Automotive wiring harness is often split into two types: main wiring harness and small wiring harness. As new energy vehicles emerge, automotive wiring harness is also divided into low-voltage and high-voltage types. Conventional fuel-powered vehicles use low-voltage harness while new energy vehicles employ the high-voltage harness.

The boom of new energy vehicles will fuel the demand for high-voltage wiring harness. On our estimate, the global new energy vehicle high-voltage wiring harness market was valued at RMB4.69 billion in 2020, 41.4% more than in the previous year, sharing roughly 3% of the entire automotive wiring harness market. In future, the new energy vehicles promoted by governments and automakers will see a rising sales share, which in turn will give a big boost to the high-voltage wiring harness market in the years to come.

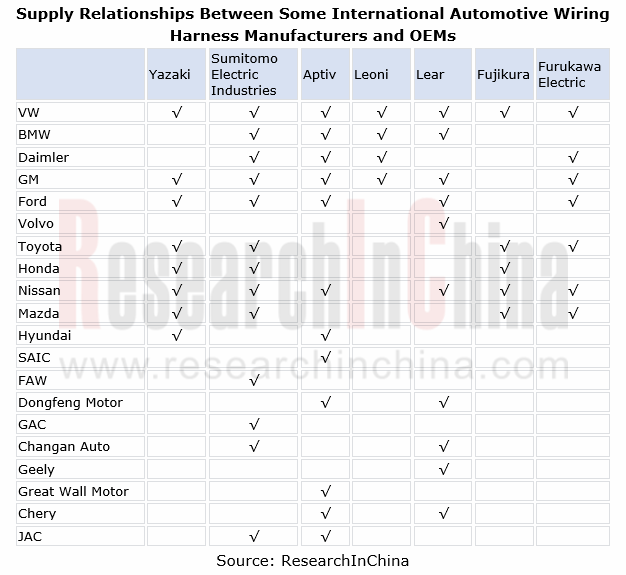

Globally, there are four echelons of automotive wiring harness companies: the first-echelon players are Yazaki and Sumitomo Electric Industries; Aptiv, Leoni and Lear are typical second-echelon players; the third-echelon players are led by Draexlmaier, Kromberg & Schubert, Furukawa Electric, Yuratech, Kyungshin and Fujikura; players in the fourth echelon are a number of other small wiring harness firms.

In current stage, the global automotive wiring harness market is almost carved up by the first three echelons which have built stable supply relationships with automakers. Furthermore, international wiring harness manufacturers deploy the promising Chinese market by way of acquiring or establishing wholly-owned companies or joint ventures with local companies, hoping to support co-funded auto plants and homegrown automakers.

Local companies edge into the supply chains of international automakers.

In China, typical automotive wiring harness companies include Kunshan Huguang Auto Harness Co., Ltd., THB Group, Shenzhen Deren Electronics Co., Ltd., Shanghai Jinting Automobile Harness Co., Ltd. (Jiangsu Etern Co., Ltd.), Mind Electronic Appliances Co., Ltd., Luxshare Precision Industry Co., Ltd., Shenzhen Qiaoyun Electronics Co., Ltd., Jiangsu Huakai Wire Harness Co., Ltd. and Keboda Technology Co., Ltd.

As more homemade auto parts tend to be purchased, some domestic harness companies with years of technical expertise and synchronous development experience have gained far more strength and edged into the supply chains of world-renowned automakers by virtue of timely and effective services and reliable products. Examples include THB Group, Kunshan Huguang Auto Harness Co., Ltd., Shanghai Jinting Automobile Harness Co., Ltd., Shenzhen Deren Electronics Co., Ltd. and Keboda Technology Co., Ltd.

The more functions are added in vehicles, the more wiring harnesses are demanded, which directly causes a surge in length and weight of wiring harnesses and further much heavier automobiles, and makes it too much harder to deploy wires. Optimizing wiring harnesses from quality to wiring is a must for meeting the soaring demand. We argue that automotive wiring harness will head in the following directions:

Trend 1: lightweight

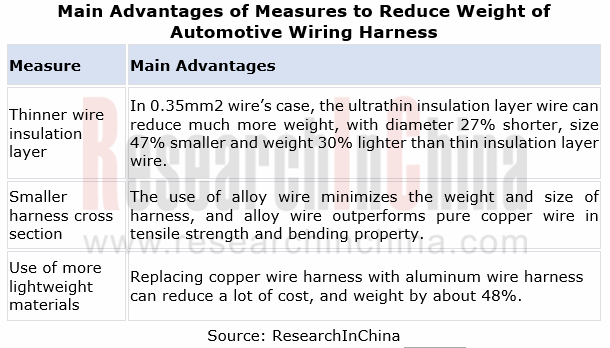

Automotive wiring harness is a key component that makes up around 5% of vehicle curb weight. As vehicles become lighter, lightweight automotive wiring harness already holds the trend. Currently, there are mainly three ways to reduce the weight of automotive wiring harness: thinner wire insulation layer; improved process for smaller harness cross section; use of more lightweight materials.

Trend 2: E/E architecture design optimization

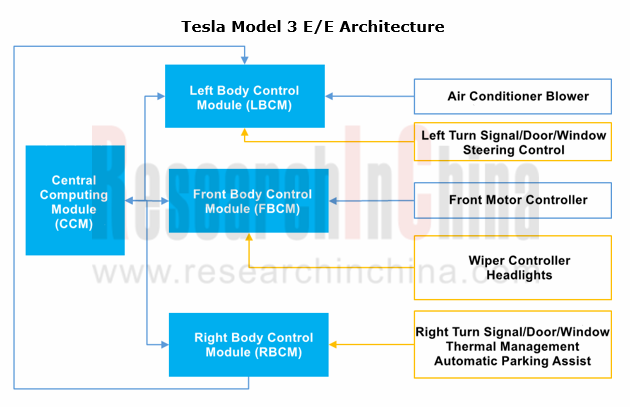

Lightweight automotive wiring harness can reduce weight, but fundamentally less use of harness will pay off more in optimizing harness. The adoption of new E/E architecture is a key to improving automotive wiring harness. A new architecture can lessen wires used for various vehicle functions through simplifying wiring design, also reduce weight to favor automated production and lower cost.

Take Tesla as an example. Its application of new E/E architecture leads to a sharp cut in harness length from 3km of Model S to 1.9km of Model 3. In addition, its patented technology released in 2019 upgrades the wiring layout where harness can be as short as 100m. Yet current Model Y falls short of the goal. In future, the mass adoption of flexible circuit boards to replace current wires may achieve the length cut goal.

Also, Aptiv announced its smart vehicle architecture (SVA) that allows for the integration of multiple ECUs into a small domain control unit. The architecture can thus save multiple microcontrollers, multiple power supply devices, and multiple housings and copper wiring harnesses but still maintain or even improve the vehicle computing power, which contributes to a 20% reduction in both harness weight, and the weight and size of computing-related hardware.

Trend 3: production process automation

Wiring harness is a typical labor-intensive industry where 95% harnesses are handmade products and productivity is low, because automotive wiring layout is complex. Labor cost therefore has been a critical constraint on capacity expansion and scale effect. At present, most automotive wiring harness manufacturers still rest on advanced equipment to automate just some production links. Intelligent manufacturing has not yet become widespread.

As automotive wiring harness tends to be integrated and production technology advances, intelligent manufacturing will have the potential to penetrate the whole process of automotive wiring harness from design, production, warehousing and logistics to management and service. Automotive wiring harness players such as Aptiv, Lear and Kunshan Huguang Auto Harness all are promoting the automated production process.

Trend 4: apply wireless communication to reduce the use of wiring harnesses

The application of wireless communication will reduce the use of wiring harnesses.

A patent Yazaki obtained in 2018 involves an extended system’s electronic device and ECU that are configured to send and receive signals with each other via wireless communication. This avoids the necessary addition of communication circuits to the extended system, simplifying wiring layout and lessening harnesses.

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...