Global and China Wafer Foundry Industry Report, 2013-2014

-

Sep.2014

- Hard Copy

- USD

$2,300

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

ZYW183

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Global and China Wafer Foundry Industry Report, 2013-2014 is all about the followings:

1. Overview of Global Semiconductor Industry

2. Downstream Market of Wafer Foundry Industry

3. Wafer Foundry Industry

4. Semiconductor Industry in China

5. 13 Key Wafer Foundry Vendors

The wafer foundry market experienced a wavy development, jumping by 39.4% in 2010 following a 7.9% decline in 2009. And the growth rate first shrank to 8.7% in 2011, then expanded to 21.7% in 2012, and fell back to 6.8% in 2013. It is projected that the growth rate will stand at 15.6% in 2014 and 6.0% in 2015. The fluctuation in the wafer foundry market will begin to present an increasingly small growth rate, which is mainly because of the differentiation in wafer foundry industry.

In terms of product type, foundry can be divided into two categories: Logic IC Foundry and specifically Foundry. The former is mainly comprised of high-shipment Logic IC, including CPU, GPU, Baseband, Application Processor, FPGA, APU, PLD, Networking Processor, and DTV MPU, etc. And the latter primarily consists of analog IC, mixed signals, Power IC, NVM, RF/HPA, CIS, MEMS, DDI (Display Driver). For the former, it is necessary to continuously improve manufacturing process and constantly narrow the line width, which could not only improve performance and reduce power consumption, but also reduce costs. These products update quickly, with the life cycle typically no more than three years, which requires a massive fund for developing next-generation technologies. As for the latter, however, its products have a long life cycle, with the life cycle for analog IC generally exceeding 5-10 years. And even a more than 20-year life cycle is not rare. These products can narrow line width but fail to reduce costs, and could increase costs instead. The specifically Foundry has a small market size and stable sales volume, but with low costs and high returns. In contrast, Logic IC Foundry has a large market size, but with a considerable fluctuation. Most important, only the leading player in the Logic IC Foundry industry can make profit, otherwise it is easy to make a loss. Take TSMC for example, which has taken the lead in the global market since its establishment in 1987, with its market share never less than 50%. Besides, TSMC is also the wafer foundry vendor that earns the highest profit around the globe, with the gross margin never lower than 40% even close to 50% in 2014 (exceeding Apple and Qualcomm). The No.2, No.3 and No. 4 players have ever suffered losses for many years, with SMIC, for example, making profit only in 2010 during the 12 years from 2000 to 2011. And the third player, Global Foundries, has suffered losses for years, with the revenue in 2013 showing a slight growth but the operating loss expanding from AED2.217 billion to AED3.217 billion.

According to the nature of the vendors, the foundry businesses can be divided into two segments, namely, IDMs offering their excess capacity to third parties and pure-play (or dedicated) foundries, with the former including Samsung, Intel, and IBM. Global Foundries can be barely included in IDMs, for it originated from AMD. These vendors have long product lines, which makes it possible to cause competition with their customers. And IDMs, in reality, are not involved in foundry businesses and could conduct foundry business only when they have excess capacity. These IDMs will not become the first choice of the customers unless special reasons.

Money and technology do not always help do well in wafer foundry industry, which has been best illustrated by IBM. Recently, IBM was willing to pay USD1 billion for the sale of its wafer foundry business to Global Foundries. And Global Foundries suggested that the payment was very small and should be expanded to USD2 billion due to the fact that the business, which generates revenue of less than USD500 million annually, caused IBM to suffer approximately USD1.5 billion loss a year. Except TSMC, most foundries have more or less bought IBM's technology, especially Samsung, STMicroelectronics, and Global Foundries, which are all technologically brought up by IBM.

Over the years, the four giants—Samsung, STMicroelectronics, Global Foundries, and IBM have formed an alliance in a vain attempt to compete against TSMC. Instead, TSMC has grown stronger and stronger. After years of efforts, Samsung has won a client in wafer foundry business—Apple. Unfortunately, the order of Apple’s main products A8 was gained by TSMC in 2014, thus leading to the first loss of Samsung System LSI Division over the years.

Although Samsung’s 14nm technology seems to take the lead, this is not approved by Apple. This is mainly because the four companies—Samsung, STMicroelectronics, Global Foundries, and IBM all developed from IDM. And Samsung has a long product line and therefore could compete with any electronic company in the world. Previously, Apple did not choose TSMC because the company suffered capacity constraints, and as TSMC’s capacity was expanded and met Apple’s requirements, Apple lost no time in making a shift from Samsung to TSMC.

Unlike IDMs such as Samsung, TSMC is pure-play foundry and will not compete with clients, which makes it easier for the company to get orders. And Samsung, STMicroelectronics, Global Foundries, IBM and Intel are the second choices for the clients.

The investment of Chinese enterprises in the field of semiconductors is totally dependent on the government, resulting in a lower efficiency. In 2010, Shanghai Huali Microelectronics Corporation was established with an investment of RMB14.5 billion. Although it had been into operation for 3 years, the company's revenue was less than RMB1.2 billion in 2013. SMIC’s major clients include Spreadtrum, RDA, Hisilicon, GalaxyCore Inc., Rockchip, Allwinner Technology, GigaDevice, HED, Fudan Microelectronics, TMC, and DMT. The last few enterprises, which are mainly relied on the government orders, are the major design houses of chips for a variety of smart cards, including social security cards, ID cards, SIM cards, Union Pay cards. Therefore, 40% of SMIC’s revenue came from the low-end 0.15/0.18μm technology while TSMC’s revenue from lower than 65 nm technology accounted for 71% of the total.

1 Global Semiconductor Industry

1.1 Overview of Semiconductor Market

1.2 Semiconductor Industry Suppy Chain

1.3 Overview of Semiconductor Industry

1.4 Semiconductor Industry Expenditure Trend

2 Foundry Downstream Market

2.1 Mobile Phone Market

2.2 Mobile Phone Industry

2.3 PC Market

2.4 Tablet PC Market

2.5 Baseband IC and AP industries

3 Foundry Industry

3.1 Industry Size

3.2 Industry Competition

3.3 Industry Ranking

3.4 Foundry Development Trends

3.5 Overview of Semiconductor Industry in China

3.6 Overview of Semiconductor Market in China

3.7 Ranking of China’s Semiconductor Market

3.8 Wafer Foundry Trends in China

4 Foundry Vendors

4.1 TSMC

4.2 UMC

4.3 SMIC

4.4 VIS

4.5 POWERCHIP

4.6 HHGRACE

4.7 DONGBU HITEK

4.8 TOWER

4.9 X-FAB

4.10 ASMC

4.11 SAMSUNG

4.12MAGNACHIP

4.13 GLOBALFOUNDRIES

Semiconductor Industry Growth versus Worldwide GDP Growth, 1990-2014

Quarterly Revenue of Global Semiconductor Industry, 2012-2014

Global Semiconductor Market Breakdown by Product, 2012-2017E

Market Size Growth of Various Semiconductor Products, 2012-2017E

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Top 25 Semiconductor Sales Leaders, 1Q2014

Worldwide IC Sales by Company Headquarters Location, 1990-2013

Fabless IC Sales Market Share by Company Headquarters Location, 2013

Top 10 IC Vendors in China, 2008-2013

Top 10 Spenders Capital Spending Outlook, 2011-2014F

Top 5 Share of Total Semiconductor Capital Spending, 1994-2013

Proportion of Global Semiconductor Capital Spending in Full-Year Budget, 1Q2014

Average IC Costs Per Mobile Phone, 2008-2016E

Global Mobile Phone Shipments, 2007-2015E

Worldwide Mobile Phone Sales to End Users by Vendor, 2006- 2013

Worldwide Smartphone Sales to End Users by Vendor, 2006-2013

Worldwide Smartphone Sales to End Users by Operating System, 2013

Shipments of Major Mobile Phone Vendors, 1Q2013-1Q2014

Shipments of Global CPU and Discrete GPU for PCs, 2008-2015E

Notebook PCs Shipments, 2008-2015E

Shipments of Major Global Notebook PC ODM Vendors, 2010-2013

Global Tablet PCs Shipments, 2011-2016E

Market Share of Major Tablet PC Brands, 2013

Output of Global Tablet PC Vendors, 2012-2013

Market Share of Major Baseband Companies by Revenue, 2014

Market Share of Major AP Companies by Revenue, 2014

Market Share of Major Baseband Companies by Unit, 2014

Market Size of Global Foundry, 2008-2015E

Foundry Revenue of Advanced Node, 2012-2017E

Global Foundry Capacity by Node, 2012-2018E

Global Foundry Revenue by Node, 2012-2018E

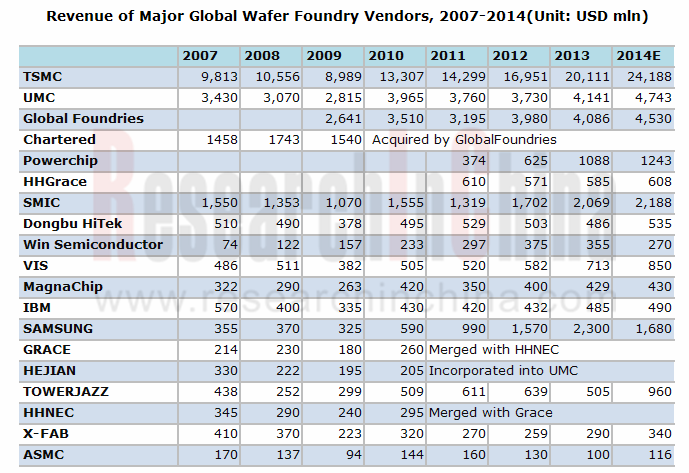

Global Ranking by Foundry, 2005-2014

Semiconductor Market Size in China, 2003-2014

Output of Main Electronic Products in China, 2008-2014

Top 10 Semiconductor Suppliers to the Chinese market, 2012–2013

Ranking of Semiconductor Companies in China, 2013

Ranking of Top 10 IC Design Houses in China by Sales, 2013

Organization Structure of TSMC

Revenue, Gross Margin and Operating Margin of TSMC, 2005-2014

TSMC’s Wafers Shipments and Utilization, 2004-2013

TSMC’s Market Capitalization, 2009-2013

TSMC’s Assets and Shareholders’ Equity, 2009-2013

TSMC’s R&D Expenses, 2009-2014

TSMC’s Capital Investment, 2009-2014

TSMC’s Quarterly Revenues, Gross Profit, Operation Income and Net Income, 2012Q1-2014Q2

TSMC’s Quarterly Revenues and Wafers Shipments, 2012Q1-2014Q2

TSMC’s Quarterly Revenues by Node, 2012Q1-2014Q2

TSMC’s Quarterly Revenues by Application, 2012Q1-2014Q2

TSMC’s Quarterly Revenues by Region, 2012Q1-2014Q2

TSMC’s Quarterly Wafer Shipments and ASP, 2013Q1-2014Q4

TSMC’s Quarterly Wafer Shipments and Utilization, 2013Q1-2014Q4

TSMC’s Fab List

Financial Figures of TSMC's Shanghai Factory, 2013

UMC’s Revenue and Operating Margin, 2004-2014

UMC’s Shipments and Capacity Utilization, 2004-2013

UMC’s Quarterly Revenue and Gross Margin, 2012Q3-2014Q2

UMC’s Quarterly Revenue by Node, 2012Q3-2014Q2

UMC’s Quarterly Revenue by Region, 2012Q3-2014Q2

UMC’s Quarterly Revenue by Application, 2012Q3-2014Q2

UMC’s Quarterly Capacity, 2006Q1-2014Q2

UMC’s Operating Revenue by Client Location, 2012-2013

Revenue and Operating Margin of SMIC, 2003-2014

SMIC’s Capacity, 2008-2014

SMIC’s Gross Margin, 2008-2014

SMIC Quarterly Gross Margin, 2009Q1-2014Q1

SMIC’s Quarterly Net Margin, 2009Q1-2014Q1

Revenue Breakdown of SMIC by Region, 2010-2013

SMIC’s Quarterly Revenue Breakdown by Geography, 2013Q2-2014Q2

Revenue Breakdown of SMIC by Application, 2010-2013

SMIC’s Quarterly Revenue Breakdown by Application, 2013Q2-2014Q2

SMIC’s Revenue Breakdown by Node, 2010-2013

SMIC’s Quarterly Revenue Breakdown by Node, 2013Q2-2014Q2

SMIC’s Quarterly Capacity, 2013Q2-2014Q2

SMIC’s Quarterly Utilization (%), 2009Q1-2014Q1

ORGANIZATION OF VIS

VIS’s Revenue and Operating Margin, 2005-2014

VIS’S Quarterly Revenue and Gross Margin1, 1Q2012-2Q2014

VIS’S Quarterly Revenue and UTIL Rate, 1Q2012-2Q2014

VIS’S Quarterly Revenue Breakdown by Node, 1Q2012-2Q2014

VIS’S Quarterly Revenue Breakdown by Application, 1Q2012-2Q2014

VIS’S Quarterly Revenue Breakdown by Product, 1Q2012-2Q2014

Organization Structure of Powerchip

Monthly Revenue of Powerchip, 7/2012-7/2014

Revenue, Gross Profit, and Operating Income of HHGRACE, 2011-2013

Revenue, Net Income, Asset-liability Ratio of HHGRACE, 2011-2014

Revenue Breakdown of HHGRACE by Product, 2011-2013

Revenue Breakdown of HHGRACE by Node, 2011-2013

Capacity Utilization of HHGRACE, 2011-2013

Revenue Breakdown of HHGRACE by Client, 2011-2013

Revenue Breakdown of HHGRACE by Region, 2011-2013

Revenue Breakdown of HHGRACE by Application, 2011-2013

Revenue and Operating Margin of Dongbu HiTek, 2005-2014

Profile of Dongbu Hitek

Revenue and Gross Margin of TowerSemi, 2003-2014

Tower Semiconductor Shareholders Structure

Revenue and Gross Margin of ASMC, 2003-2014

ASMC’s Revenue Breakdown by Applications, 2Q13-2Q14

ASMC’s Revenue Breakdown by Region, 2Q13-2Q14

ASMC’s Revenue Breakdown by Client, 2Q13-2Q14

ASMC’s Revenue by Fab, 2Q13-2Q14

ASMC’s UTIL Rate (%), 2Q13-2Q14

Revenue and Operating Margin of Samsung’s System LSI Division, 2009-2015

MagnaChip’s Revenue and Gross Margin, 2005-2014

MagnaChip’s Revenue and Operating Margin, 2005-2014

MagnaChip’s Revenue Breakdown by Product, 2004-2013

MagnaChip’s Revenue Breakdown by Region, 2004-2013

Wafer Fabs of MAGNACHIP

Financial Figures for Global Foundries, 2012/2013

Global Foundries Milestone

Global Foundries Global Footprints

GLOBALFOUNDRIES Corporate Headquarters

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...