Global and China Elevator Industry Report, 2019-2025

-

Nov.2019

- Hard Copy

- USD

$3,200

-

- Pages:230

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC092

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually 15.3 million sets in the year. The global sales of elevators continue an uptrend and will expectedly reach 810,000 sets in 2019 with a year-on-year increase of 1.3%.

Nowadays, the global elevator market is highly concentrated and firmly dominated by the giants like Otis, Schindler, Kone and ThyssenKrupp, and four of them held a combined 64.4% share of the world’s elevator market in 2018.

On a regional basis, Asia-Pacific is a region where elevators are massively produced and consumed, and China has been the largest producer and consumer of elevators in the world. Well-known elevator brands have already established either exclusively funded or joint-stock companies there.

In 2018, approximately 485,000 elevators were sold in China, a 1% rise from a year earlier alongside the burgeoning demand from the real estate sector and rail transit, and sharing 60.6% of the global total. It is expected that in the forthcoming years China’s elevator sales will continue to grow steadily under the drive of old buildings to be equipped with elevators, population aging, rail transit and real estate development, and the sales figure will jump to 610,000 sets in 2025.

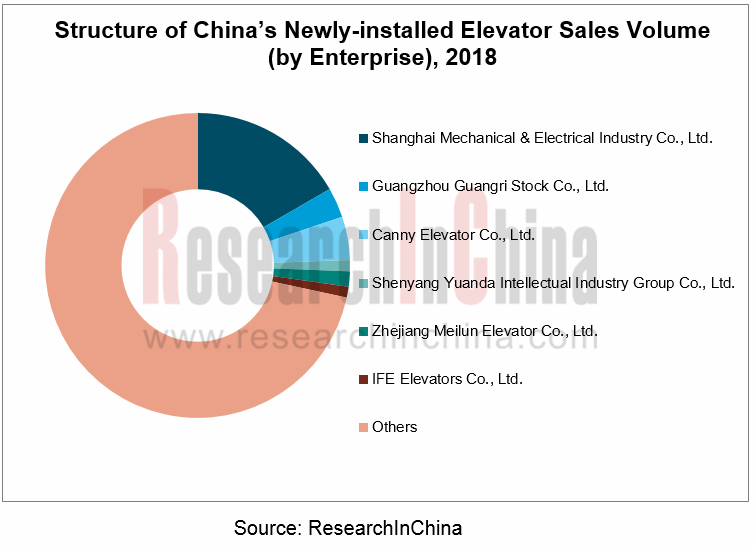

Adjustments are accelerated in the Chinese elevator industry with excess capacity, and competition between elevator makers pricks up and there is an obvious tendency of small players to be forced out of business. Chinese elevator manufacturers consist mainly of Shanghai Mechanical & Electrical Industry Co., Ltd., Canny Elevator Co., Ltd., Guangzhou Guangri Stock Co., Ltd., SJEC Corporation, Shenyang Yuanda Intellectual Industry Group Co., Ltd., Zhejiang Meilun Elevator Co., Ltd., and IFE Elevators Co., Ltd., among which Shanghai Mechanical & Electrical Industry Co., Ltd., Canny Elevator Co., Ltd., Guangzhou Guangri Stock Co., Ltd. enjoys higher sales at least 10,000 sets/year apiece. In 2018, Shanghai Mechanical & Electrical Industry sold a total of 80,753 elevators and swept the largest 16.7% share in China.

Chinese elevator maintenance market is developing by leaps and bounds with the growing ownership of elevators at home. If 5.5 million elevators in operation in 2018 and a maintenance cost of RMB8,000 per set in China are taken into account, the Chinese elevator maintenance market is currently worth RMB44 billion, a figure projected to surge to RMB64.8 billion in 2025 with the steady growth of new elevator market.

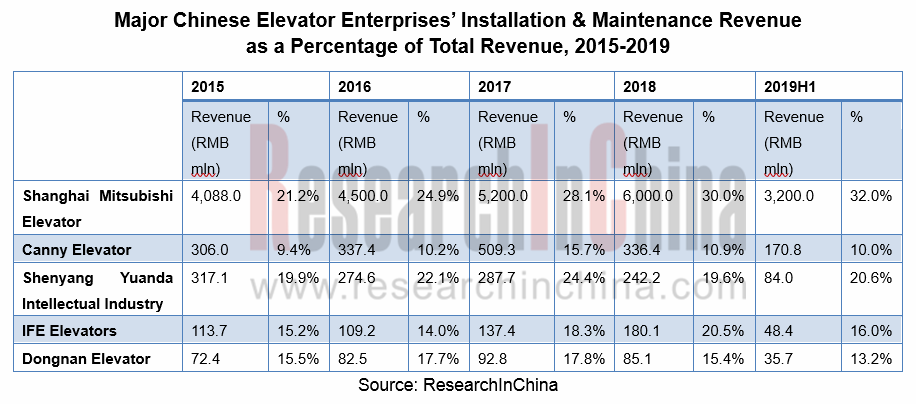

The Chinese players represented by Shanghai Mechanical & Electrical Industry Co., Ltd., Canny Elevator Co., Ltd., Shenyang Yuanda Intellectual Industry Group Co., Ltd., IFE Elevators Co., Ltd and Dongnan Elevator Co., Ltd. have forayed into the elevator installation and maintenance areas, particularly Shanghai Mechanical & Electrical Industry’s revenue from installation and maintenance services as a percentage of more than 30% in its total revenue.

The report covers:

Global elevator industry (new elevator market, maintenance market and competitive pattern);

Global elevator industry (new elevator market, maintenance market and competitive pattern);

China elevator industry (new elevator market, maintenance market, competitive landscape and development tendencies);

China elevator industry (new elevator market, maintenance market, competitive landscape and development tendencies);

The demand for elevators in China (downstream demand, demand structure, factors influencing the demand, etc.);

The demand for elevators in China (downstream demand, demand structure, factors influencing the demand, etc.);

12 Chinese and 7 foreign elevator manufacturers (operation, elevator business, investment in R&D, development strategies, among others.

12 Chinese and 7 foreign elevator manufacturers (operation, elevator business, investment in R&D, development strategies, among others.

1. Overview of Elevator Industry

1.1 Definition and Classification

1.2 Policy Environment

2. Development of Global Elevator Industry

2.1 New Elevator Market

2.1.1 Sales Volume

2.1.2 New Elevator Sales by Region

2.2 Maintenance Market

2.2.1 Elevator Ownership

2.2.2 Maintenance Market Becomes a Major Growth Engine

2.3 Competitive Landscape

2.4 Development Mode

2.4.1 Two Modes

2.4.2 Business Development in Asia-Pacific

2.4.3 Global Expansion

3. Development of China Elevator Industry

3.1 Product Structure

3.2 New Elevator Market

3.2.1 Status Quo

3.2.2 Sales Volume

3.2.3 Sales Volume of Major Enterprises

3.2.4 Market Size of Newly-installed Elevators

3.3 Maintenance Market

3.3.1 Status Quo

3.3.2 Elevator Ownership

3.3.3 Maintenance Market Size

3.3.4 Layout of Domestic Elevator Manufacturers in Maintenance Market

3.3.5 Maintenance Business Comparison between Major Enterprises

3.4 Import and Export

3.4.1 Import

3.4.2 Export

3.4.3 Import and Export Unit Price

3.5 Competitive Landscape

3.5.1 Layout of Foreign Brands in China

3.5.2 Financing of Local Enterprises

3.5.3 Operating Result Comparison between Major Enterprises

3.6 Summary & Forecast

3.6.1 New Elevator Keeps Growing Sales

3.6.2 Intelligent Manufacturing to Become Transformation Direction of Elevator Enterprises

3.6.3 Maintenance Service to realize industrialization

3.6.4 Industry concentration to be enhanced further

3.6.5 Old Building Equipped with An Elevator Brings Vast Room for Development

4. Demand of China Elevator Industry

4.1 Downstream Demand Structure

4.2 Demand Composition

4.3 Influencing Factors

4.3.1 Real Estate Sector

4.3.2 Urbanization

4.3.3 Aging Population

4.3.4 Urban Rail Transit

4.3.5 Renewal and Upgrading of Old Elevators

5. Key Elevator Companies in China

5.1 Shanghai Mechanical & Electrical Industry Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Elevator Business

5.1.6 Shanghai Mitsubishi Elevator Co., Ltd.

5.1.7 Mitsubishi Electric Shanghai Electric Elevator Co., Ltd.

5.1.8 R&D Investment

5.1.9 Development Strategy

5.2 Guangzhou Guangri Stock Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Elevator Business

5.2.6 Guangri Elevator

5.2.7 R&D Investment

5.3 Canny Elevator Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Elevator Business

5.3.6 R&D Investment

5.3.7 Development Strategy

5.4 SJEC Corporation

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Elevator Business

5.4.6 Typical Projects

5.4.7 R&D Investment

5.4.8 Development Strategy

5.5 Shenyang Yuanda Intellectual Industry Group Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Elevator Business

5.5.6 R&D Investment

5.5.7 Development Strategy

5.6 Dongnan Elevator Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Major Customers

5.6.6 Special Elevator Typical Projects

5.6.7 Development Strategy

5.7 Shandong Bunse Elevator Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 Major Customers

5.7.6 Typical Projects

5.7.7 R&D Investment

5.7.8 Development Strategy

5.8 Hunan Sida Intelligent Equipment Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 Major Customers

5.8.6 Typical Projects

5.8.7 R&D Investment

5.9 Rhine Elevator

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 Major Customers

5.9.6 R&D Investment

5.9.7 Development Strategy

5.10 Shenlong Elevator Co., Ltd.

5.10.1 Profile

5.10.2 Elevator Capacity, Output and Sales Volume

5.10.3 Typical Projects

5.10.4 Dynamics

5.11 Zhejiang Meilun Elevator Co., Ltd.

5.11.1 Profile

5.11.2 Operation

5.11.3 Revenue Structure

5.11.4 Gross Margin

5.11.5 Elevator Business

5.11.6 Development Strategy

5.12 IFE Elevators Co., Ltd.

5.12.1 Profile

5.12.2 Operation

5.12.3 Revenue Structure

5.12.4 Gross Margin

5.12.5 Elevator Business

6. Key Foreign Elevator Companies

6.1 Otis

6.1.1 Profile

6.1.2 Operation

6.1.3 Orders

6.1.4 Development in China

6.1.5 Otis Electric

6.1.6 Elevator Orders of Otis Electric

6.2 Hitachi

6.2.1 Profile

6.2.2 Operation

6.2.3 Elevator Business

6.2.4 Development in China

6.2.5 Orders in China

6.3 Schindler

6.3.1 Profile

6.3.2 Operation

6.3.3 Orders

6.3.4 Development in China

6.3.5 Orders in China

6.4 ThyssenKrupp

6.4.1 Profile

6.4.2 Operation

6.4.3 Elevator Business

6.4.4 Development in China

6.4.5 Orders in China

6.5 Toshiba

6.5.1 Profile

6.5.2 Operation

6.5.3 Elevator Business

6.5.4 Development in China

6.5.5 Orders in China

6.6 Fujitec

6.6.1 Profile

6.6.2 Operation

6.6.3 Orders

6.6.4 Development in China

6.7 Kone

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Development in China

6.7.5 Orders in China

Global Newly-Installed Elevator Sales Volume, 2010-2019

Global Newly-Installed Elevator Sales Volume by Region, 2010-2018

Global Newly-Installed Elevator Sales Volume Structure by Region, 2010-2018

Global Newly-Installed Elevator Sales Structure by Region, 2015-2018

Elevator Ownership per 1000 People and Utilization Rate in Major Countries, 2010-2030E

Global Elevator Ownership, 2013-2025E

KONE’s Maintenance Revenue as a Percentage of Total Revenue, 2005-2019

Global Elevator Market Share, 2018

Kone’s Order Intake in China and Sales Share, 2017-2018

Structure of Elevator Product

Market Share of Medium/Low Speed Elevator Product in China, 2005-2018

China’s Elevator Sales Volume, 2012-2019

Structure of China’s Newly-installed Elevator Sales Volume (by Enterprise), 2018

Newly-installed Elevator Sales of Major Chinese Elevator Enterprises, 2015-2019

Market Size of Newly-installed Elevators in China, 2012-2019

Market Share of Newly-installed Elevators by Company, 2018

Elevator Ownership in China, 2015-2025E

Elevator Maintenance Market Size in China, 2015-2025E

China’s Passenger Elevator/Escalator/Moving Walk Import Volume and Value, 2017-2019

Import Origins of Passenger Elevators, Escalators and Moving Walkways in China, Jan.-Sept.2019

Provinces/Municipalities Importing Passenger Elevators, Escalators and Moving Walkways in China, Jan-Sept.2019

China’s Passenger Elevator/Escalator/Moving Walkway Export Volume and Value, 2017-2019

Top 10 Destinations of the Exported Passenger Elevators from China, Jan.-Sept.2019

Top 10 Destinations of the Exported Escalators and Moving Walkways from China, Jan.-Sept.2019

Provinces/Municipalities Exporting Passenger Elevators in China, Jan-Sept.2019

Provinces/Municipalities Exporting Escalators and Moving Walkways in China, Jan-Sept.2019

China’s Passenger Elevator Import and Export Price, 2017-2019

China’s Escalator/Moving Walk Import and Export Price, 2017-2019

Market Share of Elevator Industry in China (by Enterprise), 2018

Sales Volume of Newly-installed Elevators in China, 2018-2025E

Policies/Documents about Promoting “Renovation of Old Buildings” in China, 2019

Elevator Downstream Demand Structure in China

Elevator Demand Market Components

Composition of Elevator Demand in China, 2018

Completed Investment in China’s Real Estate Development, 2010-2019

Commercial Building Sales Area in China, 2013-2019

Commercial Residential Building Sales in China, 2013-2019

Floor Space Newly Started in China, 2013-2019

Urbanization Rate in China, 2010-2018

Planned Starts, Actual Starts and Rate of Completions of China’s Shantytown Reconstruction Program, 2014-2020E

Proportion of Population Aged 60 or Above in China, 2010-2018

Total Operating Mileage of Urban Rail Transit in China, 2012-2018

Revenue and Net Income of Shanghai Mechanical & Electrical Industry, 2013-2019

Revenue Breakdown of Shanghai Mechanical & Electrical Industry (by Product), 2014-2018

Revenue Structure of Shanghai Mechanical & Electrical Industry (by Product), 2014-2018

Gross Margin of Shanghai Mechanical & Electrical Industry (by Product), 2014-2018

Output, Sales Volume and Inventory of Shanghai Mechanical & Electrical Industry, 2014-2018

Operating Performance of Shanghai Mitsubishi Elevator, 2014-2019

Installation & Maintenance Revenue of Shanghai Mitsubishi Elevator, 2014-2019

Operating Performance of Mitsubishi Electric Shanghai Electric Elevator, 2014-2019

R&D Costs and % of Total Revenue of Shanghai Mechanical & Electrical Industry, 2014-2019

Development Course of Shenlong Elevator

Product Specifications Covered by Shenlong Elevator’s CE Certification

Revenue and Net Income of Zhejiang Meilun Elevator, 2014-2019

Revenue Breakdown (by Product) of Zhejiang Meilun Elevator, 2014-2018

Revenue Structure (by Product) of Zhejiang Meilun Elevator, 2014-2018

Revenue Breakdown (by Region) of Zhejiang Meilun Elevator, 2014-2018

Revenue Structure (by Region) of Zhejiang Meilun Elevator, 2014-2018

Gross Margin (by Product) of Zhejiang Meilun Elevator, 2014-2018

Major Elevators of Zhejiang Meilun Elevator

Elevator Sales of Zhejiang Meilun Elevator, 2014-2018

Elevator Output of Zhejiang Meilun Elevator, 2014-2018

Zhejiang Meilun Elevator’s Usage of the Funds Raised via IPO

Revenue and Net of IFE Elevators, 2014-2019

Revenue Breakdown (by Product) of IFE Elevators, 2014-2019

Revenue Structure (by Product) of IFE Elevators, 2014-2019

Revenue Breakdown (by Region) of IFE Elevators, 2014-2018

Revenue Structure (by Region) of IFE Elevators, 2014-2018

Gross Margin of IFE Elevators, 2014-2019

Gross Margin (by Product) of IFE Elevators, 2014-2019

Major Elevators of IFE Elevators

Output and Sales Volume of IFE Elevators, 2014-2018

IFE Elevators’ Usage of the Funds Raised via IPO

Progress of IFE Elevators’ Investment Projects with the Funds Raised via IPO, by H1 2019

Classification of Elevator Products

Main Components of Elevator

Laws and Regulations on Chinese Elevator Industry, 2000-2017

Policies on Chinese Elevator Industry, 2006-2018

KONE’s M&A Cases and Their Influences

Schindler’s M&A Cases

Newly-installed Elevator Sales Volume of Major Chinese Elevator Enterprises, 2014-2018

Major Chinese Elevator Enterprises’ Installation & Maintenance Revenue as a Percentage of Total Revenue, 2015-2019

Comparison between Chinese and International Enterprises in High Speed Elevator Layout

Layout of Major Foreign Elevator Brands in China

Developments of Foreign Elevator Enterprises in China, 2011-2019

Comparison of Revenue from Major Chinese Elevator Enterprises, 2014-2019

Comparison of Net Income from Major Chinese Elevator Enterprises, 2014-2019

Elevator Maintenance Service Layout of Major Chinese Elevator Companies

Factors Influencing Elevator Demand Market Segments

Characteristics of Demand for Elevators under the New-type Urbanization

Number of Elevators to Be Updated in China, 2010-2024E

Major Orders of Shanghai Mitsubishi Elevator, 2018

Milestones in Development of Shanghai Mitsubishi Elevator

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...