Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

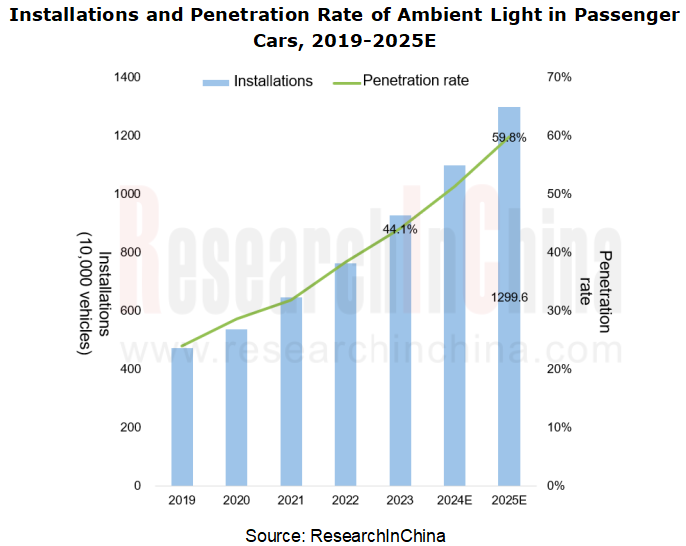

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. Interior lighting mainly includes ambient, reading, trunk, door, and cluster lights. Among them, the ambient light boasted a penetration of 44.1% in 2023, and sustained an AAGR of 16.3% in recent five years. ResearchInChina predicts that the ambient light as a standard configuration will be installed in 13 million vehicles in 2025, with a penetration rate of nearly 60%.

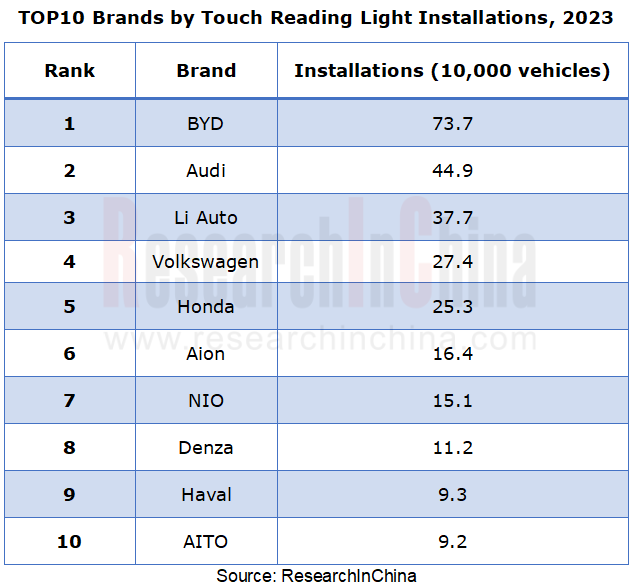

The installations of touch reading light soared from 2019 to 2023, with penetration up to 16.8% in 2023, and the most models equipped with this function were from BYD, Audi, and Li Auto.

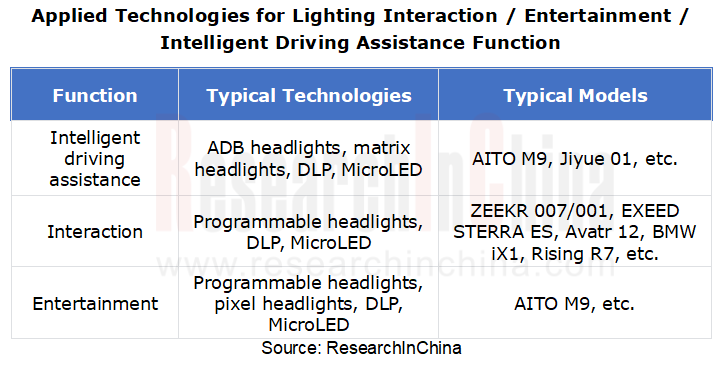

Intelligent headlights are led by DLP headlights, digital headlights, programmable headlights, and adaptive driving beam (ADB) headlights. They can enable such functions as autonomous driving assistance, exterior interaction, and entertainment projection.

In 2023, the mainstream light source of intelligent headlights was LED combination, sweeping about 84% of the installations; halogen headlights made up 15%; laser headlights still took a less than 0.5% share. In 2023, among intelligent headlights, matrix headlights were installed most, and mounted on 2,229,000 vehicles; geometric multi-beam headlights followed, with installation in 231,000 vehicles.

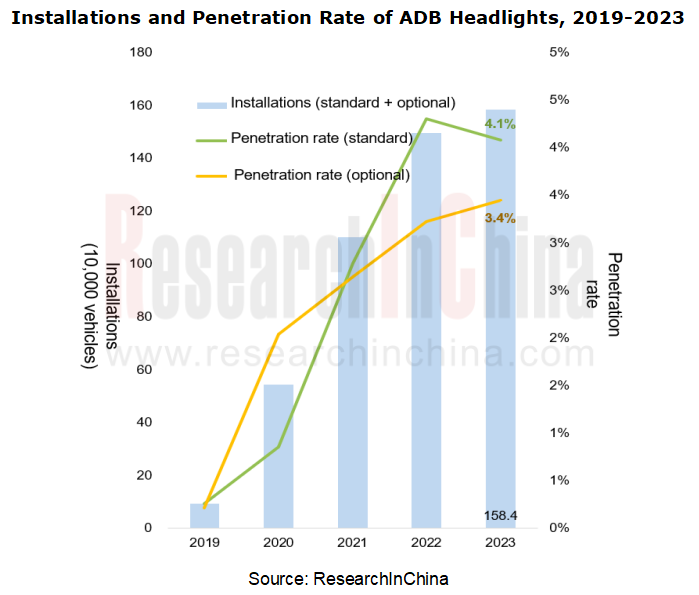

In recent five years, the installations of ADB headlights were on the rise: in 2021, the installations of the standard ADB headlights exceeded the optional for the first time; in 2023, ADB headlights were installed in 1,584,000 vehicles.

Intelligent headlights bear interaction, entertainment and intelligent driving assistance functions.

In late 19th century, the first electric headlamp was available on market, mainly for night lighting.

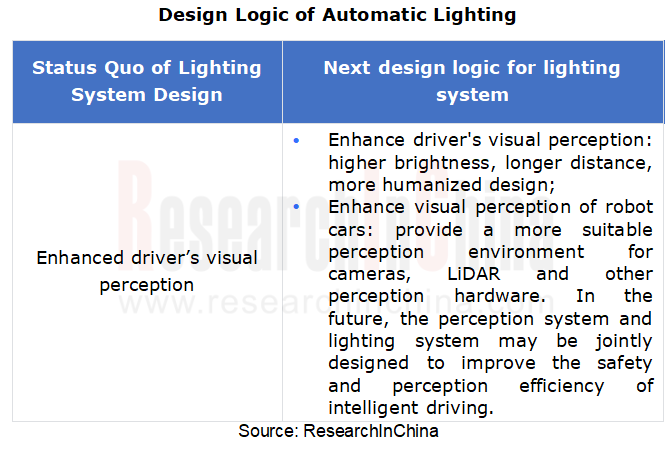

In 2023, headlights became more diversified. As technology evolves, they begin to carry functions other than lighting, including: intelligent driving assistance, interaction, and entertainment.

The diversification of automotive lighting functions has not only expedited the application of lighting technologies like DLP, MicroLED, and pixel headlights, but also fueled the integration of automotive lighting with other auto parts, for example, "lighting-screen integration" (using displays for exterior lighting and display), "lighting-surface integration" (integrating smart surface technology into the lighting system, mainly exterior grille lights and interior ambient/door lights), and "perception lighting" (integrating sensors into lights to enhance intelligence).

In the case of interaction function of intelligent lighting, the images projected by headlights and the pixel graphics showed by the LED display convey the user’s intents for interaction with pedestrians and vehicles. This technology is mainly enabled by the projection of pixel headlights and the light information interaction mode of programmable headlights.

Xpeng was the first to introduce the light information interaction function, and used it in P7 in 2020, a model with sales of about 5,000 units. This function was available to P5 and G9 in 2022, and smart#1, Avatr 11, SAIC Rising/IM series, and Hongqi H9 began to follow suit in the year. In 2023, the models equipped with lighting information interaction function began to boom, with 330,000 vehicles installed with it, the penetration rate up to 1.6%.

ZEEKR 007 packs Valeo ZEEKR STARGATE, an integrated intelligent light curtain in the front face. The front light curtain supports the light information interaction design, adopts the "light-screen integration" approach, and allows customization of intelligent expressions and courtesy signs. ZEEKR STARGATE is independently controlled by 75 automotive-grade driver ICs provided by TI.

In December 2023, AITO M9 was officially released with Huawei's XPixel automotive lighting technology. DLP projection enables intelligent driving assistance functions such as lane change and turning alert, lane guidance, and light blanket projection. In terms of interaction function, AITO M9's ISD lights with more than 1,000 pixels have built in over 10 animation effects such as welcome, charging animation and light information interaction, as well as over 40 customized patterns. The 4M high-speed serial communication realizes smoother animation effects, and the customized animations can be refreshed via OTA updates to meet the customization requirements of different target groups.

Intelligent automotive lighting is integrated with sensors.

As autonomous driving technology advances, automotive lighting systems are no longer limited to lighting functions, but further integrated with radar, camera and other ADAS sensors. They utilize intelligent perception function and common EEA to further enhance lighting intelligence, and keep evolving towards perception lighting.

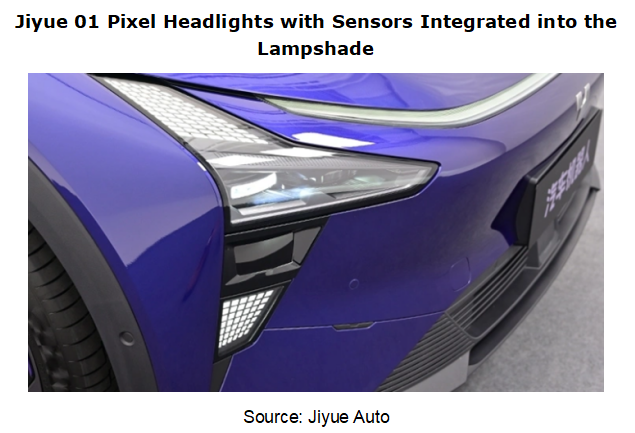

In the case of Jiyue 01, a model launched in October 2023, its lighting system and full intelligent driving domain adopt the same visual system. The intelligent interactive lighting system is applicable to lighting interaction designs for different scenarios such as autonomous driving, voice interaction and safety protection. Headlights and high/low beam can be switched automatically through the visual system.

For example, the perception system recognizes the environment before and after entering the lane, and then automatically turns the lights on or off through the autonomous driving execution system. The next step is to automate the lever and directly use vision to determine which lane to enter, and then determine whether to turn left or right. In the future, users will not need to pay attention to the left or right turn when driving.

ZKW has been researching the integration of sensors and lighting systems since 2019, and has launched products that integrate radar sensors and lighting systems, for example, the "Project Dragonfly".

In May 2023, ZKW and REHAU Automotive decided to jointly drive forward the integration of modern lighting systems in vehicle fronts. They will promote the “seamless intelligent vehicle front” project where light, sensor technology and electronics in the vehicle front are connected. The seamless vehicle front is enriched with light, logo, sensor and heating elements and thus becomes an intelligent design object.

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...

Integrated Battery (CTP, CTB, CTC, and CTV) and Battery Innovation Technology Report, 2025

Power battery research: 17 vehicle models use integrated batteries, and 34 battery innovation technologies are released

ResearchInChina released Integrated Battery (CTP, CTB, CTC, and CTV)and Battery...

AI/AR Glasses Industry Research Report, 2025

ResearchInChina released the " AI/AR Glasses Industry Research Report, 2025", which deeply explores the field of AI smart glasses, sorts out product R&D and ecological layout of leading domestic a...

Global and China Passenger Car T-Box Market Report 2025

T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 20...

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...

Automotive LiDAR Industry Report, 2024-2025

In early 2025, BYD's "Eye of God" Intelligent Driving and Changan Automobile's Tianshu Intelligent Driving sparked a wave of mass intelligent driving, making the democratization of intelligent driving...

Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report

Research on automotive SOA and middleware: Development towards global SOA, cross-domain communication middleware, AI middleware, etc.

With the implementation of centrally integrated EEAs, OEM softwar...

Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate...

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...

China Passenger Car Digital Chassis Research Report, 2025

Digital chassis research: Local OEMs accelerate chassis digitization and AI

1. What is the “digital chassis”?

Previously, we mostly talked about concepts such as traditional chassis, ch...

Automotive Micromotor and Motion Mechanism Industry Report, 2025

Automotive Micromotor and Motion Mechanism Research: More automotive micromotors and motion mechanisms are used in a single vehicle, especially in cockpits, autonomous driving and other scenarios.

Au...

Research Report on AI Foundation Models and Their Applications in Automotive Field, 2024-2025

Research on AI foundation models and automotive applications: reasoning, cost reduction, and explainability

Reasoning capabilities drive up the performance of foundation models.

Since the second ha...

China's New Passenger Cars and Suppliers' Characteristics Research Report, 2024-2025

Trends of new cars and suppliers in 2024-2025: New in-vehicle displays are installed, promising trend of AI and cars is coming

ResearchInChina releases the China's New Passenger Cars and Suppli...

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...