Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market becomes saturated, image sensor chip vendors are turning to booming intelligent vehicle market. The development of automotive intelligence has led to a sharp increase in demand for cameras, with the installation volume of passenger car cameras in Chinese market expected to exceed 100 million by 2025. The huge demand also drives the growth of automotive image sensors and gives rise to more market segments.

ICV TANK forecasts that the market for automotive CIS will reach $7.4 billion by 2027.

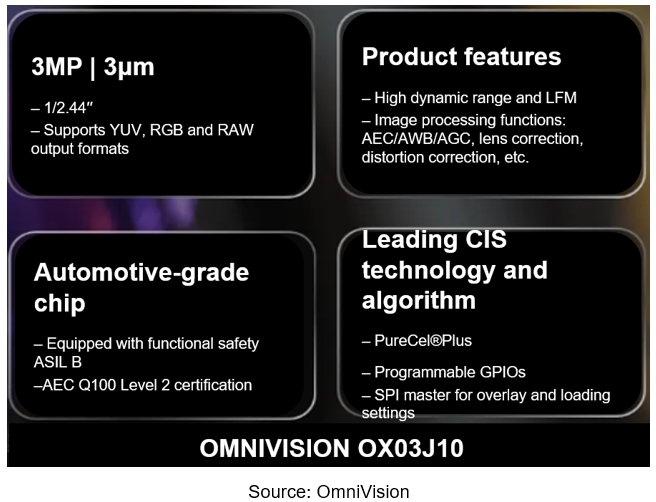

The requirements of CIS chips for intelligent vehicle are much higher than those of mobile phone CIS. Take OmniVision OX03J10 chip as an example, as an automotive-grade chip it has passed AEC-Q100 Level 2 certification and ASIL B functional safety certification; it also has high dynamic range and LFM (LED Flicker Mitigation) function.

By application scenario, automotive CIS can be subdivided into three categories: CIS for ADAS, CIS for cockpit, and CIS for image (mainly for human eyes, such as surround view & rear view). According to Yole's forecast, by 2026, CIS for ADAS will reach 100 million pieces, CIS for automotive images (e.g., surround view & rear view) will reach 182 million pieces, and CIS for cockpit will reach 82 million pieces.

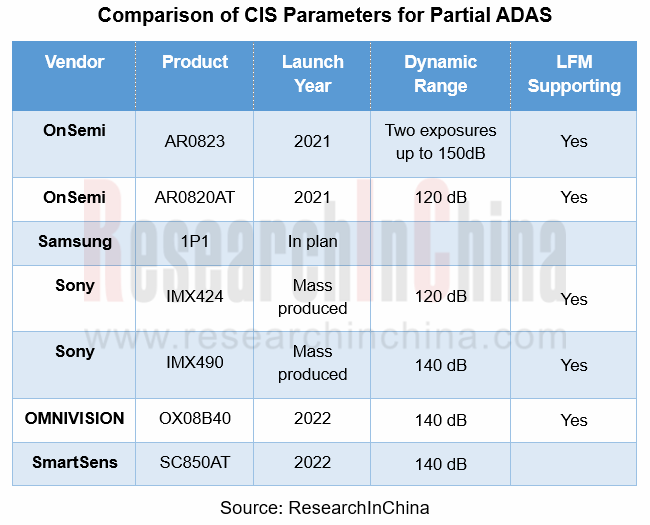

The latest CIS for ADAS in general has reached 8 megapixels and the dynamic range is starting to reach 140 dB, as shown in the following figure:

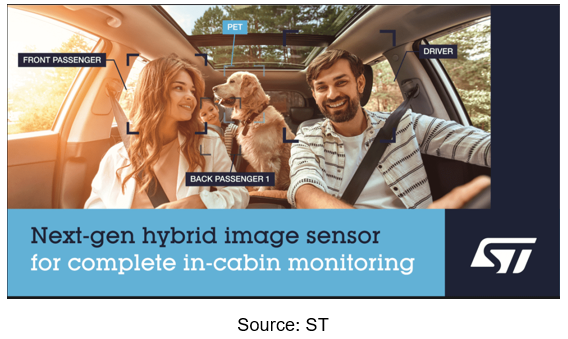

CIS for cockpits generally has a high frame rate (60fps or more), often with a global shutter, and integrated technology allows the driver monitoring and occupant monitoring system to operate effectively with one camera instead of two.

In 2022H2, ST introduced Vx1940, a next-generation hybrid dual-shutter image sensor that builds on VB56G4A, the first-generation cockpit CIS product, to monitor the entire vehicle interior, covering the driver and all occupant spaces. New target applications for this new image sensor include driver monitoring, video calling, occupant seat belt detection, vital signs monitoring, child presence detection, gesture recognition and high-quality video recording and photography, with a single sensor covering all DMS and OMS applications.

The CIS of surround view & rear view (image) category is generally 1-3 MP, with the dynamic range of 120 dB for most and 140 dB for a few. OMNIVISION released the new 1.3 MP image sensor OX01E20 for 360 ° Surround View System (SVS) and Rear View Camera (RVC) at CES 2023.

OMNIVISION says the OX01E20 meets ASIL-B safety standards and will be in mass production by June 2023 with the following key features:

?140dB HDR and LFM simultaneously.

?Good HDR and LFM performance over the entire temperature range of the vehicle.

?Advanced ISP, including DC/PC and OSD.

?Small size solutions with a-CSP technology.

?Low power consumption.

?Based on OMNIVISION's PureCel Plus architecture, which offers good low light sensitivity.

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...