Global and China Marine Diesel Engine Industry Report, 2016

-

June 2016

- Hard Copy

- USD

$2,300

-

- Pages:96

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZHP039

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

A marine diesel engine is the major power equipment of a vessel, with the cost accounting for around 10% of the total. It can be divided into low-speed, medium-speed and high-speed marine diesel engines according to the rotational speed.

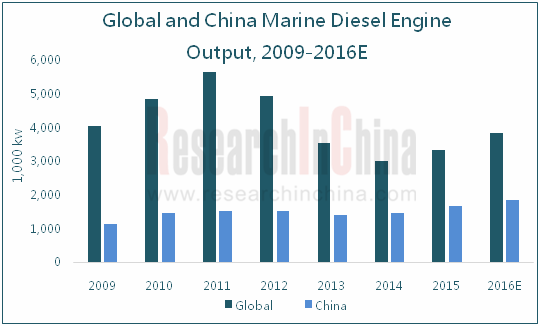

In 2015, the global marine diesel engine market size was 33.43 million kilowatts, up 10.2% from a year earlier. The global marine diesel engine production was mainly concentrated in China, Japan, and South Korea. And South Korea mainly produced low-speed marine diesel engines while China and Japan primarily focused on medium-speed engines.

In 2015, fueled by the growing starts in vessels, the output of marine diesel engines in China rose by 15.1% year on year to 16.99 million kilowatts, with the output of low-speed, medium-speed, and high-speed engines accounting for 41.2%, 40.1%, and 18.7%, respectively.

In China, marine diesel enginesare mainlyp roduced through patent licensing. Low-speed engines are absolutely dominated by MAN,Wartsila, and Mitsubishi Heavy Industries; in medium-speed engine market, Wartsila, MAN, and Caterpillar represented a combined market share of 82% (in 2015); high-speed engine brands primarily include MTU, Deutz, MWM, SACM, Pielstick, Ruston, and Paxman.

China's marine diesel engine market started late, so much so that it is poor in production technology and R&D capability. Therefore, most engine products with high technical content are still reliant on imports. In 2015, China imported USD1.07 billion worth of marine diesel engines and exported USD94.95 million engines, with a trade deficit of as much as USD970 million.

In China’s low-speed diesel engine market, Hudong Heavy Machinery, Dalian Marine Diesel, and Yichang Marine Diesel Engine accounted for an aggregate market share of roughly 95.9%; in medium-speed diesel enginemarket, Weichai Heavy Machinery and CSSC Marine Power made up a 58.9% market share; high-speed diesel engine manufacturers mainly include Weichai Heavy Machinery, Shaanxi Diesel Engine Heavy Industry, and Henan Diesel Engine Industry, of which Weichai Heavy Machinery has a market share of around 26%.

To improve the competitiveness in marine diesel engine market, major Chinese diesel engine manufacturers are working on new product development.

Hudong Heavy Machinery is the largest manufacturer of low-speed marine diesel engines in China (a roughly 65% share in domesticmarket). It gained a 51% stake in CSSC-MES Diesel in 2013. In April 2016, the company’s high-pressure marine air supply system became China’s first certified FGSS, thus breaking the monopoly of Japan and South Korea in the product market.

In October 2015, CSSC Marine Power renewed the contract with MAN Diesel & Turbofor another 10 years of production of four-stroke medium speed engines. In May 2016, the company’s 6S60ME low-speed diesel engine started operation. The latest designed model is the largest diesel engine constructed by CSSC Marine Power, which weighs approximately 390 tons.

Henan Diesel Engine Industry released the first domestic HPCR high-speed high-power diesel engine -- CHD622V20CR in December 2015, a move that helped fill the gap in the domestic 3500kw-above high-speed diesel engine market.

Yichang Marine Diesel Engine completed the bench test of its first 8S60ME-C8.2 diesel enginein August 2015, and the performance indicators of the product satisfied the design requirements.With a rated power of 14100KW, it could be the largest diesel engine product in power since the company’s founding.

The report highlights the followings:

Market size and competitive landscape of global marine diesel engine;

Market size and competitive landscape of global marine diesel engine;

Industry environment, policy environment, market size, import and export, and competitive landscape of marine diesel engine in China;

Industry environment, policy environment, market size, import and export, and competitive landscape of marine diesel engine in China;

Market status, major enterprises, and competitive landscape of the Chinese marine diesel engine market segments (low-speed diesel engine, medium-speed diesel engine, and high-speed diesel engine);

Market status, major enterprises, and competitive landscape of the Chinese marine diesel engine market segments (low-speed diesel engine, medium-speed diesel engine, and high-speed diesel engine);

Operation, development in China, R&D capability, and development strategies of 7 global and 16 Chinese marine diesel engine companies.

Operation, development in China, R&D capability, and development strategies of 7 global and 16 Chinese marine diesel engine companies.

1 Overview of Marine Diesel Engine

1.1 Definition

1.2 Classification & Features

1.2.1 Classification

1.2.2 Features

2 Development of Global Marine Diesel Engine

2.1 Market Size

2.2 Competitive Landscape

2.2.1 by Country

2.2.2 by Enterprise

3 Development Environment of Marine Diesel Engine in China

3.1 Industrial Environment

3.2 Policy Environment

3.2.1 Industrial Planning

3.2.2 Trade Policy

4 Marine Diesel Engine Market in China

4.1 Supply & Demand

4.1.1 Supply

4.1.2 Demand

4.2 Import & Export

4.2.1 Import

4.2.2 Export

4.3 Competitive Landscape

4.3.1 Regional Competition

4.3.2 Corporate Competition

5 Chinese Marine Diesel Engine Market Segments

5.1 Low-Speed Marine Diesel Engine

5.1.1 Status Quo

5.1.2 Key Players

5.2 Medium-Speed Marine Diesel Engine

5.2.1 Status Quo

5.2.2 Key Players

5.3 High-Speed Marine Diesel Engine

5.3.1 Status Quo

5.3.2 Key Players

6 Key Global Marine Diesel Engine Companies

6.1 MAN Group

6.1.1 Profile

6.1.2 Operation

6.1.3 Marine Diesel Engine Business

6.1.4 Development in China

6.2 Wartsila

6.2.1 Profile

6.2.2 Operation

6.2.3 Marine Diesel Engine Business

6.2.4 Development in China

6.3 Caterpillar

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Hyundai Heavy Industries

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Mitsubishi Heavy Industries

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 Doosan Engine

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 MTU

6.7.1 Profile

6.7.2 Development in China

7 Key Enterprises in China

7.1 Hudong Heavy Machinery

7.1.1 Profile

7.1.2 Operation

7.1.3 Major Subsidiary—CSSC-MES Diesel Co., Ltd.

7.1.4 Major Subsidiary—China Shipbuilding Power Engineering Institute Co. Ltd.

7.1.5 R&D Capability

7.2 Dalian Marine Diesel

7.2.1 Profile

7.2.2 Operation

7.2.3 R&D Capability

7.3 Yichang Marine Diesel Engine

7.3.1 Profile

7.3.2 Operation

7.3.3 R&D Capability

7.3.4 Development Strategy

7.4 Weichai Heavy Machinery

7.4.1 Profile

7.4.2 Operation

7.4.3 Project Progress

7.5 Shaanxi Diesel Engine Heavy Industry

7.5.1 Profile

7.5.2 Operation

7.5.3 R&D Capability

7.5.4 Development Strategy

7.6 CSSC Marine Power

7.6.1 Profile

7.6.2 Operation

7.6.3 Subsidiary—Anqing CSSC Marine Diesel Co., Ltd.

7.6.4 Development Strategy

7.7 Zibo Diesel Engine Parent Company

7.7.1 Profile

7.7.2 Operation

7.7.3 R&D Capability

7.8 Henan Diesel Engine Industry

7.8.1 Profile

7.8.2 Operation

7.8.3 R&D Capability

7.9 Others

7.9.1 Jiangsu Antai Power Machinery Co., Ltd.

7.9.2 Shanghai Xinzhong Power Machine Co., Ltd.

7.9.3 Hefei RongAn Power Machinery Co., Ltd.

7.9.4 ZGPT Diesel Heavy Industry Co. Ltd.

7.9.5 Ningbo C.S.I. Power & Machinery Group Co., Ltd.

7.9.6 ZhongJi Hitachi Zosen Diesel Engine Co., Ltd.

7.9.7 Yuchai Marine Power Co., Ltd

7.9.8 CSR Ziyang Locomotive Co., Ltd.

8 Development Trend of China Marine Diesel Engine Industry

8.1 Existing Problems

8.2 Development Trend

9 Summary and Forecast

9.1 Market

9.2 Enterprises

9.2.1 Global

9.2.2 China

Classification of Marine Diesel Engines

Global Marine Diesel Engine Market Size, 2005-2016

Global Low-speed Marine Diesel Engine Market Size, 2005-2016

Global Low-speed Marine Diesel Engine Market Share (by Country), 2015

Japan’s Marine Diesel Engine Output and Revenue, 2009-2015

Japan’s Low-speed Marine Diesel Engine Output and Output Value, 2009-2015

Japan’s Marine Diesel Engine Output Structure (by Power), 2015

Market Share of Major Global Low-speed Marine Diesel Engine Brands (by Power), 2007-2015

Market Share of Major Global Medium-speed Marine Diesel Engine Brands (by Power), 2007-2015

Three Indicators of Global Shipbuilding, 2010-2016

Three Indicators of China’s Shipbuilding, 2010-2016

Memorandum of Understanding Signed between China Association of the National Shipbuilding Industry, MAN and W?rtsil?, 2011

NOx Emission Standards for Marine Diesel Engines

Development of Marine Diesel Engines Complying with Tier Standards in China, 2010-2016

Policies on Marine Diesel Engine in China, 2007-2016

China’s Output of Marine Diesel Engines, 2009-2016

Shipbuilding Completions in China, 2010-2016

Import Volume and Value of Marine Diesel Engines in China, 2008-2016

TOP 10 Import Sources of Marine Diesel Engines in China, 2014-2015

TOP 10 Importers (Provinces/Municipalities) of Marine Diesel Engines in China, 2014-2015

Export Volume and Value of Marine Diesel Engines in China, 2008-2016

TOP 10 Exporters (Provinces/Municipalities) of Marine Diesel Engines in China, 2014-2015

Top 10 Export Destinations of Marine Diesel Engines in China, 2015

Key Production Areas and Representative Companies of Marine Diesel Engines in China

China’s Output of Low-speed Marine Diesel Engines, 2011-2016

Output and Market Share of Major Low-speed Marine Diesel Engine Companies in China, 2014-2015

Low-Speed Marine Diesel Engine Manufacturers and Their Technical Copartners in China

China's Output of Medium-speed Marine Diesel Engines, 2011-2016

Competitive Landscape of China’s Medium-speed Marine Diesel Engine Market, 2015

Output of Major Medium-speed Marine Diesel Engine Companies in China, 2009-2015

Chinese Medium-speed Marine Diesel Engine Manufacturers and Technical Copartners

High-speed Marine Diesel Engine Output in China, 2011-2016

Major High-speed Marine Diesel Engine Manufacturers and Products in China

MAN's Order Value, 2008-2015

MAN's Revenue and Net Income, 2007-2015

MAN's Revenue Structure (by Business), 2013-2015

MAN's Revenue Breakdown (by Region), 2014-2015

Major Operating Indicators of MAN MDT, 2013-2015

Marine Diesel Engine Manufacturing Bases of MAN

Wartsila's Order Value and Revenue, 2007-2015

Wartsila's Order Value and Revenue (by Business), 2009-2015

Wartsila's Revenue (by Region), 2009-2015

Wartsila's Marine Diesel Engines and Applications

Wartsila's Dual-fuel Medium-speed Engine Models and Power

Loading Capacity of W?rtsil? – Hyundai 50DF Engine, 2006-2015

Wartsila's Joint Ventures and Sole Proprietorships in China, 2015

Revenue and Net Income of QMD, 2013-2015

Caterpillar's Revenue and Growth Rate, 2008-2015

Caterpillar's Revenue (by Business), 2011-2015

Caterpillar's Power System Revenue (by Region), 2010-2015

Caterpillar’s Presence in China

Global Network of Hyundai Heavy Industries

Revenue and Net Income of Hyundai Heavy Industries, 2010-2015

Revenue and Order Value of Engine and Machinery Division of Hyundai Heavy Industries, 2007-2015

New Order Structure of Engine and Machinery Division of Hyundai Heavy Industries (by Region), 2007-2015

Major Economic Indicators of Mitsubishi Heavy Industries, FY2010-FY2015

Revenue of Mitsubishi Heavy Industries (by Business), FY2014-FY2015

Major Technical Copartners of Mitsubishi Heavy Industries in Marine Diesel Engine

Presence of Mitsubishi Heavy Industries in China

Competitive Edges of Doosan Engine

Revenue and Profits of Doosan Engine, 2011-2015

Organizations of Doosan Engine in China, 2015

Emission Level of MTU 4000 Series

Diesel Engine Output of Hudong Heavy Machinery, 2007-2015

Revenue and Net Income of Hudong Heavy Machinery, 2009-2015

Marine Diesel Engine Output of CSSC-MES Diesel, 2009-2015

Marine Diesel Engine Output of Dalian Marine Diesel, 2010-2015

Revenue and Total Profit of Dalian Marine Diesel, 2009-2015

Major Operating Indicators of Yichang Marine Diesel Engine, 2007-2015

Marine Diesel Engines of Weichai Heavy Machinery, 2015

Revenue and Net Income of Weichai Heavy Machinery, 2009-2016

Revenue and Gross Margin of Weichai Heavy Machinery (by Business), 2011-2015

Key Marine Diesel Engines of Shaanxi Diesel Engine Heavy Industry

Major Operating Indicators of Shaanxi Diesel Engine Heavy Industry, 2007-2015

Revenue and Total Profit of CSSC Marine Power, 2010-2015

Marine Diesel Engine Output of CSSC Marine Power, 2009-2015

Marine Diesel Engines of Henan Diesel Engine Industry

Major Economic Indicators of Henan Diesel Engine Industry, 2012-2015

Diesel Engine Delivery of RongAn Power Machinery, 2010-2015

Marine Gas Engines Launched by World’s Major Manufacturers

Marine Medium-speed Dual-fuel Engines Launched by World’s Major Manufacturers

Marine Diesel Engine Manufacturers Authorized by MAN, Wartsila and MTU in China

Output and Capacity of Major Marine Diesel Engine Companies in China, 2015

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...