Global and China Forklift Industry Report, 2015-2017

-

Dec.2015

- Hard Copy

- USD

$2,700

-

- Pages:138

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

BXM086

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

With the progress of modern logistics as well as the growth in demand for replacing workforce by machinery, forklifts have become the most widely used tools for handling materials in logistics industry. In 2014, global forklift sales volume exceeded one million sets for the first time, representing a year-on-year increase of 7.5%; wherein, China sold 360,000 ones, up 9.4% year on year, still ranking first worldwide.

In 2015, European and American forklift markets continue to maintain steady growth. Chinese forklift market has re-entered the adjustment phase since 2012 as the economic slowdown pulls down the demand of traditional industries for forklifts; therefore, the annual sales volume in the country will return to the level in 2013, but it will maintain its position as the world's largest market.

With the development of Chinese forklift market, the forklift product mix also changes. All along, internal combustion forklifts occupy roughly 80% market share in China. However, in recent years, electric forklifts have been growing radically thanks to the demand for energy saving and environmental protection. In 2014, electric forklifts accounted for 30.6% of China’s forklift sales volume, 3.5 percentage points higher than the previous year, marking the fastest growth in recent years. During 2015, internal combustion forklifts continue to decline, while electric forklifts, especially electric warehouse forklifts, grow significantly at the estimated above 10%.

At the same time, major manufacturers have been intensifying R & D of electric warehouse forklifts and new energy forklifts, like HeLi develops LNG and LPG internal combustion forklifts; BYD researches lithium battery forklifts; EP Equipment, Noblelift and Ruyi develop electric warehouse vehicles.

Regarding enterprises, domestic brands seize approximately 80% market share, of which Anhui HeLi and Hangcha hold about 45%. In foreign brands, Kion Group enjoys the highest share, with 6.3% in 2014. In addition, Toyota, Mitsubishi Nichiyu Forklift and UniCarriers also act as major players.

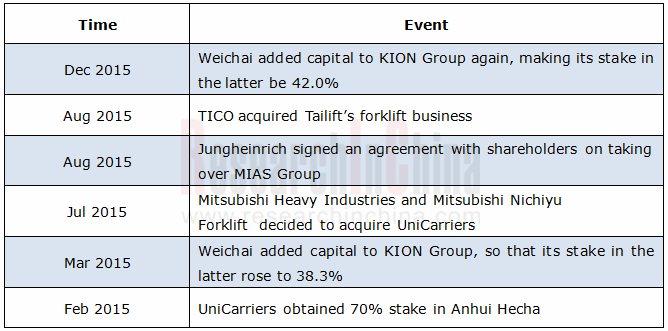

In recent years, China's manufacturing industry has stepped into the transition phase. On the one hand, forklift companies speed up the upgrading of their product structure and gradually transfer to the medium-end economical forklift market; on the other hand, they enhance competitiveness through mergers and acquisitions and other means. For instance, UniCarriers obtained 70% stake in Anhui Hecha; TICO acquired Tailift’s forklift business. In the next five to ten years, mergers and acquisitions in the forklift industry or across industries will continue to occur.

Major M & A Events in Global Forklift Market, 2015

Global and China Forklift Industry Report, 2015-2017 released by ResearchInChina focuses on the followings:

Status quo of global forklift market, forklift development of major countries, as well as top 20 global forklift enterprises, etc.;

Status quo of global forklift market, forklift development of major countries, as well as top 20 global forklift enterprises, etc.;

Production, sale, and import & export of forklifts in China;

Production, sale, and import & export of forklifts in China;

Status quo and key players in electric and internal combustion forklift markets in China;

Status quo and key players in electric and internal combustion forklift markets in China;

Product, regional, and corporate structure of forklifts in China;

Product, regional, and corporate structure of forklifts in China;

Operation and forklift business of 10 global and 29 Chinese enterprises;

Operation and forklift business of 10 global and 29 Chinese enterprises;

Development trend and prospects of China’s forklift industry.

Development trend and prospects of China’s forklift industry.

1 Overview of Forklift

1.1 Definition

1.2 Classification

1.3 Upstream & Downstream

2 Status Quo of Global Forklift Industry

2.1 Development

2.1.1 Order Intake

2.1.2 Sales Volume

2.2 Forklift Development in Major Countries

2.2.1 United States

2.2.2 Japan

2.3 Key Global Forklift Manufacturers

3 Forklift Market in China

3.1 Overview

3.2 Production

3.2.1 Manufacturers

3.2.2 Output and Structure

3.3 Sale

3.3.1 Sales Volume

3.3.2 Sales Volume Structure

3.4 Import & Export

3.4.1 Import

3.4.2 Export

4 Forklift Market Segments in China

4.1 Internal Combustion Forklift

4.1.1 Development

4.1.2 Key Manufacturers

4.2 Electric Forklift

4.2.1 Development

4.2.2 Major Products

4.2.3 Key Manufacturers

5 Competitive Landscape of Forklift Market in China

5.1 Product Competition

5.2 Enterprise Competition

5.3 Regional Competition

6 Key Global Forklift Manufacturers

6.1 Toyota Industrial Corp

6.1.1 Profile

6.1.2 Operation

6.1.3 Forklift Business

6.1.4 Forklift Business in China

6.1.5 Forklift Business Development Plan

6.2 Kion Group

6.2.1 Profile

6.2.2 Operation

6.2.3 Forklift Business

6.2.4 Forklift Business in China

6.2.5 Development Strategy

6.3 Jungheinrich Group

6.3.1 Profile

6.3.2 Operation

6.3.3 Forklift Business

6.3.4 Forklift Business in China

6.4 Hyster-Yale Materials Handling, Inc.

6.4.1 Profile

6.4.2 Operation

6.4.3 Forklift Business

6.4.4 Forklift Business in China

6.5 Crown Equipment Corp.

6.5.1 Profile

6.5.2 Operation

6.5.3 Forklift Business in China

6.6 Mitsubishi Nichiyu Forklift

6.6.1 Profile

6.6.2 Operation

6.6.3 Forklift Business in China

6.7 UniCarriers Corporation

6.7.1 Profile

6.7.2 Operation

6.7.3 Forklift Business in China

6.8 Komatsu Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Forklift Business

6.9 CLARK Material Handling International

6.9.1 Profile

6.9.2 Operation

6.9.3 Forklift Business in China

6.10 Dooan Industrial Vehicle

6.10.1 Profile

6.10.2 Operation

6.10.3 Forklift Business in China

7 Key Forklift Manufacturers in China

7.1 Anhui HeLi Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 R&D Capability

7.1.6 Development Strategy

7.2 Hangcha Group Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Major Clients

7.2.5 Development Strategy

7.3 Lonking (Shanghai) Forklift Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 R&D

7.4 Tailift Qingdao Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Development Strategy

7.5 Guangxi LiuGong Machinery Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.5.3 Forklift Business

7.6 Sino-American-Zhejiang Maximal Foklift Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 R&D

7.7 EP Equipment Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 R&D

7.8 Anhui Jianghuai-Yinlian Heavy-Duty Construction Machine Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 R&D Capability

7.9 Dalian Forklift Co., Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 R&D

7.10 Ningbo Ruyi Joint Stock Co., Ltd

7.10.1 Profile

7.10.2 Operation

7.11 Zhejiang Goodsense Forklift Co., Ltd.

7.11.1 Profile

7.11.2 Operation

7.11.3 R&D

7.12 Zhejiang Noblelift Equipment Joint Stock Co., Ltd.

7.12.1 Profile

7.12.2 Operation

7.12.3 Development Strategy

7.13 Zoomlion Anhui Industrial Vehicles Co., Ltd.

7.13.1 Profile

7.13.2 Operation

7.13.3 Development Strategy

7.14 Anhui Hecha Forklift Co., Ltd.

7.14.1 Profile

7.14.2 Operation

7.15 Hyundai (Beijing) Construction Machinery Co., Ltd.

7.15.1 Profile

7.15.2 Operation

7.16 Xiamen XGMA Machinery Co., Ltd.

7.16.1 Profile

7.16.2 Operation

7.16.3 Forklift Business

7.17 BYD Forklift (Shaoguan) Co., Ltd

7.17.1 Profile

7.17.2 Operation

7.17.3 R&D

7.18 Anhui TEU Forklift Co., Ltd.

7.18.1 Profile

7.18.2 Operation

7.19 Shandong Shantui Machinery Co., Ltd.

7.19.1 Profile

7.19.2 Operation

7.19.3 R&D

7.20 Other Enterprises

7.20.1 Hangzhou Good Friend Precision Machinery Co., Ltd.

7.20.2 Vita-Wheel Holdings Ltd.

7.20.3 YTO (Luoyang) transportation Machinery Co., Ltd.

7.20.4 Jiangsu Jingjiang Forklift Truck Co., Ltd.

7.20.5 Shandong Wecan Technology Co., Ltd.

7.20.6 Wuxi KIPOR Machinery Co., Ltd.

7.20.7 Zhejiang Huahe Forklift Co., Ltd.

7.20.8 Hefei Banyitong Science & Technology Developing Co., Ltd

7.20.9 Zhejiang UN Forklift Co., Ltd.

7.20.10 Suzhou Pioneer Logistics Equipment & Technology Co., Ltd.

8. Development Trend of China's Forklift Industry

8.1 Energy-saving and Environment-friendly Forklift

8.2 Forklift After-market

9. Summary and Forecast

9.1 Market

9.2 Enterprises

Features of Forklift by Type

Composite Price Index of Steel in China, 2011-2015

Forklift Distribution in Downstream Sectors

Order Intake and YoY Growth of Global Forklifts, 2008-2015

Order Intake of Global Forklifts by Region, 2013-2015

Order Intake of Global Forklifts by Product, 2009-2015

Sales Volume and YoY Growth of Global Forklifts, 2008-2015

Sales Volume of Global Forklifts by Region, 2010-2015

Sales Volume of Global Forklifts by Product, 2010-2015

Sales Volume of Forklifts in USA and % of Global Total, 2009-2015

Forklift Output in Japan by Product, 2005-2015

Domestic Forklift Sales Volume in Japan by Product, 2005-2015

Forklift Export Volume in Japan by Product, 2005-2015

Top 20 Forklift Manufacturers Worldwide, 2014

Domestic Sales Volume of Forklifts in China and % of Global Total, 2008-2015

Export Volume of Forklifts and % of Total Sales Volume in China, 2007-2015

Major Forklift Manufacturers in China, 2015

Top 40 Forklift Enterprises in China, 2014

Output of Forklifts in China, 2007-2015

Output of Forklifts in China by Product, 2011-2015

Sales Volume and YoY Growth of Forklifts in China, 2005-2015

Domestic Sales Volume of China’s Forklifts and % of Total Sales Volume, 2008-2015 Sales Volume of Forklifts in China by Product, 2010-2015

Import Volume and YoY Growth of Forklift in China, 2008-2015

Import Volume of Forklifts in China by Product, 2008-2015

Import Volume of Forklifts (by Country) and % of Total Import Volume in China, 2014

Average Import Price of Forklifts in China by Product, 2009-2015

Export Volume and YoY Growth of Forklifts in China, 2008-2015

Export Volume of Forklifts in China by Product, 2008-2015

Export Volume of Forklifts (by Region) and % of Total Export Volume in China, 2014

Average Export Price of Forklifts in China by Product, 2009-2015

Sales Volume of Internal Combustion Counterbalanced Forklifts in China, 2008-2015

Top 5 Enterprises in China by Sales Volume of Internal Combustion Counterbalanced Ride-on Forklifts, 2010-2014

Sales Volume of Electric Forklifts in China, 2008-2015

Sales Volume of Electric Warehouse Forklifts in China, 2008-2015

Top 6 Enterprises in China by Sales Volume of Electric Counterbalanced Ride-on Forklifts and Electric Warehouse Forklifts, 2014

Proportion of Sales of Electric Forklifts and Internal Combustion Counterbalanced Forklifts in China, 2008-2015

Forklift Sales Structure of Major Regions Worldwide by Product, 2013

Forklift Market Concentration in China by Sales Volume, 2014

Competition Pattern in Chinese Forklift Market, 2013-2014

Market Share of Two Major Forklift Groups in China, 2009-2015

Subsidiaries in China of Key Overseas Forklift Manufacturers, 2015

Sales Structure of Forklift in China by Region, 2013-2015

Revenue and Net Income of Toyota, FY2010-FY2016

Revenue of Toyota by Business, FY2010- FY2016

Global Presence of Toyota’s Forklift Business

Sales Volume of Toyota’s Forklifts, FY2010-FY2016

Sales Volume of Toyota’s Forklifts by Region, FY2010-FY2016

Major Forklift Companies of Toyota in China

Sales Network of Toyota (Shanghai)

Kion Group’s Products and Services

Global Market Share of Kion Group by Region, 2014

Development History of Kion Group

Kion Group’s Equity Structure, 2015

Major Financial Indicators of Kion Group, 2011-2015

Revenue of Kion Group by Business, 2013-2015

Revenue of Kion Group by Product, 2013-2015

Revenue of Kion Group by Region, 2013-2015

Forklift Series of Kion Group

Kion Group’s Forklift Production Bases Worldwide, 2015

Global Forklift Sales Network of Kion Group, 2015

Forklift Order Intake of Kion Group by Region, 2010-2014

Kion Group’s Forklift Subsidiaries in China

Major Financial Indicators of Jungheinrich, 2008-2015

Revenue of Jungheinrich by Region, 2010-2015

Revenue of Jungheinrich by Business, 2013-2015

Growth Strategy of Jungheinrich

Global Factory Distribution of Jungheinrich, 2015

Forklift Output of Jungheinrich, 2008-2015

Revenue and Net Income of Hyster-Yale, 2009-2015

Revenue of Hyster-Yale by Region, 2010-2015

Forklift Series of Hyster-Yale

Hyster-Yale’s Production and Sales Bases, 2014

Forklift Revenue Structure of Hyster-Yale, 2014

Major Forklift Customers of Hyster-Yale, 2015

Forklift Business Development Strategy of Hyster-Yale, 2015

Global Business Layout of Crown Equipment, 2015

Revenue of Crown Equipment, 2010-2015

Stockholder Structure of Mitsubishi Nichiyu Forklift, FY2014

Planning of Mitsubishi Nichiyu Forklift, FY2014-FY2017E

Revenue and Net Income of Mitsubishi Nichiyu Forklift, FY2010-FY2015

Revenue of Mitsubishi Nichiyu (by Region) and % of Total Revenue, FY2014

Business Layout of Mitsubishi Nichiyu Forklift in China, 2015

UniCarriers’ Forklift Products

Revenue of UniCarriers, FY2011-FY2015

Development History of UniCarriers, 2011-2015

Main Products of Komatsu

Revenue and Net Income of Komatsu, FY2009- FY2015

Revenue of Komatsu by Business, FY2009- FY2015

Major Production Bases and Modes of Komatsu’s Construction and Mining Equipment Business

Revenue Structure of Komatsu’s Construction, Mining and Utility Equipment Business (by Region), FY2014

Main Forklift Products of Komatsu

CLARK’s Main Forklift Products

CLARK’s Global Network

Revenue of CLARK, 2011-2015

Development History of Dooan Industrial Vehicle, 2011-2015

Global Business Distribution of Dooan Industrial Vehicle, 2014

Revenue of Dooan Industrial Vehicle, 2011-2015

Dooan Industrial Vehicle’s Forklift Subsidiaries in China

Revenue and Net Income of Anhui HELI, 2009-2015

Operating Revenue of Anhui HELI by Product, 2009-2015

Operating Revenue of Anhui HELI by Region, 2010-2015

Gross Margin of Anhui HELI, 2009-2015

Gross Margin of Major Products of Anhui HELI, 2009-2015

Capacity of Hangcha Group by Product, 2011-2015

Revenue and Net Income of Hangcha Group, 2011-2015

Sales Volume of Hangcha Group’s Forklifts by Product, 2011-2014

Operating Revenue of Hangcha Group by Product and % of Total Revenue, 2011-2014

Hangcha Group’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2014

Output and Sales Volume of Lonking, 2009-2015

Revenue and Net Income of Guangxi LiuGong Machinery, 2011-2015

Operating Revenue of Guangxi LiuGong Machinery by Region, 2011-2015

Main Forklift Products of Guangxi LiuGong Machinery

Development History of Forklift Business of Guangxi LiuGong Machinery

Forklift Sales Volume of Guangxi LiuGong Machinery, 2011-2015

Sales Volume and Revenue of Zhejiang Maximal Forklift, 2010-2014

Domestic Marketing Network of Anhui Jianghuai-Yinlian Heavy-Duty Construction Machine

Forklift Sales Volume of Dalian Forklift, 2009-2015

New Products of Goodsense, 2014-2015

Revenue and Net Income of Zhejiang Noblelift Equipment Joint Stock, 2011-2015

Operating Revenue of Zhejiang Noblelift Equipment Joint Stock by Product, 2012-2015

Operating Revenue of Zhejiang Noblelift Equipment Joint Stock by Region, 2011-2015

Fundraising Projects of Zhejiang Noblelift Equipment Joint Stock, 2014

Forklift Sales Network of Zoomlion

Forklift Sales Network of Beijing Hyundai

Revenue and Net Income of Xiamen XGMA Machinery, 2011-2015

Forklift Sales Volume of Xiamen XGMA Machinery, 2009-2015

Forklift Sales Volume of Jiangsu Jingjiang Forklift Truck, 2009-2014

R & D of New Energy Forklifts of Major Domestic and Foreign Enterprises

Ownership of Forklift Market in China, 2012-2018E

Sales Volume of Forklifts in China, 2011-2017E

Market Share of Major Forklift Companies Worldwide, 2014

Market Share of Major Forklift Companies in China, 2014

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...