DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

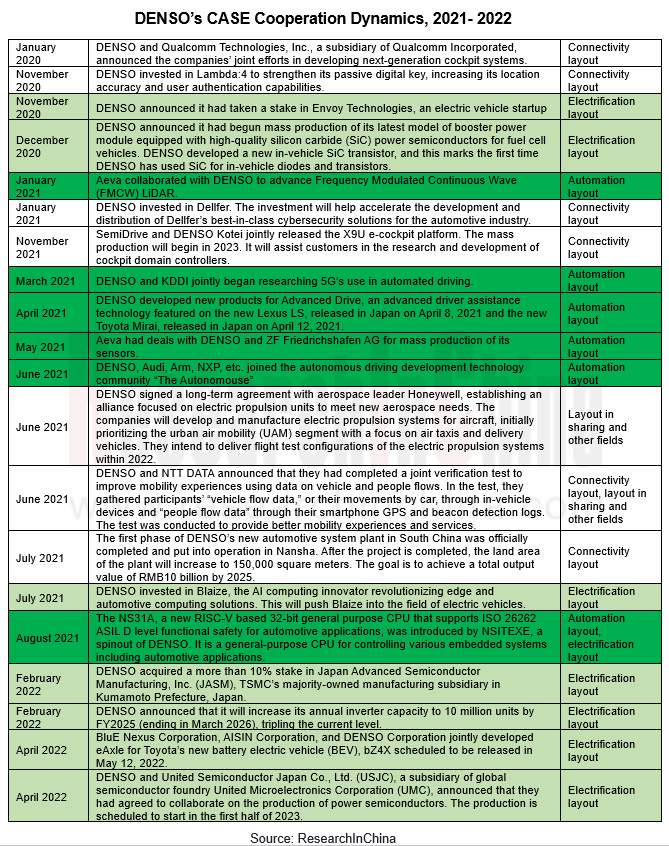

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022 to sort out and study the layout of Japan-based DENSO Group in the fields of automation, connectivity, electrification and other fields, summarize its development dynamics in 2021-2022 and predict its future business focus.

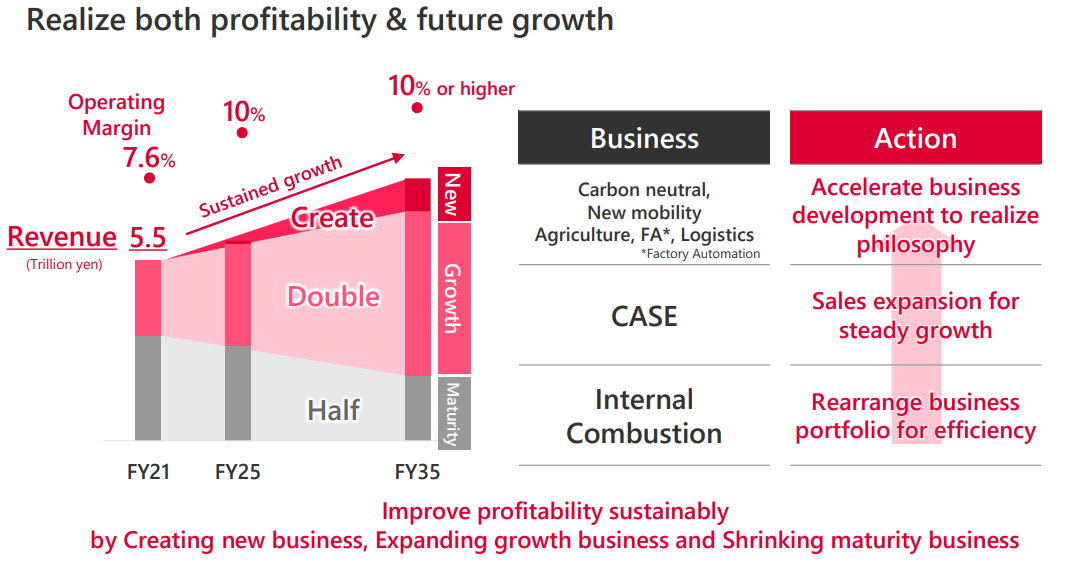

1. DENSO's future growth will mainly hinge on CASE

With the transformation and development of CASE, DENSO has built relatively sound technical capabilities in the fields of automation, connectivity, and electrification, and its future growth will mainly hinge on CASE.

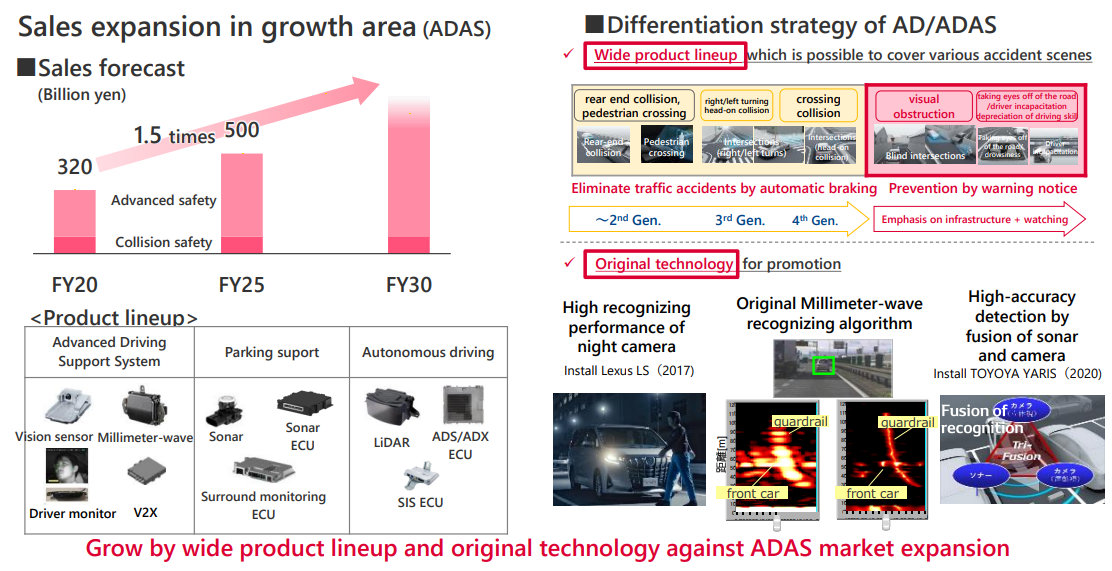

In the field of automation, DENSO has formed ADAS (L2-L4), surround-view systems, AVP, autonomous platooning, autonomous taxis, a series of active safety systems, AD systems and ADAS through the provision of cameras (front-view monocular/binocular, surround-view), radar (forward, corner), LiDAR, ultrasonic radar, integrated control software for autonomous driving and other products. In addition, it provides users with integrated software and hardware solutions.

At this stage, DENSO mainly applies the autonomous braking function to the front, rear, left and right directions, and to avoid traffic accidents in scenarios such as crossing intersections. In the future, DENSO will strengthen the development of early warning functions with the help of V2X and other infrastructure.

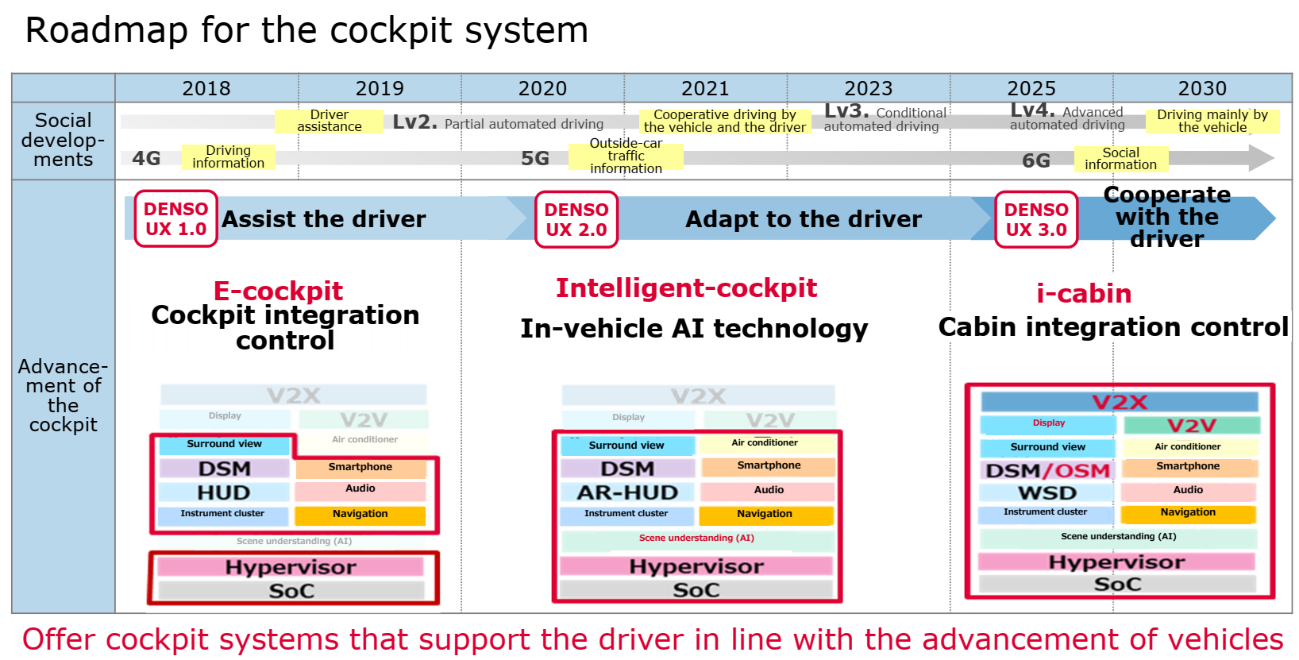

In the field of connectivity, DENSO’s products cover automotive communication, IVI systems, digital keys, OTA solutions, cyber security solutions, cockpit domain control platforms, clusters & center consoles, HUD, DMS, etc. Among them, automotive V2X communication equipment features wireless communication, vehicle positioning and status judgment, and it enables safe driving assistance through wireless vehicle-to-vehicle and road-vehicle communication. It has been installed in Toyota Prius, Crown, Lexus RX, Lexus LS and other models. DENSO plans to integrate V2X, V2V, display systems, DMS/OMS and other functions into the bottom layer of cockpit to offer a more intelligent cockpit solution by 2025.

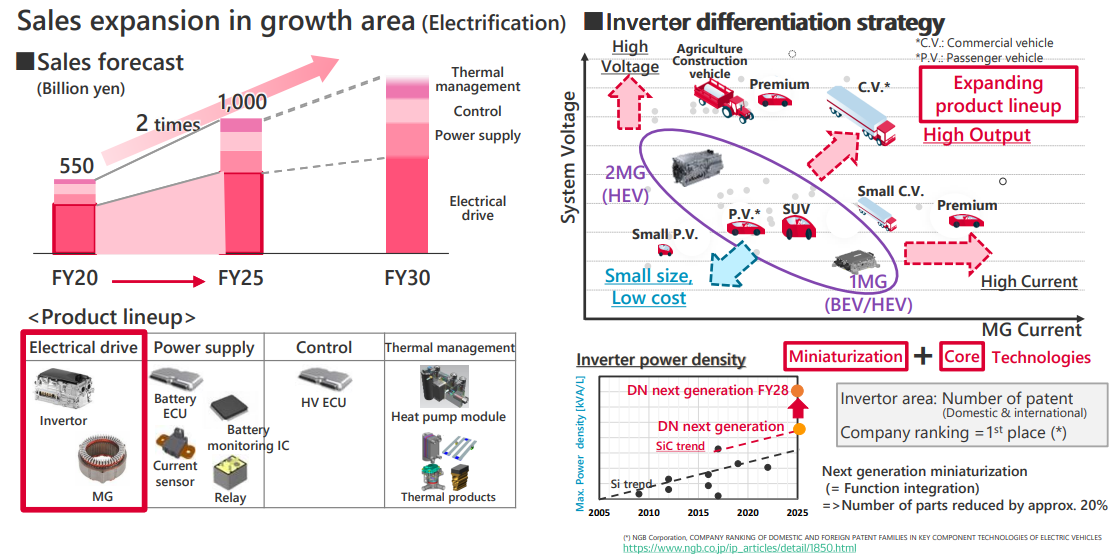

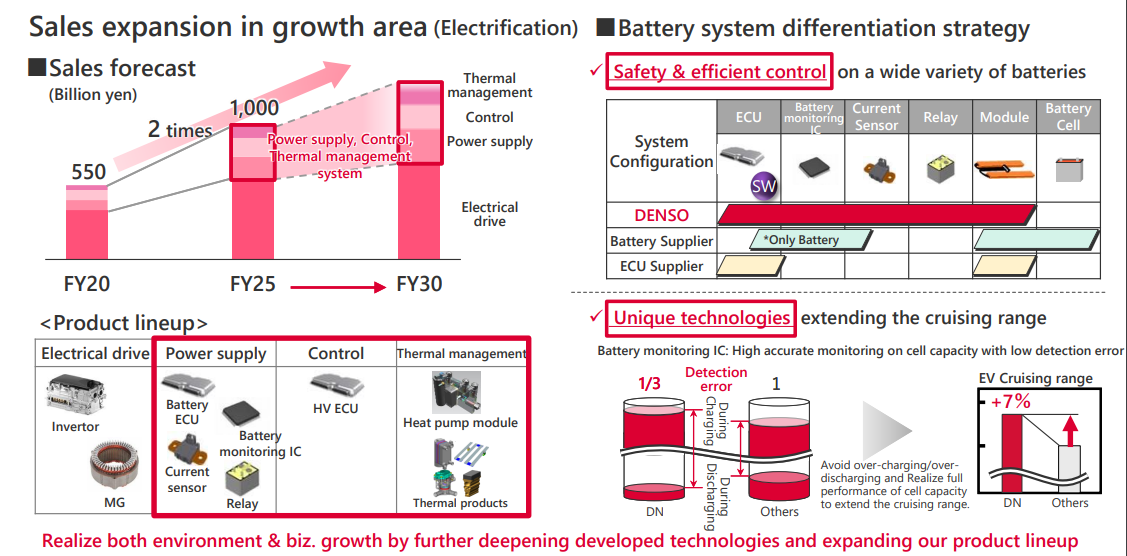

In the field of electrification, DENSO focuses on the development of core products across electrified powertrain platforms (PHEV, HEV, BEV, FCEV): battery packs, motors, inverters, and energy management systems.

According to the plan, DENSO will center on the development of inverter and stator winding technologies before 2025, extend to power modules, control modules and thermal management systems from 2026 to 2030, and further enhance its supply chain.

2. Toyota contributes over 50% to DENSO's revenue

After DENSO was separated from Toyota in 1949, the two have maintained an amicable and cooperative relationship. In FY2022, Toyota contributed 51.4% to DENSO's revenue, an increase of 0.8 percentage point from the previous fiscal year; the order intake worth JPY2,837.6 billion, up 13.5% year-on-year.

DENSO's CASE products are mainly tested and mass-produced through Toyota. For instance:

In April 2021, DENSO announced it had developed products for Advanced Drive, an advanced driver assistance technology featured on the new Lexus LS and the new Toyota Mirai. DENSO’s newly developed products used in Advanced Drive include LiDAR, a binocular vision system, an Spatial Information Service Electronic Control Unit (SIS ECU), an Advanced Drive System Electronic Control Unit (ADS ECU) and Advanced Drive Extension Electronic Control Unit (ADX ECU).

In April 2021, DENSO announced it had developed products for Advanced Drive, an advanced driver assistance technology featured on the new Lexus LS and the new Toyota Mirai. DENSO’s newly developed products used in Advanced Drive include LiDAR, a binocular vision system, an Spatial Information Service Electronic Control Unit (SIS ECU), an Advanced Drive System Electronic Control Unit (ADS ECU) and Advanced Drive Extension Electronic Control Unit (ADX ECU).

In May 2022, BluE Nexus Corporation, AISIN Corporation, and DENSO Corporation announced that they had jointly developed eAxle for Toyota’s new battery electric vehicle (BEV), bZ4X.

In May 2022, BluE Nexus Corporation, AISIN Corporation, and DENSO Corporation announced that they had jointly developed eAxle for Toyota’s new battery electric vehicle (BEV), bZ4X.

In addition, DENSO's forward-looking layout and innovative products in CASE almost reflect Toyota's presence. They are deeply bound and closely tied up in CASE transformation.

3. The semiconductor business will help DENSO go "from Toyota to the world”

In 2022, DENSO's layout concentrates on the semiconductor field.

In February 2022, DENSO acquired a more than 10% stake in Japan Advanced Semiconductor Manufacturing, Inc. (JASM), TSMC’s majority-owned manufacturing subsidiary in Kumamoto Prefecture, Japan. With this equity investment, DENSO became JASM’s third largest shareholder. TSMC will build a new chip factory in Kumamoto Prefecture, Japan through JASM to produce cutting-edge logic semiconductors for image sensors and MCUs, with mass production scheduled to begin by the end of 2024. The acquisition will enable DENSO to stably purchase cutting-edge semiconductors with circuit line widths of around 10-20 nanometers in Japan.

In February 2022, DENSO acquired a more than 10% stake in Japan Advanced Semiconductor Manufacturing, Inc. (JASM), TSMC’s majority-owned manufacturing subsidiary in Kumamoto Prefecture, Japan. With this equity investment, DENSO became JASM’s third largest shareholder. TSMC will build a new chip factory in Kumamoto Prefecture, Japan through JASM to produce cutting-edge logic semiconductors for image sensors and MCUs, with mass production scheduled to begin by the end of 2024. The acquisition will enable DENSO to stably purchase cutting-edge semiconductors with circuit line widths of around 10-20 nanometers in Japan.

In February, DENSO announced that it will increase its annual inverter capacity to 10 million units by FY2025 (ending in March 2026), tripling the current level. In order to achieve this goal, DENSO will expand or build new factories in Japan, the United States, China, Europe, Southeast Asia, India and other countries and regions. In addition to supplying products to Toyota, it will contact European and American OEMs.

In February, DENSO announced that it will increase its annual inverter capacity to 10 million units by FY2025 (ending in March 2026), tripling the current level. In order to achieve this goal, DENSO will expand or build new factories in Japan, the United States, China, Europe, Southeast Asia, India and other countries and regions. In addition to supplying products to Toyota, it will contact European and American OEMs.

In April 2022, DENSO and United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of global semiconductor foundry United Microelectronics Corporation (UMC), announced that they had agreed to collaborate on the production of IGBTs at USJC's 300mm fab. The production is scheduled to start in the first half of 2023.

In April 2022, DENSO and United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of global semiconductor foundry United Microelectronics Corporation (UMC), announced that they had agreed to collaborate on the production of IGBTs at USJC's 300mm fab. The production is scheduled to start in the first half of 2023.

"DENSO is considering spinning off its JPY420 billion chip business”, CTO Yoshifumi Kato said in an interview in June 2022.

"DENSO is considering spinning off its JPY420 billion chip business”, CTO Yoshifumi Kato said in an interview in June 2022.

With the development of mobility technologies such as autonomous driving and electrification, the importance of semiconductors in the automotive industry is becoming more and more prominent. Recently, DENSO's semiconductor layout mainly pivots on digital chips with high computing power, which will be mainly used in AD systems/ADAS. In order to obtain more semiconductor-related resources, DENSO has successively formed close capital bonds with Renesas, Infineon, TSMC, and UMC.

At present, DENSO keeps an eye to meet the internal chip demand and support Toyota. If DENSO splits its semiconductor business in the future, the relationship with Toyota is expected to be loosened, facilitating its global expansion. After all, DENSO has become the world's fifth-largest supplier of automotive chips by sales volume, and digital semiconductors to mass-produced in 2023-2024 will be a blessing.

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...