Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

-

Jan.2020

- Hard Copy

- USD

$2,800

-

- Pages:132

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

ZLC095

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$3,000

-

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and its price kept rising worldwide in the first three quarters of 2018 as the global MLCC capacity structure changed and the robust demand from new applied markets of terminals grew substantially. Entering the fourth quarter of 2018, MLCC price fell a bit due to the Sino-US trade frictions, the decreasing demand for consumer electronics like smart phone, among others. As estimated, the world’s MLCC market was worth $12.8 billion in 2018, surging by 21.9% on annualized basis. In 2025, the global MLCC market size will be up to $24 billion in pace with advances in communication standards and the popularization of new energy vehicle.

China is not only the key manufacturing base for global consumer electronics but also the world’s producer and consumer of MLCCs. Spurred by strong demand from downstream industries, Chinese MLCC market is enlarging from RMB67.353 billion (up 21% YoY) in 2018 to expectedly RMB130.015 billion in 2025.

MLCC mainly finds application in such fields as consumer electronics, automotive electronics, industry/IoT/security, and military electronics. Noticeably, 64.2% of MLCCs get used in consumer electronics, accompanied by the rising share of MLCC use for new energy vehicle from 11.2% in 2018 to an estimated 19.3% in 2025 as new energy vehicle springs up.

The world-renowned MLCC vendors come mainly from Japan, South Korea and Taiwan (China) and they are divided into three echelons. The giants including Murata, Samsung Electro-Mechanics, TDK, Taiyo Yuden, and Yageo stay ahead of other peers by superiorities in ceramic powder materials and manufacturing technologies. Japanese players are in supremacy in small high-capacity and ceramic powder technologies and boast complete product matrices. The competitors from Taiwan (China), South Korea and the United States have their own edges, while the Mainland Chinese counterparts are in the third echelon.

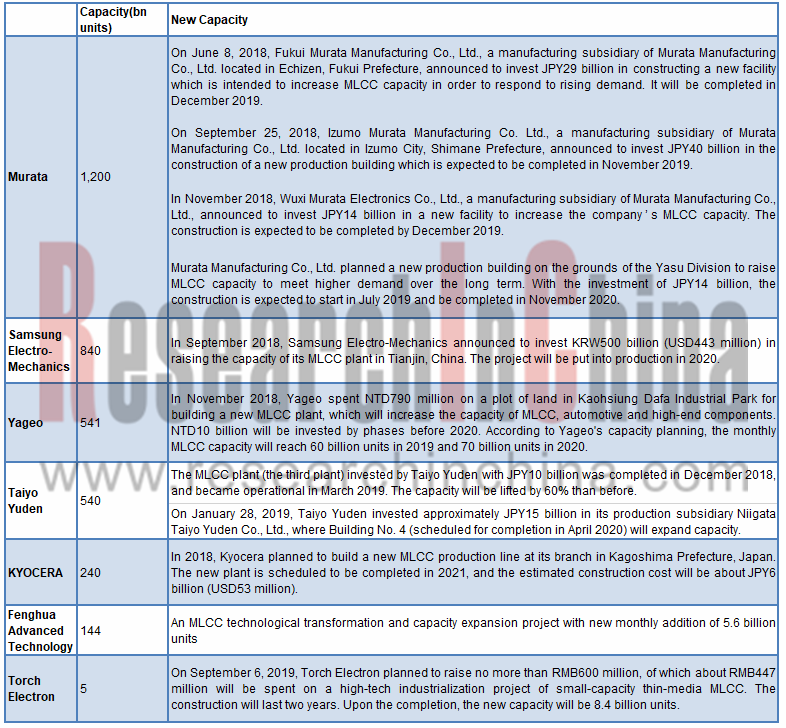

Starting from 2017, Japanese and Korean MLCC tycoons have been pushing ahead with industrial upgrading and gearing towards small high-end capacitors with high capacity. The global under-capacity of MLCC caused MLCC price to rise ever in 2018, alluring key companies like Murata, Samsung, Yageo and Taiyo Yuden to lavish huge capital in capacity expansion successively. It is expected that global MLCC capacity will reach 6,100 billion units per year in 2025 and the tight supply will be eased then.

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2019-2025 highlights the following:

MLCC market (size, production & sales, demand, capacity and competitive pattern);

MLCC market (size, production & sales, demand, capacity and competitive pattern);

MLCC market segments (military, industrial, consumer electronics, automotive electronics);

MLCC market segments (military, industrial, consumer electronics, automotive electronics);

Upstream sectors;

Upstream sectors;

8 foreign and 7 Chinese MLCC companies (operation, products, etc.).

8 foreign and 7 Chinese MLCC companies (operation, products, etc.).

1. Overview of MLCC Industry

1.1 Product Definition

1.2 Main Classification of Ceramic Capacitor

1.3 Trends of MLCC Products

1.4 Industry Supervision and Laws & Regulations

1.5 Industry Policy

2. MLCC Market Size

2.1 Overall Market Size

2.2 Production & Sales

2.3 Capacity

2.4 Competitive Landscape

3. Market Segments

3.1 Military

3.2 Industrial Products

3.3 Consumer Electronics Market

3.4 Automotive Electronics Market

4. Upstream Materials Market

4.1 Introduction to MLCC Ceramic Materials

4.2 Supply

4.3 Demand

4.4 Competitive Landscape

5. Major Foreign MLCC Vendors

5.1 Murata

5.1.1 Profile

5.1.2 Operation

5.1.3 Main Business

5.1.4 Orders

5.1.5 Main Products

5.1.6 Wuxi Murata Electronics Co., Ltd

5.1.7 Beijing Murata Electronics Co., Ltd.

5.1.8 Capacity Expansion Plan

5.1.9 Latest Advances

5.2 Samsung Electro-Mechanics

5.2.1 Profile

5.2.2 Operation

5.2.3 Product Structure

5.2.4 Regional Structure

5.2.5 Main Products

5.2.6 Dongguan Samsung Electro-Mechanics Co., Ltd. (DSEM)

5.2.7 Tianjin Samsung Electro-Mechanics Co., Ltd. (TSEM)

5.2.8 Samsung Electro-Mechanics Co., Binhai Branch Factory

5.2.9 Samsung Electro-Mechanics Co., Suzhou Branch Factory

5.2.10 Capacity Expansion Plan

5.3 TDK

5.3.1 Profile

5.3.2 Operation

5.3.3 Main Business

5.3.4 Product

5.3.5 R&D

5.3.6 Latest Advances

5.3.7 Production Bases in China

5.3.8 TDK Xiamen Co., Ltd.

5.4 KYOCERA

5.4.1 Profile

5.4.2 Operation

5.4.3 Main Business

5.4.4 Main Products

5.4.5 R&D

5.4.6 Shanghai KYOCERA Electronics Co., Ltd.

5.4.7 Latest Advances

5.5 Taiyo Yuden

5.5.1 Profile

5.5.2 Operation

5.5.3 Main Business

5.5.4 R&D expenses

5.5.5 Main Products

5.5.6 Strategy for MLCC Development

5.5.7 Dongguan Taiyo Yuden Co., Ltd.

5.5.8 Latest Advances

5.6 KEMET

5.6.1 Profile

5.6.2 Operation

5.6.3 Main Business

5.6.4 Main Products

5.7 Samwha Electric

5.7.1 Profile

5.7.2 Main Products

5.7.3 Tianjin Samwha Electric Co., Ltd.

5.8 Nippon Chemi-Con

5.8.1 Profile

5.8.2 Operation

5.8.3 Main Business

5.8.4 Main Products

6. Major Chinese MLCC Manufacturers

6.1 Fenghua Advanced Technology

6.1.1 Profile

6.1.2 Operation

6.1.3 Main Business

6.1.4 Gross Margin

6.1.5 Production, Sales, and Capacity of Main Products

6.1.6 Customers & Suppliers

6.1.7 R&D

6.1.8 Guanhua Chip Type Ceramic Capacitor Branch

6.2 Tianli Holdings Group Limited

6.2.1 Profile

6.2.2 Operation

6.2.3 Main Business

6.2.4 Gross Margin

6.2.5 Main Products

6.2.6 R&D

6.3 Chaozhou Three-circle

6.3.1 Profile

6.3.2 Operation

6.3.3 Main Business

6.3.4 Main Products

6.3.5 R&D

6.4 Torch Electron

6.4.1 Profile

6.4.2 Operation

6.4.3 Main Business

6.4.4 Gross Margin

6.4.5 R&D

6.4.6 Main Products

6.4.7 Production Lines and Capacity

6.5 Walsin Technology

6.5.1 Profile

6.5.2 Operation

6.5.3 Main Business

6.5.4 Main Products

6.5.5 Production & Sales

6.5.6 Major Customers and Channels

6.5.7 Development Strategy

6.5.8 Dongguan Walsin Technology Electronics Co., Ltd.

6.6 Yageo

6.6.1 Profile

6.6.2 Operation

6.6.3 Main Business

6.6.4 Main Products

6.6.5 Production & Sales

6.6.6 Production Layout

6.6.7 Yageo Electronics (China) Co., Ltd.

6.7 Holy Stone

6.7.1 Profile

6.7.2 Operation

6.7.3 Main Business

6.7.4 Main Products

6.7.5 Production & Sales

6.7.6 Global Layout

Main Production Processes and Technologies of MLCC

MLCC Industry Chain

Mainstream MLCC Size, 1996-2020

Market Size of Global MLCC Industry, 2013-2025E

Market Size of China MLCC Industry, 2013-2025E

Market Size of China MLCC Industry (by Application), 2018&2025E

China’s MLCC Output and Sales, 2016-2025E

China’s MLCC Demand, 2016-2025E

Global MLCC Manufacturers Distribution, 2018

Global MLCC Capacity Distribution, 2018

Global MLCC Capacity, 2012-2025E

Growth Rate of Global MLCC Market (by Region), 2019-2024E

Market Share of Global Major MLCC Manufacturers, 2018

Main Applications of Military MLCC

China's Defense Budget Growth Rate, 2011-2019

China’s Military MLCC Market Size, 2016-2025E

Comparison of Gross Margin (by Business Model) between Military and Civil MLCC Companies in China

China’s Industrial MLCC Market Size, 2016-2025E

Number of MLCC Used in Each Generation of iPhones

Number of MLCC Used in Phones with Different Communication Standards

China’s Consumer Electronics MLCC Market Size, 2016-2025E

Global Demand from New Energy Vehicle for MLCCs, 2018-2025E

China’s Automotive Electronics MLCC Market Size, 2016-2025E

Global MLCC Electronic Ceramics Output, 2017-2025E

Global Demand for MLCC Electronic Ceramics, 2017-2025E

Market Share of Global Major MLCC Electronic Ceramics Manufacturers, 2019

Revenue and Net Income of Murata, FY2012-FY2019

Revenue and Net Income of Samsung Electro-Mechanics, 2011-2019

Revenue and Net Income of DSEM, 2011-2018

Revenue and Net Income of TSEM, 2011-2018

Five Core Technologies and 15 Key Businesses of TDK

Revenue and Net Income of TDK, FY2013-FY2020

Automotive MLCCs of TDK

R&D Expenses to Net Sales Ratio, FY2014-FY2019

Revenue and Net Income of Kyocera, FY2013-FY2020

R&D Expenditure of Kyocera, FY2014-FY2019

Revenue and Net Income of Taiyo Yuden, FY2013-FY2020

Revenue Structure (by Application) of Taiyo Yuden, FY2015-FY2019

R&D Expenditure of Taiyo Yuden, FY2015-FY2019

MLCC Development Course of Taiyo Yuden

Main MLCC Products of Taiyo Yuden

TAIYO YUDEN’s MLCC Strengths in Automobile Market

MLCC Development Strategy Map of Taiyo Yuden

MLCC Production Bases of Taiyo Yuden

Revenue and Net Income of KEMET, FY2013-FY2020

Revenue of KEMET by Product& Region, 1HFY2020

Parameters of Samwha Electric’s MLCCs

Revenue and Net Income of Nipppon Chemi-kon, FY2014-FY2019

Revenue of Nippon Chemi-kon by Product, FY2016-FY2019

Revenue and Net Income of Fenghua Advanced Technology, 2012-2019

Revenue of Fenghua Advanced Technology (by Region), 2012-2019

R&D Costs and % of Total Revenue of Fenghua Advanced Technology, 2012-2019

Progress of Big Non-equity Investment Projects of Fenghua Advanced Technology, H1 2019

Revenue and Net Income of Tianli Holdings, 2012-2019

MLCC Gross Margin of Tianli Holdings, 2011-2019

R&D Costs and % of Total Revenue of Tianli Holdings, 2012-2019

Revenue and Net Income of Chaozhou Three-circle, 2011-2019

Main MLCC Products of Chaozhou Three-circle

R&D Costs and % of Total Revenue of Chaozhou Three-circle, 2011-2019

Revenue and Net Income of Torch Electron, 2011-2019

R&D Costs and % of Total Revenue of Torch Electron, 2013-2019

New Products of Torch Electron

Own Business, Proxy Business and Corresponding Customers of Torch Electron

Revenue and Net Income of Walsin Technology, 2012-2019

Main MLCC Series of Walsin

Main Customer Categories and % of Total Revenue of Walsin, 2018

Main Channels and % of Total Revenue of Walsin, 2018

Revenue and Net Income of Yageo, 2012-2019

Product Category of Yageo

MLCC Factory Overview of Yageo, 2019

Revenue and Net Income of Holy Stone, 2013-2019

Global Layout of Holy Stone, 2018

Advantages and Applications of Main Capacitor Products

Main Classification of Capacitors

China’s Policies on MLCC and Related Material Industries

MLCC Capacity Expansion Plan of Major Manufacturers, 2019

MLCC Production Distribution of Foreign Manufacturers in China

MLCC Maker Production Capacity, 2018

Number of MLCC Demanded in Different Vehicle Models and Sub-systems

Classification and Application of MLCC Electronic Ceramics Materials

Basic Information of Murata

Revenue of Murata (by Product), FY2016-FY2019

Revenue of Murata (by Region), FY2015-FY2019

Revenue of Murata (by Application), FY2015-FY2019

Main Product Orders of Murata, FY2017-FY2019

Main MLCC Product Series of Murata

Basic Information of Wuxi Murata Electronics

Basic Information of Beijing Murata Electronics

New Factory Construction Plan of Wuxi Murata Electronics

Specification of NFM18HC series

Revenue and Profit Structure (by Product) of Samsung Electro-Mechanics, 2016-2019

Regional Distribution of Samsung Electro-Mechanics’ Major Products and Customers

Revenue and Profit Structure (by Region) of Samsung Electro-Mechanics, 2016-2018

MLCC Product Series of Samsung Electro-Mechanics

Basic Information of TDK

Revenue of TDK (by Product), FY2018-FY2020

Revenue of TDK (by Region), FY2014-FY2020

Main Passive Components Product of TDK

Technical Parameters of MEGACAP Type with Metal Terminal

Main Passive Components Production Bases of TDK in China

Basic Information of TDK Xiamen

Main MLCC Products of TDK Xiamen

Basic Information of Kyocera

Key Segment and Product of Kyocera

Revenue of Kyocera (by Product), FY2015-FY2020

Revenue of Kyocera (by Region), FY2015-FY2019

MLCC Product Series of Kyocera

Basic Information of Shanghai Kyocera Electronics

Parameter Indicators of Kyocera’s 0201 / 01005 MLCC

Basic Information of Taiyo Yuden

Revenue of Taiyo Yuden (by Product), FY2015-FY2020

Revenue of Taiyo Yuden (by Region), FY2015-FY2019

Basic Information of Taiyo Yuden (Guangdong)

Main Parameter Indicators of PMK432 BJ108MU-TE

Revenue of KEMET by Product, FY2017-FY2019

Revenue of KEMET by Region, FY2017-FY2019

Major MLCC Products of KEMET

Main MLCC Products of Samwha Electric

Basic Information of Tianjin Samwha Electric

Revenue of Nippon Chemi-kon by Product, FY2016-FY2018

Revenue of Nippon Chemi-kon by Region, FY2017-FY 2018

MLCC Product Series of Nippon Chemi-kon

Revenue of Fenghua Advanced Technology (by Product), 2017-2019

Gross Margin of Fenghua Advanced Technology (by Product), 2016-2019

Output, Sales Volume, and Inventory of Fenghua Advanced Technology (by Product), 2016-2018

Fenghua Advanced Technology’s Sales from Top 5 Customers and % of Total Sales, 2017-2018

Fenghua Advanced Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2017-2018

5.6 billion units/month MLCC Technology Transformation & Production Expansion Project of Fenghua Advanced Technology

Revenue of Tianli Holdings (by Product), 2016-2019

Revenue of Tianli Holdings (by Region), 2016-2018

Main MLCC Products of Tianli Holdings

Revenue Breakdown and Structure of Chaozhou Three-circle (by Product), 2016-2019

Revenue Breakdown of Chaozhou Three-circle (by Region), 2011-2019

Revenue of Torch Electron (by Product), 2016-2019

Revenue of Torch Electron (by Region), 2013-2019

Gross Margin of Torch Electron by Product, 2016-2019

Main Products of Torch Electron

Main Capacitor Production Lines of Torch Electron

Revenue Structure of Walsin (by Product), 2013-2018

Revenue Breakdown of Walsin (by Region), 2015-2018

Capacity and Output of Walsin (by Product), 2015-2018

Sales Volume and Value of Walsin (by Product), 2017-2018

Basic Information of Dongguan Walsin Technology Electronics

Revenue Structure of Yageo (by Product), 2013-2018

Revenue Structure of Yageo (by Region), 2012-2018

MLCC Product Series of Yageo

Capacity and Output of Yageo (by Product), 2015-2018

Sales Volume and Value of Yageo (by Product), 2017-2018

Basic Information of Yageo Electronics (China)

Revenue Structure of Holy Stone by Product, 2013-2018

Revenue Structure of Holy Stone by Region, 2016-2018

MLCC Product Series of Holy Stone

Capacity and Output of Holy Stone, 2016-2018

Sales Volume and Value of Holy Stone, 2017-2018

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...