Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-computer interaction, vehicle display technology keeps updating and iterating.

From the product releases at major exhibitions, it can be seen that main panel manufacturers, Tier 1 suppliers and automakers have introduced privacy screens, transparent displays, foldable/rollable (flexible) screens, lifting/sliding screens, and light field screens, as well as multiple innovative display technologies such as integration of display and interior and integration of display and lighting. Display technology is rapidly evolving from LCD to OLED, MiniLED and MicroLED. These technologies will change the conventional display and interaction modes.

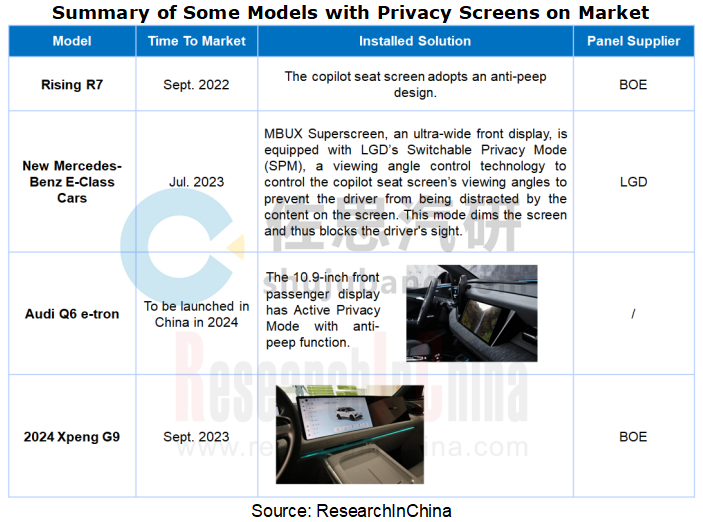

All major suppliers and automakers have deployed anti-peeping screens which have been seen in cars.

In some cars equipped with a co-pilot seat display, it is inevitable that the driver is disturbed and distracted by the content displayed on the screen or its light when driving. The vehicle display capable of anti-disturbance can effectively prevent the driver from being distracted by screen information and light, while providing entertainment services for the front seat passenger, further ensuring driving safety. At present, vehicle display Tier 1 suppliers such as Continental, Visteon and Marelli, and panel manufacturers like LGD, BOE, and TCL CSOT have released such products for anti-peeping display in the car and higher driving safety.

Continental Switchable Privacy Display integrates two unique backlights into a 12.3-inch screen. A simple touch on the switch key at the bottom of the copilot seat screen enables switching between the Privacy and Public modes. This smart privacy display is expected to be rolled out in 2024.

Of course, this concept of anti-peeping for privacy protection isn’t just seen in exhibits. Rising R7, a model launched on market in September 2022, has such anti-peeping design of the copilot seat screen for the safety of the driver. In addition, new Xpeng G9, new Mercedes-Benz E-Class cars, and Audi Q6 e-tron to be available on the Chinese market in 2024 are already equipped with anti-peeping screens.

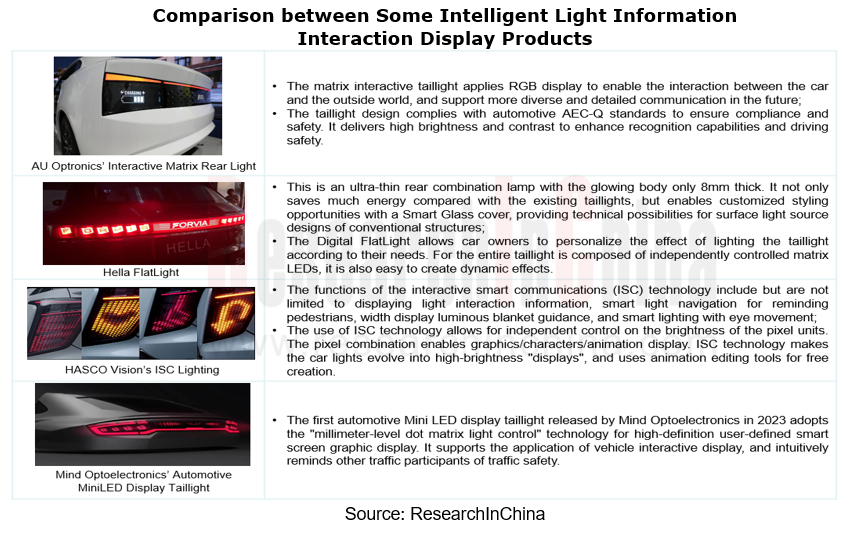

Exterior interaction is evolving towards the lighting + display integration.

As vehicle intelligence speeds up, automotive lighting has also entered the era of intelligent lighting featuring unbounded interaction and cross-domain integration. In addition to the lighting function, intelligent vehicles also introduce display functions into lights using new intelligent headlight technologies such as DLP and Micro LED, allowing lights to have more interactions with the driver. There is a trend towards the display + lighting integration, enabling human-vehicle interaction inside and outside vehicles, vehicle-vehicle interaction and vehicle-road interaction.

The intelligent light information interaction system gives vehicle lights social attributes, and allows them to carry and display much more information and directly show "the vehicle’s emotions" and the driving intent towards pedestrians. For example, the Intelligent Social Display Marelli exhibited at CES 2024 provides new opportunities for illumination and communication via light, on and around the vehicle. This technology is developed to support vehicle-to-x communication while giving OEMs the freedom to customize messages.

The Intelligent Social Display can indicate when the car is in autonomous mode, signal driver intent, and communicate to pedestrians with messages such as “safe to cross” when approaching an intersection or crosswalk.

There are many integration options available with the Intelligent Social Display. Automotive OEMs are integrating the displays into the front and side of the vehicle, offering on-demand functionality and customized patterns for safety and socializing. Use cases for integration in the rear include using symbols to convey environmental scenarios such as a traffic jam, accident ahead, or unsafe driving conditions.

Marelli is in series production with two Chinese automakers with mid-resolution displays integrated into the vehicle front. For integration within the rear lamp or trunk surface, a second generation of high-resolution displays based on mini-LED technology is in development and can also achieve homologated lighting functions.

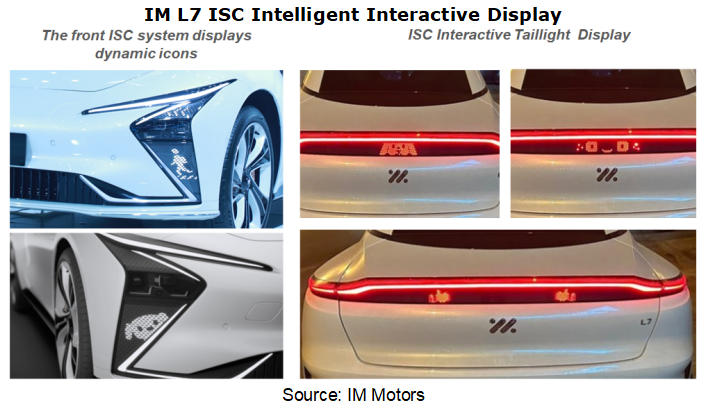

In IM L7’s case, the DLP lights of IM L7 are equipped with HASCO Vision’s digital signal light ISC system, namely, "intelligent interactive taillight" which is actually a DLP technology supplement for the headlights. The Interactive Signal Communication (ISC) technology allows for display of information to front and rear traffic participants such as vehicles and pedestrians in the form of images and texts, for example, when DLP prompts the front pedestrians to go first, the rear display area will show "please give way to pedestrians passing".

The personalized custom light interaction function enables the custom taillight effect, displaying different colors and patterns according to user’s mood. Combining DLP and ISC, IM L7 transforms car lights from function-defined scenarios to scenario-defined functions, that is, manufacturers only provide basic lighting hardware which is then upgraded over the air (OTA) when producing cars. As autonomous driving and V2X develop, all traffic participants have new interaction needs. The intelligent light information interaction system can support in-depth OTA updates.

IM L7's ISC intelligent interactive taillight packs TI TLC6C5748-Q1, an automotive 48-channel LED driver. Through controlling the highly integrated independent LED pixels, it drives a total of 5,000+ LED units in the front and rear of the car, and enables 255 levels of individually adjustable brightness two-color control. Moreover, the adoption of an LED direct drive solution reduces much power consumption of the ISC module, thereby ensuring that IM L7 can have a longer cruising range.

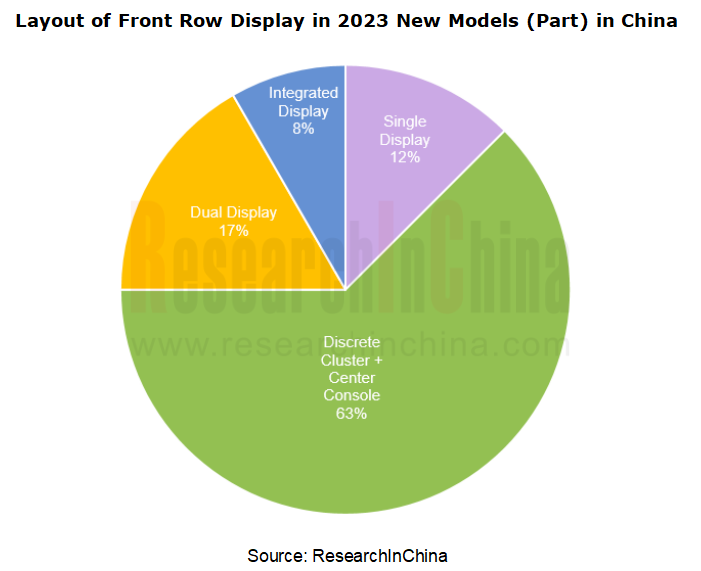

The front cabin cluster + center console discrete layout is mainstream, and there is still a trend towards large and multiple screens.

Since Tesla adopted the 17-inch large center console display, car center consoles have entered the era of large screens. Since then, sundry designs have begun to emerge, such as horizontal screen, vertical screen, dual display, triple display, and integrated display.

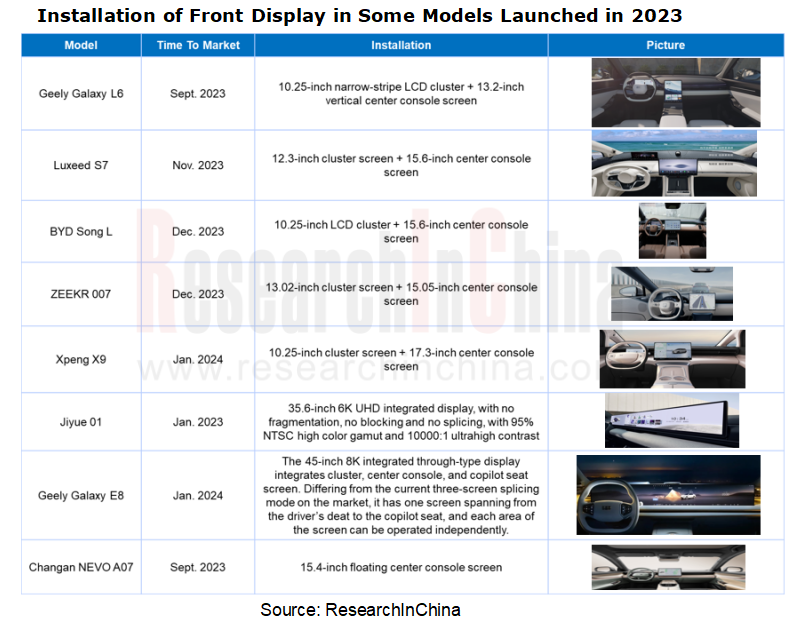

In terms of some new models launched in China in 2023 and 2024, 24 in total here, the front cabin discrete cluster + center console layout is still mainstream. Wherein, there are 3 models using the single display solution (center console screen), namely, Changan NEVO A07, Changan Deepal S7 and ARCFOX αT5; 15 models using the discrete solution, such as ZEEKR 009, new NIO ES6, GAC Hyper GT, Denza N7, Geely Galaxy L6 and ZEEKR 007; 4 models using multi-screen display design, namely, Rising F7, 2024 New Voyah Dreamer, Haval Fierce Dragon MAX and Kia EV5; only two models using an integrated through-type display, namely, Jiyue 01 and Geely Galaxy E8.

Vehicle displays serve as a medium for human-vehicle interaction. The booming intelligent vehicles have put forward new requirements for vehicle displays which then already become a hotspot major manufacturers compete to deploy. Vehicle displays are no longer restricted to conventional positions and shapes such as center console and cluster. The cockpit also adds a range of new application scenarios such as HUD, copilot seat screen, rear entertainment screen, electronic rearview mirror, and transparent A-pillar.

In the future, vehicle displays will tend to provide better display effects and more precise human-computer interaction, integrate more functions, and fuse with interiors. Multiple innovative features such as privacy protection and transparent display will bring richer experiences for safe driving and comfortable riding.

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...

Integrated Battery (CTP, CTB, CTC, and CTV) and Battery Innovation Technology Report, 2025

Power battery research: 17 vehicle models use integrated batteries, and 34 battery innovation technologies are released

ResearchInChina released Integrated Battery (CTP, CTB, CTC, and CTV)and Battery...

AI/AR Glasses Industry Research Report, 2025

ResearchInChina released the " AI/AR Glasses Industry Research Report, 2025", which deeply explores the field of AI smart glasses, sorts out product R&D and ecological layout of leading domestic a...

Global and China Passenger Car T-Box Market Report 2025

T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 20...

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...

Automotive LiDAR Industry Report, 2024-2025

In early 2025, BYD's "Eye of God" Intelligent Driving and Changan Automobile's Tianshu Intelligent Driving sparked a wave of mass intelligent driving, making the democratization of intelligent driving...

Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report

Research on automotive SOA and middleware: Development towards global SOA, cross-domain communication middleware, AI middleware, etc.

With the implementation of centrally integrated EEAs, OEM softwar...

Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate...

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...

China Passenger Car Digital Chassis Research Report, 2025

Digital chassis research: Local OEMs accelerate chassis digitization and AI

1. What is the “digital chassis”?

Previously, we mostly talked about concepts such as traditional chassis, ch...

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...