Global and China Elevator Industry Report, 2016-2020

-

Aug.2016

- Hard Copy

- USD

$2,600

-

- Pages:168

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZLC034

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,800

-

In 2015, the global elevator sales volume dropped for the first time within 20 years to 803,000, down 3% year on year. This was mainly due to the decline in the housing demand in China. In 2016, the sluggish Chinese market may further drag down the global elevator sales volume to 783,000.

At present, China has become the world's largest elevator market in terms of production and consumption. Major global brands have established sole proprietorships or joint ventures in China which acts as the world's elevator factory and manufacturing center.

In 2015-2016, Chinese elevator market characterizes the followings:

1, The new elevator sales volume slumped, but it had little effect on several large elevator companies

In 2015, the real estate downturn and frequent elevator accidents led to the decline in China’s elevator sales volume for the first time in recent years, from 500,000 in 2014 to 480,000, down 4% year on year. In 2016, the sales volume will continue to drop.

Sharp fall in new elevator sales exerted greater impact on SMEs (Small- and Medium-sized Enterprises) instead of several large elevator companies which saw higher sales volume by holding abundant capital, stable customers and stronger competitiveness. In 2015, Shanghai Mechanical & Electrical Industry Co., Ltd., Canny Elevator Co., Ltd. and Guangzhou Guangri Stock Co., Ltd. achieved the respective sales volume of 61,898 units, 19,530 units and 11,016 units, up 4.5%, 10.6% and 2.0% separately.

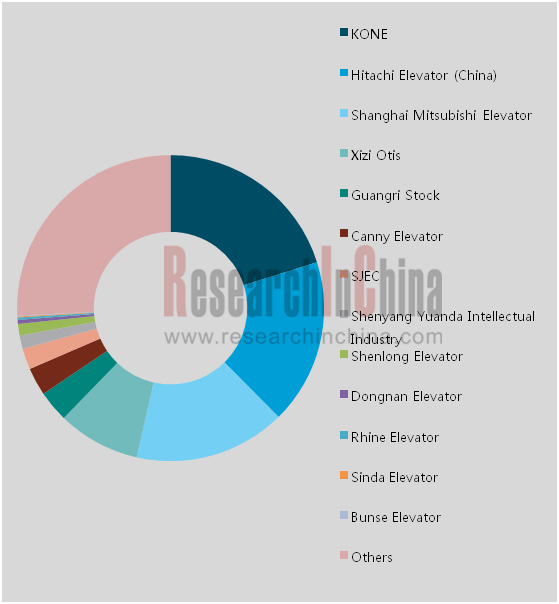

Market Share of China Elevator Industry, 2015 (by Company)

Source: ResearchInChina

2, The maintenance market turned to be a new profit growth engine, so that major companies intensified layout

Based on the elevator stock market, the elevator maintenancebusiness is featured with high margin and huge market space. By the end of 2015, China had owned a total of 4 million elevators. Assuming the unit maintenance is RMB8,000 / year, Chinese elevator maintenance market size will be RMB32 billion.

Although the maintenance revenue contributes little, most of Chinese enterprises have realized that the maintenance market becomes a new profit growth engine for the elevator industry; in this case, they have stepped up the layout of a nationwide marketing network to seize the market.

By the end of 2015, Shanghai Mitsubishi Elevator Co., Ltd had established more than 80 branches and over 360 maintenance service outlets in the country; in 2015, it garnered RMB4.088 billion from installation, maintenance and other services, accounting for 23.2% of the company’s total revenue. Meanwhile, Canny Elevator Co., Ltd. set up 79 branches and service centers, of which 23 ones obtainedClass-A installation and maintenance qualifications; the annual revenue of installation and maintenance reached RMB306 million, accounting for 9.4% of total revenue.

Elevator exports increased steadily thanks to the main exporters -- Jiangsu and Zhejiang

In 2015, China exported 74,101 passenger elevators, escalators and moving walkways, increasing by 5,191 units from a year ago; the export value jumped 8% year on year to USD2.1202 billion.

Zhejiang and Jiangsu are the main provinces exporting passenger elevators and escalators in China. In 2015, Jiangsu ranked first in the country with the export volume of 25,999, equivalent to 48.5% of total exports. 6,911 escalators were exported, accounting for 33.6%.

The new elevator market is expected to rebound in recent years; themaintenance market based on the stock market will grow stably

In 2016, the elevator demand is expected to fall again amid the slowdown of Chinese real estate sector, and the sales volume is estimated at about 470,000. In 2017-2020, the sales volume may rebound under the impetus of urbanization, aging population, fast-growing urban rail transit, gradual enforcement of elevator installation policies as well as an increasing number of old elevators to be replaced. By 2020, the sales volume is expected to reach 650,000, the elevator ownership 5.9 million, and the maintenance market size RMB47.2 billion.

Global and China Elevator Industry Report, 2016-2020 highlights the followings:

Overview of global elevator industry, including new elevator market, maintenance market and competitive landscape;

Overview of global elevator industry, including new elevator market, maintenance market and competitive landscape;

Overview of China elevator industry, embracing new elevator market, maintenance market, development trend and competitive landscape between major companies;

Overview of China elevator industry, embracing new elevator market, maintenance market, development trend and competitive landscape between major companies;

Demand of China elevator industry, covering demand structure and main influencing factors;

Demand of China elevator industry, covering demand structure and main influencing factors;

Operation, elevator business, output, sales volume, major projects and major customers of 10 domestic elevator companies; operation, elevator business and development in China of seven foreign elevator companies.

Operation, elevator business, output, sales volume, major projects and major customers of 10 domestic elevator companies; operation, elevator business and development in China of seven foreign elevator companies.

1 Overview of Elevator Industry

1.1 Overview

1.2 Policy Environment

2 Development of Global Elevator Industry

2.1 New Elevator Market

2.1.1 Elevator Sales Volume Dropped for the First Time within 20 Years

2.1.2 New Elevator Sales by Region

2.2 Maintenance Market

2.2.1 Elevator Ownership

2.2.2 Maintenance Market Becomes a Major Growth Engine

2.3 Competitive Landscape

2.4 Development Mode

2.4.1 Two Modes

2.4.2 Business Development in Asia Pacific

2.4.3 Global Expansion

3 Development of China Elevator Industry

3.1 Product Structure

3.2 New Elevator Market

3.2.1 Status Quo

3.2.2 Sales Volume

3.2.3 Sales Volume of Major Enterprises

3.3 Maintenance Market

3.3.1 Status Quo

3.3.2 Elevator Ownership

3.3.3 Maintenance Market Size

3.3.4 Maintenance Business Comparison between Major Enterprises

3.3.5 Layout of Domestic Elevator Manufacturers in Maintenance Market

3.4 Import and Export

3.4.1 Import Tends to Decline

3.4.2 Export Grows Steadily

3.4.3 Import and Export Unit Price

3.5 Competitive Landscape

3.5.1 Layout of Foreign Brands in China

3.5.2 Financing of Local Enterprises

3.5.3 Operating Result Comparison between Major Enterprises

4 Demand of China Elevator Industry

4.1 Downstream Demand Structure

4.2 Demand Composition

4.3 Influencing Factors

4.3.1 Real Estate Sector

4.3.2 Urbanization

4.3.3 Aging Population

4.3.4 Urban Rail Transit

4.3.5 Renewal and Upgrading of Old Elevators

5 Key Elevator Companies in China

5.1 Shanghai Mechanical & Electrical Industry Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Major Customers

5.1.6 Elevator Business

5.1.7 Shanghai Mitsubishi Elevator Co., Ltd

5.1.8 Major Orders of Shanghai Mitsubishi Elevator Co., Ltd

5.1.9 Mitsubishi Electric Shanghai Electric Elevator Co., Ltd.

5.1.10 Elevator Output and Sales Volume

5.1.11 R&D Investment

5.1.12 Development Forecast

5.2 Guangzhou Guangri Stock Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Major Customers

5.2.6 Elevator Business

5.2.7 Guangri Elevator

5.2.8 Typical Projects

5.2.9 Elevator Output and Sales Volume

5.2.10 R&D Investment

5.2.11 Development Forecast

5.3 Canny Elevator Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Major Customers

5.3.6 Elevator Output and Sales Volume

5.3.7 Typical Projects

5.3.8 R&D Investment

5.3.9 Development Forecast

5.4 SJEC Corporation

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Elevator Output and Sales Volume

5.4.6 Foreign Typical Projects

5.4.7 R&D Investment

5.4.8 Establishment of "Internet + Elevator Service System Center"

5.4.9 Orders

5.4.10 Development Forecast

5.5 Shenyang Yuanda Intellectual Industry Group Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Major Customers

5.5.6 Elevator Output and Sales Volume

5.5.7 Foreign Typical Projects

5.5.8 R&D Investment

5.5.9 Development Forecast

5.6 Shenlong Elevator Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Elevator Capacity, Output and Sales Volume

5.6.6 Major Customers

5.6.7 Foreign Typical Projects

5.6.8 R&D Investment

5.6.9 Development Forecast

5.7 Dongnan Elevator Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 Major Customers

5.7.6 Special Elevator Typical Projects

5.7.7 R&D Investment

5.7.8 Development Forecast

5.8 Shandong Bunse Elevator Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 Major Customers

5.8.6 Typical Projects

5.8.7 R&D Investment

5.8.8 Development Forecast

5.9 Hunan Sinda Elevator Co., Ltd.

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 Major Customers

5.9.6 Typical Projects

5.9.7 R&D Investment

5.9.8 Development Forecast

5.10 Rhine Elevator

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.10.4 Gross Margin

5.10.5 Major Customers

5.10.6 R&D Investment

5.10.7 Development Forecast

6 Key Foreign Elevator Companies

6.1 Otis

6.1.1 Profile

6.1.2 Operation

6.1.3 Orders

6.1.4 Development in China

6.1.5 Xizi Otis

6.1.6 Main Elevator Orders of Xizi Otis

6.2 Hitachi

6.2.1 Profile

6.2.2 Operation

6.2.3 Elevator Business

6.2.4 Development in China

6.2.5 Orders in China

6.3 Schindler

6.3.1 Profile

6.3.2 Operation

6.3.3 Orders

6.3.4 Development in China

6.3.5 Orders in China

6.4 ThyssenKrupp

6.4.1 Profile

6.4.2 Operation

6.4.3 Elevator Business

6.4.4 Development in China

6.4.5 Orders in China

6.5 Toshiba

6.5.1 Profile

6.5.2 Operation

6.5.3 Elevator Business

6.5.4 Development in China

6.5.5 Orders in China

6.6 Fujitec

6.6.1 Profile

6.6.2 Operation

6.6.3 New Mid-term Management Plan

6.6.4 Orders

6.6.5 Development in China

6.6.6 Orders in China

6.7 Kone

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Development in China

6.7.5 Orders in China

Classification of Elevator Products

Main Components of Elevator

Laws and Regulations on Chinese Elevator Industry

Policies on Chinese Elevator Industry

Global Elevator Sales Volume, 2010-2020E

Global Elevator Sales Volume (by Region), 2010-2016E

Global Elevator Sales Volume (by Region), 2014-2015

Structure of Global Elevator Sales Volume (by Country), 2015

Share of Global Newly-Installed Elevator Orders (by Region), 2005-2015

Elevator Ownership per 1000 People and Utilization Rate in Major Countries, 2010-2030E

Global Elevator Ownership, 2013-2020E

Share of Global Elevator Ownership (by Region), 2015

KONE’s Maintenance Revenue as a Percentage of Total Revenue, 2005-2015

Global Elevator Market Share, 2015

KONE’s Revenue in China as a Percentage of Total Revenue, 2015

KONE’s M&A Cases and Their Influences

Schindler’s M&A Cases

Structure of Elevator Product

Market Share of High/Medium Speed Elevator Product in China, 2005-2015

China’s Elevator Sales Volume, 2012-2020E

Sales Volume of Major Chinese Elevator Enterprises, 2015

Structure of China’s Elevator Sales Volume (by Enterprise), 2015

Elevator Sales of Major Chinese Elevator Enterprises, 2015

New Elevator Market Share in China (by Enterprise), 2015

Elevator Maintenance Market Share in China, 2015

Elevator Ownership in China, 2015-2020E

Elevator Maintenance Market Size in China, 2015-2020E

Major Chinese Elevator Enterprises’Installation & Maintenance Revenue as a Percentage of Total Revenue

China’s Passenger Elevator/Escalator/Moving Walk Import Volume and Value, 2010-2015

Top 10 Countries by Passenger Elevator Import Volume in China, 2015

Top 10 Countries by Escalator/Moving Walk Import Volume in China, 2015

China’s Passenger Elevator/Escalator/Moving Walk Export Volume and Value, 2010-2015

Top 10 Chinese Provinces by Passenger Elevator Export Volume, 2015

Top 10 Chinese Provinces by Escalator/Moving Walk Export Volume, 2015

Top 10 Countries by Passenger Elevator Export Volume in China, 2015

Top 10 Countries by Escalator/Moving Walk Export Volume in China, 2015

China’s Passenger Elevator Import and Export Price, 2010-2015

China’s Escalator/Moving Walk Import and Export Price, 2010-2015

Market Share of Elevator Industry in China (by Enterprise), 2015

Comparison between Chinese and International Enterprises in High Speed Elevator Layout

Layout of Major Foreign Elevator Brands in China

Developments of Foreign Elevator Enterprises in China, 2011-2015

Comparison of Revenue from Major Chinese Elevator Enterprises, 2013-2016

Comparison of Net Income from Major Chinese Elevator Enterprises, 2013-2016

Elevator Downstream Demand Structure in China

Elevator Demand Market Components

Factors Influencing Elevator Demand Market Segments

Composition of Elevator Demand in China, 2015

Completed Investment in China’s Real Estate Development, 2010-2015

Growth of Commercial Residential Building Sales Area and Sales in China, 2014-2015

Density of Elevator Configuration in China, 2000-2015

Urbanization Rate in China, 2010-2015

Characteristics of Demand for Elevators under the New-type Urbanization

Proportion of Population Aged 60 or Above in China, 2010-2015

Urban Rail Transit in China

Total Operating Mileage of Urban Rail Transit in China, 2012-2015

Number of Elevators to Be Updated in China, 2010-2024E

Revenue and Net Income of Shanghai Mechanical & Electrical Industry, 2013-2016

Revenue Breakdown of Shanghai Mechanical & Electrical Industry (by Product), 2014-2015

Revenue Structure of Shanghai Mechanical & Electrical Industry (by Product), 2014-2015

Gross Margin of Shanghai Mechanical & Electrical Industry (by Product), 2014-2015

Shanghai Mechanical & Electrical Industry’s Revenue from Top 5 Customers, 2014-2015

Operating Performance of Shanghai Mitsubishi Elevator, 2014-2015

Installation & Maintenance Revenue of Shanghai Mitsubishi Elevator, 2014-2015

Milestones in Development of Shanghai Mitsubishi Elevator

Main Orders of Shanghai Mitsubishi Elevator

Operating Performance of Mitsubishi Electric Shanghai Electric Elevator, 2014-2015

Elevator Output and Sales Volume of Shanghai Mechanical & Electrical Industry, 2014-2015

R&D Costs and % of Total Revenue of Shanghai Mechanical & Electrical Industry, 2014-2015

Revenue and Net Income of Shanghai Mechanical & Electrical Industry, 2015-2020E

Revenue and Net Income of Guangzhou Guangri Stock, 2013-2016

Revenue Breakdown of Guangzhou Guangri Stock (by Product), 2014-2015

Revenue Breakdown of Guangzhou Guangri Stock (by Region), 2014-2015

Gross Margin of Guangzhou Guangri Stock, 2014-2015

Gross Margin of Guangzhou Guangri Stock (by Product), 2014-2015

Gross Margin of Guangzhou Guangri Stock (by Region), 2014-2015

Guangzhou Guangri Stock’s Revenue from Top 5 Customers, 2014-2015

Main Production Bases of Guangzhou Guangri Stock

Financial Indexes of Guangzhou Guangri Elevator Industry, 2014-2015

Typical Projects of Guangzhou Guangri Elevator Industry

Production and Sales of Guangzhou Guangri Stock, 2015

R&D Costs and % of Total Revenue of Guangzhou Guangri Stock, 2013-2015

Guangzhou Guangri Stock’s Layout in Industry 4.0 Intelligence Platform

Revenue and Net Income of Guangzhou Guangri Stock, 2015-2020E

Production Base Layout of Canny Elevator

Global Layout of Canny Elevator

Revenue and Net Income of Canny Elevator, 2013-2016

Revenue Breakdown of Canny Elevator (by Product), 2014-2015

Revenue Structure of Canny Elevator (by Product), 2014-2015

Revenue Breakdown of Canny Elevator (by Region), 2014-2015

Revenue Structure of Canny Elevator (by Region), 2014-2015

Main Overseas Projects of Canny Elevator

Gross Margin of Canny Elevator, 2014-2015

Gross Margin of Canny Elevator (by Product), 2014-2015

Gross Margin of Canny Elevator (by Region), 2014-2015

Canny Elevator’s Revenue from Top 5 Customers, 2014-2015

Major Customers of Canny Elevator

Output and Sales Volume of Canny Elevator, 2014-2015

Typical Projects of Canny Elevator

R&D Costs and % of Total Revenue of Canny Elevator, 2013-2015

Revenue and Net Income of Canny Elevator, 2015-2020E

Revenue and Net Income of SJEC Corporation, 2013-2016

Revenue Breakdown of SJEC Corporation (by Product), 2014-2015

Revenue Structure of SJEC Corporation (by Product), 2015

Revenue Breakdown of SJEC Corporation (by Region), 2014-2015

Revenue Structure of SJEC Corporation (by Region), 2014-2015

Gross Margin of SJEC Corporation (by Product), 2014-2015

Gross Margin of SJEC Corporation (by Region), 2014-2015

Production and Sales of SJEC Corporation (by Product), 2013-2015

Typical Overseas Projects of SJEC Corporation

R&D Costs of SJEC Corporation, 2014-2015

Amount of Valid Orders Being Executed by SJEC Corporation, 2013-2015

Revenue and Net Income of SJEC Corporation, 2015-2020E

Revenue and Net Income of Shenyang Yuanda Intellectual Industry Group, 2013-2016

Revenue Breakdown of Shenyang Yuanda Intellectual Industry Group (by Product), 2014-2015

Revenue Structure of Shenyang Yuanda Intellectual Industry Group (by Product), 2014-2015

Revenue Breakdown of Shenyang Yuanda Intellectual Industry Group (by Region), 2014-2015

Revenue Structure of Shenyang Yuanda Intellectual Industry Group (by Region), 2014-2015

Gross Margin of Shenyang Yuanda Intellectual Industry Group, 2014-2015

Gross Margin of Shenyang Yuanda Intellectual Industry Group (by Product), 2014-2015

Gross Margin of Shenyang Yuanda Intellectual Industry Group (by Region), 2014-2015

Shenyang Yuanda Intellectual Industry Group’s Revenue from Top 5 Customers, 2014-2015

Production and Sales of Shenyang Yuanda Intellectual Industry Group, 2014-2015

Typical Overseas Projects of Shenyang Yuanda Intellectual Industry Group

R&D Costs of Shenyang Yuanda Intellectual Industry Group, 2013-2015

Revenue and Net Income of Shenyang Yuanda Intellectual Industry Group, 2015-2020E

Revenue and Net Income of Shenlong Elevator, 2012-2015

Revenue Breakdown of Shenlong Elevator (by Product), 2012-2014

Revenue Breakdown of Shenlong Elevator (by Region), 2012-2014

Revenue Structure of Shenlong Elevator (by Product), 2012-2014

Gross Profit of Shenlong Elevator (by Product), 2012-2014

Gross Margin of Shenlong Elevator (by Product), 2012-2014

Output of Shenlong Elevator, 2012-2014

Sales Volume of Shenlong Elevator (by Product), 2012-2014

Unit Product Price of Shenlong Elevator, 2012-2014

Top 5 Export Customers of Shenlong Elevator, 2012-2014

Top 5 Accessories Sales Customers of Shenlong Elevator, 2012-2014

Typical Overseas Projects of Shenlong Elevator

R&D Costs of Shenlong Elevator, 2012-2014

Use of Shenlong Elevator’s IPO Raised Funds, 2015

Revenue and Net Income of Shenlong Elevator, 2015-2020E

Application Cases of Dongnan Elevator’s Special Elevator Products

Revenue and Net Income of Dongnan Elevator, 2013-2015

Revenue Breakdown of Dongnan Elevator (by Product), 2013-2015

Revenue Structure of Dongnan Elevator (by Product), 2013-2015

Revenue Breakdown of Dongnan Elevator (by Region), 2013-2015

Revenue Structure of Dongnan Elevator (by Region), 2013-2015

Gross Margin of Dongnan Elevator, 2013-2015

Gross Margin of Dongnan Elevator (by Product), 2013-2015

Dongnan Elevator’s Revenue from Top 5 Customers, 2013-2015

Typical Projects for Special Elevators of Dongnan Elevator

R&D Costs of Dongnan Elevator, 2013-2015

Revenue and Net Income of Dongnan Elevator, 2015-2020E

Revenue and Net Income of Shandong Bunse Elevator, 2013-2015

Revenue Breakdown of Shandong Bunse Elevator (by Business), 2013-2015

Revenue Structure of Shandong Bunse Elevator (by Business), 2013-2015

Gross Margin of Shandong Bunse Elevator, 2013-2015

Top 5 Customers of Shandong Bunse Elevator, 2014-2015

Typical Projects of Shandong Bunse Elevator

R&D Costs of Shandong Bunse Elevator, 2013-2015

Revenue and Net Income of Shandong Bunse Elevator, 2015-2020E

Revenue and Net Income of Hunan Sinda Elevator, 2013-2015

Revenue Breakdown of Hunan Sinda Elevator (by Business), 2013-2015

Revenue Structure of Hunan Sinda Elevator (by Business), 2013-2015

Gross Margin of Hunan Sinda Elevator, 2013-2015

Hunan Sinda Elevator’s Revenue from Top 5 Customers, 2014-2015

Typical Projects of Hunan Sinda Elevator

R&D Costs and % of Total Revenue of Hunan Sinda Elevator, 2013-2015

Revenue and Net Income of Hunan Sinda Elevator, 2015-2020E

Main Technologies of Rhine Lift

Main Elevator Products of Rhine Lift

Revenue and Net Income of Rhine Lift,2013-2015

Revenue Breakdown of Rhine Lift (by Business), 2013-2015

Revenue Structure of Rhine Lift (by Business), 2013-2015

Revenue Breakdown of Rhine Lift (by Region), 2013-2015

Revenue Structure of Rhine Lift (by Region), 2013-2015

Gross Margin of Rhine Lift, 2013-2015

Top 5 Customers of Rhine Lift, 2013-2015

R&D Costs of Rhine Lift,2013-2015

Revenue and Net Income of Rhine Lift, 2015-2020E

Main Financial Indexes ofOtis, 2012-2016

Major Orders for Otis Worldwide

Expansion Process of Otis in China

Major Elevator Orders for Otis in China, 2009-2016

Main Financial Indexes ofXizi Otis, 2015

Major Elevator Orders for Xizi Otis, 2011-2015

Main Financial Indexes ofHitachi, FY2014-FY2015

Revenue Structure of Hitachi (by Division), FY2014-FY2015

Revenue Breakdown of Hitachi (by Region), FY2014-FY2015

Revenue and Operating Income of Hitachi’s Social Infrastructure & Industrial Systems, FY2015

Global Layout of Hitachi Elevators

Development History of Hitachi Elevators

Main Elevator Projects of Hitachi, FY2015

Profile of Hitachi Elevator (China)

Major Elevator Manufacturing Bases of Hitachi in China

Revenue and Net Income of Hitachi Elevator (China), 2011-2015

Main Elevator Orders of Hitachi in China, 2011-2016

Development History of Schindler

Main Financial Indexes of Schindler, 2014-2016

Amount of Schindler’sUndelivered Orders, 2011-2015

Structure of Schindler’s Revenue and Undelivered Orders (by Region), 2005-2015

Development Course of Schindler China

Main Orders of Schindler in China, 2015-2016

Order Amount and Sales of ThyssenKrupp, FY2014-FY2016

Order Amount of ThyssenKrupp (by Business), FY2014-FY2016

Sales of ThyssenKrupp (by Business), FY2014-FY2016

Order Amount and Sales of ThyssenKrupp Elevators, FY2014-FY2016

Development Course of ThyssenKrupp in China

Production Bases of ThyssenKrupp Elevator in China

Main Elevator Orders of ThyssenKrupp in China

Main Financial Indexes of Toshiba, FY2015-FY2016

Revenue and Operating Income Structure of Toshiba (by Business), FY2014-FY2015

Development History of Toshiba Elevators

Sales and Operating Income of Toshiba Community Solutions, FY2014-FY2015

Main Elevator Projects of Toshiba

Main Escalator Projects of Toshiba

Global Layout of Fujitec

Main Financial Indexes of Fujitec, FY2014-FY2015

Revenue Structure of Fujitec (by Region), FY2014-FY2015

Revenue Breakdown of Fujitec (by Region), FY2016E

Medium-term Business Plan for Fujitec

Orders of Fujitec, 2014-2015

Orders of Fujitec (by Region), FY2013-FY2015

Main Elevator Projects of Fujitec

Layout of Fujitec in China

Elevator Manufacturing Bases of Fujitec in China

Main Elevator Projects of Fujitec in China

Global Business Distribution of KONE

Main Financial Indexes of KONE, 2013-2015

Revenue Structure of KONE (by Region), 2005-2015

Revenue Structure of KONE (by Business), 2005-2015

Dominant Companies of KONE in China

Development History of KONE in China

Main Orders of KONE in China, 2016

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...