Global and China Flame Retardant Industry Report, 2014-2016

-

July 2014

- Hard Copy

- USD

$2,500

-

- Pages:115

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

PQ009

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

Flame retardant is a general term for the substances that prevent and reduce flammability of fuels or delay their combustion. Over the past 30 years, flame retardant and flame-resisting materials have played an important role in reducing losses of life and property caused by fire disasters. In 2005-2013, the market volume of global flame retardant grew at a CAGR of about 4.2%, to 2.055 million tons in 2013.

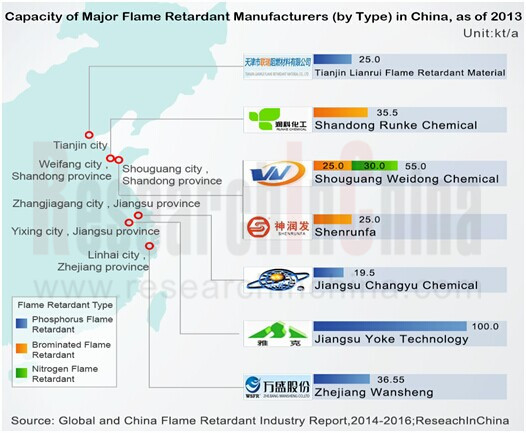

The global flame retardant market is mainly dominated by Albemarle, Chemtura and Clariant from the United States, Israel’s ICL, Japan’s ADEKA and Jiangsu Yoke Technology and Zhejiang Wansheng from China, which leads to a relatively higher concentration.

In terms of consumption regions, despite a higher consumption proportion in Europe, America and Japan, these markets were stable and their demands grew at a relatively slow pace. However, the Asian region including China but excluding Japan showed a double-digit growth, making it the most important driving force of the flame retardant markets around the world. In 2013, this region accounted for a roughly 31.1% market share of the global flame retardant, up nearly 13 percentage points from 2005.

Flame retardant can fall into halogen flame retardant (chlorine-based and bromine-based, etc.), phosphorus flame retardant and inorganic flame retardant, etc.

Bromine-based Flame Retardant: As a traditional variety, bromine-based flame retardant absolutely dominated general-purpose plastics and engineering plastics. But due to an increasingly stringent requirement from environmental protection, bromine-based flame retardants including HBCD and DECA are being phased out. The U.S. and Canadian governments had long reached agreement with Albemarle, Chemtura and ICL that the three would retreat from the DECA production agreement by the end of 2013. Japan began to prohibit HBCD in May 2014.

Organophosphorus Flame Retardant: With obvious advantages like environmental friendliness and safety, organophosphorus flame retardant is gradually substituting for halogen flame retardant (chlorine-based and bromine-based, etc.), with the market volume of global organophosphorus flame retardant in 2010-2013 representing a CAGR of 9.8%. And in 2013 alone, the market volume of organophosphorus flame retardant reached some 620 kt, accounting for 30% of the global total.

Although China’s flame retardant industry started later than Europe, the United States and Japan, the output of flame retardant in China has maintained a rapid growth rate in recent years, with the output for 2013 approximating 987 kt, up 15.2% from a year earlier. At present, the demand for flame retardant in China accounts for roughly 60% of its total output. And as the industries like energy saving in buildings, electronics & electrical appliances and automobile manufacturing develop and the State adopted increasingly stringent policies on flame retardant, the market potential of flame retardant in China will be further released.

Currently, the Chinese flame retardant market is still dominated by halogen flame retardant (chlorine-based and bromine-based, etc.). However, in view of the factors such as environmental policies and market demand, a growing number of Chinese manufacturers have begun to turn to non-halogen flame retardant, especially organophosphorus flame retardant products. In 2013, the output of organophosphorus flame retardant in China reached more than 200 kt.

?

As the leading organophosphorus flame retardant manufacturer in China, Jiangsu Yoke Technology achieved an annual capacity of 100 kt in 2013 and planned to expand this capacity to around 160 kt/a. With a capacity of 36.55 kt/a, Zhejiang Wansheng ranked second in the organophosphorus flame retardant market in China. Besides, the company is planning to increase its capacity to 53.5 kt/a.

?

Global and China Flame Retardant Industry Report, 2014-2016 highlights the following:

Policy environment, global market, status quo, competition pattern and outlook of China flame retardant industry;

Policy environment, global market, status quo, competition pattern and outlook of China flame retardant industry;

Supply & demand, competition pattern, and development of flame retardant market segments (including brominated flame retardant, phosphorus flame retardant and inorganic flame retardant) in China and beyond;?

Supply & demand, competition pattern, and development of flame retardant market segments (including brominated flame retardant, phosphorus flame retardant and inorganic flame retardant) in China and beyond;?

Operation, flame retardant business, business in China, and development prospects of 13 global and 6 Chinese flame retardant enterprises.

Operation, flame retardant business, business in China, and development prospects of 13 global and 6 Chinese flame retardant enterprises.

1. Overview of Flame Retardant Industry

1.1 Definition and Classification

1.2 Applications

2. Development of China Flame Retardant Industry

2.1 Operating Environment

2.1.1 Policies and Regulations

2.1.2 International Market

2.2 Status Quo

2.3 Competition Pattern

2.4 Influence from Upstream and Downstream Sectors

2.4.1 Upstream Sector

2.4.2 Downstream Sector

2.5 Development Prospects and Prediction

3. Flame Retardant Market Segments

3.1 Halogen Flame Retardant

3.1.1 Supply & Demand

3.1.2 Competition Pattern

3.1.3 Development Outlook and Prediction

3.2 Phosphorus Flame Retardant

3.2.1 Supply & Demand

3.2.2 Competition Pattern

3.2.3 Development Prospects and Prediction

3.3 Inorganic Flame Retardant

3.4 Others

4. Major Global Flame Retardant Companies

4.1 Albemarle

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Operating Margin

4.1.5 R&D and Investment

4.1.6 Flame Retardant

4.1.7 Business in China

4.1.8 Development Forecast

4.2 Chemtura

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Operating Margin

4.2.5 R&D and Investment

4.2.6 Flame Retardant

4.2.7 Business in China

4.2.8 Development Forecast

4.3 ICL

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Operating Margin

4.3.5 R&D and Investment

4.3.6 Flame Retardant

4.3.7 Business in China

4.3.8 Development Forecast

4.4 Clariant

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 R&D and Investment

4.4.5 Flame Retardant

4.4.6 Business in China

4.4.7 Development Forecast

4.5 ADEKA

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Operating Margin

4.5.5 Flame Retardant

4.5.6 Business in China

4.5.7 Development Forecast

4.6 Teijin

4.6.1 Profile

4.6.2 Flame Retardant

4.6.3 Business in China

4.7 AkzoNobel

4.7.1 Profile

4.7.2 Flame Retardant

4.7.3 Business in China

4.8 BASF

4.8.1 Profile

4.8.2 Flame Retardant

4.8.3 Business in China

4.9 Dupont

4.9.1 Profile

4.9.2 Flame Retardant

4.9.3 Business in China

4.10 Italmatch Chemicals

4.10.1 Profile

4.10.2 Flame Retardant

4.10.3 Business in China

4.11 Lanxess Group

4.11.1 Profile

4.11.2 Flame Retardant

4.11.3 Business in China

4.12 DOW

4.12.1 Profile

4.12.2 Flame Retardant

4.12.3 Business in China

4.13 Dover Chemical

5. Main Flame Retardant Companies in China

5.1 Jiangsu Yoke Technology

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R&D and Investment

5.1.6 Clients & Suppliers

5.1.7 Flame Retardant

5.1.8 Development Forecast

5.2 Zhejiang Wansheng Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 R&D and Investment

5.2.6 Clients & Suppliers

5.2.7 Flame Retardant Business

5.2.8 Development Forecast

5.3 Shouguang Weidong Chemical Co., Ltd.

5.4 Weifang Brother Chemical Co., Ltd.

5.5 Shouguang Shen Runfa Ocean Chemical Industry Co., Ltd.

5.6 Tianjin Lianrui Flame Retardant Material Co., Ltd.

6. Summary and Forecast

6.1 Summary

6.2 Forecast

Classification of Flame Retardant by Application

Classification and Advantages & Disadvantages of Flame Retardant by Composition

Performance: Brominated Flame Retardant vs. Phosphorus Flame Retardant vs. Inorganic Flame Retardant

Downstream Consumption Structure of Global Flame Retardant

Main Flame Retardant Products and Their Applications

Policies and Regulations on Flame Retardant in China, 2005-2013

Market Volume of Global Flame Retardant, 2005-2013

Market Volume of Global Flame Retardant by Region, 2005-2013

Capacity of Major Flame Retardant Manufacturers by Type as of the end of 2013

Market Price (Low-end Price) Trend of Liquid Chlorine (99.6%) in China by Region, 2008-2014

Market Price (Middle Price) Trend of Liquid Chlorine (99.6%) in China by Region, 2008-2014

Market Price (High-end Price) Trend of Liquid Chlorine (99.6%) in China by Region, 2008-2014

Price Trend of Yellow Phosphorus in China, 2006-2014

Output and YoY Growth of Plastic Products in China, 2006-2014

Planned/Ongoing Flame Retardant Projects in China, as of June 2014

Capacity Structure (%) of Global Bromine Series Product Manufacturers, 2012-2013

Market Volume and YoY Growth of Global Organophosphate Flame Retardant, 2010-2013

Revenue and YoY Growth of Albemarle, 2008-2014

Net Income and YoY Growth of Albemarle, 2008-2014

Revenue of Albemarle by Division, 2010-2013

Operating Margin of Albemarle by Division, 2008-2014

R&D Costs and % of Total Revenue of Albemarle, 2008-2014

Capital Expenditure and YoY Growth of Albemarle, 2008-2014

Some Flame Retardant Products of Albemarle

Distribution of Albemarle’s Flame Retardant Business-related Facilities, 2013

Albemarle’s Revenue from Flame Retardant Business and YoY Growth, 2008-2013

Revenue and Net Income of Albemarle, 2012-2016E

Primary Products and Commodities of Chemtura and Their Applications

Revenue and Net Income of Chemtura, 2009-2014

Revenue of Chemtura by Division, 2011-2014

Revenue Structure of Chemtura by Region, 2013

Operating Margin of Chemtura by Division, 2011-2014

R&D Costs and % of Total Revenue of Chemtura, 2009-2014

Revenue and Net Income of Chemtura, 2012-2016E

ICL’s Main Products and Ranking in Global Market, as of the end of 2013

Capacity of ICL’s Main Products, as of the end of 2013

Output of ICL’s Main Products, 2013

Revenue and Net Income of ICL, 2009-2014

Revenue of ICL by Division, 2010-2014

Revenue of ICL by Region, 2010-2014

Operating Margin of ICL by Division, 2010-2014

R&D Costs and % of Total Revenue of ICL, 2009-2014

ICL’s Revenue from Flame Retardant Business, 2010-2013

List of Companies under ICL in China

Revenue and Net Income of ICL, 2012-2016E

Revenue and Net Income of Clariant, 2009-2014

Revenue Structure of Clariant by Division, 2013

Revenue Structure of Clariant by Region, 2013

R&D Costs and % of Total Revenue of Clariant, 2009-2014

Revenue and YoY Growth of Clariant in China, 2009-2014

Clariant’s Major Subsidiaries, 2013

Revenue and Net Income of Clariant, 2012-2016E

ADEKA Main Business and Products

Revenue and Net Income of ADEKA, FY2009-FY2013

Revenue of ADEKA by Segment, FY2009-FY2013

Operating Margin of ADEKA by Division, FY2009-2013

ADEKA’s Main Flame Retardant Products and Application

Some of ADEKA’s Subsidiaries in China

Revenue and Net Income of ADEKA, 2012-2016E

Teijin’s Major Manufacturers in China and Their Main Business

AkzoNobel’s Flame Retardant and Flame Retardant Synergist Products and Their Application

BASF’s Flame Retardant Products and Their Application

Dupont’s New Flame Retardant Products and Their Application

Production Bases and Products of LANXESS in China and Market Application

Dow’s Flame Retardant Products and Their Application

Jiangsu Yoke Technology’s Subsidiaries and Their Primary Business

Revenue and Net Income of Jiangsu Yoke Technology, 2009-2014

Revenue of Jiangsu Yoke Technology by Product, 2010-2013

Revenue of Jiangsu Yoke Technology by Region, 2010-2013

Gross Margin of Jiangsu Yoke Technology by Product, 2010-2014

R&D Costs and % of Total Revenue of Jiangsu Yoke Technology, 2010-2013

Jiangsu Yoke Technology’s Revenue from Top 5 Clients and % of Total Revenue, 2010-2013

Jiangsu Yoke Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2013

Jiangsu Yoke Technology’s Revenue from Flame Retardant and % of Total Revenue, 2010-2013

Revenue and Net Income of Jiangsu Yoke Technology, 2012-2016E

Revenue and Net Income of Zhejiang Wansheng, 2011-2013

Revenue of Zhejiang Wansheng by Product, 2011-2013

Revenue of Zhejiang Wansheng by Region, 2011-2013

Gross Margin of Zhejiang Wansheng by Product, 2011-2013

R&D Costs and % of Total Revenue of Zhejiang Wansheng, 2011-2013

Zhejiang Wansheng’s Fundrasing Project through Planned IPO and Flame Retardant by Segmented Product, Apr. 2014

Zhejiang Wansheng’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Name List, Sales Products and Revenue Contribution of Zhejiang Wansheng’s Top 5 Clients, 2013

Zhejiang Wansheng’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2013

Name List, Procurement and Procurement Contribution of Zhejiang Wansheng’s Top 5 Suppliers, 2013

Capacity, Output, Capacity Utilization and Sales-output ratio of Organophosphorus Flame Retardant of Zhejiang Wansheng, 2011-2013

Sales Volume and Global Market Share of Organophosphorus Flame Retardant of Zhejiang Wansheng, 2011-2013

Sales Breakdown of Flame Retardant of Zhejiang Wansheng by Segmented Product and Sales Value, 2011-2013

Sales Mode of Flame Retardant of Zhejiang Wansheng by Segmented Product and Sales Value, 2011-2013

Revenue and Net Income of Zhejiang Wansheng, 2012-2016E

Capacity and Major Application of Brominated Flame Retardant Products of Weifang Brother Chemical by Segmented Product

Market Volume and YoY Growth of Global Flame Retardant, 2012-2016E

Market Volume of Global Flame Retardant by Region, 2012-2016E

Market Volume and YoY Growth of Global Organophosphorus Flame Retardant, 2012-2016E

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...

Global and China Natural Rubber Industry Report, 2017-2021

In 2016, the global natural rubber output edged up 1.1% year on year to 12.4 million tons, and the consumption rose by 3.8% year on year to 12.6 million tons, indicating the gap of 200,000 tons betwee...

China Synthetic Rubber Industry Report, 2017-2021

Synthetic rubber is one of important strategic materials, mainly used in tyres and other industries. In 2016, the global output and consumption of synthetic rubber reached 14.822 million tons and 14.9...

Global and China 1,4-butanediol (BDO) Industry Report, 2017-2021

1,4-butanediol (BDO) is a key raw material for organic and fine chemicals, capable of generating various derivatives like THF, PTMEG and GBL. BDO and its derivatives find wide application in PBT plast...

Global and China Ethylene Oxide (EO) Industry Report, 2017-2021

Ethylene oxide (EO) is one of the major derivatives of the ethylene industry. Featured with special reactivity, it can generate a series of fine chemical products for a wide range of applications.

In...