Global and China LED Industry Report, 2014-2015

-

Feb.2015

- Hard Copy

- USD

$2,600

-

- Pages:127

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZYW197

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,800

-

Global and China LED Industry Report, 2014-2015 is primarily concerned with the following:

1. LED development trend

2. LED industry analysis

3. 38 LED companies

After experiencing fall to the bottom and price slump in LED during 2012-2013, quite a few LED enterprises have been forced to go bankrupt or retreat from the industry. However, those that still struggled on the manufacturing front have reduced their capacity. Even worse, so many companies have aborted their capacity expansion plans, which is particularly true of the upstream sectors. Price reduction stimulates the market and capacity cuts stabilizes the price. Therefore, the LED industry improved greatly in the first half of 2014, which soon came to an end. The market rise propelled enterprises to operate in full capacity, and even the enterprises that had been closed down resumed their capacity. But in the second half of 2014, the LED market plummeted and will very likely continue to worsen in 2015.

The LED lighting market seems to have broad prospects, but the industry’s threshold is extremely low, especially in downstream sectors of LED lighting, which virtually have no financial and technical thresholds. Price competition prevails in this market. On the other hand, there are a great number of enterprises in the downstream sectors of LED lighting industry that they, to open the market, have to invest capital into marketing. Although LED lighting market looks good, the profit, particularly operating income, shows declining trend. Take example for Cree, a large US company, whose operating margin in Q4 2014 was only 2.5% in sharp contrast to 8.5% in Q4 2013.

In October 2014, Samsung announced that it would retreat from overseas LED lighting market and shift its focus to the market in South Korea. In addition, GE repositioned its lighting business and is very likely to spin off the lighting business. Toshiba also largely withdrew from the overseas LED lighting market.

In July 2014, Philips merged LED Chip business and automotive lighting business into a new company, while other businesses were integrated to form Philips Lighting. In future, Philips will sell the equities of Philips Lighting, and the highly profitable LED Chip and automotive lighting businesses will still be Philips’ wholly-owned subsidiary.

NICHIA’s YAG is generally recognized as white-light LED patent with the best performance. The patent fee is very high and NICHIA has a stringent patent authorization, but this patent will expire in 2017. The white-light LED patents from other companies -- such as Toyota Gosei’s orthosilicate fluorescent powder containing Sr, Ba, and Ca, will devalue after 2017. Recently, Toyota Gosei’s LED revenue declined and its profit slumped, which made the company be willing to transfer its patents at a low price. In 2014, Toyota Gosei transferred the patent to Harvatek and JuFei Optoelectronics. This was the first time that the mainland Chinese enterprise had gained the white-light LED patent. However, JuFei Optoelectronics is a downstream packaging enterprise, and Toyota Gosei’s patent transfer is to get profit and to entrust JuFei Optoelectronics to produce for it.

In 2014, as the companies in LED industry were aggressively expanding industry chain and packaging companies were entering retailing fields of lighting industry. This was particularly true of companies in Mainland China. The MLS Lighting -- the largest packaging enterprise in Chinese Mainland, for instance, was building a huge marketing network, with a network of 300 distributors brought into being in 2014. Its target is to create a network of 3,000 distributors. In August 2014, Tsinghua Tongfang acquired Neo-Neon LED Lighting International, a company listed in Hong Kong. In FY 2014, Neo-Neon reported revenue of HKD841 million and a loss of HKD731 million in net income. But the company had a complete marketing network, which was Tsinghua Tongfang’s top concern.

In 2014, Epistar’s buyout of Formosa Epitaxy was the largest acquisition in LED industry. When the acquisition was completed, Epistar would have over 400 MOCVDs , more than doubling that of its rivals. In Q4 2014, Epistar’s capacity was estimated to hold 11% of the market’s total. After the merger, its capacity would increase an additional 4%, far exceeding the 7% for Sanan Optoelectronics and Samsung, which would make it the largest GaN wafer supplier around the world.

1 LED Market

1.1 LED Market Size

1.2 LED Lighting Market Size

1.3 LED Lighting Market Trend

1.4 Japan’s LED Lighting Market

1.5 North America’s LED Lighting Market

1.6 LED for Large-size BLU Market

1.7 Mobile Phone BLU Market

1.8 LED Automotive Lighting

1.8.1 LED Automotive Lighting Market

1.8.2 Automotive Interior LED Lighting

1.8.3 Automotive Exterior LED Lighting

1.9 Digital Billboard Market

2 LED Packaging

2.1 Overview of LED Packaging

2.2 COB Packaging

2.3 Flip Chip Packaging

2.3.1 Introduction

2.4 Medium Power LED

2.5 Trend of LED Packaging Size

3 LED Industry Chain

3.1 LED Industry Chain

3.2 Sapphire Ingot Market

3.3 Sapphire Ingot Industry

3.4 Sapphire Substrate

3.5 Rubicon

3.6 MOCVD Industry

3.7 AIXTRON

3.8 VEECO

3.9 Geographical Distribution of LED Industry

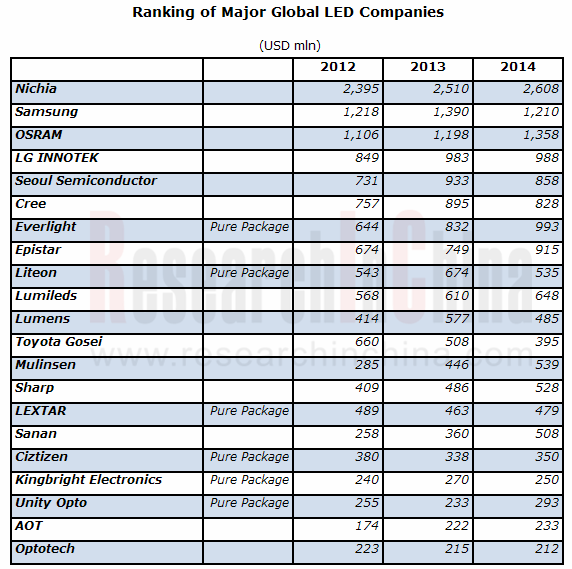

3.10 Global Top 30 LED Vendors by Revenue, 2012-2014

3.11 Summary of LED Industry in Mainland China

3.12 White Light LED Patents

4 Taiwanese LED Companies

4.1 Everlight Electronics

4.2 Epistar Corporation

4.3 Genesis Photonics

4.4 Formosa Epitaxy

4.5 Lite-On Technology

4.6 Advanced Optoelectronic Technology

4.7 Bright LED Electronics Corp.

4.8 Opto Tech

4.9 Harvatek

4.10 Tekcore

4.11 Unity Opto Technology

4.12 Huga Optotech

4.13 Lextar Electronics

4.14 TYNTEK

4.15 Edison Opto

5 LED Companies in Mainland China

5.1 Epiligh Technology Co., Ltd.

5.2 Hunan HuaLei Optoelectronic Corporation

5.3 Hangzhou Silan Azure Co., Ltd.

5.4 Sanan Optoelectronics Co., Ltd.

5.5 Nantong Tongfang Semiconductor Co., Ltd.

5.6 Shandong Inspur Huaguang Optoelectonics Co., Ltd.

5.7 Foshan Nationstar Optoelectronics Co. Ltd.

5.8 Shanghai Rainbow Optoelectronics Material Co. Ltd.

5.9 Dalian Lumei Optoelectronics Corporation

5.10 Xiamen Changelight Co., Ltd.

5.11 Elec-tech International Co., Ltd.

5.12 HC SemiTek Corporation

5.13 MLS Lighting Co., Ltd.

6 Foreign LED Companies

6.1 Cree Inc.

6.2 Toyoda Gosei

6.3 Nichia Corporation

6.4 Osram Opto Semiconductor

6.5 Philips Lumileds Lighting Company

6.6 Seoul Semiconductor.

6.7 LG Innotek

6.8 Samsung LED

6.9 Lumens Digital Optics Inc.

Global LED Market Size, 2008-2016E

Distribution of LED Market Size by Downstream Sector, 2013-2018E

Distribution of Global Lighting Market by Technology, 2009-2017E

LED Chips Volume of Lighting by Application, 2011-2016E

Policies on Lighting Energy Saving by Country

Price Trend of 40W and 60W LED Light Bulbs, May, 2012-Jan. 2014

ASP of LED Bulb in Japan, 2012-2014

Bulbs Sales Growth Rate in Japan, 2012-2014

Market Share of Major LED Lighting Manufacturers in Japan, 2013

Proportion of Large-sized BLU Applied, 2009-2015E

Global Mobile Phone Shipments, 2007-2014

Geographical Distribution of Global 3G/4G Mobile Phone Shipments, 2011-2014

Global Smartphone Sales to End Users by Vendor, 2013

Global Smartphone Sales to End Users by Operating System, 2013

Global Mobile Phone Sales to End Users by Vendor, 2013

Market Size of Global LED Automotive Lighting, 2010-2016E

Costs and Illuminance Trend of Five Automotive Light Sources, 2007-2014

LED Structure

LED Costs

COB Packaging

Sapphire Ingot Demand, 2012-2016E

Sapphire Ingot Demand Value, 2012-2016E

Capacity Trend of Major Global Sapphire Ingot Companies, 2012-2016E

Sapphire Ingot Price by Size, 2012-2016E

Sapphire Substrate Demand by Country, 2012-2016E

Sapphire Substrate Demand by Size, 2012-2016E

Revenue and Operating Margin of Rubicon Technology, 2005-2014

Production Flow of Rubicon Technology

Revenue Breakdown of Rubicon Technology by Region, 2009-2013

Revenue Breakdown of Rubicon Technology by Product, 2009-2013

Market Size of LED Front-end Equipment, 2009-2017E

Market Share of Major MOCVD Manufacturers,1999-2013

Global Presence of Aixtron

Revenue and EBIT Margin of Aixtron, 2003-2014

Aixtron’s Revenue\New Order\Backlog for Eight Successive Quarters

Aixtron’s Revenue by Application and Region, 2010

Aixtron’s Revenue by Application and Region in Q1-Q3, 2014

Aixtron’s Revenue by Application,1999-2013

VEECO’s Revenue and Operating Margin, 2004-2014

VEECO’s Revenue by Business, 2011-2013

VEECO’s Key Customers

VEECO’s Quarterly Orders by Application, 2013Q3-2014Q3

Distribution of Global LED Output Value by Region, 2013 & 2014

Operating Margin of Taiwanese LED Companies, 2012-2014

Organizational Structure of Everlight Electronics

Revenue and Operating Margin of Everlight Electronics, 2003-2014

Revenue Breakdown of Everlight Electronics by Product, 2008-2011

Revenue Breakdown of Everlight Electronics by Product, 2012-2015E

Revenue Breakdown of Everlight Electronics by Application, 2005-2015E

Capacity and Capacity Utilization of Everlight Electronics, 2013-2014

Monthly Revenue and Growth Rate of Everlight Electronics, Dec. 2012-Dec. 2014

Quarterly Revenue and Inventory of Everlight Electronics, 2011Q4-2014Q3

Quarterly Debt Ratio of Everlight Electronics, 2011Q4-2013Q4

Organizational Structure of Epistar

Revenue and Operating Margin of Epistar, 2004-2014

Monthly Revenue and Growth Rate of Epistar, Dec. 2012-Dec. 2014

Revenue Breakdown of Epistar by Application, 2012-2015E

Revenue Breakdown of Epistar by Product, 2012-2015E

R&D Capabilities of Epistar

Revenue Breakdown of Epistar by Customer, 2012

Revenue and Gross Margin of Genesis Photonics, 2003-2014

Revenue and Operating Margin of Genesis Photonics, 2003-2014

Monthly Revenue of Genesis Photonics, Dec. 2012-Dec. 2014

Revenue and Operating Margin of Formosa Epitaxy, 2002-2014

Monthly Revenue and Growth Rate of Formosa Epitaxy, Dec. 2012-Dec. 2014

Revenue Breakdown of Formosa Epitaxy by Product, 2009-2013

Capacity of Formosa Epitaxy, 2012-2013

Revenue and Operating Margin of Bright LED Electronics, 2002-2014

Monthly Revenue and Growth Rate of Bright LED Electronics, Dec. 2012-Dec. 2014

Revenue and Gross Margin of Opto Tech, 2004-2014

Revenue and Operating Margin of Opto Tech, 2008-2014

Monthly Revenue of Opto Tech, Dec. 2012-Dec. 2014

Revenue Breakdown of Opto Tech by Product, 2008-2013

Revenue Breakdown of Opto Tech (Except System Products) by Region, 2013-Q1/2014

Opto Tech’s Revenue from System Products by Region, 2013-Q1/2014

Revenue and Operating Margin of Harvatek, 2000-2014

Monthly Revenue of Harvatek, Dec. 2012-Dec. 2014

Revenue and Gross Margin of Tekcore, 2005-2014

Revenue and Operating Margin of Tekcore, 2008-2014

Monthly Revenue and Growth Rate of Tekcore, Dec. 2012-Dec. 2014

Revenue and Operating Margin of Unity Opto, 2004-2014

Monthly Revenue and Growth Rate of Unity Opto, Dec. 2012-Dec. 2014

Revenue and Operating Income of Huga Optotech, 2004-2012

Monthly Revenue and Growth Rate of Huga Optotech, May, 2010-May, 2012

Revenue and Operating Margin of Lextar Electronics, 2009-2014

Monthly Revenue and Growth Rate of Lextar Electronics, Dec. 2012-Dec. 2014

Organizational Structure of Tyntek

Revenue and Operating Margin of Tyntek, 2004-2014

Monthly Revenue and Growth Rate of Tyntek, Dec. 2012-Dec. 2014

Revenue and Operating Margin of Edison Opto, 2006-2014

Monthly Revenue and Growth Rate of Edison Opto, Dec. 2012-Dec. 2014

Revenue and Gross Margin of AOT, 2010-2014

AOT’s Monthly Revenue, Dec. 2012-Dec. 2014

AOT’s Key Customers

AOT’s Revenue Breakdown by Application, 2013Q1-2014Q3

AOT’s Technology Roadmap

Revenue and Net Income of Epiligh Technology, 2008-2012

Revenue and Operating Margin of Silan Microelectronics, 2006-2014

Revenue and Net Income of Silan Azure, 2007-2011

Revenue and Gross Margin of Sanan Optoelectronics, 2005-2014

Revenue Breakdown of Sanan Optoelectronics by Business, 2009-2012

Revenue and Net Income of Sanan Optoelectronics’ Subsidiaries, 2013

Revenue and Operating Margin of Nationstar Optoelectronics, 2007-2014

Revenue Breakdown of Nationstar Optoelectronics by Product, 2007-2013

Top 5 Customers of Nationstar Optoelectronics, 2013

Top 5 Suppliers of Nationstar Optoelectronics, 2013

Revenue and Operating Margin of AXT, 2004-2014

AXT’s Revenue by Product, 2006-2013

AXT’s Revenue by Region, 2006-2014

Revenue and Operating Income of Xiamen Changelight, 2007-2014

Epitaxy Revenue and Gross Margin of Xiamen Changelight, 2010-2013

Financial Data of Xiamen Changelight’s Key Subsidiaries, 2013

Financial Data of Elec-tech International’s Key Subsidiaries, 2013

Financial Data of Elec-tech International’s Key Subsidiaries, 2014H1

Revenue and Operating Income of HC SemiTek, 2009-2014

MLS’ Revenue and Operating Margin, 2008-2014

MLS’ Shipments, 2008-2014

Revenue and Operating Margin of Cree, FY2004-FY2015

Cree’s Revenue Breakdown by Product, FY2011-FY2014

Gross Margin of Cree by Product, FY2011-FY2014

Cree’s Presence Worldwide

Cree’s Revenue Breakdown by Region, FY2009-FY2014

Revenue and Operating Margin of Toyoda Gosei, FY2008-FY2015

LED Revenue and Operating Margin of Toyoda Gosei, FY2008-FY2015

Revenue and Operating Margin of Nichia, 2003-2014

LED Revenue and Operating Margin of Nichia, 2004-2013

Quarterly Revenue and EBITA Margin of OSRAM, 2012Q1-2014Q2

OSRAM’s Revenue Breakdown by Segment, 2012-2014

OSRAM’s Revenue Breakdown by Business, FY2014

OSRAM’s Revenue Breakdown by Region, FY2014

OSRAM’s Revenue Breakdown by Channel, FY2014

EBITA of OSRAM by Segment, 2012-2014

OSRAM’s Revenue Breakdown by Region, 2012-2014

Revenue and EBITDA of Philips Lumileds Lighting, 2011Q4-2013Q4

Revenue Breakdown of Philips Lumileds Lighting by Business, 2014

Revenue Breakdown of Philips Lumileds Lighting by Application, 2014H1

Revenue Breakdown of Philips Lumileds Lighting by Region, 2014H1

Product Distribution of Seoul Semiconductor

Revenue and Operating Margin of Seoul Semiconductor, 2003-2014

Quarterly Revenue of Seoul Semiconductor, 2011Q1-2014Q3

Gross Margin of Seoul Semiconductor, 2011Q1-2014Q3

Operating Margin of Seoul Semiconductor, 2011Q1-2014Q3

Net Profit Margin of Seoul Semiconductor, 2011Q1-2014Q3

Revenue Breakdown of Seoul Semiconductor by Application, 2011Q1-2014Q3

Revenue and Operating Margin of LG Innotek, 2006-2015

Revenue and Operating Margin of LG Innotek, 2012Q1-2014Q4

Revenue Breakdown of LG Innotek by Business, 2011-2015

Operating Income of LG Innotek by Business, 2011-2015

Quarterly LED Revenue of LG Innotek, 2011Q4-2014Q3

Samsung’s LED Revenue, 2005-2012

Samsung’s LED Revenue by Application, 2010

Revenue and EBITDA Margin of Lumens Digital Optics, 2007-2014

Lumens’ Revenue Breakdown by Application, 2012-2014

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...