public Road

4.8.3 Digital Road Models (3) - Proving Ground

4.8.4 ADAS & AV Solutions

4.8.4 Application Cases of rFpro in ADAS & AV (1)

4.8.4 Application Cases of rFpro in ADAS & AV (2)

4.8.5 ADAS/AV: Synthetic Training Data

4.8.6 ADAS/AV: SIL, HIL and Real-time DIL

4.8.7 Customers and Partners

4.8.7.1 Cooperation Case I: rFpro + Xylon

4.8.7.2 Cooperation Case II: rFpro + Nardo Proving Ground

4.9 Cognata

4.9.1 Profile

4.9.2 Overview of Autonomous Driving Simulation (1)

4.9.2 Overview of Autonomous Driving Simulation (2)

4.9.3 Simulation Products (1)

4.9.3 Simulation Products (2)

4.9.3 Simulation Products (3)

4.9.3 Simulation Products (4)

4.9.3 Simulation Products (5)

4.9.3 Simulation Products (6)

4.9.3 Simulation Products (7)

4.9.4 Large-scale Scene Generation (1)

4.9.4 Large-scale Scene Generation (2)

4.9.5 Dynamics in Cooperation

4.10 Parallel Domains

4.10.1 Profile

4.10.2 Simulation Platform

4.10.2 Simulation Platform: Batch Mode

4.10.2 Simulation Platform: Step Mode

4.10.3 Public Datasets

4.10.3 Public Dataset Examples (1)

4.10.3 Public Dataset Examples (2)

4.11 AAI

4.11.1 Profile

4.11.2 Main Products & Solutions

4.11.3 Sensor Simulation

4.11.4 AAI Replicar

4.11.5 Scene Cloning and Extraction (1)

4.11.6 Data Labeling Service

4.12 Applied Intuition

4.12.1 Profile

4.12.2 Simulation Platform (1)

4.12.2 Simulation Platform (2)

4.12.3 Verify L3+ AV

4.12.4 Verify ADAS

4.12.5 Latest Developments

4.13 Ansible Motion

4.13.1 Profile

4.13.2 DIL Driving Simulator Products

4.13.2 Delta Series S3 DIL Simulators

4.13.2 Sigma Series DIL Simulators

4.13.2 Theta Series DIL Simulators

4.13.3 Driving Simulator Application

4.13.4 Technical Partners of DIL Simulators

4.14 UNITY

4.14.1 Introduction

4.14.2 Unity SimViz

4.14.3 AirSim on Unity

4.15 CityEngine

4.15.1 Introduction

4.15.2 Updates

4.16 VTD

4.16.1 MSC Software

4.16.2 Introduction

4.16.2 Introduction

4.16.2 Introduction

4.16.3 Components

4.16.4 Application Fields

4.16.5 OpenDRIVE Scenario Editor

5 Foreign Sensor Simulation Platforms

5.1 monoDrive

5.1.1 Profile

5.1.2 Overview of Products

5.1.2 Sensor Simulator (1)

5.1.2 Sensor Simulator (2)

5.1.3 Simulator Features

5.1.4 Camera Simulator

5.1.5 Real to Virtual

5.1.6 Real-time SiL and HiL

5.1.7 Test Models

5.1.8 Scene Editor - Lights API

5.1.9 monoDrive Map + Carla Map

5.1.10 LiDAR Sensor Simulation Example

5.2 RightHook (under VI-grade)

5.2.1 Profile

5.2.2 VI-grade Simulator Series

5.2.3 VI-WorldSim (1)

5.2.3 VI-WorldSim (2)

5.2.4 VI-WorldSim Environment/Scene Construction (1)

5.2.4 VI-WorldSim Environment/Scene Construction (2)

5.2.4 VI-WorldSim Sensor Fusion

5.2.4 Third-party Software Tool/Interface of VI-grade Simulator

5.2.5 Customers of VI-grade

5.3 Foretellix

5.3.1 Profile

5.3.2 Foretify Solution

5.3.2 Foretify Coverage Driven Verification (CDV) Flow

5.3.3 M-SDL/OSC2.0 and Test & Verification Module Packages

5.3.4 Customers and Cooperation Cases

5.4 OTSL

5.4.1 Profile

5.4.2 COSMOSIM (1)

5.4.2 COSMOSIM (2)

5.4.3 Dynamics

6 Foreign Simulation Interfaces and HIL Platforms

6.1 NI

6.1.1 Profile

6.1.2 Autonomous Driving Test Solutions

6.1.3 Data Logging System AD

6.1.4 Camera Interface Modules for ADAS

6.1.5 HIL & SIL Closed-loop Sensor Fusion Tests

6.1.6 ADAS/AV: Sensor Fusion Test

6.1.7 ADAS/AV: Vehicle Radar Test System (VRTS)

6.1.8 ADAS/AV Test: Coverage Analysis

6.1.9 ADAS/AV Test: V2X Conformance Test

6.1.10 Cooperation Events

6.2 ETAS

6.2.1 Profile

6.2.2 Test and Validation Services: LABCAR (1)

6.2.2 Test and Validation Services: LABCAR (2)

6.2.2 Test and Validation Services: LABCAR (3)

6.2.3 Test and Validation Services: Co-simulation Platform COSYM (1)

6.2.3 Test and Validation Services: Co-simulation Platform COSYM (2)

6.2.3 Test and Validation Services: Co-simulation Platform COSYM (3)

6.3 Vector

6.3.1 Profile

6.3.2 Closed-loop Test System Simulation Environment: Overview

6.3.2 Closed-loop Test System Simulation Environment: Features

6.3.2 Closed-loop Test System Simulation Environment: Application

6.3.3 Specific HIL Application Cases

6.3.4 VT System: HIL System Seamlessly Integrated with CANoe

6.4 dSPACE

6.4.1 Profile

6.4.2 ADAS/AD Development and Verification Solutions

6.4.2.1 Rapid Prototyping & Machine Learning (1)

6.4.2.1 Rapid Prototyping & Machine Learning (2)

6.4.2.2 SIL and HIL Tests

6.4.2.3 Simulation Modeling

6.4.2.4 Bus and Network Simulation

6.4.2.5 IVS Sensor DATA Management Platform for Autonomous Driving

6.4.3 Cooperation Events (1)

6.4.3 Cooperation Events (2)

6.4.4 Partners

6.4.4 Automotive Customers

6.4.5 Dynamics

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...