China Motion Controller Industry Report, 2018-2023

-

Mar.2019

- Hard Copy

- USD

$3,000

-

- Pages:130

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

BXM121

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

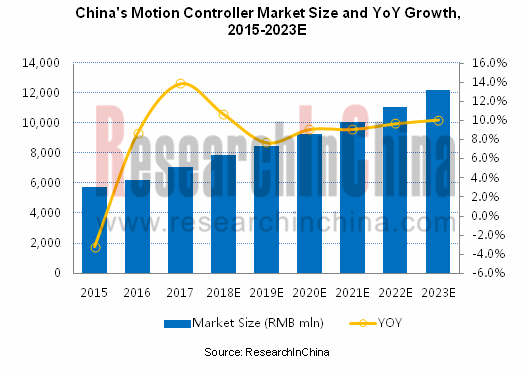

The motion controller industry of China has seen a volatile growth rate over the recent years in the wake of a shift in the global economy and downstream demand. In 2017, the robust growth in both traditional manufacturing sectors (machine tool, packaging machinery, textile machinery, etc.) and the emerging ones (robotics, semiconductor, etc.) gave great impetus to motion controller market which grew at a rate of over 13%; in 2018 “Coming off early highs” became a commonplace in the downstream sectors, which led to a lower increase in the motion controller market. Yet it is predicted that the motion controller market in China will rebound a bit in 2019.

In China, motion controllers fall into three types: PC-based controller, special controller and programmable logic controller (PLC). As the structural adjustment in manufacturing goes on in the country, special controller and PLC markets begin to shrink while PC-based controller is on the rise and will replace the PLC in a broader range of fields for its outperformance in motion control. Special controller which was first used in CNC, now has made its way into industrial robots, textile machinery and so forth, especially in industrial robot industry where it will sustain its key role in the years to come.

In the Chinese motion controller market, European and Japanese giants are dominant, but Chinese peers have sprung up, with a narrowing gap between competitors, which intensifies competition. In 2017, the top three players by market share were Siemens, Syntec and LNC Technology, among which Siemens was way ahead of its counterparts, and Syntec and LNC Technology were two bellwethers in special CNC system field; Advantech and Googol Technology gathered pace in the PC-based motion controller market.

A growing number of companies are racing to access into motion controller market as concepts like industry 4.0 and intelligent manufacturing becomes prevalent and gets implemented, as they did in 2017 alone when several cases of mergers and acquisitions occurred. For instance, B&R became part of ABB’s Industrial Automation division as a new global business unit--Machine & Factory Automation; Servotronix joined Midea Group as the latter’s key developer of motion controllers, drives and motors (including customized ones); Estun bought a 100% stake in TRIO, a British motion controller maker. In December 2018, Shanghai MOONS’ Electric Co., Ltd. announced acquisition of T Motion to strengthen its competence in the high-end motion control solution market.

China Motion Controller Industry Report, 2018-2023 highlights the following:

Global and China motion controller industry (market size, servo/stepper system market (status and competitive pattern), etc.);

Global and China motion controller industry (market size, servo/stepper system market (status and competitive pattern), etc.);

China motion controller market (policies, market size and structure, competition, development trends, etc.);

China motion controller market (policies, market size and structure, competition, development trends, etc.);

China PC-based/special/PLC controller market (market size, downstream application and competitive pattern);

China PC-based/special/PLC controller market (market size, downstream application and competitive pattern);

China motion controller downstream sectors (machine tool, robotics, semiconductor, textile machinery, printing machinery, packaging machinery, EMS, etc.) (status and demand for motion controllers);

China motion controller downstream sectors (machine tool, robotics, semiconductor, textile machinery, printing machinery, packaging machinery, EMS, etc.) (status and demand for motion controllers);

22 Chinese motion controller companies (operation, motion controller business, development strategy, etc.).

22 Chinese motion controller companies (operation, motion controller business, development strategy, etc.).

1. Profile of Motion Controller

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2. Motion Controller Industry in China

2.1 Global

2.2 China

2.2.1 Market Size

2.2.2 Major Companies

2.3 Servo System

2.3.1 Market Size

2.3.2 Competitive Pattern

2.4 Stepping System

2.4.1 Status Quo

2.4.2 Competitive Pattern

3. Motion Controller Market in China

3.1 Major Policies

3.2 Status Quo

3.2.1 Market Size

3.2.2 Downstream Demand and Structure

3.2.3 Product Structure

3.3 Competition Pattern

3.4 Development Trend

3.4.1 Product

3.4.2 Technology

3.4.3 Application

4. Chinese Motion Controller Market Segments

4.1 PC-based Motion Controllers

4.1.1 Overview

4.1.2 Market Size and Application

4.1.3 Key Manufacturers

4.2 PLC Motion Controllers

4.2.1 Overview

4.2.2 Market Size and Application

4.2.3 Key Manufacturers

4.3 Special Motion Controllers

4.3.1 Overview

4.3.2 Market Size and Application

4.3.3 Key Manufacturers

5. Motion Controller Application Industry in China

5.1 Overview

5.2 Machine Tools

5.2.1 Market Situation

5.2.2 Application of Motion Controllers in Machine Tool

5.3 Robotics

5.3.1 Market Situation

5.3.2 Application of Motion Controllers in Robotics

5.4 Textile Machinery

5.4.1 Market Situation

5.4.2 Application of Motion Controllers in Textile Machinery

5.5 Semiconductor Equipment

5.6 Electronic Devices and Services

5.7 Packaging Machinery

5.8 Printing Machinery

5.9 Medical Equipment

6. Major Motion Controller Manufacturers in China

6.1 Advantech Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Motion Controller Business

6.1.4 Strategic Cooperation

6.2 Leadshine Technology

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Motor Controller Business

6.2.5 Clients

6.3 ADTECH

6.3.1 Profile

6.3.2 Operation

6.3.3 Motion Controller Business

6.4 Leetro Automation Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Motion Controller Business

6.4.4 Key Clients and Suppliers

6.5 Googol Technology (HK) Limited

6.5.1 Profile

6.5.2 Operation

6.5.3 Cooperation

6.6 ADLINK

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Motion Controller Business

6.7 Estun

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Motion Controller Business

6.7.5 Development Strategy

6.8 Shanghai Weihong Electronic Technology Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Revenue Structure

6.8.4 Gross Margin

6.8.5 R&D

6.9 RichAuto S&T

6.9.1 Profile

6.9.2 Operation

6.9.3 Motion Controller Business

6.10 SYNTEC

6.10.1 Profile

6.10.2 Motion Controller Business

6.11 LNC Technology

6.11.1 Profile

6.11.2 Motion Controller Business

6.12 Beijing KND CNC Technique Co. Ltd. (KND)

6.12.1 Profile

6.12.2 Motion Controller Business

6.13 TOPCNC Automation Technology Co., Ltd.

6.13.1 Profile

6.13.2 Motion Controller Business

6.14 Shenzhen Tankon Technology Co., Ltd.

6.14.1 Profile

6.14.2 Motion Controller Business

6.15 Haichuan Numerical Control Technology Co., Ltd.

6.15.1 Profile

6.15.2 Motion Controller Business

6.16 Overseas Companies in China

6.16.1 Siemens

6.16.2 Mitsubishi Electric

6.16.3 B&R

6.16.4 Beckhoff

6.16.5 Delta Tau

6.16.6 Galil

6.16.7 Servotronix

Structure of Motion Controller System

Factors Influencing Performance of Motion Controller

Features and Application of Three Motion Controller Types

Motion Controller Industry Chain

Global Market Size of Motion Controller, 2014-2023E

Global Market Size of Motion Controller by Product, 2015-2018

Global Market Size of Motion Controller by Application, 2016-2023E

Global Market Size of Motion Controller by Region, 2017

Market Size of Motion Controllers in China by Product, 2016-2018

Favored Brands in China’s Motion Control Industry, 2018

Most Influential Enterprises and Most Competitive Brands in China’s Motion Control Industry, 2018

Schematic Diagram of Servo System Operation

Market Size of Servo System in China, 2013-2023E

Competitive Pattern of Servo System Market in China, 2017

Market Size of Stepping System in China, 2014-2023E

Competitive Pattern of Stepping System in China, 2017

Policies on Motion Controllers in China, 2015-2019

Market Size of Motion Controllers and YOY in China, 2015-2023E

Market Share of Motion Controllers in China by Sector, 2018

Motion Controller Product Structure in China (by Market Size), 2015-2023E

Competitive Pattern of Motion Controller Market in China, 2017

Comparison of Three Types of PC-Based Motion Controller

Market Size of PC-Based Motion Controller in China, 2015-2023E

Applied Structure of PC-Based Motion Controller in China, 2018

Segment Product Structure of PC-Based Motion Controller, 2016-2023E

Bus-type Motion Controller Structure by Product in China, 2020E

Competitive Pattern of PC-Based Motion Controller Market in China, 2017

Features and Application Fields of PLC

Market Size of PLC Motion Controller in China, 2015-2023E

Applied Structure of PLC Motion Controller in China, 2018

Competitive Pattern of PLC Motion Controller Market in China, 2017

Features and Key Manufacturers of Special Motion Controller

Market Size of Special Motion Controller in China, 2015-2023E

Applied Structure of Special Motion Controller in China, 2018

Competitive Pattern of Special Motion Controller Market in China, 2017

Growth Change of Downstream Sector of Motion Controller in China, 2017-2019

Consumption of Metal Processing Machine Tool in China, 2011-2020E

Output of CNC Machine Tools in China, 2010-2018

Global Sales Volume of Industrial Robots, 2009-2021E

Sales Volume of Industrial Robots in China, 2009-2023E

Enterprises in Robotics Industry Chain in China

Installation Density of Industrial Robots in Major Countries, 2017

Major Chinese and Foreign Robot Controller Manufacturers and Their Products

Market Size of Textile Machinery Industry in China, 2010-2020E

Sales Volume of Major Textile Machinery Products in China, 2014-2018

Application of Motion Controllers in Textile Machinery Industry in China

China-made Semiconductor Equipment Revenue by Product in China, 2017-2020E

Market Size of Electronic Equipment Industry in China, 2013-2020E

Global Top Ten EMS Suppliers

Revenue of Packaging Machinery in China, 2011-2020E

Market Share of Automatic Products of Printing Machinery in China, 2018

Market Size of Medical Equipment Industry in China, 2011-2020E

Organization Structure of Advantech

Revenue and Net Income of Advantech, 2014-2018

Revenue of Advantech by Region, 2017

Revenue of Advantech by Business, 2017

Motion Control Products of Advantech

Product Line Change of Leadshine

Financials of Leadshine Technology, 2015-2018

Operating Revenue of Leadshine Technology by Product, 2015-2018

Operating Revenue of Leadshine Technology by Region, 2015-2018

Operating Revenue of Leadshine Technology by Application, 2015-2018

Controller Product Series of Leadshine Technology

Capacity, Output and Sales Volume of Leadshine Technology, 2015-2018

Revenue, Gross Margin and Price of Leadshine Technology, 2015-2018

Leadshine Technology’s Revenue from Top Five Clients and % of Total Revenue, 2016-2018

Revenue and Net Income of ADTECH, 2014-2018

Main Motion Controllers of ADTECH

Revenue and Net Income of Leetro, 2014-2018

Revenue Structure of Leetro by Business, 2013-2017

Motion Controller Series of Leetro

Leetro's Revenue from Top 5 Clients and % of Total Revenue, 2017

Leetro's Procurement from Top 5 Suppliers and % of Total Procurement, 2017

Development Course of Googol Technology

Main Motion Controllers of Googol Technology

Applications of Motion Controllers of Googol Technology

Revenue and Net Income of ADLINK, 2013-2018

Revenue Breakdown of ADLINK by Business, 2016-2017

Revenue Breakdown of ADLINK by Region, 2017

EtherCAT Motion Control Card PCIe-8338 of ADLINK

Motion Control Card Products of ADLINK

Revenue and Net Income of Estun, 2013-2018

Revenue of Major Business and % of Total Revenue of Estun, 2016-2018

Revenue of Estun by Region, 2016-2018

Motion Controllers of Estun

M&A Cases of Estun, 2016-2017

Development Course of Weihong Electronic

Major Brands of Weihong Electronic

Revenue and Net Income of Weihong Electronic, 2013-2018

Revenue of Weihong Electronic by Product, 2016-2018

Revenue of Weihong Electronic by Region, 2016-2018

Gross Margin of Weihong Electronic by Product, 2016-2018

Revenue and Net Income of RichAuto S&T, 2014-2018

Revenue of RichAuto S&T by Business, 2016-2018

RichAuto S&T’s Revenue from Top 5 Clients and % of Total Revenue, 2017-2018

Main Motion Controllers of RichAuto S&T

Motion Controllers of Syntec

Global Network of Syntec

New Products of Syntec, 2018

Development Course of LNC Technology

Controller Products and Application of LNC Technology

Global Presence of LNC Technology

Motion Controllers of Beijing KND

Motion Controllers of TOPCNC Automation

Main Motion Controllers of Tankon

Main Motion Controllers of Haichuan Numerical Control

Motion Controllers of Siemens

Development Course of Siemens Numerical Control Ltd., Nanjing

Motion Controllers of Mitsubishi Electric

Revenue of ABB by Business, 2015-2017

Main Motion Controllers of Delta Tau

Main Motion Controllers of Galil

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...