As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent driving solution has become a hot topic in 2023. This solution lessens the dependence on offline HD maps, posing a challenge to the development of HD maps.

From the development process of autonomous driving, it can be seen that human-machine co-driving will exist for a period of time. The need for maps in this phase is not necessarily HD maps. Multi-source maps that integrate the complementary characteristics of different maps may be more suitable for the needs of autonomous driving in this phase.

How do players respond to the development of new-generation autonomous driving maps?

Government: while tightening the Class A qualification for HD map surveying and mapping, work to enhance the review of ADAS maps and Class B surveying and mapping qualification.

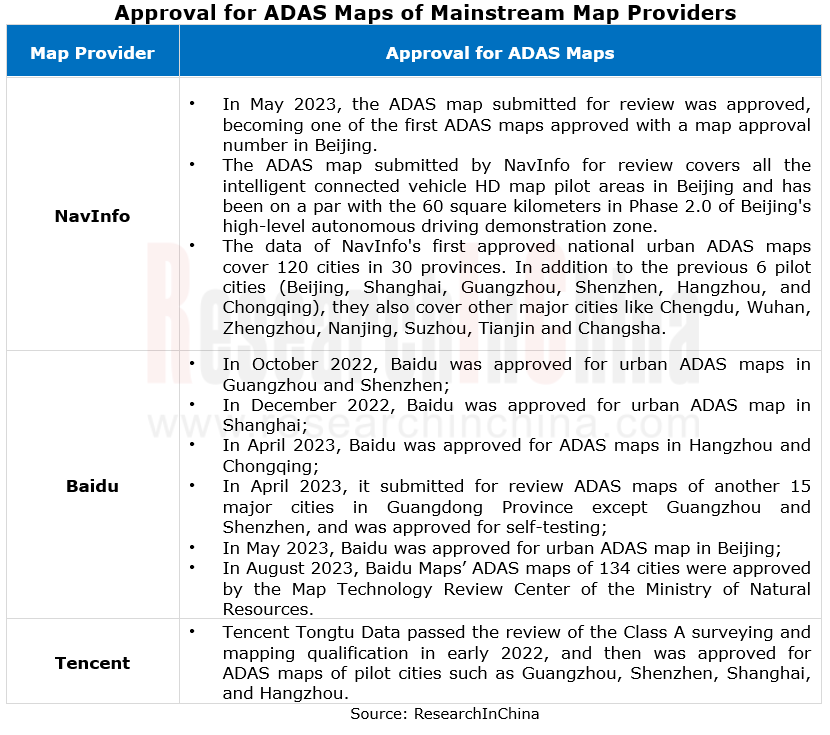

In June 2023, the Map Technology Review Center of the Ministry of Natural Resources announced the phased progress in review of ADAS maps of ordinary urban roads across China, and allowed companies to submit ADAS maps of nationwide ordinary urban roads for review in batches. Currently, NavInfo’s approved nationwide urban ADAS map data have covered 120 cities in 30 provinces; Baidu Maps has ADAS maps of 134 cities approved.

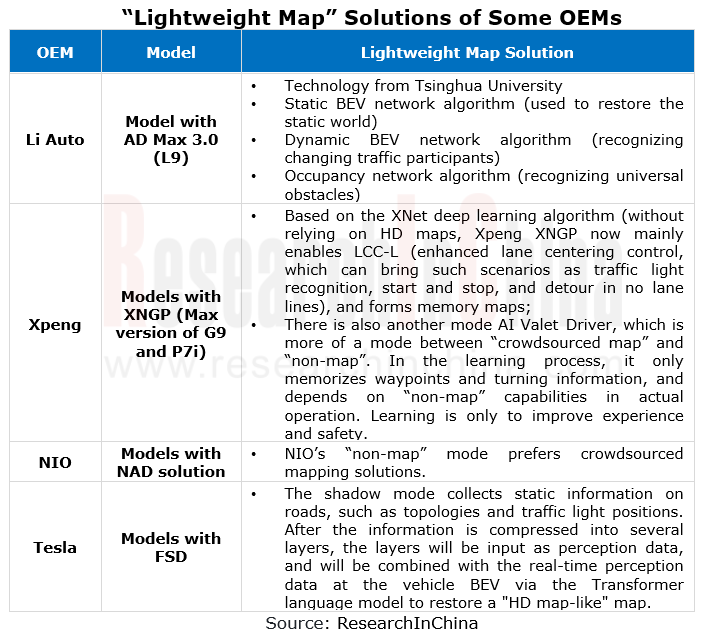

OEMs: relevant departments’ stricter review of the Class A qualification for navigation electronic map surveying and mapping has discouraged OEMs to deploy the Class A qualification for map surveying and mapping. At present, some OEMs use neural network model algorithms for real-time mapping and lower reliance on offline HD maps, and the ADS-enabled models of Tesla, Li Auto, Xpeng, and Huawei are typical cases; some other OEMs prefer stability, and obtain surveying and mapping qualifications by way of applying for Class B qualification or establishing new joint ventures with map providers. For example, GAC together with its partners such as Nanjing Institute of Surveying, Mapping and Geotechnical Surveying Co., Ltd. co-funded "Guangdong Guangqi Yutu Equity Investment Partnership (Limited Partnership)"; Anhui NIO Smart Mobility Technology Co., Ltd., a subsidiary of NIO, applied for the Class A qualification for Internet map services.

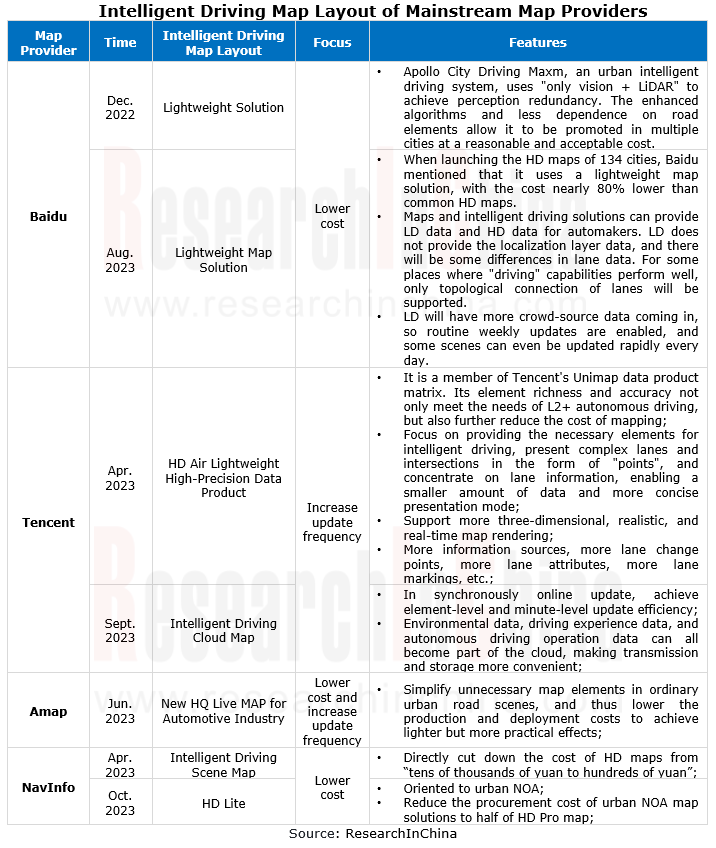

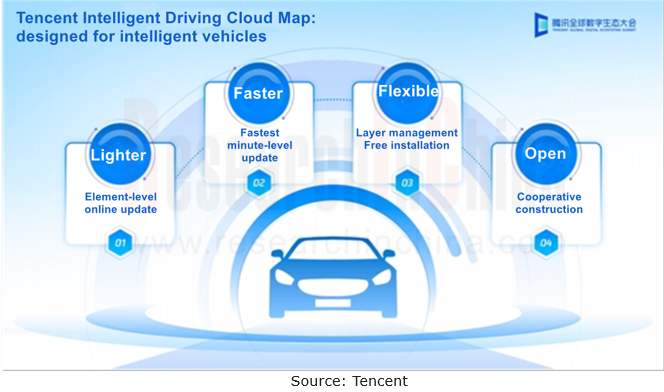

Map providers: to meet the market demand, they launch "lightweight map" solutions, putting SD data, HD data, LD data, etc. on one map to ensure the continuity of navigation. One example is Tencent which introduced the "Intelligent Driving Cloud Map" to support the cooperative construction by map providers, automakers, autonomous driving companies and other players, after launching its "three-in-one" intelligent driving map.

Emerging carmakers take the lead in launching "lightweight map" solutions.

At present, OEMs’ solutions that do not rely on HD maps don’t mean that they do not use maps at all, but subtract elements from HD maps or add them to navigation maps instead.

It is mainly emerging carmakers that are more active in "lightweight map" solutions. One reason is that they implement urban NOA functions very quickly, and HD maps fail to answer their relevant needs.

Xpeng

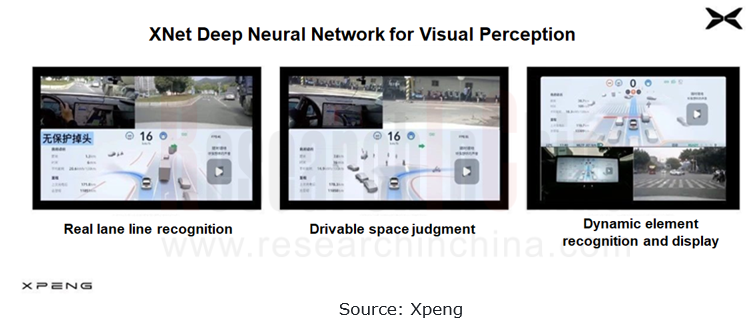

In the first half of 2023, Xpeng started developing intelligent driving solutions based on SD maps. NGP that uses HD maps or does not use adopts the same technology stack. The only difference is that the original HD map input is replaced by the navigation map input, and the understanding of navigation information in real-time perception.

Xpeng's solution that does not use HD maps has the advantages of 4 to 10 times faster generalization speed, completely solving the problem of data freshness, reducing costs, and popularizing intelligent driving, compared with the solution using HD maps.

The "no offline HD map" solution implemented by Xpeng relies on XNet to build a "HD map" in real time.

Li Auto

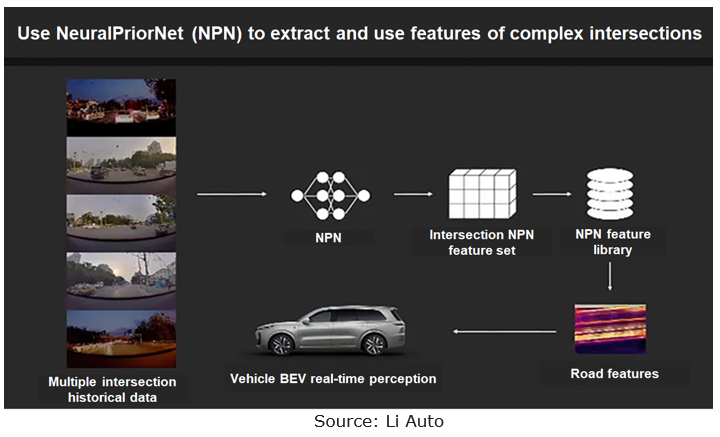

Li Auto has launched urban NOA in 2023. This solution does not rely on HD maps. It aims to construct the features of intersections to assist in real-time perception and mapping. In a word, road sections are "unmapped", and intersections are mapped by crowdsourcing.

Li Auto is now promoting the NPN solution, hoping to solve the problem of online map updates.

In terms of OEMs’ solutions, despite less dependence on HD maps, the "lightweight map" solution has higher requirements for vehicle perception and algorithms.

Conventional map providers launch lightweight autonomous driving map solutions to meet demand.

The voice of OEMs to "not rely on HD maps" is growing ever louder. To cater to the market demand, conventional map providers also make changes, trying hard to solve the three enduring problems of HD maps: update frequency, coverage area, and cost, and launching map products that more fit in with the current needs of autonomous driving.

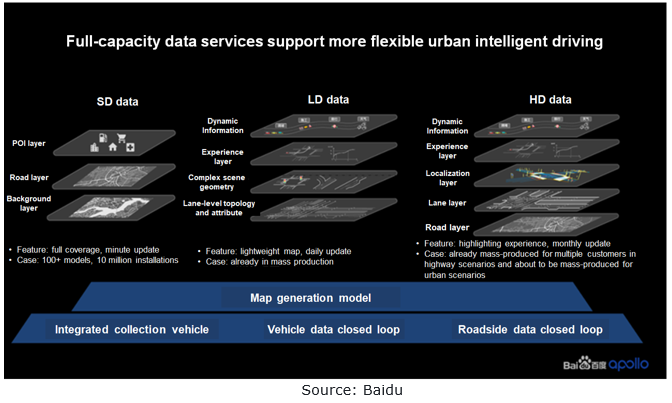

Baidu

In July 2023, Baidu MapAuto 6.5, a human-machine co-driving map, was launched. It is a full 3D lane-level map and also an all-scenario human-machine co-driving map. It can provide three types of data: SD, LD and HD. Wherein, SD data has covered the whole country and is currently available on 10 million vehicles. Baidu’s LD lightweight map data service consists of lane-level topology, complex scene geometry, experience layer, and dynamic information layer, allowing for daily update.

Amap

The new HQ Live MAP, launched in June 2023, combines the merits of HD MAP and SD MAP. In spite of a lower accuracy than HD MAP (absolute accuracy: 50cm, relative accuracy: 10cm), HQ Live MAP is enough for ADAS scenarios (highway and urban expressway scenarios: absolute accuracy of 1m, and relative accuracy of 30cm; ordinary urban road scenarios: relative accuracy of 1m), and it also simplifies unnecessary map elements in ordinary urban road scenarios, further reducing production and deployment costs.

Tencent

The latest Intelligent Driving Cloud Map, released in September 2023, enables fully cloud-based autonomous driving maps, supports element-level and minute-level online updates, and allows for the cooperative construction by map providers, automakers, autonomous driving companies and other players.

Tencent Intelligent Driving Cloud Map features scalable multi-layer forms, covering basic map layer, update element layer, ODD dynamic layer, driving experience layer and operation layer. Automakers can flexibly configure and manage the layers as they need, and build a data-driven operation platform suitable for themselves by combining it with their own data layer.

Autonomous Driving Map Industry Report, 2024 highlights the following:

Autonomous driving map (formulation of policies, regulations, standards, etc.);

Autonomous driving map (formulation of policies, regulations, standards, etc.);

Vehicle map amid the development of urban NOA (development direction, coping strategies of conventional map providers, main types of maps used in urban NOA, etc.);

Vehicle map amid the development of urban NOA (development direction, coping strategies of conventional map providers, main types of maps used in urban NOA, etc.);

HD map (market status, market size, company pattern, business model, development challenges, etc.);

HD map (market status, market size, company pattern, business model, development challenges, etc.);

Application scenarios of intelligent driving map (high-speed autonomous driving of passenger cars, low-speed parking, autonomous human carrying, autonomous object carrying, etc.);

Application scenarios of intelligent driving map (high-speed autonomous driving of passenger cars, low-speed parking, autonomous human carrying, autonomous object carrying, etc.);

Major Chinese and foreign map providers (map product series, new product layout, product application cooperation, etc.);

Major Chinese and foreign map providers (map product series, new product layout, product application cooperation, etc.);

HD map technology companies (technology layout, new technology R&D, etc.).

HD map technology companies (technology layout, new technology R&D, etc.).

1 Status Quo of Policies, Standards and Regulations Concerning Autonomous Driving Map

1.1 Policies Concerning Autonomous Driving Map

1.1.1 The Latest Policies in 2023: Guidelines for Construction of Intelligent Vehicle Basic Map Standard System (2023 Edition) (Released) (1)

1.1.2 The Latest Policies in 2023: Guidelines for Construction of Intelligent Vehicle Basic Map Standard System (2023 Edition) (Released) (2)

1.1.3 The Latest Policies in 2023: Guiding Opinions of Beijing Municipality on Piloting of HD Maps for Intelligent Connected Vehicles

1.1.4 The Latest Policies in 2023: Administrative Regulations of Hangzhou City on HD Maps for Intelligent Connected Vehicles

1.2 Regulations Concerning Autonomous Driving Map

1.2.1 Foreign Regulations Concerning HD Map

1.2.2 Chinese Regulations Concerning HD Map

1.2.3 The Latest Regulations in 2023: National Regulatory Authorities Allow Maps of Nationwide City-level Roads to Be Submitted for Review

1.2.4 The Latest Regulations in 2023: Improving the Efficiency of HD Map Review

1.3 Standards Concerning Autonomous Driving Map

1.3.1 Current Formulation of Foreign HD Map Standards

1.3.2 Current Formulation of Chinese HD Map Standards (Released)

1.3.3 Current Formulation of Chinese HD Map Standards (Pre-researched)

1.3.4 Formulation of HD Map Standards in 2023: Incremental Update on Autonomous Driving Maps for Intelligent Connected Vehicles (Filed) (1)

1.3.5 Formulation of HD Map Standards in 2023: Incremental Update on Autonomous Driving Maps for Intelligent Connected Vehicles (Filed) (2)

2 Status Quo of Autonomous Driving Map Market

2.1 Development Direction of Autonomous Driving Maps

2.1.1 Classification of Vehicle Maps: Navigation Map, ADAS Map and HD Map

2.1.2 Autonomous Driving Is in the Phase of Human-machine Co-driving

2.1.3 Challenges Posed to the Vehicle Map Industry in the Phase of Human-machine Co-driving

2.1.4 Framework of Vehicle Map in the Phase of Human-machine Co-driving

2.1.5 Vehicle Map Installation Trend: Navigation Map, ADAS Map and HD Map

2.2 Classification of Autonomous Driving Maps: Navigation Map (SD Map)

2.2.1 Vehicle Navigation Map Upgraded from 2D to 3D

2.2.2 3D Navigation Map Layout Case: Tencent

2.2.3 Navigation Map Provides Basic Data under the “Non-map” Intelligent Driving Solution (1)

2.2.4 Navigation Map Provides Basic Data under the “Non-map” Intelligent Driving Solution (2)

2.2.5 Installation of Mainstream Navigation Maps in Vehicles

2.2.6 Installations and Installation Rate of Navigation Maps in Passenger Cars in China

2.2.7 Installations and Installation Rate of Navigation Maps in Passenger Cars in China (by Price)

2.2.8 Installations and Installation Rate of Navigation Maps in Passenger Cars in China (TOP20 Models)

2.2.9 Installations and Installation Rate of Navigation Maps in Passenger Cars in China (TOP20 Brands)

2.3 Classification of Autonomous Driving Maps: ADAS Map (SD Pro MAP)

2.3.1 Categories of ADAS Maps

2.3.2 ADAS Map Production Process

2.3.3 ADAS Map Production Process 1

2.3.4 ADAS Map Production Process 2

2.3.5 ADAS Map Production Process 3

2.3.6 Key Technology for ADAS Maps: Foundation Model

2.3.7 ADAS Map Solution: Mainstream Map Providers Build Maps in Advance

2.3.8 ADAS Map Solution: Some Providers Build Maps Online via Algorithms (1)

2.3.9 ADAS Map Solution: Some Providers Build Maps Online via Algorithms (2)

2.3.10 Tier1s’ ADAS Map Solutions: Mapping Technology for Baidu Intelligent Driving Solution (1)

2.3.11 Tier1s’ ADAS Map Solutions: Mapping Technology for Baidu Intelligent Driving Solution (2)

2.3.12 Tier1s’ ADAS Map Solutions: DeepRoute.ai Driver 3.0 (1)

2.3.13 Tier1s’ ADAS Map Solutions: DeepRoute.ai Driver 3.0 (2)

2.3.14 Tier1s’ ADAS Map Solutions: MAXIEYE Hyperspace Architecture

2.3.15 Tier1s’ ADAS Map Solutions: MAXIEYE’s Automatic Mapping Memory

2.3.16 Tier1s’ ADAS Map Solutions: Juefx Technology + Horizon Robotics

2.3.17 Tier1s’ ADAS Map Solutions: Huawei

2.3.18 Tier1s’ ADAS Map Solutions: Momenta’s Non-map Intelligent Driving Algorithm Solution (1)

2.3.19 Tier1s’ ADAS Map Solutions: Momenta’s Non-map Intelligent Driving Algorithm Solution (2)

2.3.20 Tier1s’ ADAS Map Solutions: Momenta’s Non-map Intelligent Driving Algorithm Roadmap

2.3.21 Installation of ADAS Maps in Vehicles (1)

2.3.22 Installation of ADAS Maps in Vehicles (2)

2.3.23 OEMs’ ADAS Map Solutions: Tesla FSD (1)

2.3.24 OEMs’ ADAS Map Solutions: Tesla FSD (2)

2.3.25 OEMs’ ADAS Map Solutions: Voyah Urban Road High-Precision Positioning Solution

2.3.26 Development Trend of ADAS Maps: Integrated Production of SD/HD Maps

2.4 Classification of Autonomous Driving Maps: HD Map

2.4.1 HD Map

2.4.2 Perception and HD Maps Complement Each Other to Improve Urban NOA Safety

2.4.3 Comparison between Three Major Mass-Production Map Providers

2.4.4 OEMs’ Attitude towards HD Maps

2.4.5 HD Map Development Route

2.5 How Do Conventional Map Providers Make Layout Driven by Urban NOA?

2.5.1 Urban NOA Becomes A New Battlefield for Autonomous Driving of Passenger Cars

2.5.2 Multi-source Fusion Map for Autonomous Driving Is An Effective Solution to Enduring Problems in Urban NOA

2.5.3 In Urban NOA Scenario, Map Providers Focus on Deploying SD Pro MAP

2.5.4 Basic Requirements for SD Pro MAP

2.5.5 The Layout Idea of Map Providers Driven by Urban NOA: Create A Map and Lightweight Map Model

2.5.6 Layout Strategy of Map Providers (1)

2.5.7 Layout Strategy of Map Providers (2)

2.5.8 Layout Strategy of Map Providers (3)

2.5.9 Layout Strategy of Map Providers (4)

2.6 Autonomous Driving Map Selection by OEMs

2.6.1 Autonomous Driving Map Selection by OEMs (1)

2.6.2 Autonomous Driving Map Selection by OEMs (2)

3 Status Quo of HD Map Market

3.1 HD Map Market Size

3.1.1 China’s Passenger Car OEM HD Map Market Size (1)

3.1.2 China’s Passenger Car OEM HD Map Market Size (2)

3.1.3 Top 10 HD Map-enabled Production Passenger Car Models by Sales in China, 2022-2023

3.1.4 Price Range of Production Passenger Car Models with High-precision Positioning in China, 2022-2023

3.2 Competitive Pattern of HD Map Market

3.2.1 Major Players in HD Map Market

3.2.2 Players in HD Map Market (1): Chinese Map Providers (1)

3.2.3 Players in HD Map Market (1): Chinese Map Providers (2)

3.2.4 Players in HD Map Market (2): HD Map Layout of OEMs

3.2.5 Players in HD Map Market (2): OEMs Face Challenges in Self-development of HD Maps

3.2.6 OEMs’ Solutions to Map Challenges (1)

3.2.7 OEMs’ Solutions to Map Challenges (2)

3.2.8 Players in HD Map Market (3): Foreign Map Providers

3.3 Business Models for HD Map Implementation

3.3.1 HD Map Business Model 1: Autonomous Driving

3.3.2 HD Map Business Model 2: Parking Lot

3.3.3 Classification of HD Map Profit Models

3.3.4 Summary of HD Map Business Models: Chinese Map Providers (1)

3.3.5 Summary of HD Map Business Models: Chinese Map Providers (2)

3.3.6 Summary of HD Map Business Models: Foreign Map Providers

3.3.7 Changes in Business Models of Map Providers in the Development of Urban NOA

3.4 Challenges in Development of HD Maps

3.4.1 Development of HD Maps Faces Bottlenecks

3.4.2 Challenge 1 in Development of HD Maps

3.4.3 Challenge 2 in Development of HD Maps

3.4.4 Challenge 3 in Development of HD Maps

3.4.5 Challenge 4 in Development of HD Maps

3.5 HD Map Data Distribution and Fusion

3.5.1 HD Map Data Distribution and Fusion Processes

3.5.2 Process 1: HD Map Data Distribution Engine Architecture

3.5.3 Process 1: HD Map data Distribution Engine Integration Form

3.5.4 Process 1: Main Suppliers of HD Map Data Distribution Engine

3.5.5 Process 2: HD Map Data Format Conversion (1)

3.5.6 Process 2: HD Map Data Format Conversion (2)

3.5.7 Process 3: Interaction between HD Map Data Distribution and Receiving End

3.5.8 Process 4: HD Map Data Fusion

3.5.9 HD Map Data Distribution and Fusion Trends

3.6 HD Maps Applied to Lane-level Positioning

3.6.1 Structure of Lane-level Positioning Solutions Based on HD Maps

3.6.2 Providers of Lane-level Positioning Solutions Based on HD Maps

3.6.3 Cases

4 Intelligent Driving Map Application Layout of OEMs

4.1 Map Elements Required for Different Levels of Autonomous Driving

4.1.1 Map Elements Required for Autonomous Driving: L2 NOA Function

4.1.2 Map Elements Required for Autonomous Driving: L2 Hands Free Function

4.1.3 Map Elements Required for Autonomous Driving: L3

4.1.4 Map Elements Required for Autonomous Driving: L4 or Higher Level

4.2 OEMs’ Installation of Intelligent Driving Maps in Production Passenger Cars

4.2.1 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (1)

4.2.2 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (2)

4.2.3 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (3)

4.2.4 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (4)

4.2.5 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (5)

4.2.6 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (6)

4.2.7 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (7)

4.2.8 Chinese Independent Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars (8)

4.2.9 Joint Venture Brands’ Installation of Intelligent Driving Maps in Production Passenger Cars

4.2.10 OEMs’ Intelligent Driving Map Installation Case 1: GAC Aion HD Map Solution

4.2.11 OEMs’ Intelligent Driving Map Installation Case 1: GAC Aion Electronic Horizon System

4.2.12 OEMs’ Intelligent Driving Map Installation Case 1: GAC Aion HD Map Curvature and Slope

4.2.13 OEMs’ Intelligent Driving Map Installation Case 2: Xpeng Realizes Urban NOA Based on HD Maps

4.2.14 OEMs’ Intelligent Driving Map Installation Case 2: Xpeng XNGP Upgrades “Non-map” Solution (1)

4.2.15 OEMs’ Intelligent Driving Map Installation Case 2: Xpeng XNGP Upgrades “Non-map” Solution (2)

4.2.16 OEMs’ Intelligent Driving Map Installation Case 2: Xpeng XNGP Upgrades “Non-map” Solution (3)

4.2.17 OEMs’ Intelligent Driving Map Installation Case 3: Great Wall WEY Uses HD Maps to Realize Point-to-point Autonomous Driving

4.2.18 OEMs’ Intelligent Driving Map Installation Case 4: Li Auto Uses HD Maps

4.2.19 OEMs’ Intelligent Driving Map Installation Case 4: Li AD Max 3.0 Upgrades “Non-map” Solution

4.2.20 OEMs’ Intelligent Driving Map Installation Case 4: Li Auto Uses Online Mapping Technology (1)

4.2.21 OEMs’ Intelligent Driving Map Installation Case 4: Li Auto Uses Online Mapping Technology (2)

4.2.22 OEMs’ Intelligent Driving Map Installation Case 5: NIO NOP Fuses HD Maps

4.2.23 OEMs’ Intelligent Driving Map Installation Case 5: NIO Carefully Explores “Non-map” Solution

4.2.24 OEMs’ Intelligent Driving Map Installation Case 6

4.2.25 OEMs’ Intelligent Driving Map Installation Case 7

4.2.26 OEMs’ Intelligent Driving Map Installation Case 8

4.2.27 OEMs’ Intelligent Driving Map Installation Case 9

4.3 Intelligent Driving Map Application in Sub-scenarios: Low-speed Parking of Passenger Cars

4.3.1 AVP Map Category 1: HD Map

4.3.2 AVP Map Category 1: SLAM Real-Time Map

4.3.3 Top Five Providers of Parking Maps for Parking Lots

4.3.4 Installation Case: Mapping Method for Avatr Parking Functions

4.4 Intelligent Driving Map Application in Sub-scenarios: Autonomous Object Carrying

4.4.1 Importance of HD Maps for Low-speed Autonomous Object Carrying

4.4.2 HD Mapping Method for Low-speed Autonomous Object Carrying

4.4.3 Pattern of Providers of HD Maps for Autonomous Object Carrying (1)

4.4.4 Pattern of Providers of HD Maps for Autonomous Object Carrying (2)

4.5 Intelligent Driving Map Application in Sub-scenarios: Autonomous Human Carrying

4.5.1 Importance of HD Maps for High-level (Autonomous) Automated Driving

4.5.2 Application Scenarios of Autonomous Human Carrying (1)

4.5.3 Application Scenarios of Autonomous Human Carrying (2)

4.5.4 Application Scenarios of Autonomous Human Carrying (3)

5 Chinese and Foreign Map Providers

5.1 Baidu Maps

5.1.1 Autonomous Driving Architecture Adjustment: Constrict L4/L2 Solutions

5.1.2 Baidu Is Committed to Building Maps for Autonomous Driving

5.1.3 Vehicle Map Product System

5.1.4 Vehicle Map Product 1: Navigation Map

5.1.5 Vehicle Map Product 2: Baidu MapAuto 6.5 (1)

5.1.6 Vehicle Map Product 2: Baidu MapAuto 6.5 (2)

5.1.7 Vehicle Map Product 2: Baidu MapAuto 6.5 (3)

5.1.8 Vehicle Map Product 3: HD Map (1)

5.1.9 Vehicle Map Product 3: HD Map (2)

5.1.10 Map Is A Competitive Edge of Baidu’s Autonomous Driving System

5.1.11 Core Value 1 of “Familiar Road” Map: Safety (1)

5.1.12 Core Value 1 of “Familiar Road” Map: Safety (2)

5.1.13 Core Value 2 of “Familiar Road” Map: Comfort

5.1.14 Core Value 3 of “Familiar Road” Map: High Efficiency

5.1.15 Low-cost Construction of Intelligent Driving Map Technology 1: Mapping

5.1.16 Low-cost Construction of Intelligent Driving Map Technology 2: Automatic Feature Extraction

5.1.17 Compared with HD Maps, Baidu Autonomous Driving Map Loses Weight

5.2 NavInfo

5.2.1 New Vehicle Map Product System

5.2.2 New Vehicle Map Product 1: Navigation Map

5.2.3 New Vehicle Map Product 2: Scene map (1)

5.2.4 New Vehicle Map Product 2: Scene Map (2)

5.2.5 New Vehicle Map Product 3: HD Map (1)

5.2.6 New Vehicle Map Product 3: HD Map (2)

5.2.7 New Vehicle Map Product 3: HD Map (3)

5.2.8 New Vehicle Map Product 3: HD Map (4)

5.2.9 Intelligent Driving Map Application Case 1

5.2.10 Intelligent Driving Map Application Case 2

5.2.11 Intelligent Driving Map Application Case 3

5.3 Amap

5.3.1 Vehicle Map Product 1

5.3.2 Vehicle Map Product 2

5.3.3 Vehicle Map Product 3

5.3.4 Matching of HD Map and SD Map

5.4 Tencent

5.4.1 “Vehicle-Cloud Integration” Strategic Layout

5.4.2 Vehicle Map Product 1: Navigation Map

5.4.3 Vehicle Map Product 2: Intelligent Driving Cloud Map (1)

5.4.4 Vehicle Map Product 2: Intelligent Driving Cloud Map (2)

5.4.5 Vehicle Map Product 3

5.4.6 Vehicle Map Product 4

5.4.7 Coping Strategies in “Lightweight Map” Mode: In-depth Cooperation with Tier1s (1)

5.4.8 Coping Strategies in “Lightweight Map” Mode: In-depth Cooperation with Tier1s (2)

5.5 BrightMap

5.5.1 Introduction to Vehicle Map Business

5.5.2 Vehicle Map Product: AVP HD Map (1)

5.5.3 Vehicle Map Product: AVP HD Map (2)

5.6 Mxnavi

5.6.1 Business Layout

5.6.2 Vehicle Map Product 1: Crowdsourced Map Technology

5.6.3 Vehicle Map Product 2: HD Map Data

5.6.4 Vehicle Map Product 3: HD Map Fusion Platform

5.6.5 Coping Strategies in “Lightweight Map” Mode

5.7 Huawei

5.7.1 Vehicle Map Products (1)

5.7.2 Vehicle Map Products (2)

5.7.3 Vehicle Map Products (3)

5.7.4 Vehicle Map Application: High-level Autonomous Driving System (ADS)

5.8 Heading Data Intelligence

5.8.1 Map-based Product Lines

5.8.2 Vehicle Map Products (1)

5.8.3 Vehicle Map Products (2)

5.8.4 HD Map Application Scenario 1: Parking

5.8.5 HD Map Application Scenario 2: Highway/Urban Driving Assistance

5.9 JD

5.9.1 JD Logistics Builds “Yutu” Platform (1)

5.9.2 JD Logistics Builds “Yutu” Platform (2)

5.10 Leador

5.10.1 Autonomous Driving Technology Based on HD Maps

5.10.2 Application of HD Map in Parking Lots

5.11 eMapgo

5.11.1 Vehicle Map Products: HD Map for Parking Lots (1)

5.11.2 Vehicle Map Products: HD Map for Parking Lots (2)

5.11.3 Vehicle Map Products: HD Map Cloud Platform

5.11.4 Vehicle Map Application: Autonomous Driving Simulation Test

5.12 Momenta

5.12.1 Coping Strategies in “Lightweight Map” Mode

5.12.2 Non-map Solution Algorithm: Lane Line Recognition

5.12.3 Non-map Solution Algorithm: Positioning

5.12.4 Non-map Solution Algorithm: Planning & Control

5.12.5 Algorithm Iteration Path

5.13 Roadgrids

5.13.1 Automatic HD Map Building and Update

5.13.2 Selection of Lightweight HD Map Elements

5.13.3 Lightweight Map Closed-loop Solution (1)

5.13.4 Lightweight Map Closed-loop Solution (2)

5.14 Here

5.14.1 Map Evolution Mode

5.14.2 Emphasize Map Information Security

5.14.3 Launch UniMap Mapping Platform

5.14.4 HD Map Layout in China

6 HD Map Technology Companies

6.1 Mobileye

6.1.1 Focus on Deploying Lightweight Map Business (1)

6.1.2 Focus on Deploying Lightweight Map Business (2)

6.1.3 Benefits of REM

6.2 NVIDIA

6.2.1 Vehicle Map Business: DeepMap

6.2.2 Vehicle Map Product: DRIVE Map (1)

6.2.3 Vehicle Map Product: DRIVE Map (2)

6.3 DeepMotion

6.3.1 Acquired by Xiaomi

6.3.2 HD Map Technical Solution

6.3.3 Features of HD Map

6.4 Mapbox

6.4.1 Vehicle Map Products: Navigation Map

6.4.2 Vehicle Map Products: HD Map

6.4.3 Failure in the Chinese Market

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...