Global and China Bearing Industry Report, 2016-2020

-

May 2016

- Hard Copy

- USD

$2,800

-

- Pages:192

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

ZHP038

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$3,000

-

Bearing, a critical component for contemporary mechanical equipment, finds wide applications in automobile, electromechanics, construction machinery, household appliances, metallurgy and mining machinery, etc..

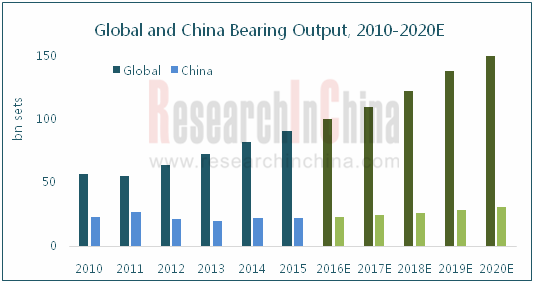

In 2010-2015, the global bearing industry grew steadily, as the output jumped at a CAGR of 9.9%. The output is expected to be 100.5 billion sets with a year-on-year growth of 10.9% in 2016, and exceed 150 billion sets in 2020.

As one of major bearing producers in the world, China produced 22 billion sets of bearings in 2015 (accounting for 24.3% globally), basically same with last year. As the bearing industry gradually stabilizes, Chinese policies will continue to encourage the development of high-end bearing products during the Thirteenth Five-year Plan period, thereby promoting the further development of the bearing industry. In 2016-2020, China's bearing output is expected to grow at a CAGR of 7.8%.

About 1/4 of bearings produced by China are exported. In 2015, Chinese bearing import and export market saw a trade surplus for the first time, namely China exported 5.46 billion sets of bearings (edging up 1.7% year on year) and fetched the export value of USD4.7 billion (up 24.7% year on year); the average export price increased by 22.6% year on year to USD0.86 per set.

In China, bearings are mainly used in automotive, motorcycle, wind power, railway and other fields. Driven by policies and market development, the demand of automotive and wind power fields for bearings will grow steadily in future. The average annual growth rate of the auto bearing demand is estimated at about 5% in 2016-2020, while the demand for high-end auto bearings will grow at more than 10%; the demand for wind power bearings will slow down, but will maintain the growth rate of above 10% in the next few years.

The global bearing market is mainly occupied by Japanese and European companies. In 2015, Sweden SKF still ranked the world's first with 11.4% market share, followed by Germany Schaeffler with 9.6%.

The largest Chinese bearing manufacturer C & U Group seized 4.3% market share in China, but only 1.8% in the global market in 2015; the second-ranked Luoyang LYC Bearing garnered 3.1% market share in China and merely 1.3% in the world.

In 2015, CR10 of Chinese bearing market was 14.5%, an increase of 4 percentage points over 2014, mainly thanks to technological breakthroughs and better market competitiveness of Chinese enterprises in the past two years.

Luoyang LYC Bearing successfully produced the first set of 6 MW wind power spindle bearings in China in March 2016 to fill the company's gap in high-megawatt spindle bearings.

In 2016, wind power 2.0 MW and 2.5 MW speed-up machine bearings developed by Wafangdian Bearing Group cover low-speed and high-speed ends as well as realize installation, substituting the imported counterparts completely and breaking the long-term monopoly of foreign companies in this field.

Global and China Bearing Industry Report, 2016-2020 by ResearchInChina highlights the followings:

Global bearing market size, structure, competitive landscape, etc;

Global bearing market size, structure, competitive landscape, etc;

Development environments, status quo, market size, market structure, competitive landscape, import & export, etc. of China bearing industry;

Development environments, status quo, market size, market structure, competitive landscape, import & export, etc. of China bearing industry;

Overview, market size, competition pattern, etc. of major upstream bearing industries (bearing steel, aluminum, copper, plastic, ceramics, etc.);

Overview, market size, competition pattern, etc. of major upstream bearing industries (bearing steel, aluminum, copper, plastic, ceramics, etc.);

Development, product applications, etc. of main downstream bearing industries (automobiles, motorcycles, railway, wind power, engineering machinery, mining and metallurgy, etc.);

Development, product applications, etc. of main downstream bearing industries (automobiles, motorcycles, railway, wind power, engineering machinery, mining and metallurgy, etc.);

Operation, layout in China, bearing business, development, etc. of 8 global and 10 Chinese bearing manufacturers.

Operation, layout in China, bearing business, development, etc. of 8 global and 10 Chinese bearing manufacturers.

1. Introduction to Bearing

1.1 Definition

1.2 Classification

1.3 Industry Characteristics

1.3.1 Periodicity

1.3.2 Regionality

1.4 Existing Problems

1.5 Industry Chain

2. Development of Global Bearing Industry

2.1 Market Size

2.1.1 Output

2.1.2 Sales

2.2 Market Structure

2.3 Competitive Landscape

2.4 Major Producers

2.4.1 Japan

2.4.2 USA

3. Bearing Industry in China

3.1 Policy Environment

3.1.1 Supportive Policies for Key Products

3.1.2 Trade Policy

3.1.3 Foreign Access Policies

3.2 Status Quo

3.2.1 Enterprises

3.2.2 Sales

3.2.3 Climate

3.3 Market Size

3.3.1 Output

3.3.2 Consumption

3.3.3 Independence

3.4 Market Structure

3.5 Import & Export

3.5.1 Import

3.5.2 Export

3.6 Competitive Landscape

3.6.1 Industry Concentration

3.6.2 Enterprise Pattern

3.6.3 Regional Structure

4 Status Quo of Major Upstream Bearing Industries

4.1 Bearing Steel

4.1.1 Overview

4.1.2 Market

4.1.3 Competition Pattern

4.2 Copper

4.2.1 Overview

4.2.2 Market

4.3 Aluminum

4.3.1 Overview

4.3.2 Market

4.4 Others

4.4.1 Plastics

4.4.2 Ceramics

5 Status Quo of Major Downstream Bearing Application Markets

5.1 Automotive

5.1.1 Bearing Applications

5.1.2 Status Quo

5.2 Motorcycle

5.2.1 Bearing Applications

5.2.2 Status Quo

5.3 Railway

5.3.1 Bearing Applications

5.3.2 Status Quo

5.4 Wind Power

5.4.1 Bearing Applications

5.4.2 Status Quo

5.5 Construction Machinery

5.5.1 Bearing Applications

5.5.2 Status Quo

5.6 Metallurgical and Mining Machinery

5.6.1 Bearing Applications

5.6.2 Status Quo

5.7 Other Application Markets

5.7.1 Petrochemical

5.7.2 Machine Tool

5.7.3 Home Appliance

6. Major Foreign Bearing Manufacturers

6.1 SKF

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Bearing Business

6.1.5 Development in China

6.2 Schaeffler

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Bearing Business

6.2.5 Development in China

6.3 NSK

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Bearing Business

6.3.5 Marketing Network

6.3.6 Development in China

6.4 NTN

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Bearing Business

6.4.5 Development in China

6.5 TIMKEN

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Bearing Business

6.5.5 Development in China

6.6 Minebea

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Bearing Business

6.6.5 Development in China

6.7 Nachi

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Bearing Business

6.7.5 Development in China

6.8 Jtekt

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Bearing business

6.8.5 Development in China

7. Major Chinese Bearing Manufacturers

7.1 Wafangdian Bearing Group Corp

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Product R&D

7.1.5 Marketing Network

7.1.6 Major Subsidiary- Wafangdian Bearing Co., Ltd

7.1.7 Development Strategy

7.2 Luoyang LYC Bearing Co., Ltd

7.2.1 Profile

7.2.2 Operation

7.2.3 Marketing Network

7.2.4 Developments

7.3 Harbin Bearing Manufacturing Co., Ltd

7.3.1 Profile

7.3.2 Operation

7.3.3 Development Strateg

7.4 Tianma Bearing Group Co., Ltd

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 Bearing Business

7.4.6 Competitive Edge

7.5 Xiangyang Automobile Bearing Co., Ltd

7.5.1 Profile

7.5.2 Major Customers and Suppliers

7.5.3 Operation

7.5.4 Revenue Structure

7.5.5 Gross Margin

7.5.6 Bearing Business

7.5.7 Marketing Network

7.6 Fujian Longxi Bearing (Group) Corp., Ltd

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Gross Margin

7.6.5 Bearing Business

7.6.6 Competitive Edge

7.6.7 Development

7.7 Luoyang Bearing Science & Technology Co., Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.7.5 Bearing Business

7.7.6 Competitive Edge

7.7.7 Developmen

7.8 Baota Industry Co., Ltd.

7.8.1 Profile

7.8.2 Major Customers and Suppliers

7.8.3 Operation

7.8.4 Revenue Structure

7.8.5 Gross Margin

7.8.6 Bearing Business

7.8.7 R&D

7.8.8 Developments

7.9 C&U Group

7.9.1 Profile

7.9.2 Operation

7.9.3 Bearing Business

7.9.4 Developments

7.10 WanxiangQianchao Co., Ltd.

7.10.1 Profile

7.10.2 Major Customers and Suppliers

7.10.3 Operation

7.10.4 Revenue Structure

7.10.5 Gross Margin

7.10.6 Bearing Business

7.10.7 Development Strategy

8. Summary and Forecast

8.1 Market

8.2 Enterprise

Classification of Bearings

Schematic Diagram of Bearing

Distribution of Five Major Bearing Industrial Agglomerations in China

Bearing Industry Chain

Global Bearing Output, 2010-2020E

Global Bearing Sales, 2008-2020E

Global Bearing Sales Structure by Region, 2015

Global Top10 Bearing Manufacturers, (FY) 2015

Japan's Bearing Output and Growth Rate, 2005-2016

Japan's Bearing Output Value and Growth Rate, 2005-2016

Japan's Bearing Output Structure (by Product), 2015

Japan's Bearing Output Value Structure (by Product), 2015

Japan's Bearing Import & Export Volume, 2009-2016

Japan's Bearing Import & Export Value, 2009-2016

USA's Bearing Import Volume Structure (by Product), 2015

USA's Bearing Import Volume Structure (by Country), 2015

Key Bearings in China

Number of Bearing Manufacturers in China, 2005-2015

Type of Bearing Manufacturers in China, 2015

Operating Revenue and Total Profit of Bearing Industry in China, 2011-2020E

Prosperity Index of Bearing Industry in China, 2012-2015

China’s Bearing Output, 2007-2020E

China’s Rolling Bearing Output and Growth Rate, 2007-2020E

China’s Apparent Consumption of Bearing, 2007-2020E

Independence of China's Major Equipment Bearings, 2015/2020E

China’s Rolling Bearing Output Structure (by Province and Municipality), 2015

China’s Bearing Import Volume and Value, 2011-2016

China’s Bearing Import Volume Structure by Country/Region, 2015

China’s Bearing Import Value Structure by Country/Region, 2015

China’s Bearing Export Volume and Value, 2008-2016

China’s Bearing Export Volume Structure by Country/Region, 2015

China’s Bearing Export Value Structure by Country/Region, 2015

China’s Bearing Export Average Price, 2014-2015

Comparison of Bearing Industry Concentration in China, Germany, United States, and Japan, 2015

Top 5 Domestic Companies by Bearing Revenue in China, 2015

China’s Bearing Output Structure by Province/Municipality, 2014-2015

Main Categories of Bearing Steel

Indicator Comparison between Domestic and Foreign Bearing Steel (GCr15)

Main Foreign New-type Bearing Steel

China’s Bearing Steel Output, 2014-2015

Bearing Steel Ex-factory Price of China’s Major Manufacturers, 2015

Competition Pattern in Chinese Bearing Steel Market, 2015

Distribution of Global Copper Mine Resources

Distribution of China's Copper Mine Resources

China’s Copper Mine Reserves Structure (by Province and Municipality), 2015

Global Refined Copper Output and Sales Volume, 2012-2016

China's Refined Copper Output and Sales Volume, 2012-2016

Distribution of Global Bauxite Resources

Distribution of China's Bauxite Resources

Global Primary Aluminum Capacity and Output, 2014-2015

Revenue and Profit of China's Plastic Product Industry, 2010-2016

Output and Growth Rate of China's Plastic Products, 2004-2016

Operating Revenue of China's Ceramic Industry, 2015

Operating Revenue Structure of China's Ceramic Industry (by Product), 2015

Loss Structure of China's Ceramic Industry (by Region), 2015

Bearing Structure of Sedan (by Type)

China’s Demand for Automotive Bearing, 2013-2020E

Major Automotive Bearing Manufacturers Worldwide

Sales Volume of Passenger Vehicle Worldwide, 2005-2016

Sales Volume of Commercial Vehicle Worldwide, 2005-2016

Automobile Sales Volume of Major Countries in the World, 2015

Changes in China’s Automobile Sales Volume, 2011-2016

China’s Automobile Output and Sales Volume, 2016-2020E

Early Warning Index of Auto Dealer Inventory in China, 2014-2016

Sales Volume Structure of Passenger Vehicles in China (by Country), 2015

Competition Pattern of Automotive Market in China, 2015

China's Motorcycle Bearing Demand, 2013-2020E

China's Motorcycle Sales Volume and Growth Rate, 2006-2016

China's Motorcycle Sales Volume Structure (by Type), 2015

China's Motorcycle Output Structure (by Province and Municipality), 2015

China’s Demand for Railway Bearing, 2013-2020E

China’s Railway Operating Mileage and Investment, 2011-2016

China’s Railway Locomotive Output and Growth Rate, 2005-2016

China’s Railway Wagon Output and Growth Rate, 2006-2016

China’s Passenger Train Output and Growth Rate, 2006-2016

China's Wind Power Bearing Demand, 2009-2020E

Major Wind Power Bearing Manufacturers in China

China's Wind Power Installed Capacity, 2008-2020E

China's New Wind Power Installed Capacity (by Province and Municipality), 2005-2015

Average Power of China's Newly and Cumulatively Installed Wind Power Units, 1991-2015

New Installed Capacity of China’s 1.5MW and 2.0MW Units, 2004-2015

Cumulative Installed Capacity Structure of China’s Wind Power Units (by Power), 2015

Share of Chinese Wind Power Manufacturers in New Installation Market, 2015

Demand of Engineering Machinery for Bearings, 2006-2020E

China’s Engineering Machinery Sales Volume, 2006-2016

Demand of Chinese Metallurgical and Mining Equipment for Bearings, 2014-2020E

China’s Metallurgical and Mining Equipment Output, 2007-2016

China’s Metal Smelting Equipment Output Structure (by Province and Municipality), 2015

China’s Metal Rolling Equipment Output Structure (by Province and Municipality), 2015

China’s Mining Equipment Output Structure (by Province and Municipality), 2015

Number of Employees of SKF, 2009-2015

Net Sales and Net Income of SKF, 2009-2015

Revenue Structure of SKF by Business, 2012-2015

Revenue Structure of SKF by Region, 2013-2015

Applications and Share of SKF’s Bearings, 2013-2015

SKF’s Revenue from Bearing Business, 2003-2016E

Bearing Business Development of SKF in China

Number of Employees of Schaeffler, 2009-2015

Revenue and Net Income of Schaeffler, 2009-2015

Revenue Structure of Schaeffler by Business, 2011-2015

Revenue Structure of Schaeffler by Region, 2014-2015

Main Bearings of Schaeffler

Schaeffler’s Revenue from Bearing Business, 2003-2016E

Development History of Schaeffler in China

Number of Employees of NSK, FY2009-FY2015

Net Sales and Net Income of NSK, FY2008-FY2015

Revenue Structure of NSK by Business, FY2011-FY2015

Revenue Structure of NSK by Business, FY2011-FY2015

NSK’s Revenue from Bearing Business, FY2010-FY2015

Bearing Sales Structure of NSK by Business, FY2010-FY2015

Industrial Machinery Bearing Sales Structure of NSK, FY2014

Global Marketing Network of NSK, 2015

Bearing Production Bases of NSK in China

Revenue of NSK in China and Growth Rate, FY2006-FY2015

Revenue Structure of NSK in China by Business, FY2014

Number of Employees of NTN, FY2009-FY2015

Net Sales and Net Income of NTN, FY2009-FY2016

Revenue Structure of NTN by Business, FY2012-FY2016

Revenue Structure of NTN by Region, FY2009-FY2016

NTN’s Bearings and Their Applications

NTN’s Revenue from Bearing Business, FY2008-FY2016

Development History of NTN in China

NTN’s Main Production Bases and Sales Outlets in China, 2016

Number of Employees of TIMKEN, 2009-2015

Net Sales and Net Income of TIMKEN, 2009-2015

Product Terminal Application Structure of TIMKEN, 2015

Revenue Structure of TIMKEN by Business, 2012-2015

Revenue Structure of TIMKEN by Region, 2009-2015

Main Bearings of TIMKEN

TIMKEN’s Revenue from Bearing Business, 2003-2016E

TIMKEN’s Layout in China

TIMKEN’s Factories in China and Core Products

Development of TIMKEN in China

Number of Employees of Minebea, FY2009-FY2016

Net Sales and Net Income of Minebea, FY2009-FY2016

Revenue Structure of Minebea by Business, FY2013-FY2016

Revenue Structure of Minebea by Region, FY2012-FY2015

Main Bearings and Global Market Share of Minebea, 2015

Minebea’s Revenue from Bearing Business, FY2011-FY2016

Minebea’s Production Bases in China, 2015

Minebea’s Revenue in China and Growth Rate, FY2011-FY2015

Number of Employees of Nachi, FY2009-FY2015

Overseas Production Bases of NACHI

Net Sales and Net Income of NACHI, FY2006-FY2015

Revenue Structure of NACHI by Product, FY2013-FY2015

Revenue Structure of NACHI by Region, FY2009-FY2015

NACHI’s Revenue from Bearing Business and Growth Rate, FY2006-FY2015

Development History of NACHI in China

Number of Employees of Jtekt, FY2009-FY2015

Net Sales and Net Income of Jtekt, FY2009-FY2015

Revenue Structure of Jtekt by Product, FY2013-FY2015

Revenue Structure of Jtekt by Region, FY2009-FY2015

Jtekt’s Revenue from Bearing Business, FY2010-FY2015

Jtekt’s Bearing Production Bases in China

Operating Revenue and Total Profit of Wafangdian Bearing Group, 2004-2015

Bearing Revenue Structure of Wafangdian Bearing Group by Product, 2013-2015

Global Marketing Network of Wafangdian Bearing Group

Revenue and Net Income of Wafangdian Bearing, 2009-2015

Revenue from and Gross Margin of Bearing Business of Wafangdian Bearing, 2010-2015

Bearing Output and Sales Volume of Wafangdian Bearing, 2012-2015

Operating Revenue and Total Profit of Luoyang LYC Bearing, 2005-2015

Competitive Product Group of Luoyang LYC Bearing

Operating Revenue and Total Profit of Harbin Bearing Manufacturing, 2004-2015

Equity Structure of Tianma Bearing Group, 2015

Number of Employees of Tianma Bearing Group, 2009-2015

Revenue and Net Income of Tianma Bearing Group, 2007-2015

Revenue Structure of Tianma Bearing Group by Product, 2012-2015

Revenue Structure of Tianma Bearing Group by Region, 2012-2015

Gross Margin of Tianma Bearing Group by Product, 2010-2015

Bearing Revenue and Growth Rate of Tianma Bearing Group, 2007-2015

Revenue of Tianma Bearing Group’s Major Bearing Subsidiaries, 2015

Equity Structure of Xiangyang Automobile Bearing, 2015

Number of Employees of Xiangyang Automobile Bearing, 2008-2015

Xiangyang Automobile Bearing’s Revenue from Major Customers and % of Total Amount, 2014-2015

Xiangyang Automobile Bearing’s Procurement from Major Suppliers and % of Total Amount, 2013-2015

Revenue and Net Income of Xiangyang Automobile Bearing, 2007-2015

Output and Sales Volume of Xiangyang Automobile Bearing’s Major Products, 2011-2015

Revenue Structure of Xiangyang Automobile Bearing by Product, 2012-2015

Revenue Structure of Xiangyang Automobile Bearing by Region, 2012-2015

Gross Margin of Xiangyang Automobile Bearing by Product, 2008-2015

Xiangyang Automobile Bearing’s Revenue from Bearing Business and Growth Rate, 2008-2015

Global Marketing Network of Xiangyang Automobile Bearing

Equity Structure of Fujian Longxi Bearing (Group), 2015

Number of Employees of Fujian Longxi Bearing (Group), 2009-2015

Revenue and Net Income of Fujian Longxi Bearing (Group), 2006-2015

Revenue Structure of Fujian Longxi Bearing (Group) by Product, 2012-2015

Revenue Structure of Fujian Longxi Bearing (Group) by Region, 2009-2015

Gross Margin of Fujian Longxi Bearing (Group) by Product, 2009-2015

Fujian Longxi Bearing (Group)’s Revenue from Bearing Business and Growth Rate, 2009-2015

Bearing Output and Sales Volume of Fujian Longxi Bearing (Group), 2014-2015

Investment in Projects under Construction of Fujian Longxi Bearing (Group), 2016

Equity Structure of Luoyang Bearing Science & Technology, 2015

Number of Employees of Luoyang Bearing Science & Technology, 2009-2015

Revenue and Net Income of Luoyang Bearing Science & Technology, 2007-2015

Revenue Structure of Luoyang Bearing Science & Technology by Product, 2012-2015

Revenue Structure of Luoyang Bearing Science & Technology by Region, 2009-2015

Gross Margin of Luoyang Bearing Science & Technology by Product, 2009-2015

Luoyang Bearing Science & Technology’s Revenue from Bearing Business and Growth Rate, 2007-2015

Bearing Output and Sales Volume of Luoyang Bearing Science & Technology, 2012-2015

Revenue of Luoyang Bearing Science & Technology’s Major Bearing Subsidiaries, 2015

Investment in Projects under Construction of Luoyang Bearing Science & Technology, 2015

Equity Structure of Baota Industry, 2015

Employees of Baota Industry, 2009-2015

Baota Industry’s Revenue from Major Customers and % of Total Amount, 2013-2015

Baota Industry’s Procurement from Major Suppliers and % of Total Amount, 2013-2015

Revenue and Net Income of Baota Industry, 2007-2015

Revenue Structure of Baota Industry by Product, 2012-2015

Revenue Structure of Baota Industry by Region, 2009-2015

Gross Margin of Baota Industry by Product, 2009-2015

Baota Industry’s Revenue from Bearing Business, 2009-2015

Main R&D Projects of Baota Industry, 2015

Revenue and Growth Rate of C&U Group, 2009-2015

Bearing Production Bases of C&U Group

C&U Group’s Revenue from Bearing Business and Growth Rate, 2009-2015

Equity Structure of WanxiangQianchao, 2015

Number of Employees of WanxiangQianchao, 2008-2015

WanxiangQianchao’s Revenue from Major Customers and % of Total Amount, 2013-2015

WanxiangQianchao’s Procurement from Major Suppliers and % of Total Amount, 2013-2015

Revenue and Net Income of WanxiangQianchao, 2007-2015

Revenue Structure of WanxiangQianchao by Product, 2013-2015

Revenue Structure of WanxiangQianchao by Region, 2012-2015

Gross Margin of WanxiangQianchao by Product, 2008-2015

Bearing Output and Sales Volume of WanxiangQianchao, 2011-2015

Revenue of WanxiangQianchao’s Major Bearing Subsidiaries, 2015

Development Pace of Global and China's Bearing Industry, 2009-2020E

China’s Bearing Import & Export, 2011-2016

Competitive Landscape of Global Bearing Industry, 2015

Competitive Landscape of China Bearing Industry, 2015

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...