China's manufacturing growth is slowing at a controlled pace with August HSBC China PMI at 49.9, which is helpful to cool inflation in the coming months.

August's final HSBC manufacturing PMI reading rebounded marginally from the flash reading, almost close to the break-even level. Both output and employment moved above 50 for the first time in three months, confirming our view that China will only see growth moderate, not collapse, in the coming months. With the PBoC's latest move to extend the base of required reserve, the monetary conditions for inflation should be more or less removed. Inflation should start to peter out in the coming months. All signs point to a soft landing in the coming quarters.

Facts:

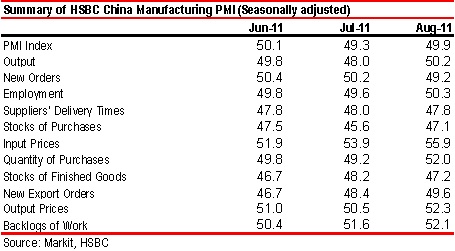

The final reading of August HSBC China manufacturing PMI was revised up to 49.9 from the flash reading of 49.8 released earlier. This is also 0.6 point higher than the final print of 49.3 in July and a touch lower the final print of 50.1 in June. The modest pick-up to a level very close to the break-even line suggests there should be no further deterioration in manufacturing growth.

The key driver was output, which returned to marginal growth territory (50.2) from below-50 readings over the previous two months. It was also better than the 49.4 flash reading. Accordingly, employment also rose to a three-month high at 50.3, better than the two months of marginally-below 50 readings.

In contrast to the improvement in output and employment, the new orders sub-index dipped to 49.2 in August from 50.2 in July. This is the first below-50 reading (although marginal) in thirteen months, with respondents reporting sluggish demand in both domestic and external markets. The former is attributed to the impact of credit tightening while the latter is reflected in the still below-50 level of new exports orders. That said, given new export orders improved slightly to a three month high at 49.6 in August, external demand appears to be stabilizing at least at a relatively weak level.

Inventory-wise, finished goods saw a sharper rate of reduction compared with the previous month (47.2 in August vs. 48.2 in July), thanks to relatively subdued output growth. This, combined with falling new orders, suggests that the difference between these two indicators (a major measure to underlying growth momentum) picked up slightly to 2 from 1.9 previously. Despite lackluster new business, the purchase stocks sub index rose to a five-month high at 52 in August, ending the marginal decline (i.e. below-50) in the previous two months, thanks to improving output growth. As a result, stocks of purchases saw a relative improvement to 47.1 in August from 45.6 in July.

Inflation for both input and output picked up but stayed largely subdued compared with the long-term average. Input prices surged to a three month-high at 55.9 in August (vs. 53.9 in July), but is still much lower than average of 58.1 in 2Q and long term average of 60.1. Output prices also picked up to a three-month high at 52.3 (vs. 50.5 in July), as manufacturers managed to pass higher input costs to consumers.

Implications

August's final readings came in largely the same as its flash readings, confirming our view that the economy is unlikely to deteriorate sharply in the coming months. Manufacturing sector growth has likely to stabilized for now, with the current PMI readings consistent with IP growth of around 13% y-o-y.

Although new orders fell marginally reflecting manufacturers' (in particular the small the medium-sized ones) pain amidst credit tightening and sluggish external demand, this is unlikely to persist over the coming months thanks to still resilient domestic demand.

First, credit tightening is approaching an end, given that inflation has peaked and growth has slowed. In other words, credit growth is likely to stabilize at around 15-16% (in line with long term average) in the coming quarters, remaining supportive to growth.

Second, investment growth should hold up well, despite the tightening-induced slowdown. Key supports to investment growth include massive ongoing infrastructure investment projects, public housing and resilient consumer demand (See China Inside Out: Investment growth - slowdown not meltdown, published 26 August 29, 2011).

Third, consumer demand should remain robust thanks to the sustained improvement in China's labour market, which should allow for continued rapid wage and income growth.

With growth not an immediate concern, inflation remains Beijing's policy focus. August's price indices highlight the risk of an inflation rebound should monetary policy be loosened too early. And the PBoC's indirect 100-150bp reserve ratio hike by expanding RRR to margin deposits also implies that the central bank is still putting price stability as the top priority. (See China Economic Spotlight: Is this the PBoC's final push, published 29 August 29, 2011). Premier Wen also reiterated that priority remains at combating inflation despite the tightening-induced slowdown in growth.

Bottom line: China's manufacturing growth is slowing at a controlled pace. This, plus the PBoC's latest move to extend the base of required reserve, is helpful to cool inflation in the coming months. A soft landing is expected in the coming quarters.