Global and China Automated Optical Inspection (AOI) Industry Report, 2018-2022

-

Jun.2018

- Hard Copy

- USD

$3,400

-

- Pages:200

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF117

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

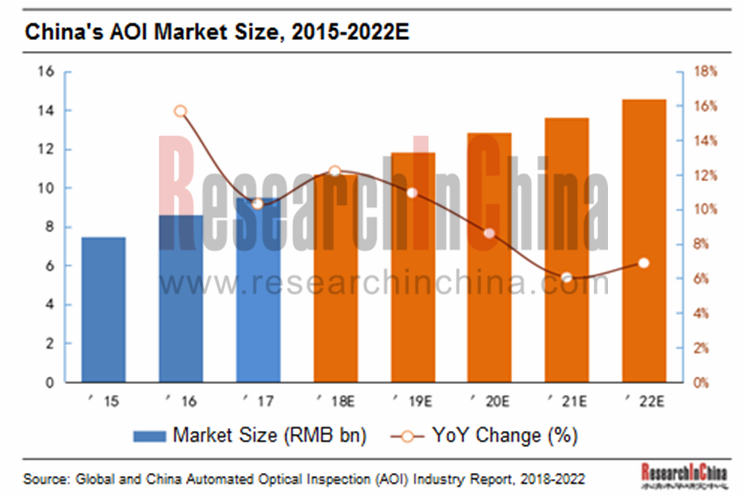

Miniaturization of electronic products conduces to components of all sorts being smaller and smaller and spurs the growing demand for automated inspection equipment. In the wake of a transfer of electronic components production capacity to China, the AOI equipment has been developing by leaps and bounds over the past several years. In 2017, Chinese AOI market was worth RMB9.52 billion, a surge of 10.3% from a year earlier and making up 21.7% of the global AOI market size. As the industries such as artificial intelligence and automotive electronics are advancing rapidly and China’s policies on high-end equipment manufacturing are being implemented, the market of high-end equipment inclusive of AOI will be booming and it is projected that the Chinese AOI market size will keep a CAGR of 8.9% between 2017 and 2022.

AOI is primarily served for PCB, FPD, semiconductor and photovoltaic cell, and finds most application in PCB sector. There is a limited market size of AOI applied in FPD industry and semiconductor industry. In 2017, AOI use in PCB, FPD and semiconductor seized a respective market share of 63.9%, 15.6% and 13.7% in total AOI market size.

As concerns competition, the Chinese AOI equipment market is still firmly dominated by foreign companies while Chinese players have come to the fore, such as Aleader, Jutze Intelligence, Ekt-Tech, Zhenhuaxing Technology, Ovi Technology and JT Automation Equipment. Those Chinese firms focus on the downstream process (like PCB) and compete fiercely due to weak R&D capability and lack of technological innovation, and consequently most of them saw a drop in both revenue and market share in 2017.

By comparison, the large multinational corporations represented by Israel-based Orbotech, Japan-based Screen and South Korea-based Koh Young Technology make foray into market segments with full product portfolios, or the foreign players represented by Omron, KLA-Tencor and HB target the front end industry (like semiconductor and FPD) and occupy the high-end market. Along with the higher and higher demanding on the yield of electronic components in China, the demand for high-end AOI keeps expanding and the international giants seize more and more market shares. In addition, Taiwanese vendors (like Test Research, Inc., Utechzone, and Machvision) approach the Mainland Chinese market by dint of Taiwan’s components supply relationship and form a competitive force which however was beginning to wind down owing to the deteriorating political climate since 2015.

The report highlights the followings:

AOI industry overview (definition, classification, composition, advantages, technologies, market features, industrial chain, business model, etc.);

AOI industry overview (definition, classification, composition, advantages, technologies, market features, industrial chain, business model, etc.);

Global AOI market (status quo, market size, competitive landscape, development trends, etc.);

Global AOI market (status quo, market size, competitive landscape, development trends, etc.);

Chinese AOI market (policy, status quo, market size, demand, competitive pattern, development prospects, etc.);

Chinese AOI market (policy, status quo, market size, demand, competitive pattern, development prospects, etc.);

Downstream of AOI Industry (market size, demand and so forth of PCB industry, FPD industry, IC industry, etc.);

Downstream of AOI Industry (market size, demand and so forth of PCB industry, FPD industry, IC industry, etc.);

11 world-renowned companies (Orbotech, Camtek, Omron, Screen, HB, Koh Young Technology, KLA-Tencor, TRI, Utechzone, Mirtec, SAKI), involving profile, performance, revenue structure, R&D expenditure, AOI business, development strategy, operations in China, etc.);

11 world-renowned companies (Orbotech, Camtek, Omron, Screen, HB, Koh Young Technology, KLA-Tencor, TRI, Utechzone, Mirtec, SAKI), involving profile, performance, revenue structure, R&D expenditure, AOI business, development strategy, operations in China, etc.);

10 Chinese AOI companies (Aleader, Jutze Intelligence, Ekt-Tech, Zhenhuaxing Technology, Ovi Technology, 3i Systems, Xieli Electronic, JT Automation Equipment, Star River Comtes, and Mingfu Automation), involving profile, performance, revenue structure, R&D expenditure, AOI business, development strategy, etc.)

10 Chinese AOI companies (Aleader, Jutze Intelligence, Ekt-Tech, Zhenhuaxing Technology, Ovi Technology, 3i Systems, Xieli Electronic, JT Automation Equipment, Star River Comtes, and Mingfu Automation), involving profile, performance, revenue structure, R&D expenditure, AOI business, development strategy, etc.)

1. Overview of AOI Industry

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Composition and Advantages

1.2.1 Composition and Structure

1.2.2 Advantages and Characteristics

1.3 AOI Related Technologies

1.3.1 Profile

1.3.2 Trends

1.4 Industry Chain

1.4.1 Profile

1.4.2 Upstream

1.4.3 Downstream

1.5 Industry Policy

2. Global AOI Market

2.1 Market Size

2.2 Competition

3. China AOI Market

3.1 Market Status and Market Size

3.2 Market Demand

3.3 Competition

4. Application of AOI in PCB

4.1 Profile

4.2 Operation of PCB Industry

4.3 AOI Market Size

5. Application of AOI in FPD

5.1 Profile

5.2 Operation of TFT-LCD Industry

5.3 AOI Market Size

6. Application of AOI in Semiconductor

6.1 Profile

6.2 Overall Market Operation

6.3 Operation of IC Industry

6.4 AOI Market Size

7. AOI Players Worldwide

7.1 Orbotech

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 R&D Expenses

7.1.5 Gross Margin

7.1.6 AOI Business

7.1.7 AOI Solutions

7.1.8 Development Strategy

7.1.9 Business in China

7.2 Camtek

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 R&D Expenses

7.2.6 AOI Business

7.2.7 Business in China

7.2.8 Camtek Imaging Technology Co., Ltd.

7.3 KLA-Tencor

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 R&D Expenses

7.3.5 Main Products

7.3.6 Business in China

7.3.7 ICOS Semiconductor Equipment (Shenzhen) Co., Ltd.

7.4 Omron

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 R&D Expenses

7.4.6 Industrial Automation Business

7.4.7 AOI Business

7.4.8 Business in China

7.5 KohYoung Technology

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Gross Margin

7.5.5 R&D Expenses

7.5.6 AOI Business

7.6 Screen

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 R&D Expenditure

7.6.5 AOI Business

7.6.6 Business in China

7.7 HB Technology (Korea)

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.7.5 R&D Expenses

7.7.6 AOI Business

7.8 TRI

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Gross Margin

7.8.5 R&D Expenses

7.8.6 Output and Sales Volume

7.8.7 AOI Business

7.8.8 Business in Mainland China

7.8.9 Tri Electronic (Shenzhen) Co., Ltd.

7.9 Utechzone

7.9.1 Profile

7.9.2 Operation

7.9.3 Revenue Structure

7.9.4 Gross Margin

7.9.5 R&D Expenses

7.9.6 Output and Sales Volume

7.9.7 AOI Business

7.9.8 Development Strategy

7.10 Mirtec

7.10.1 Profile

7.10.2 AOI Business

7.10.3 Business in China

7.11 SAKI

7.11.1 Profile

7.11.2 AOI Business

7.11.3 Business in China

7.11.4 Latest Development

8. AOI Players in China

8.1 JT Automation Equipment

8.1.1 Profile

8.1.2 Operation

8.1.3 Revenue Structure

8.1.4 Gross Margin

8.1.5 R&D Input

8.1.6 AOI Business

8.1.7 Development Strategy

8.2 Star River Comtes

8.2.1 Profile

8.2.2 Operation

8.2.3 Revenue Structure

8.2.4 Gross Margin

8.2.5 R&D Expenses

8.3 Aleader

8.3.1 Profile

8.3.2 AOI Business

8.4 Jutze Intelligence

8.4.1 Profile

8.4.2 AOI Business

8.5 Ekt-Tech

8.5.1 Profile

8.5.2 AOI Business

8.6 Zhenhuaxing Technology

8.6.1 Profile

8.6.2 AOI Business

8.6.3 Customers and Sales Network

8.7 Ovi Technology

8.7.1 Profile

8.7.2 AOI Business

8.8 Mingfu Automation

8.8.1 Profile

8.8.2 AOI Business

8.8.3 Main Clients

8.9 3i Systems

8.9.1 Profile

8.9.2 Operation

8.9.3 Revenue Structure

8.9.4 AOI Business

8.9.5 Customers and Sales Network

8.10 Xieli Electronic

8.10.1 Profile

8.10.2 AOI Business

Classification of Optical Inspection Equipment

Composition of AOI System

Advantages of AOI Equipment

Related Technologies of AOI Equipment Industry

AOI Equipment Industry Chain

AOI Equipment Upstream Raw Materials Source Countries

AOI Application Industries and Test Items

SMT Process

AOI Equipment Application in SMT Production Line

AOI Application in Solar Cell Production Line

Policies on China AOI Industry, 2006-2017

Global AOI Market Size and YoY, 2015-2022E

Global AOI Market Size (by Applications), 2015-2022E

Major Global AOI Manufacturers and Their AOI Revenue, 2015-2017

A Comparison of the Advantages and Disadvantages of Foreign and Chinese AOI Equipment Manufacturers

China's AOI Market Size, 2015-2022E

Major AOI Demanding Fields in China, 2017

Market Size of Major AOI Demanding Fields in China, 2015-2022E

Market Share of Major AOI Manufacturers in China, 2017

Major Chinese AOI Manufacturers and Their AOI Revenue

PCB Industry Chain

Application of AOI in PCB Industry

Global PCB Output Value and YoY, 2015-2022E

Global PCB Output Value by Market Segments, 2016-2022E

Global PCB Output Value Structure (by Region), 2014-2021E

Mainland China’s PCB Output Value and YoY, 2015-2022E

Global PCB Test Applied AOI Market Size and YoY, 2015-2022E

China’s PCB Test Applied AOI Market Size and YoY, 2014-2022E

Application of AOI in TFT-LCD Production Line

Main Inspection Equipment of TFT-LCD Production Process

Global Large Size TFT-LCD Panel Shipments and YoY, 2015-2022E

Global Large Size TFT-LCD Panel Shipments by Applications, 2016-2022E

Market Size and YoY of AOI Applied in FPD Test Worldwide, 2015-2022E

Market Size of AOI Applied in FPD Test in China, 2015-2022E

Application of AOI in Wafer Manufacturing

Application of AOI in Wafer Probing

Application of AOI in IC Packaging

Application of AOI in IC Testing

Global Semiconductor Industry Sales and YoY, 2015-2022E

Global Semiconductor Industry Sales Structure (by Product), 2015-2022E

Global Semiconductor Industry Sales Structure (by Region), 2015-2022E

Revenue of Global Top 10 Semiconductor Suppliers, 2016-2017

Global IC Industry Sales and YoY, 2015-2022E

China’s IC Industry Sales and YoY, 2010-2017

China’s IC Industry Sales as a Percentage of the World’s, 2011-2017

Global Semiconductor Equipment Sales (by Region), 2015-2022E

Global Semiconductor Process Control Equipment Market Size, 2015-2022E

Calculation Table of China’s Semiconductor Process Control Equipment Market Size, 2015-2022E

Calculation Table of China’s Semiconductor AOI Market Size, 2015-2022E

Orbotech’s Revenue and Net Income, 2009-2018

Orbotech’s Revenue Breakdown (by Business), 2014-2018

Orbotech’s Revenue Breakdown (by Region), 2014-2017

Orbotech’s R&D Expenses, YoY, and % of Total Revenue, 2010-2018

Orbotech’s Gross Profit, YoY, and Gross Margin, 2010-2018

Orbotech’s Main Products and Its Competitors (by Industry)

Installs of Orbotech’s Main Products, 2010-2017

New Technologies of Orbotech’s Core Markets

Orbotech’s AOIs Applied in PCB Test

Orbotech’s AOIs Applied in FPC Test

Orbotech’s Revenue from China, YoY, and % of Total Revenue, 2010-2017

Camtek’s Revenue and Net Income, 2009-2018

Camtek’s Revenue Breakdown (by Region), 2015-2017

Camtek’s Gross Profit, YoY, and Gross Margin, 2009-2018

Camtek’s R&D Expenses, YoY, and % of Total Revenue, 2009-2018

Camtek’s Major Customers in Semiconductor Field

Camtek’s Major AOI Product in Semiconductor Field

Eagle Series AOI Products

Condor Series AOI Products

Gannet Series AOI Products

Falcon Series AOI Products

Phoenix Series AOI Products

Dragon Series AOI Products

Orion Series AOI Products

LAM Series AOI Products

Major Subsidiaries of Camtek

KLA-Tencor’s Revenue and Net Income, FY2011-FY2018

KLA-Tencor’s Revenue Breakdown (by Business), FY2014-FY2018

KLA-Tencor’s Revenue Breakdown (by Region), FY2015-FY2017

KLA-Tencor’s R&D Expenses and % of Total Revenue, FY2013-FY2018

Main Products of KLA-Tencor

KLA-Tencor’s Major Customers

Staff Structure of Omron

Omron’s Revenue and Net Income, FY2009-FY2017

Omron’s Revenue Breakdown (by Business), FY2010-FY2017

Omron’s Revenue Breakdown (by Region), FY2009-FY2017

Omron’s Gross Profit, YoY, and Gross Margin, FY2009-FY2017

Omron’s R&D Expenses, YoY, and % of Total Revenue, FY2009-FY2017

OMRON Industrial Automation’s Revenue and Operating Income, FY2013-FY2018E

OMRON Industrial Automation’s Revenue Breakdown (by Region), FY2010-FY2017

OMRON Industrial Automation’s R&D Expenses, YoY, and % of the Department’s Revenue, FY2010-FY2015

Main AOI Products of Omron

Omron’s Sales in Greater China Region, FY2010-FY2018

KohYoung Technology’s Business Growth Model

KohYoung Technology’s Revenue and YoY, 2009-2017

Revenue Structure of KohYoung Technology by Region, 2016-2017

KohYoung Technology’s Gross Profit, YoY, and Gross Margin, 2012-2017

KohYoung Technology’s R&D Expenses and % of Total Revenue, 2013-2017

KohYoung Technology’s SMI Solutions

KohYoung Technology’s Semiconductor Solutions

Screen’s Revenue and YoY, FY2010-FY2018

Screen’s Revenue Breakdown (by Business Unit), FY2011-FY2018

Screen’s Revenue Breakdown (by Region), FY2011-FY2018

Revenue Structure of Screen Media and Precision Technology Company, FY2010-FY2018

Screen’s R&D Expenditure, YoY, and % of Total Revenue, FY2010-FY2018

Number of Patents Held by Screen, FY2013-FY2017

Screen’s Main AOI Equipment

Screen’s PCB Related Equipment Revenue and YoY, FY2010-FY2019E

Revenue of Screen GP China, FY2013-FY2018

HB Technology’s Revenue and YoY, 2009-2017

HB Technology’s Revenue Breakdown (by Product & Marketing Channel), 2015-2017

HB Technology’s Gross Profit, YoY, and Gross Margin, 2010-2017

HB Technology’s R&D Expenses and % of Total Revenue, 2010-2017

HB Technology’s AOI Capacity, 2013-2017

Output and Average Selling Price of HB Technology’s AOI Products, 2010-2017

HB’s Main AOI Products

TRI’s Revenue and Net Income, 2010-2017

TRI’s Revenue Breakdown (by Product), 2011-2016

TRI’s Revenue Breakdown (by Region), 2010-2017

TRI’s Gross Profit, YoY, and Gross Margin, 2010-2017

TRI’s R&D Expenses, YoY, and % of Total Revenue, 2010-2017

Capacity and Output of TRI’s Main Products, 2011-2015

Sales Volume of TRI’s Main Products, 2010-2015

TRI’s Main Product Models and Their Applications

Main 3D SPI AOI Products of TRI

Main AXI Products of TRI

Global Network Distribution of TRI

Utechzone’s Revenue and Net Income, 2010-2017

Utechzone’s Revenue Breakdown (by Product), 2010-2017

Utechzone’s Revenue Breakdown (by Region), 2010-2017

Utechzone’s Gross Profit, YoY, and Gross Margin, 2010-2017

Utechzone’s R&D Expenses, YoY, and % of Total Revenue, 2010-2017

R&D Results of Utechzone, 2016

Output and Output Value of Utechzone’s Main Products, 2015-2016

Sales Volume of Utechzone’s Main Products, 2015-2016

Sales of Utechzone’s Main Products, 2012-2015

Main Products and Functions of Utechzone’s Optical Inspection Equipment

Main Performance Index of PCB AVI

Main Products of FPD AOI

Main Products of Touch Panel AOI

Other AOI Products

Short-term Development Plan of Utechzone

Long-term Development Plan of Utechzone

Mirtec’s AOIs Applied in SMT

Mirtec’s AOIs Applied in LED

SAKI’s Newly Launched Products, 2012-2017

SAKI’s Main 2D AOI Equipment

SAKI’s Main 3D AOI/SPI Equipment

SAKI’s Main AXI Products

Distribution of SAKI’s Companies and Distributors Worldwide

SAKI’s Distributors in China

JT Automation Equipment’s Revenue and YoY, 2010-2018

JT Automation Equipment’s Revenue Breakdown (by Product), 2016-2017

JT Automation Equipment's Revenue Breakdown (by Region), 2011-2017

JT Automation Equipment's Gross Margin (by Product), 2011-2017

JT Automation Equipment’s R&D Expenses, YoY, and % of Total Revenue, 2011-2017

Development History of JT Automation Equipment’s AOI Equipment, 2009-2015

Revenue and YoY of JT Automation Equipment’s AOI Equipment, 2010-2017

Automation Equipment’s Revenue and Net Income, 2015-2022E

Star River Comtes’ Revenue and Net Income, 2010-2017

Star River Comtes’ Revenue Breakdown by Product, 2014-2016

Star River Comtes’ Gross Margin , 2010-2017 (%)

Star River Comtes’ R&D Expenses and % of Total Revenue, 2010-2017

Main AOI Products of ALeader

Main Customers of ALeader

Main AOI Products of Jutze Intelligence

Main AOI Products of ekt-Tech

Main Customers of ekt-Tech

Main AOI Products of ZhenHuaXing Technology

New AOI Products of ZhenHuaXing Technology

Main Customers of ZhenHuaXing Technology

Sales Network of ZhenHuaXing Technology

Main AOI Products of Ovi Technology

Main Customers of Ovi Technology

Main AOI Products of Mingfu Automation

Main Customers of Mingfu Automation

3i Systems’ Revenue and Net Income, 2014-2017

Revenue Structure of 3i Systems’ by Product, 2016-2017

3i Systems’ Procurement from Top 5 Suppliers, 2017

Main Flat Display AOI Products of 3i Systems

3i Systems Display Panel AOI Customers

3i Systems PV Cell AOI Customers

3i Systems’ Revenue from Top 5 Customers, 2017

Performance Indicators of IMPRESS Q Series AOI Products

Performance Indicators of IMPRESS Q+ Series AOI Product

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...