China Automated Logistics Equipment Industry Report, 2016-2020

-

Feb.2016

- Hard Copy

- USD

$2,600

-

- Pages:139

- Single User License

(PDF Unprintable)

- USD

$2,450

-

- Code:

CYH045

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

As a key integral of automated logistics system, automated logistics equipment mainly includes AGVs, forklifts, automated stereo warehouse, automated conveyors and sorters, etc.

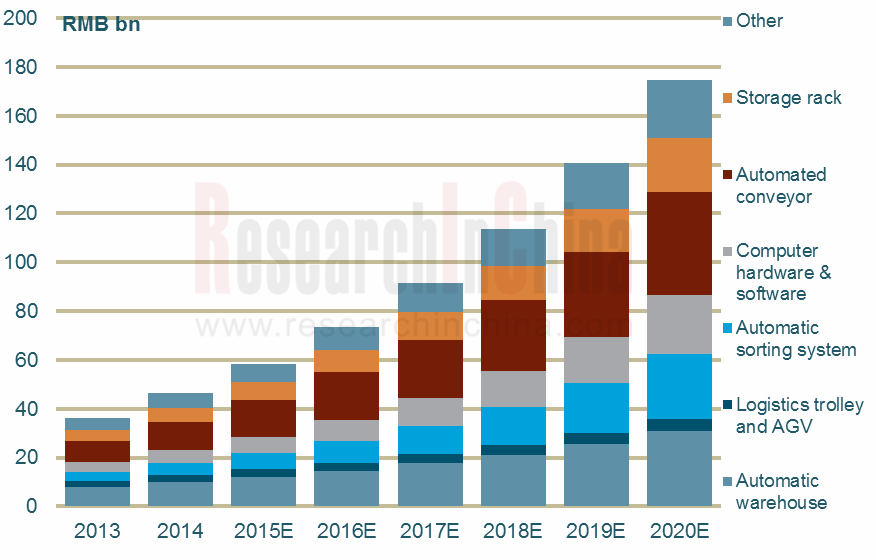

In 2015, the market size of automated logistics system in China approximated RMB58.3 billion, up 25.7% from a year earlier. Of all, automated conveying and sorting equipment of high value boasts market size of around RMB21.62 billion, sharing 37.1% or so.

In the future, fueled by the rise of factory automation and the rapid development of emerging logistics modes like third-party logistics and e-commerce, the market size of automated logistics equipment system in China is expected to reach RMB174.5 billion by 2020, of which RMB68.93 billion will be contributed by automated conveyor and sortation systems.

Market Size of Automated Logistics Equipment in China by Product, 2013-2020E

Source: ResearchInChina

Logistics automation finds application in tobacco, medical drugs, and automobiles. In 2015, the automated logistics equipment revenue from the above three sectors amounted to RMB 9.172 billion, RMB7.512 billion, and RMB8.65 billion, respectively, and the figures by 2020 are likely to rise to RMB26.901 billion, RMB24.186 billion, and RMB38.29 billion.

At present, logistics equipment suppliers in China fall into domestic Chinese suppliers and overseas peers, among which the latter plays a leading role, especially in high-end logistics fields like e-commerce and airport, which are almost monopolized by foreign companies. In contrast, domestic suppliers mostly deliver single-equipment, and are principally involved in downstream logistics sectors such as tobacco, pharmaceuticals, power system, apparel, and food.

In recent years, with the accelerated construction of intelligent plants and the growing demand for e-commerce, the competition in automated logistics equipment has pricked up. In this context, a number of Chinese companies including Shanxi Oriental Material Handling, Guangdong Dong Fang Precision Science & Technology, MESNAC, and Sanfeng Intelligent Conveying Equipment have begun to enhance their competitiveness through acquisitions, construction expansion, etc.

Guangdong Dong Fang Precision Science & Technology: In June 2014, the company made layout of intelligent logistics system business by acquiring a 20% stake in Jaten Robot & Automation. In April 2015, it signed a Cooperative Letter of Intent with Italy-based Ferretto Group to further build integrated solutions for intelligent warehousing and logistics.

MESNAC: In 2010, the company started layout of robot and automatic logistics business, and established Qingdao Kengic Logistics Technology Co., Ltd. in 2015. In H1 2015, robot and the logistics information business contributed revenue of RMB50.2 million. The company’s ongoing industrial robot and intelligent logistics system industrialization base project (Phase II) will add a capacity of 75 sets/a of automated logistic equipment.

Sanfeng Intelligent Conveying Equipment: capable of producing both aerial and ground intelligent conveyors (complete sets), the company’s intelligent conveying equipment expansion project under construction is anticipated to reach the design capacity in 2016, when the capacity will be 300 units annually.

The report is primarily concerned with the followings:

Market size, product mix, demand structure, and competitive landscape of automated logistics system in China;

Market size, product mix, demand structure, and competitive landscape of automated logistics system in China;

Development, market size, and competitive landscape of product segments of automated logistics equipment in China, including automatic stereo warehouse, automated conveyor, AGV, and forklift;

Development, market size, and competitive landscape of product segments of automated logistics equipment in China, including automatic stereo warehouse, automated conveyor, AGV, and forklift;

Development, demand, corporate competition of automated logistics equipment in major downstream sectors like automobiles, tobacco, and medical drugs in China;

Development, demand, corporate competition of automated logistics equipment in major downstream sectors like automobiles, tobacco, and medical drugs in China;

Development of and trends in logistics, e-commerce, and cold-chain logistics markets in China

Development of and trends in logistics, e-commerce, and cold-chain logistics markets in China

Operation of 8 global automated logistics equipment companies and their development in China;

Operation of 8 global automated logistics equipment companies and their development in China;

Operation and development strategies of 11 Chinese automated logistics equipment enterprises.

Operation and development strategies of 11 Chinese automated logistics equipment enterprises.

1. Overview

1.1 Automated Logistics System

1.1.1 Definition

1.1.2 Industry Chain

1.2 Automated Logistics Equipment

1.2.1 Definition and Classification

1.2.2 Development History

2. Development of China’s Automated Logistics Equipment Industry

2.1 Policy

2.2 Market Size

2.3 Product Mix

2.4 Market Demand

2.5 Competitive Landscape

3. Development of Automated Logistics Equipment Product Segments

3.1 Automated Stereoscopic Warehouse

3.1.1 Overview

3.1.2 Automatic Stereoscopic Warehouse VS General Warehouse

3.1.3 Market Size

3.1.4 Market Demand

3.1.5 Competitive Landscape

3.2 Automated Guided Vehicle (AGV)

3.2.1 Market Size

3.2.2 Product Mix

3.2.3 Demand Structure

3.2.4 Competitive Landscape

3.2.5 Development Trend

3.3 Automated Sorter

3.3.1 Market Size

3.3.2 Product Mix

3.3.3 Competitive Landscape

3.4 Automated Conveyor

3.4.1 Market Size

3.4.2 Demand Structure

3.4.3 Corporate Competition

3.5 Palletizing Robot

3.5.1 Market Size

3.5.2 Competitive Landscape

3.6 Forklift

3.6.1 Output and Sales Volume

3.6.2 Product Competition

3.6.3 Regional Competition

3.6.4 Competition Pattern

3.6.5 Development Trend

4. Demand from Main Downstream Sectors of Automated Logistics Equipment

4.1 Automobile

4.1.1 Development

4.1.2 Demand

4.1.3 Corporate Competition

4.1.4 Development Trend

4.2 Tobacco

4.3 Pharmaceuticals

4.3.1 Development

4.3.2 Demand

4.3.3 Development Trend

5. Development of China’s Logistics Market

5.1 Development of Logistics Industry

5.2 Development of Intelligent Logistics

5.3 Express Delivery & E-commerce Logistics

5.3.1 Development

5.3.2 Logistics Construction

5.4 Cold-chain Logistics

5.4.1 Development

5.4.2 Development of Cold-chain Logistics-related Equipment

5.4.3 Development Trend

5.5 Warehousing and Logistics Park Construction

5.6 Development Trend

6. Major Global Automated Logistics Equipment Suppliers

6.1 Daifuku

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Development in China

6.2 SSI SCH?FER

6.2.1 Operation

6.2.2 Development in China

6.3 Swisslog

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Warehousing & Logistics Business

6.3.5 Development in China

6.4 DEMATIC

6.4.1 Operation

6.4.2 Development in China

6.5 Linde Material Handling

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 TGW

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Interroll

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Development in China

6.8 KNAPP AG

6.8.1 Operation

6.8.2 Development in China

7. Major Chinese Automated Logistics Equipment Suppliers

7.1 Shanxi Oriental Material Handling Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Projects under Construction

7.1.6 Output and Sales Volume

7.1.7 Development Prospects

7.2 Miracle Automation Engineering Co., Ltd. (002009)

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Projects under Construction

7.2.6 Automated Logistics Equipment Business

7.2.7 Development Prospects

7.3 Guangdong Dong Fang Precision Science & Technology Co., Ltd. (002611)

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Intelligent Warehousing Equipment Business

7.3.5 Development Prospects

7.4 MESNAC (002073)

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 Projects under Construction

7.4.6 Automated Logistics Equipment Business

7.4.7 Development Prospects

7.5 Anhui Heli Co., Ltd. (600761)

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Gross Margin

7.5.5 Automated Logistics Equipment Business

7.6 Zhejiang Noblelift Equipment Joint Stock Co., Ltd. (603611)

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Gross Margin

7.6.5 Projects under Construction

7.6.6 Output and Sales Volume

7.7 Damon Group

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.8 YongLi (300230)

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Gross Margin

7.8.5 Automated Logistics Equipment Business

7.9 Siasun

7.9.1 Profile

7.9.2 Operation

7.9.3 Revenue Structure

7.9.4 Gross Margin

7.9.5 Automated Logistics Equipment Business

7.9.6 Development Prospects

7.10 Sanfeng Intelligent Conveying Equipment Co., Ltd. (300276)

7.10.1 Profile

7.10.2 Operation

7.10.3 Revenue Structure

7.10.4 Gross Margin

7.10.5 Automated Logistics Equipment Business

7.11 KSEC Logistics & Information Industry Co. Ltd.

8. Conclusion and Prediction

8.1 Enterprises

8.2 Market

Subdivision of Automated Logistics System

Constitution of Automated Logistics System

Industrial Chain of Automated Logistics System

Main Automated Logistics Equipment Products

Classification of Automated Logistics

Development History of Automated Logistics System and Equipment in China

Policies on Automated Logistics Equipment in China, 2008-2016

Market Size of Automated Logistics Equipment in China, 2012-2020E

Market Size of Automated Logistics Equipment in China by Equipment Type, 2013-2020E

Penetration of China’s Automated Logistics Equipment and System in Downstream Sectors

Demand Structure of Automated Logistics Equipment in China by Application, 2013-2020E

Distribution of Major Automated Logistics Equipment Clients in China

Ranking of Top 10 Global Automated Logistics Suppliers by Sales, 2012-2015

Business Domains of Main Automated Logistics Equipment Manufacturers in China, 2016

Gross Margin of Chinese Automated Logistics System and Equipment Suppliers

Constitution of Automatic Stereo Warehouse

Classification of Automatic Stereo Warehouse

Development History of Automatic Stereo Warehouse in China

Fixed Investment and Cost Comparison of Automatic Stereo Warehouse and General Warehouse

Cost Comparison of Automatic Stereo Warehouse and General Warehouse

Market Size of Automatic Stereo Warehouse in China, 2012-2020E

Stereoscopic Warehouse Equipment Investment Details

Automatic Stereo Warehouse Ownership by Sector and Equipment Suppliers in China, 2015

Major Automatic Stereo Warehouse Enterprises in China by Sector

Annual Increment and YoY Growth of AGVs in China, 2011-2020E

Sales Volume Structure of AGV in China by Product, 2015

Demand Structure of Logistics AGV Market by Sector, 2014-2015

Usage Density of Automotive AGVs in Major Countries Worldwide

Market Share of AGVs in China by Enterprise, 2014

TOP 10 AGV Manufacturers in China, 2015

Future Development Trend in AGVs

Market Size of Automated Sorters in China, 2013-2020E

Daily Sorting Quantity of Mainstream Express Enterprises in China, 2015

Development Trend in Automated Sorters

Distribution of Automated Sorting Equipment Enterprises by Category

Major Automated Sorter Manufactures in China

Cross-belt Sorter Performance and Clients of Major Chinese and Global Suppliers

Market Size of Automated Conveyors in China, 2013-2020E

Demand Structure of Automated Conveyors in China by Sector, 2015

Palletizing Robot VS Mechanical Palletizer

Sales Volume and Ownership of Palletizing Robots in China, 2009-2015

Output of Forklifts in China, 2007-2017E

Total Sales Volume and YoY Growth of Forklifts in China, 2005-2017E

Proportion of Exported Forklifts in Total Sales Volume in China, 2007-2017E

Output of Forklifts in China by Product, 2011-2017E

Sales Volume of Forklifts in China by Product, 2010-2017E

Sales Volume Proportion of Electric Forklifts to Internal Combustion Counterbalance Forklifts in China, 2008-2017E

Sales Volume Structure of Forklifts in China by Region, 2013-2015

Sales Volume of Forklifts in China by Company Type, 2014-2017E

Market Concentration of Forklifts in China by Sales Volume, 2014

Competitive Landscape of Forklift Market in China, 2013-2014

Market Share of Two Major Forklift Companies in China, 2009-2015

China-based Subsidiaries of Major Overseas Forklift Companies, 2015

Output and Ownership of Automobiles in China, 2005-2015

Percentage of Logistics Equipment Applied in Automotive Industry by Automobile Manufacturing Process, 2015

Demand for Automated Logistics Equipment in China’s Automobile Industry, 2013-2020E

Competitive Landscape of Automotive Intelligent Logistics Equipment Market in China, 2015

Revenue of Major Automotive Logistics Automation Equipment Suppliers, 2011-2015

Demand for Automated Logistics Equipment in China’s Tobacco Industry, 2013-2020E

Total Amount of Goods in China’s Drug Circulation, 2013-2020E

Automated Logistics Equipment Demand from Pharmaceutical Logistics in China, 2013-2020E

China’s Total Social Logistics, 2010-2015

Market Size of Intelligent Logistics in China, 2010-2015

Market Size and YoY Growth of Online Shopping in China 2007-2015

E-commerce Market Size in China, 2008-2015

Business Volume of Express Delivery Enterprises above Designated Size in China, 2008-2020E

Development Trend and Distribution Modes of E-commerce Firms in China

Logistics Construction of Major E-commerce Firms in China, 2015

Logistics Construction Plan of Major Logistics Enterprises in China, 2015

Construction of Major Logistics Enterprises in China, 2015

Market Size of Cold-chain Logistics in China, 2013-2020E

Classification of Cold-Chain Clients

Rental Price for Cold Storage in the Chinese Cold Chain by Region, 2015

Average Operation of Refrigerated Transport Vehicles in China, 2015

Development Goals of Daifuku by Region

Business Structure of Daifuku

Revenue and Net Income of Daifuku, FY2010-FY2015

Order Value of Daifuku by Sector and % of Total Revenue, FY2013-FY2015

Sales Value of Daifuku by Sector and % of Total Revenue, FY2013-FY2015

Revenue Structure of Daifuku by Region, FY2013-FY2015

Revenue of Daifuku in China, FY2013-FY2015

Revenue of SSI SCH?FER, 2012-2015

Business and Product Distribution of Swisslog

Order Value, Sales Value, and Net Income of Swisslog, 2010-2014

Order Value and Sales Value of Swisslog by Business, 2010-2014

Revenue Structure of Swisslog by Region, 2014

Warehousing and Delivery Solution Order Value and Revenue of Swisslog, 2010-2014

Warehousing and Delivery Solution Revenue Structure of Swisslog by Business, 2013-2014

Warehousing and Delivery Solution Orders of Swisslog by Sector, 2014

Swisslog’s Development Strategy for Warehousing and Delivery Solutions

DEMATIC’s Typical Customers in China

Main Subsidiaries of Linde Material Handling

Order Value, Revenue, and Operating Income of Linde Material Handling, 2013-2015

Operation of TGW Logistics Group, FY2010-FY2016

Interroll’s Businesses

Interroll’s Global Layout

Revenue and Net Income of Interroll, 2010-2015

Revenue Breakdown of Interroll by Product, 2010-2015

Revenue Structure of Interroll by Region, 2013-2015

Revenue and Net Income of Shanxi Oriental Material Handling, 2012-2015

Revenue Structure of Shanxi Oriental Material Handling by Product, 2012-2015

Revenue Breakdown of Shanxi Oriental Material Handling by Region, 2012-2015

Revenue Structure of Shanxi Oriental Material Handling by Application, 2012-2014

Gross Margin of Shanxi Oriental Material Handling by Product, 2012-2015

Major Projects under Construction of Shanxi Oriental Material Handling, 2016

Capacity, Output and Sales Volume of Shanxi Oriental Material Handling by Product, 2012-2014

Revenue and Net Income of Shanxi Oriental Material Handling, 2014-2020E

Business Pattern of Miracle Automation

Revenue and Net Income of Miracle Automation, 2010-2015

Operating Revenue Structure of Miracle Automation by Product, 2012-2015

Operating Revenue Breakdown of Miracle Automation by Region, 2012-2015

Gross Margin of Miracle Automation by Product, 2012-2015

Major Projects under Construction of Miracle Automation, 2016

Logistics Automation Equipment Revenue of Miracle Automation by Product, 2012-2015

Revenue and Net Income of Automated Logistics Equipment Subsidiaries of Miracle Automation, 2014-2015

Miracle Automation’s Major Clients in Automotive Logistics Equipment

Major Events of Layout in Automated Logistics & Warehousing of Miracle Automation, 2014-2016

Revenue and Net Income of Miracle Automation, 2014-2020E

Strategic Layout of Guangdong Dong Fang Precision Science & Technology

Revenue and Net Income of Guangdong Dong Fang Precision Science & Technology, 2012-2015

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Product, 2014-2015

Operating Revenue Structure of Guangdong Dong Fang Precision Science & Technology by Region, 2013-2015

Major Events of Layout in Intelligent Packaging Logistics System of Guangdong Dong Fang Precision Science & Technology, 2014-2016

Revenue and Net Income of Guangdong Dong Fang Precision Science & Technology, 2014-2020E

Revenue and Net Income of MESNAC, 2010-2015

Operating Revenue Structure of MESNAC by Product, 2013-2015

Operating Revenue Breakdown of MESNAC by Region, 2012-2015

Gross Margin of MESNAC by Product, 2013-2015

Major Proposed Projects of MESNAC, 2016

Development History of MESNAC Automated Logistics System, 2010-2016

Revenue and Net Income of MESNAC, 2014-2020E

Revenue and Net Income of Anhui Heli, 2012-2015

Output and Sales Volume of Anhui Heli by Product, 2014-2015

Operating Revenue Breakdown of Anhui Heli by Product, 2013-2015

Operating Revenue Breakdown of Anhui Heli by Region, 2013-2015

Gross Margin of Anhui Heli by Product, 2012-2015

Revenue and Net Income of Zhejiang Noblelift Equipment Joint Stock, 2011-2015

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Product, 2013-2015

Operating Revenue Breakdown of Zhejiang Noblelift Equipment Joint Stock by Region, 2013-2015

Gross Margin of Zhejiang Noblelift Equipment Joint Stock by Product, 2013-2015

Major Projects under Construction of Zhejiang Noblelift Equipment Joint Stock, 2016

Capacity, Output and Sales Volume of Zhejiang Noblelift Equipment Joint Stock by Product, 2011-2014

Revenue and Net Income of Damon Group, 2011-2015

Major Clients of Damon Group by Sector

Operating Revenue Structure of Damon Group by Product, 2011-2015

Operating Revenue Breakdown of Damon Group by Region, 2011-2015

Gross Margin of Damon Group by Product, 2011-2015

Revenue and Net Income of YongLi, 2012-2015

Revenue Structure of YongLi by Product, 2013-2015

Revenue Breakdown of YongLi by Region, 2013-2015

Gross Margin of YongLi by Product, 2013-2015

Operating Revenue Structure of Siasun by Product, 2014-2015

Operating Revenue Structure of Siasun by Region, 2014

Gross Margin of Siasun by Product, 2013-2015

Siasun’s Intelligent Logistics Solutions

Revenue Structure of Siasun by Product, 2012-2017E

Revenue and Net Income of Sanfeng Intelligent Conveying Equipment, 2011-2015

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Product, 2012-2015

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Sector, 2013-2015

Revenue Structure of Sanfeng Intelligent Conveying Equipment by Region, 2014

Gross Margin of Sanfeng Intelligent Conveying Equipment by Product, 2012-2015

Intelligent Conveyor Revenue of Sanfeng Intelligent Conveying Equipment, 2012-2015

Operation of Major Automated Logistics Equipment Suppliers and Automated Logistics Equipment Revenue in China, 2013-2015

Development Trend for Automated Logistics Equipment and System Enterprises

Market Size of Automated Logistics Equipment in China by Product, 2013-2020E

Market Size of Automated Logistics Equipment in China by Sector, 2020E

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...