Global and China Machine Tool Report, 2016-2020

-

Apr.2016

- Hard Copy

- USD

$2,600

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,350

-

- Code:

BXM090

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,800

-

- Hard Copy + Single User License

- USD

$2,800

-

Affected by factors such as economic downturn at home and abroad, weak market demand and the amounting pressure of industrial transformation and upgrading, the machine tool industry of China was on a downward path in 2015 when the operating revenue fell 9.2% from a year earlier and total profit plunged 43.5% year on year; specifically, the metal cutting machine tool has come down for four consecutive years, and the metal forming machine tool dropped sharply for the first time. It is expected that in 2016 China’s machine tool industry would continue to decline but the drop range is anticipated to be narrowed.

Although it remains sluggish, the machine tool industry of China showed some new characteristics in 2015 as the industrial restructuring paces up. First, the structure of demand accelerates to be upgraded, with common machine tools seeing a significant decline but high-end products like machining center rising; then, the export market showed negative growth as a whole, but special processing machine tool and others still kept growth; next, the support capability of functional components and so on was improved, and breakthroughs were made in the CNC system.

Facing harsh reality of the industry, Chinese enterprises are seeking strategic breakthroughs by means like innovation of products, extension of industrial chain as well as cooperation between enterprises.

Dalian Machine Tools Group (DMTG): As the vanguard in Chinese machine tool industry, DMTG’s output of metal cutting machine tools reached 38,000 units and gained the revenue of more than RMB160 million in 2015, both ranking first within the industry. In April 2016, the East China Base project of DMTG was settled in the Economic Development Zone, Zhangjiagang city, with the project investment up to RMB4.5 billion; of all, the first-stage investment is about RMB1.5 billion mainly for constructing a machine tool manufacturing base, a remanufacturing base and an incubation base.

Shenyang Machine Tool Co., Ltd. (SMTCL): As a pioneer in Chinese machine tool industry, SMTCL launched the world’s first model of intelligent motion control technology i5 in 2014 on basis of which the i5 series intelligent machine tools were manufactured. The orders for i5 series hit 4,800 sets or more in 2015. Then in April 2016, SMTCL raised funds of at most RMB3 billion for the intelligent machine tool industrialization and upgrading project as well as the R&D and layout of the marketing network upgrading project.

Qinchuan Machine Tool & Tool (Group) Corp (QCMT&T): Being listed in 2014, QCMT&T is now deploying “three one-thirds” business segments including host machine, functional parts, and modern manufacturing services.

Wuhan Huazhong Numerical Control Co., Ltd. (HNC): As the representative company in CNC system in China, HNC has actively carried out “one core, two segments” strategy, i.e., to build the core of numerical control system technologies, and two segments – machine tool CNC system and industrial robot. In May 2015, HNC joined hands with Foshan Municipal Nanhai District Lianhua Asset Operation & Management Co., Ltd to set up a joint venture named Foshan Huashu Robot Co., Ltd (temporary). In December 2015, the Dongguan-based Startup Incubation Base built by HNC with DMTG was put into operation officially.

Global and China Machine Tool Industry Report, 2016-2020 highlights the followings:

Production and sale, import & export of machine tool and competitive pattern of enterprises worldwide;

Production and sale, import & export of machine tool and competitive pattern of enterprises worldwide;

Policies on and operation, import & export and competition of Chinese machine tool industry;

Policies on and operation, import & export and competition of Chinese machine tool industry;

Production and sale, import & export and key manufacturers of metal cutting machine tool, metal forming machine tool and CNC machine tool in China;

Production and sale, import & export and key manufacturers of metal cutting machine tool, metal forming machine tool and CNC machine tool in China;

Operation and business in China of eight world renown companies;

Operation and business in China of eight world renown companies;

Operation, revenue structure, development strategies and so forth of 18 Chinese players.

Operation, revenue structure, development strategies and so forth of 18 Chinese players.

1 Overview of Machine Tool Industry

1.1 Definition and Classification

1.2 Status in National Economy

1.3 Industry Chain

2 Status Quo of Global Machine Tool Industry

2.1 Production and Consumption

2.1.1 Production

2.1.2 Consumption

2.2 Import and Export

2.2.1 Import

2.2.2 Export

2.2.3 Trade Balance Analysis

2.3 Competitive Landscape

2.3.1 Germany

2.3.2 Japan

2.3.3 USA

3 Development Environment of Machine Tool Industry in China

3.1 Macro-environment

3.1.1 GDP

3.1.2 Fixed-asset Investment

3.2 Policy Environment

4 Development of Machine Tool Industry in China

4.1 International Status

4.2 Industry Operation

4.3 Import and Export

4.3.1 Export

4.3.2 Import

4.4 Competition Pattern

4.4.1 Enterprise Pattern

4.4.2 Regional Pattern

5 Status Quo of Major Machine Tool Market in China

5.1 Metal Cutting Machine Tools

5.1.1 Production and Marketing

5.1.2 Import and Export

5.1.3 Major Product Market

5.1.4 Key Enterprises

5.2 Metal Forming Machine Tools

5.2.1 Production

5.2.2 Import and Export

5.2.3 Key Enterprises

5.3 CNC Machine Tools

5.3.1 Overview

5.3.2 Production

5.3.3 Import and Export

5.3.4 Key Enterprises

6 Major Global Machine Tool Manufacturers

6.1 Yamazaki Mazak

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 Trumpf

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 Amada

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Komatsu

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 DMG MORI AKTIENGESELLSCHAFT

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 DMG MORI CO., LTD

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Jtekt

6.7.1 Profile

6.7.2 Operation

6.7.3 Development in China

6.8 Okuma

6.8.1 Profile

6.8.2 Operation

6.8.3 Development in China

7 Major Chinese Machine Tool Manufacturers

7.1 Shenyang Machine Tool Co., Ltd. (SMTCL)

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Development Strategy

7.2 Shenji Group Kunming Machine Tool Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Development Strategy

7.3 Qinchuan Machine Tool & Tool (Group) Corp.(QCMT&T).

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Development Strategy

7.4 Jiangsu Yawei Machine Tool Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 Development Strategy

7.5 Wuhan Huazhong Numerical Control Co., Ltd. (HNC)

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Gross Margin

7.5.5 R&D

7.5.6 Development Strategy

7.6 Qinghai Huading Industrial Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Major Customers

7.6.5 Development Strategy

7.7 WeihaiHuadong Automation Co., Ltd. (HDCNC)

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.8 Tontec Technology Investment Group Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Development Strategy

7.9 Zhejiang Rifa Precision Machinery Co., ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 Revenue Structure

7.9.4 Gross Margin

7.9.5 Development Strategy

7.10 Unlisted Companies

7.10.1 Dalian Machine Tool Group Corporation (DMTG)

7.10.2 Qiqihar Heavy CNC Equipment Co., Ltd.

7.10.3 Beijing Beiyi Machine Tool Co., Ltd (BYJC)

7.10.4 Qier Machine Tool Group Co., Ltd.

7.10.5 JIER Machine-Tool Group Co., Ltd.

7.10.6 Chongqing Machine Tool Co., Ltd.(CHMTI)

7.10.7 Spark Machine Tool Co., Ltd.

7.10.8 Yunnan CY Group Co., Ltd.

7.10.9 Shanghai Machine Tool Works Ltd.

8 Summary and Forecast

8.1 Market

8.1.1 Global

8.1.2 China

8.2 Enterprise

8.2.1 Overseas enterprises

8.2.2 Domestic enterprises

Classification of Machine Tools

Demand of Major Industries for Machine Tools

Machine Tool Industry Chain

Production and Consumption of Machine Tool (Metal Working Machine) Worldwide, 1981-2015

Total Output Value of Machine Tools Worldwide, 2008-2020E

Output Value of Machine Tools Worldwide (by Country/Region), 2014

Output Value of Machine Tools (by Continent) and % of Total Worldwide, 2013

Consumption of Machine Tools Worldwide, 2008-2020E

Consumption of Machine Tools Worldwide (by Country/Region), 2013-2015

Consumption of Machine Tools in Global Top5 Consumers, 1981-2015

Per Capita Machine Tool Consumption in Major Countries/Regions, 2014

Import Value and YoY Growth of Machine Tools Worldwide (by Country/Region), 2014

Export Value and YoY Growth of Machine Tools Worldwide (by Country/Region), 2014

Level of Machine Tool Manufacturing and Representative Companies in the World’s Major Countries

Orders for German Machine Tools, 2005-2015

Production and Sale of Machine Tools in Germany, 2005-2015

CNC Machine Tool Output Value in Germany, 2011-2015

Orders for Japan-made Machine Tools, 2011-2016

Orders for Japan-made Machine Tools (by Market), 2011-2016

Output Value and Sales of Japan-made Machine Tools, 2011-2016

Import and Export of Machine Tools in Japan, 2011-2015

Orders for USA-Made Machine Tools (by Product), 2013-2015

China’s GDP and Growth Rate,2011-2020

Growth Rate of Fixed-asset Investment in China’s Machinery Industry, 2009-2020

Growth Rate of Fixed-asset Investment in China’s Machine Tool Industry,2009-2020

Main Policies on Machine Tool Industry in China, 2011-2015

Import of CNC Machine Tool-related Technologies and Products Encouraged by China

China’s Global Ranking in Machine Tool Industry, 2014

Prosperity Index of Machine Tools (by Sub-industry) in China, 2014-2015

Prosperity Index of Machine Tools (by Enterprise Nature) in China, 2014-2015

Major Economic Indicators for Machine Tool Industry in China, 2012-2015

Major Economic Indicators for Metal Cutting Machine Tool and Metal Forming Machine Tool Industries, 2010-2015

Import and Export Value of Machine Tools in China, 2009-2015

Export Volume and Value of Metal Working Machine Tools in China, 2008-2015

Export Value and YoY Growth of Machine Tools in China (by Product), 2014-2015

Export Destinations of China-made Metal Working Machine Tools, 2013

Import Value of Metal Working Machine Tools in China, 2009-2015

Import Value and YoY Growth of Machine Tools in China (by Product), 2014-2015

Import Origins of Metal Working Machine Tools in China, 2013

Top 30 Companies in China’s Machine Tool Industry, 2015

Output and YoY Growth of Metal Cutting Machine Tools in China, 2009-2016

Output of Metal Cutting Machine Tools in China (by Province/Municipality), 2012-2015

Import and Export Value of Metal Cutting Machine Tools in China, 2007-2015

Import and Export Value of Metal Cutting Machine Tool Products in China, 2011-2015

Output and Output Value of Major Metal Cutting Machine Tool Products in China, 2013

TOP10 Metal Cutting Machine Tool Enterprises in China by Output Value, 2015

Output and YoY Growth of Metal Forming Machine Tools in China, 2009-2016

Output of Metal Forming Machine Tools (by Province/Municipality), 2012-2015

Import and Export Value of Metal Forming Machine Tools in China, 2007-2015

TOP3 Metal Forming Machine Tool Enterprises in China by Output Value, 2015

Output of CNC Machine Tools in China, 2008-2015

CNC Proportion of CNC Metal Cutting Machine Tools in China, 2006-2015

CNC Metal-cutting Machine Tool Output in China by Province, 2013-2015

CNC Metal Forming Machine Tool Output in China by Province, 2013-2015

Import and Export Value of CNC Machine Tools (Metal Working Machine) in China, 2010-2015

Import and Export Value of CNC Metal Cutting Machine Tools in China (by Product), 2010-2015

Structure of CNC System

CNC System Output Value in China by Product, 2013

Product Line of Major CNC System Manufacturers

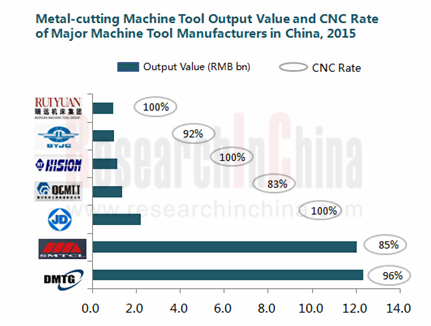

Output and Output Value of CNC Metal Cutting Machine Tools of Major Machine Tool Enterprises in China, 2015

Yamazaki Mazak’s Production Base Distribution Worldwide, 2015

Yamazaki Mazak’s Support Base Distribution Worldwide, 2015

Milestones of Yamazaki Mazak, 2011-2015

Yamazaki Mazak’s Enterprise Distribution in China, 2015

Distribution of Trumpf’s Major Subsidiaries Worldwide

Trumpf’s Sales and Orders, FY2011-FY2015

Trumpf’s Sales and Share (by Business), FY2015

Trumpf’s Machine Tool Business Distribution Worldwide

Trumpf’s Enterprise Distribution in China, 2015

Amada’s Revenue and Net Income, FY2011-FY2015

Amada’s Order Amount (by Product), FY2013-FY2015

Amada’s Sales (by Product), FY2010-FY2015

Amada’s Revenue (by Region), FY2011-FY2015

Amada’s Enterprise Distribution in China, 2015

Major Economic Indicators of Komatsu, FY2010-FY2015

Komatsu’s major products and Application

Komatsu’s Revenue (by Segment), FY2010-FY2015

Revenue Structure of Komatsu (by Region), FY2014

Business Structure of Dmg Mori Aktiengesellschaft

Main Business Indicators of Dmg Mori Aktiengesellschaft, 2009-2015

Revenue and Order Intake of Dmg Mori Aktiengesellschaft (by Segment), 2009-2015

Machine Tool Revenue and Order Intake of Dmg Mori Aktiengesellschaft (by Region), 2014-2015

Major Machine Tool Companies of Dmg Mori Aktiengesellschaft, 2015

Development History of DMG MORI

Revenue and Net Income of DMG MORI, FY2008-FY2015

Revenue of DMG MORI (by Region), FY2013-FY2014

Revenue of DMG MORI (by Segment), 2014-2015

Machine Tool Order Amount and Structure of DMG MORI, FY2009-FY2013

DMG MORI Plant in Tianjin

Jtekt’s Revenue and Net Income, FY2011-FY2014

Jtekt’s Revenue (by Segment), FY2014

Jtekt’s Revenue (by Region), FY2011-FY2014

Jtekt’s Enterprise Distribution in China

Okuma’s Order Amount, FY2010-FY2015

Okuma’s Revenue and Net Income, FY2011-FY2015

Okuma’s Revenue and New Orders(by Region), FY2010-FY2015

Okuma’s Revenue and New Orders (by Product), FY2013-FY2015

Okuma’s Sales Outlet Distribution in China

SMTCL’s Revenue and Net Income, 2009-2015

SMTCL’s Operating Revenue (by Product), 2010-2015

SMTCL’s Operating Revenue (by Region), 2010-2015

SMTCL’s Gross Margin, 2009-2015

SMTCL’s Gross Margin (by Product), 2010-2015

Revenue and Net Income of Kunming Machine Tool, 2009-2015

Kunming Machine Tool’s Order Amount and CNC Proportion, 2009-2015

Operating Revenue of Kunming Machine Tool (by Product), 2011-2015

Kunming Machine Tool’s Gross Margin, 2009-2015

Kunming Machine Tool’s Gross Margin (by Product), 2013-2015

Revenue and Net Income of Qinchuan Machine Tool Group, 2009-2015

Operation of Main Subsidiaries of QCMT&T, 2015

Operating Revenue of QCMT&T (by Segment), 2014-2015

Operating Revenue of QCMT&T (by Region), 2014-2015

Gross Margin of QCMT&T (by Segment), 2012-2015

Revenue and Net Income of Jiangsu Yawei Machine Tool, 2009-2015

Operating Revenue of Jiangsu Yawei Machine Tool (by Region), 2009-2015

Gross Margin of Jiangsu Yawei Machine Tool, 2009-2015

HNC’s Revenue and Net Income, 2009-2015

HNC’s Operating Revenue (by Product), 2010-2015

HNC’s Operating Revenue (by Region), 2010-2015

HNC’s Gross Margin, 2009-2015

HNC’s Gross Margin (by Product), 2009-2015

HNC’s R&D Costs and % of Total Revenue, 2011-2015

Application of HNC’s Tapping/Drilling Center System in the 3C Industry

Revenue and Net Income of Qinghai Huading, 2009-2015

Operating Revenue of Qinghai Huading (by Segment), 2012-2015

Revenue of Qinghai Huading’s Major Machine Tool Subsidiaries, 2011-2015

Operating Revenue of Qinghai Huading (by Region), 2011-2015

Qinghai Huading’s Revenue from Top 5 Clients and % of Total Revenue, 2014

Revenue and Net Income of WeihaiHuadong Automation, 2009-2015

Performance of WeihaiHuadong Automation’s Major Subsidiaries, 2015

Operating Revenue of WeihaiHuadong Automation (by Product), 2011-2015

Operating Revenue of WeihaiHuadong Automation (by Region), 2011-2015

Gross Margin of WeihaiHuadong Automation, 2009-2015

Gross Margin of WeihaiHuadong Automation (by Product), 2011-2015

Revenue and Net Income of TONTEC, 2009-2015

Operating Revenue and Gross Margin of TONTEC (by Product), 2015

Operating Revenue and Gross Margin of TONTEC (by Region),2015

Revenue and Net Income of RIFA Digital Precision Machinery, 2009-2015

Operating Revenue of RIFA Digital Precision Machinery (by Product), 2011-2015

Operating Revenue of RIFA Digital Precision Machinery (by Region), 2011-2015

Gross Margin of RIFA Digital Precision Machinery, 2010-2015

Gross Margin of RIFA Digital Precision Machinery (by Product), 2011-2015

DMTG’s Major Product Production Modes and Production Subsidiaries

Distribution of DMTG’s Production Bases

DMTG’s Output and Capacity of Major Products, 2012-2015

Main Operating Indicators of DMTG, 2010-2015

Market Shares of DMTG’s Major Products, 2014

DMTG’s Operating Revenue and Gross Margin (by Product), 2013-2015

Proposed Projects of DMTG, 2016

Main Economic Indicators of Qiqihar Heavy CNC Equipment, 2011-2015

BYJC’s Main Subsidiaries

JIER Machine-Tool’s Major Clients

Consumption Structure of Machine Tools (by Region) Worldwide, 2014-2015

Production Structure of Machine Tools (by Region) Worldwide, 2014-2015

Output and YoY Growth of Metal Cutting Machine Tool in China, 2011-2020E

CNC Machine Tool Output Structure in China by Level, 2007-2020E

Revenue and Market Share of Major Metal Cutting Machine Tool Manufacturers in China, 2015

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...