Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business Report 2023" released in June 2023 mentioned that Huawei sold 10,000 and 40,032 intelligent vehicles in May 2023 and January 2024 respectively, reflecting rapid growth.

At the end of 2023, the most eye-catching Huawei City NCA were available in 45 cities. In February 2024, Huawei City NCA began to cover most cities in China with the support of intelligent driving technology independent of HD maps.

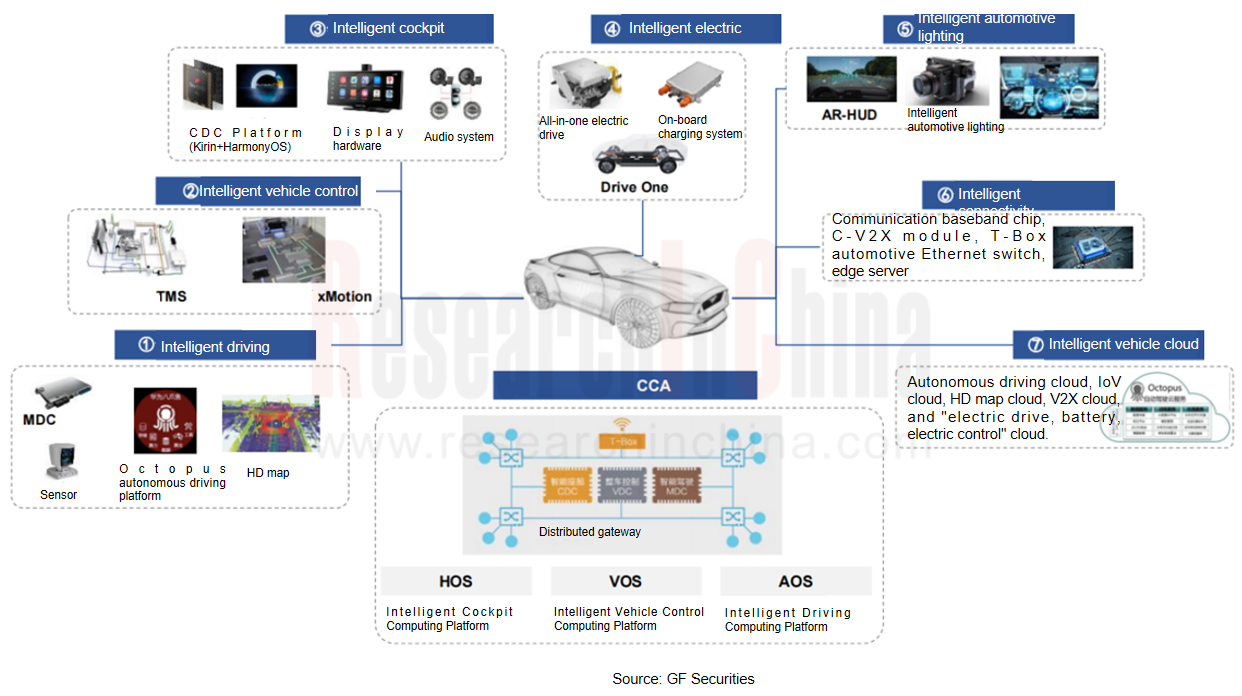

In the field of smart cars, Huawei has deployed CCA, intelligent driving, intelligent car control, intelligent cockpits, intelligent electric, intelligent automotive lighting, intelligent connectivity, and intelligent car cloud.

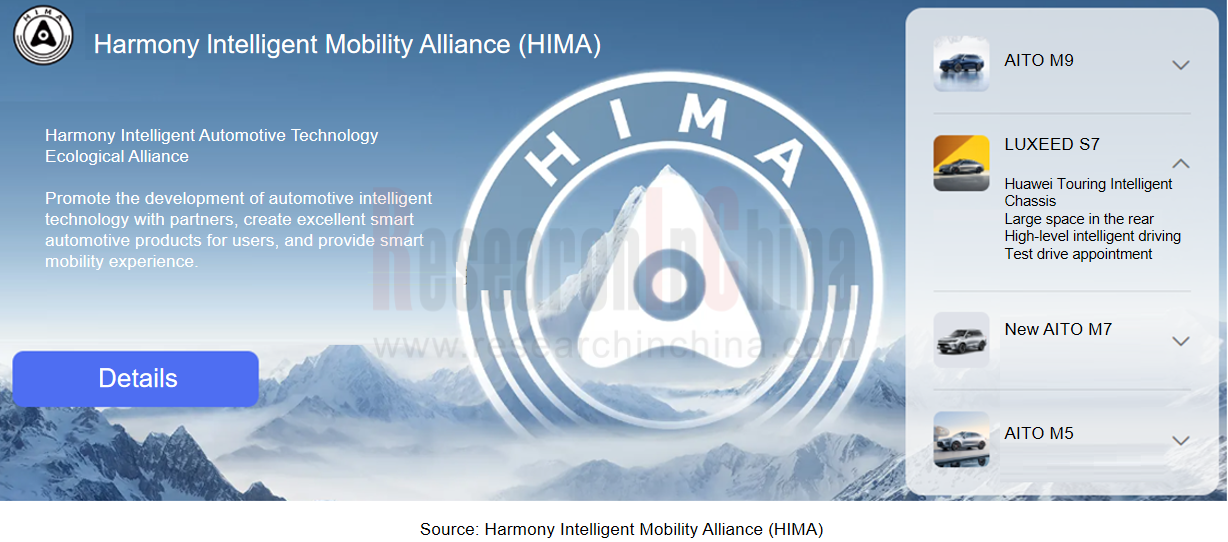

Huawei cooperates with car companies through three models: parts supply model, solution model (ie. Huawei Inside), and Huawei Smart Selection (upgraded to Harmony lntelligent Mobility Alliance (HIMA)).

Progress in parts supply model

By the end of 2022, Huawei had launched more than 30 smart auto parts and shipped nearly 2 million sets of parts, including smart cockpits, smart driving, smart electric, smart car cloud, radar, cameras, gateways, lidar, computing platforms, AR HUD, T-Box and other products and solutions.

On February 24, 2024, Huawei and GAC Trumpchi announced that the Master Pioneer Version of Trumpchi M8 equipped with Huawei HarmonyOS debuted.

Traditional car companies are not as sophisticated as Huawei and other IT companies in terms of IT ecological layout. As a result, the IVI (and cockpit) experience of most traditional car companies is not as good as that of emerging automakers. Therefore, Huawei's HarmonyOS cockpits are widely used in the new models of Changan, GAC and Dongfeng.

Although Huawei ships considerable smart auto parts, the output value is not high due to the fierce competition among parts manufacturers.

Huawei's Intelligent Automotive Solution Business Unit earned the revenue of about RMB2 billion in 2022, and about RMB1 billion in the first half of 2023, which basically did not grow or cover the cost of more than RMB10 billion per year. Therefore, Huawei has gradually weakened the parts supply model, paid more attention to Huawei Inside and Huawei Smart Selection, and achieved the goal of gradually turning losses around by upgrading Huawei Inside and Huawei Smart Selection.

Upgrade of Huawei Inside

Huawei Inside is a cooperative mode in which Huawei and car companies jointly define and develop smart cars. In this mode, Huawei will integrate its self-developed intelligent driving systems, cockpit systems, domain controllers, chips, motors and various sensors into smart cars, and cooperate with car companies in depth. In short, Huawei Inside is developed by Huawei and car companies together. Huawei provides full-stack solutions to help car companies make cars, but the ultimate dominance still lies with the car companies.

Since the introduction of Huawei Inside, BAIC ARCFOX and Changan Avatr have chosen this mode. GAC once cooperated with Huawei in Huawei Inside, but later withdrew.

Due to the large investment in intelligent business, it is difficult for Huawei to support its Intelligent Automotive Solution Business Unit to make a profit alone. In addition, the solution provided by Huawei Inside to car companies is a package solution, which is unacceptable to most OEMs. Therefore, Huawei changed its strategy and set up joint ventures with car companies instead at the end of 2023 to bind each other.

On November 26, 2023, Changan Automobile announced to sign the Investment Cooperation Memorandum with Huawei. Through negotiation between both parties, Huawei plans to set up a company (target company) engaged in R&D, design, production, sale and services of automotive intelligent systems and parts solutions, and Changan Automobile intends to invest in this target company and carry out strategic cooperation with it.

According to the memorandum, Huawei will integrate the core technologies and resources of smart car solutions business into the new company. Changan Automobile and its related parties will intend to invest in the company, with a contribution of no more than 40%, and support the future development of the company with Huawei.

On January 16, 2024, Shenzhen Yinwang Intelligent Technology Co., Ltd. was established with a registered capital of RMB1 billion. Shenzhen Yinwang Intelligent Technology Co., Ltd. will secure the current technologies and resources of Huawei's Intelligent Automotive Solution Business Unit as Huawei's wholly-owned subsidiary which will welcome more partners in the future. On the same day, Zhu Huarong, Chairman of Changan Automobile, revealed at the “2024 Changan Automobile Global Partner Conference" that the new joint venture between Changan and Huawei was tentatively named "Newcool", which involved seven fields, such as intelligent driving, intelligent cockpits, intelligent automotive digital platforms, intelligent vehicle cloud, AR-HUD and intelligent headlights, and Huawei's future goal was to reduce its shareholding to less than 30%.

After the upgrade of Huawei Inside, Huawei reached cooperation with Dongfeng Voyah and Dongfeng Warrior in early 2024.

Upgrade of Huawei Smart Selection

Based on Huawei Inside, Huawei Smart Selection is deeply involved in product definition, research and development, manufacturing and marketing. In Huawei Smart Selection, Huawei enjoys the dominance. Seres AITO and Chery LUXEED have opted Huawei Smart Selection, and STELATO and Aojie will follow suit.

Compared with Huawei Inside, Huawei Smart Selection has achieved initial success under the leadership of Yu Chengdong (AITO has ranked first among emerging brands by sales volume). Huawei Smart Selection is a ToC model where, Yu Chengdong, the CEO of the Consumer BG at Huawei Technologies, has rich experience in addition to marketing and brand building.

By the end of 2023, Huawei Smart Harmony Intelligent Mobility Alliance (HIMA).? Under HIMA, Huawei empowers partners in all aspects, such as products, quality, sale, services and marketing.

If Huawei cannot unify the car purchase process of its HIMA partners, different OEM brands will compete with each other, which will bring disadvantages to the promotion of Huawei Smart Selection. In view of the increase in car models, the need to expand the showroom area, and the necessity of unifying the HIMA sales and delivery process, Huawei has begun to build independent HIMA stores.

On January 10, 2024, HIMA’s official Weibo account stated that China National Postal & Telecommunications Appliances Co., Ltd. (PTAC) was building a new HIMA user center. It is estimated that about 800 HIMA stores will be built in 2024 and the number will hit 1,000 in 2025.

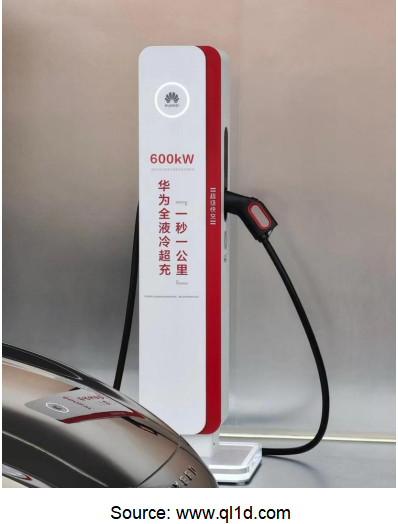

With the soaring sales volume of Huawei Smart Selection, the construction of charging piles, the most important supporting facilities for electric vehicles, is also imminent, let alone the expansion of sales stores.

In 2023, Huawei, together with a number of partners, deployed more than 10,000 charging piles nationwide, covering 31 provinces. It is expected that by the end of 2024, Huawei will deploy more than 100,000 fully liquid-cooled ultra-fast/fast charging piles in 340+ cities and on major highways across the country. The maximum output power of Huawei's fully liquid-cooled supercharging terminal is 600kW, which is close to “one kilometer per one second".

Hou Jinlong, the president of Huawei Digital Energy Technologies, predicted that in the next decade, the ownership of electric vehicles will escalate from the existing 20 million to astonishing 200 million, with the charging capacity swelling from 100 billion kWh to 1 trillion kWh. The number of charging piles is expected to increase by fivefold in the next decade.

To sum up, in the transformation of automotive electrification, connectivity, intelligence and sharing, Huawei has set a benchmark for domestic and foreign automotive enterprises and Tier 1 suppliers.

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...