China Relay Industry Report, 2015-2018

-

Sep.2015

- Hard Copy

- USD

$2,400

-

- Pages:96

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZLC024

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

China is the key production base of relays in the world, with its output holding more than 50% of global total. Driven by the expanding demand from downstream markets, China’s relay sales and output reported RMB18.5 billion and about 6.79 billion units separately in 2014, when home appliance relay and automotive relay, as the main categories in Chinese relay market, swept shares of 30% and 18.7% respectively.

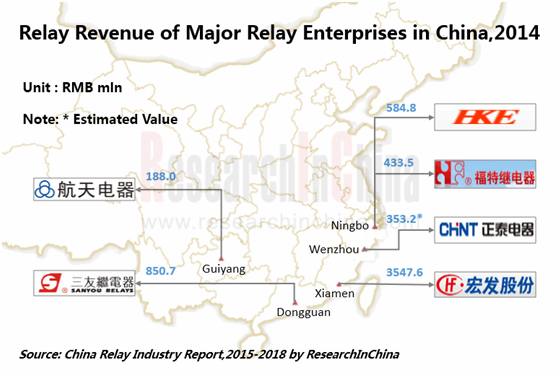

Presently, the high-end relay market in China is principally monopolized by foreign brands such as Omron, Panasonic and TE Connectivity, while the low-end market is controlled by local Chinese players like Hongfa Technology, Dongguan Sanyou Electrical Appliances, Zhejiang HKE, Ningbo Forward Relay, and Guizhou Space Appliance.

As the leader in Chinese relay industry, Hongfa Technology boasts annual capacity of producing one billion relays, occupying an 8.9% share of global relay market and ranking the fourth, and accounting for 19.2% share of Chinese relay market and ranking the first in 2014. In May, 2015, Hongfa Holding, a sub-subsidiary of Hongfa Technology invested USD20 million to acquire CLODI’s patents, trademarks and 100% equities of KG Company (held by CLODI), through which Hongfa further consolidated its position in the world’s market.

Dongguan Sanyou Electrical Appliances is one of the top 100 enterprises in China electronic components industry, ranking the 44th in 2014. The company’s products, without exception, have passed UL, CUL and CQC certifications and can meet the requirements of EU’s ROHS and REACH, and part of products even gained German VDE and TUV accreditations. It boasts annual production capacity of 600 million relays. In 2014, the company’s revenue reached RMB850.7 million, making up 4.6% share of Chinese relay market.

Ningbo Forward Relay is an export-oriented relay manufacturing enterprise, exporting 70% of its products to foreign countries and possessing annual capacity of producing 150 million relays. In 2014, the company’s revenue hit RMB433.5 million, being the 71st among top 100 players in China’s electronic components industry, and taking a 2.3% share of Chinese relay market.

Guizhou Space Appliance is the listed company under China Aerospace Science & Industry Corp (CASIC) and also the leading enterprise in military relay field. In 2014, the company’s relay output and sales volume was up to 12.03 million units and 11.66 million units respectively, harvesting the revenue of RMB188 million, a share of 11.7% in total revenue and accounting for 1% share of Chinese relay market.

This report highlights the followings:

Overview of global relay industry, covering market size, market structure, competitive landscape, etc.;

Overview of global relay industry, covering market size, market structure, competitive landscape, etc.;

Overview of China relay industry, such as market size, market structure, import & export, competition pattern, etc.;

Overview of China relay industry, such as market size, market structure, import & export, competition pattern, etc.;

Downstream sectors of China relay industry, such as home appliance, automobile, etc.;

Downstream sectors of China relay industry, such as home appliance, automobile, etc.;

Operation and relay business of 5 global and 8 Chinese relay companies.

Operation and relay business of 5 global and 8 Chinese relay companies.

1 Overview of Relay Industry

1.1 Definition

1.2 Classification

2 Overview of Global Relay Industry

2.1 Market Size

2.2 Market Structure

2.3 Competition

3 Overview of China Relay Industry

3.1 Market Size

3.2 Market Structure

3.3 Import & Export

3.3.1 Import

3.3.2 Export

3.4 Competition

3.5 Policies

4 Downstream of China Relay Industry

4.1 Home Appliance

4.1.1 Air-conditioner

4.1.2 Refrigerator

4.1.3 Washing Machine

4.1.4 Color TV

4.2 Automobile

5 World’s Renown Relay Companies

5.1 OMRON

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Relay Business

5.1.6 Development in China

5.2 TE Connectivity

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Relay Business

5.2.6 Development in China

5.3 Panasonic

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Relay Business

5.3.6 Development in China

5.4 Schneider Electric

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.5 R&D

5.4.4 Gross Margin

5.4.6 Relay Business

5.4.7 Development in China

5.5 Fujitsu

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Relay Business

5.5.6 Development in China

6 Major Chinese Relay Companies

6.1 Hongfa Technology Co., Ltd

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D and Investment

6.1.6 Relay Business

6.1.7 Supply and Sales

6.1.8 Forecast and Outlook

6.2 Guizhou Space Appliance Co., Ltd

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R&D and Investment

6.2.6 Relay Business

6.2.7 Forecast and Outlook

6.3 CHINT Electrics Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 R&D and Investment

6.3.6 Relay Business

6.3.7 Forecast and Outlook

6.4 Dongguan Sanyou Electrical Appliances Co., Ltd.

6.4.1 Profile

6.4.2 Development

6.5 Zhejiang HKE Co., Ltd.

6.5.1 Profile

6.5.2 Development

6.6 Ningbo Forward Relay Co., Ltd.

6.6.1 Profile

6.6.2 Development

6.7 Zhejiang Shenle Electric Co., Ltd.

6.7.1 Profile

6.7.2 Development

6.8 DELIXI Electric Co., Ltd.

6.8.1 Profile

6.8.2 Development

6.8.3 Relay Business

7 Prediction and Prospect

7.1 Forecast of Industry Development

7.2 Operational Comparison between Leading Players

7.2.1 Revenue

7.2.2 Relay Business

Main Technical Parameters of Relay

Classification of Relays (by Working Principle)

Working Principles of Electromagnetic Relay

Global Relay Sales and Growth Rate, 2008-2018E

Global Relay Sales Structure (by Sector), 2014/2016

Competitive Landscape in Global Relay Market, 2014

China’s Relay Sales and YoY Growth, 2008-2014

China’s Relay Output, 2011-2014

Relay Market Sales (by Sector) in China, 2014

Development Trends of Relays for Home Appliances and Automobile

Import Volume and Value of 60V-and-below Relays in China, 2013-2014

Top 10 Countries and Regions by Volume of Imported 60V-and-below Relays by China, 2014

Import Volume and Value of Above-60V Relays in China, 2013-2014

Top 10 Countries and Regions by Volume of Imported Above-60V Relays by China, 2014

Export Volume and Value of 60V-and-below Relays in China, 2013-2014

Top 10 Countries and Regions by Volume of Exported 60V-and-below Relays from China, 2014

Export Volume and Value of Above-60V Relays in China, 2013-2014

Top 10 Countries and Regions by Volume of Exported Above-60V Relays from China, 2014

Top 10 Players in China Relay Industry

Market Share (by Enterprise) of China Relay Industry, 2014

Policies on Relay Industry in China

Market Size and YoY Growth of China Home Appliance Industry, 2011-2014

China’s Air-conditioner Output and Sales Volume, 2009-2015

Market Share (by Brand) of China Air-conditioner Industry, 2014

Household Refrigerator Output and Sales Volume in China, 2009-2015

Market Share (by Brand) of China Refrigerator Industry, 2014

Output and Sales Volume of Washing Machines in China, 2009-2015

Market Share (by Brand) of China Washing Machine Industry, 2014

Color TV Output and Sales Volume in China, 2009-2015

Automobile Ownership and YoY Growth in China, 2009-2015

Automobile Output and YoY Growth in China, 2009-2015

Revenue and YoY Growth of Chinese Automobile Companies, 2011-2015

Revenue and Net Income of Omron, FY2010-FY2014

Revenue Breakdown of Omron (by Division), FY2010-FY2014

Revenue Structure of Omron (by Division), FY2010-FY2014

Revenue Breakdown of Omron (by Region), FY2010-FY2014

Revenue Structure of Omron (by Region), FY2010-FY2014

Gross Margin of Omron, FY2010-FY2014

Revenue of Omron’s EMC Division and % of Total Revenue, FY2010-FY2014

Revenue Structure of Omron’s EMC Division (by Region), FY2014

Revenue Structure of Omron’s EMC Division (by Product), FY2014

Omron’s Revenue from Greater China and % of Total Revenue, FY2010-FY2014

Profile of TE, 2015

Revenue and Net Income of TE, FY2010-FY2015

Revenue Breakdown of TE (by Division), FY2013-FY2014

Revenue Structure of TE (by Division), FY2013-FY2014

Revenue Breakdown of TE (by Region), FY2010-FY2014

Revenue Structure of TE (by Region), FY2010-FY2014

Gross Margin of TE, FY2010-FY2015

Relay Sealing Process of TE

TE’s Relay Product Lines and Applications

TE’s Revenue from China and % of Total Revenue, FY2010-FY2014

TE’s Automotive Electronics Production Base in China

TE’s Business Layout in China

Panasonic’s Business System

Revenue and Net Income of Panasonic, FY2011-FY2015

Revenue Breakdown of Panasonic (by Division), FY2014-FY2015

Revenue Structure of Panasonic (by Division), FY2014-FY2015

Revenue Breakdown of Panasonic (by Region), FY2011-FY2015

Revenue Structure of Panasonic (by Region), FY2011-FY2015

Gross Margin of Panasonic, FY2011-FY2015

Business Breakdown of Panasonic’s AIS Division

Revenue of Panasonic’s AIS Division and % of Total Revenue, FY2014-FY2015

Revenue Structure (by Business) of Panasonic’s AIS Division, FY2014

Relay Sealing Process of Panasonic

Main Features of Panasonic’s HE-S Relay

Panasonic’s Revenue from China and % of Total Revenue, FY2011-FY2015

Panasonic’s R&D Expenses in China and Number of Patents Applied, 2011-2013

Revenue and Net Income of Schneider, 2010-2015

Revenue Structure of Schneider (by Region), 2014

Schneider’s R&D Costs and % of Total Revenue, 2013-2014

Gross Margin of Schneider, 2013-2014

Schneider’s Revenue in China, 2013-2014

Revenue and Net Income of Fujitsu, FY2010-FY2014

Revenue Breakdown of Fujitsu (by Division), FY2011-FY2014

Revenue Structure of Fujitsu (by Division), FY2011-FY2014

Revenue Breakdown of Fujitsu (by Region), FY2013-FY2014

Revenue Structure of Fujitsu (by Region), FY2013-FY2014

Gross Margin of Fujitsu, FY2010-FY2014

Revenue of Fujitsu’s Device Solution Division and % of Total Revenue, FY2011-FY2014

Key Subsidiaries of Fujitsu in China

Equity Structure of Hongfa Technology, 2014

Subsidiaries and Responsibilities of Hongfa Technology

Revenue and Net Income of Hongfa Technology, 2010-2015

Revenue Breakdown of Hongfa Technology (by Product), 2012-2015

Revenue Structure of Hongfa Technology (by Product), 2012-2015

Revenue Breakdown of Hongfa Technology (by Region), 2012-2015

Revenue Structure of Hongfa Technology (by Region), 2012-2015

Gross Margin of Hongfa Technology, 2010-2015

Gross Margin of Hongfa Technology (by Product), 2012-2015

Hongfa Technology’s R&D Costs and % of Total Revenue, 2012-2015

Relay Product Certifications of Hongfa Technology as of 2014

High-voltage DC Relay of Hongfa Technology

Major Customers for High-voltage DC Relays of Hongfa Technology

Major Automotive Relay Projects of Hongfa Technology, early 2015

Hongfa Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2012-2014

Hongfa Technology’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2014

Revenue and Net Income of Hongfa Technology, 2014-2018E

Regional Distribution of Guizhou Space Appliance

Key Subsidiaries of Guizhou Space Appliance

Revenue and Net Income of Guizhou Space Appliance, 2010-2015

Revenue Breakdown of Guizhou Space Appliance (by Product), 2010-2015

Revenue Structure of Guizhou Space Appliance (by Product), 2010-2015

Revenue Breakdown of Guizhou Space Appliance (by Region), 2010-2015

Revenue Structure of Guizhou Space Appliance (by Region), 2010-2015

Gross Margin of Guizhou Space Appliance, 2010-2015

Gross Margin of Guizhou Space Appliance (by Product), 2010-2015

Gross Margin of Guizhou Space Appliance (by Region), 2010-2015

Guizhou Space Appliance’s R&D Costs and % of Total Revenue, 2010-2015

Guizhou Space Appliance’s Relay Business Revenue and % of Total Revenue, 2010-2015

Output, Sales Volume and Inventory (by Product) of Guizhou Space Appliance, 2013-2014

Revenue and Net Income of Guizhou Space Appliance, 2014-2018E

Revenue and Net Income of CHINT Electrics, 2010-2015

Revenue Breakdown of CHINT Electrics (by Product), 2010-2015

Revenue Structure of CHINT Electrics (by Product), 2010-2015

Revenue Breakdown of CHINT Electrics (by Region), 2010-2015

Revenue Structure of CHINT Electrics (by Region), 2010-2015

Gross Margin of CHINT Electrics, 2010-2015

Gross Margin of CHINT Electrics (by Product), 2010-2015

CHINT Electrics’ R&D Costs and % of Total Revenue, 2012-2015

CHINT Electrics’ Relay Revenue and % of Total Revenue, 2010-2015

Revenue and Net Income of CHINT Electrics, 2014-2018E

Equity Structure of Dongguan Sanyou Electrical Appliances, 2014

Revenue of Dongguan Sanyou Electrical Appliances, 2011-2014

Revenue of Zhejiang HKE, 2012-2014

Equity Structure of Ningbo Forward Relay

Revenue of Ningbo Forward Relay, 2012-2014

Equity Structure of DELIXI Electric

JRS1Ds Thermal Overload Relay of DELIXI Electric

Parameters of JRS1Ds Thermal Overload Relay of DELIXI Electric

Market Size and YoY Growth of China Relay Industry, 2013-2018E

China’s Relay Output, 2014-2018E

Revenue of Leading Companies in China Relay Industry, 2012-2014

Relay Business Revenue of Leading Companies in China Relay Industry, 2012-2014

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...