China Motion Controller Industry Report, 2013-2016

-

July 2014

- Hard Copy

- USD

$1,900

-

- Pages:80

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

LT019

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

In recent years, China has seen rapid development in machine tool, textile, printing, packaging, electronics, and other industries, which has boosted the demand for motion controllers. In 2006-2012, the demand for motion controllers in China presented steady growth, from 253,600 sets in 2006 to 754,500 sets in 2012. In 2013, the market demand for motion controllers in China still showed a relatively stable growth, at roughly 19%, to about 900,000 sets.

The market size of universal motion controllers, which serve as the control devices of the servo system, is directly influenced by the system. In recent years, the rapid growth of the servo system in China has driven the market size of universal motion controllers to rise from RMB543 million in 2006 to RMB1.946 billion in 2012, with a CAGR of 23.7%. And in 2013, the market size of general motion controllers in China stood at RMB2.34 billion, an increase of some 16.9% on a year-on-year basis.

According to different platforms, general motion controllers can fall into three categories: PLC controller, embedded controller, and PC-based controller card. In 2013, the market share of PLC controllers in China reached 55.68%, followed by embedded controllers.

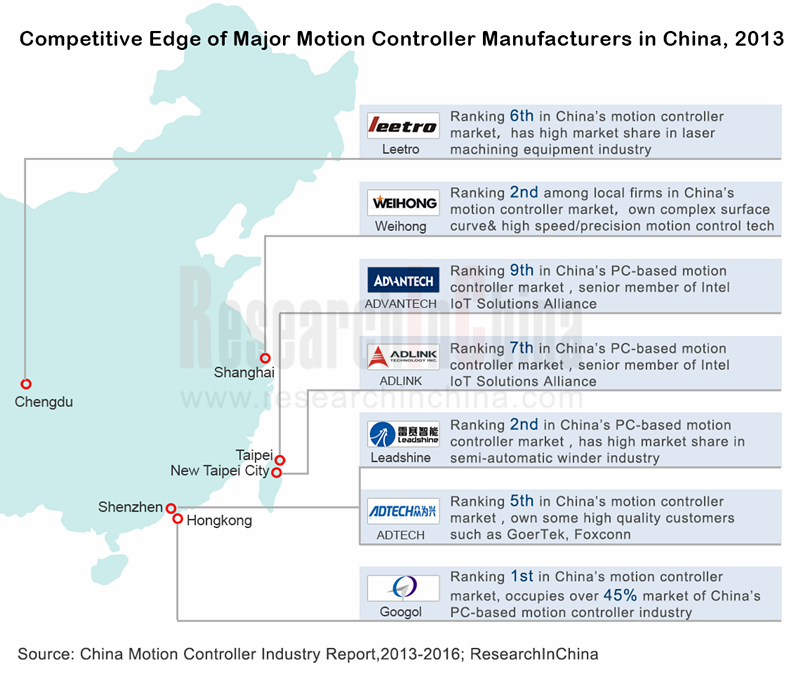

Currently, some Chinese motion controller manufacturers including Googol Technology, Shanghai Weihong and Leadshine Technology are targeted at medium and low-end market while European and American companies focus mainly on high-end market. Generally, the market share of the Chinese enterprises has exceeded 50%, and Googol Technology ranked first with a 14.2% market share in 2013.

In recent years, with the open system, reasonable performance and lower prices, Pc-based controllers have developed at a fast pace in China, hence a popularity in the Chinese market. As for Pc-based controllers, the Chinese manufacturers have gradually emerged as major players, including Googol Technology, Leadshine Technology, Adtech, Leetro, and Shanghai Weihong, etc. Meanwhile, these players also provide dedicated controllers to some industry segments. However, Googol Technology has dominated the Pc-based controller market, with the market share in 2013 hitting as high as 45.32%.

In the forthcoming years, the growth of demand for motion controllers will still come from such industries as machine tool, printing, packaging, and electronics while the industries like tobacco machinery and medical device will see a steadily growing demand for motion controllers. It is projected that by 2016 the demand for motion controllers in China will be close to 1.9 million sets, and that the market size of general motion controllers will be very likely to reach RMB4 billion or so.

China Motion Controller Industry Report, 2013-2016 released by ResearchInChina will mainly deal with the followings:

Development environment of motion controllers in China, including industry and policy environment, etc.;

Development environment of motion controllers in China, including industry and policy environment, etc.;

Market size of motion controllers in China and the expectations in the following 3 years, competition pattern (the market share of Top 10 manufacturers) as well as supply and demand, etc.;

Market size of motion controllers in China and the expectations in the following 3 years, competition pattern (the market share of Top 10 manufacturers) as well as supply and demand, etc.;

Application of motion controllers in downstream sectors (including machine tools, textile machinery, plastics machinery industry, etc.) in China and market analysis, etc.;

Application of motion controllers in downstream sectors (including machine tools, textile machinery, plastics machinery industry, etc.) in China and market analysis, etc.;

Operation of 11 key medium and low-voltage inverter manufacturers in China (including Leadshine Technology, Googol Technology, Adtech, Advantech and Leetro, etc.) and analysis of motion controller business, etc.

Operation of 11 key medium and low-voltage inverter manufacturers in China (including Leadshine Technology, Googol Technology, Adtech, Advantech and Leetro, etc.) and analysis of motion controller business, etc.

1. Profile of Motion Controller

1.1 Definition and Classification

1.2 Industry Access Barrier

1.3 Upstream and Downstream Industry Chain

2 Development Environment of Motion Controller Industry in China

2.1 Industry Environment

2.2 Policy Environment

3 Motion Controller Market in China

3.1 Development

3.2 Supply & Demand

3.3 Competition Pattern

4 Motion Controller Application Industry in China

4.1 Overview of Application Industry

4.2 Numerically Controlled Machine Tools

4.3 Textile Machinery

4.4 Medical Equipment

4.5 Electronic Equipment

4.6 Plastic Machinery

4.7 Printing Machinery

5 Major Motion Controller Manufacturers in China

5.1 Leadshine Technology

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Clients and Suppliers

5.1.6 R&D

5.1.7 Motion Controller Business

5.1.8 Development Prospects

5.2 ADTECH

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Clients and Suppliers

5.2.6 Motion Controller Business

5.2.8 Development Prospects

5.3 Leetro Automation Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Clients

5.3.6 R&D

5.3.7 Motion Controller Business

5.3.8 Development Prospects

5.4 Googol Technology (HK) Limited

5.4.1 Profile

5.4.2 Operation

5.4.3 Motion Controller Business

5.4.4 Investment

5.5 ADLINK

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Motion Control Card Business

5.5.6 Development Prospects

5.6 Advantech

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 R&D and Investment

5.6.6 Motion Control Card Business

5.6.7 Development Prospects

5.7 Sciyon

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.6.5 R&D and Investment

5.7.6 Motion Controller Business

5.7.7 Development Prospects

5.8 Shanghai Weihong Electronic Technology Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Clients and Suppliers

5.1.6 R&D and Investment

5.1.7 Motion Controller Business

5.1.8 Development Prospects

5.9 TOPCNC Automation Technology Co., Ltd.

5.9.1 Profile

5.9.2 Motion Controller Business

5.10 Tankon

5.10.1 Profile

5.10.2 Motion Controller Business

5.11 Haichuan Numerical Control Technology Co., Ltd.

5.11.1 Profile

5.11.2 Motion Controller Business

6 Summary and Forecast

6.1 Summary

6.2 Forecast

Classification of Motion Controllers

Motion Controller Industry Chain

Market Size of Servo System Products in China, 2006-2015E

Market Share of Servo Systems in China by Sector, 2013

Policies on Motion Controllers in China, 2004-2013

Development Trend of Motion Controller Industry in China

Market Size of Motion Controllers in China, 2006-2013

Market Share of Motion Controllers in China by Type, 2013

Market Size of General Motion Controllers in China, 2006-2013

Output of Motion Controllers in China, 2006-2013

Output of Control Shafts of Motion Controllers in China, 2006-2013

Demand for Motion Controllers in China, 2006-2013

Market Share of Major Motion Controller Manufacturers in China, 2013

Market Share of Major PC-based Motion Controller Manufacturers in China, 2013

Market Share Breakdown of Motion Controllers in China by Sector, 2013

Market Size of Machine Tools in China, 2006-2013

Market Size of Motion Control Products in CNC Machine Tool Industry in China, 2008-2015E

Market Size of Motion Control Products in Engraving and Milling Industry in China, 2008-2015E

Market Size of Motion Control Products in Engraving and Milling Industry in China, 2008-2015E

Market Size of Textile Machinery Industry in China, 2006-2015E

Application of Motion Controllers in Textile Machinery Industry in China by 2013

Market Size of Medical Device Industry in China, 2004-2013

Market Size of Electronic Equipment Manufacturing Industry in China, 2009-2015E

Market Size of Plastic Processing Machinery Industry in China, 2004-2013

Market Size of Printing Machinery Industry in China, 2004-2013

Revenue and Net Income of Leadshine Technology, 2011-2013

Revenue Structure of Leadshine Technology by Product, 2011-2013

Revenue Structure of Leadshine Technology by Region, 2011-2013

Revenue Structure of Leadshine Technology by Sales Model, 2011-2013

Leadshine Technology’s Revenue from Distributors and % of Total Revenue, 2011-2013

Revenue Structure of Leadshine Technology by Sector, 2011-2013

Gross Margin of Leadshine Technology by Product, 2011-2013

Leadshine Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2013

Leadshine Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Leadshine Technology’s Revenue Top 5 Clients and % of Total Revenue, 2011-2013

Leadshine Technology’s Revenue from Top 5 Clients and % of Total Revenue, 2013

R&D Costs of Leadshine Technology and % of Revenue, 2011-2013

General Motion Controller R&D Project of Leadshine Technology by 2014Q1

Leadshine Technology’s Revenue from Motion Controllers by Product, 2011-2013

Average Selling Price of Motion Controllers of Leadshine Technology, 2011-2013

Sales Volume and Gross Margin of Motion Controllers of Leadshine Technology, 2011-2013

Revenue and Net Income of Leadshine Technology, 2013-2016E

Revenue and Net Income of ADTECH, 2011-2013

Revenue Structure of ADTECH by Product, 2013

Gross Margin of ADTECH by Product, 2013

Main Motion Controllers of ADTECH

Revenue and Net Income of ADTECH, 2013-2016E

Revenue and Net Income of Leetro, 2011-2013

Revenue Structure of Leetro by Product, 2011-2013

Revenue Structure of Leetro by Region, 2011-2013

Gross Margin of Leetro by Product, 2011-2013

Leetro’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

R&D Costs of Leetro and % of Revenue, 2011-2013

Leetro’s Revenue and Gross Margin from Motion Controllers, 2011-2013

Main Motion Controllers of Leetro

Leetro’s Revenue and Gross Margin from Motion Controllers, 2013-2016E

Revenue and Net Income of Googol Technology, 2009-2010

Main Motion Controllers of Googol Technology

Revenue and Net Income of ADLINK, 2009-2013

Revenue Structure of ADLINK by Product, 2010-2013

Revenue Structure of ADLINK by Region, 2010-2013

Motion Control Card Products of ADLINK

Revenue and Net Income of ADLINK, 2013-2016E

Revenue and Total Profit of Advantech, 2008-2013

Revenue Structure of Advantech by Product, 2010-2013

Revenue Structure of Advantech by Region, 2010-2013

Gross Margin of Advantech, 2010-2013

R&D Costs of Advantech and % of Revenue, 2008-2013

List of Companies Acquired by Advantech, 2013

Revenue and Net Income of Companies Acquired by Advantech, 2013

Motion Control Card Products of Advantech

Revenue and Net Income of Advantech, 2013-2016E

Revenue and Net Income of Sciyone, 2008-2014

Revenue Structure Sciyon by Product, 2008-2013

Revenue Structure of Sciyon by Region, 2008-2013

Gross Margin of Sciyon by Product, 2008-2013

R&D Costs of Sciyon and % of Revenue, 2008-2013

Progress of Sciyon’s Self-Raised Fund Investment Projects by the End of 2013

Motion Controllers of Sciyon

Revenue and Net Income of Sciyon, 2013-2016E

Revenue and Net Income of Weihong Electronic, 2011-2013

Revenue Structure of Weihong Electronic by Product, 2011-2013

Revenue Structure of Weihong Electronic by Region, 2011-2013

Gross Margin of Weihong Electronic by Product, 2011-2013

Weihong Electronic’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2013

Weihong Electronic’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2013

R&D Costs of Weihong Electronic and % of Revenue, 2011-2013

Raised Fund Investment Projects of Listed Weihong Electronic, 2013

Sales Volume and Sales-output Ratio of Motion Control Cards of Weihong Electronic, 2011-2013

Revenue and Net Income of Shanghai Weihong Electronic Technology, 2013-2016E

Main Motion Controllers of TOPCNC

Main Motion Controllers of Tankon

Main Motion Controllers of Haichuan Numerical Control

Gross Margin of Chinese Motion Controller Manufacturers, 2011-2013

Demand for Motion Controllers in China, 2013-2016E

Market Size of General Motion Controllers in China, 2006-2016E

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...