Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain integration layout

Driven by centralization of EEA, high-computing-power chips and improved software development capabilities, cockpit domain is constantly integrating new functions, and the intelligent cockpit is evolving from a single domain to cross-domain integration, such as integration of cockpit domain and ADAS domain. Some enterprises even have embarked on R&D layout of vehicle-cloud integrated multi-domain central computing platforms.

At the beginning of 2022, Thundersoft released a new Intelligent cockpit solution. Based on Qualcomm SA8295, it is a one-core multi-screen cockpit domain control solution. With high computing power and multiple cameras, it integrates low-speed assisted driving and cockpit domain to better support 360° surround view and smart parking.

In addition, Thundersoft uses Qualcomm 8795 chip to deploy cockpits and domain integration in the field of autonomous driving. Mass production is planned for 2024.

In 2021, Bosch China's first cockpit domain control product was mass-produced. At present, Bosch is actively exploring a vehicle-cockpit-driving integration platform that conforms to the central E/E architecture. The hardware will be designed in the form like a pluggable blade. Combined with a cross-domain SOA platform, a set of middleware meet the demand of both intelligent driving and intelligent cockpits to integrate information between all domains of the vehicle, allocate computing power, and promote the application of cross-domain integration.

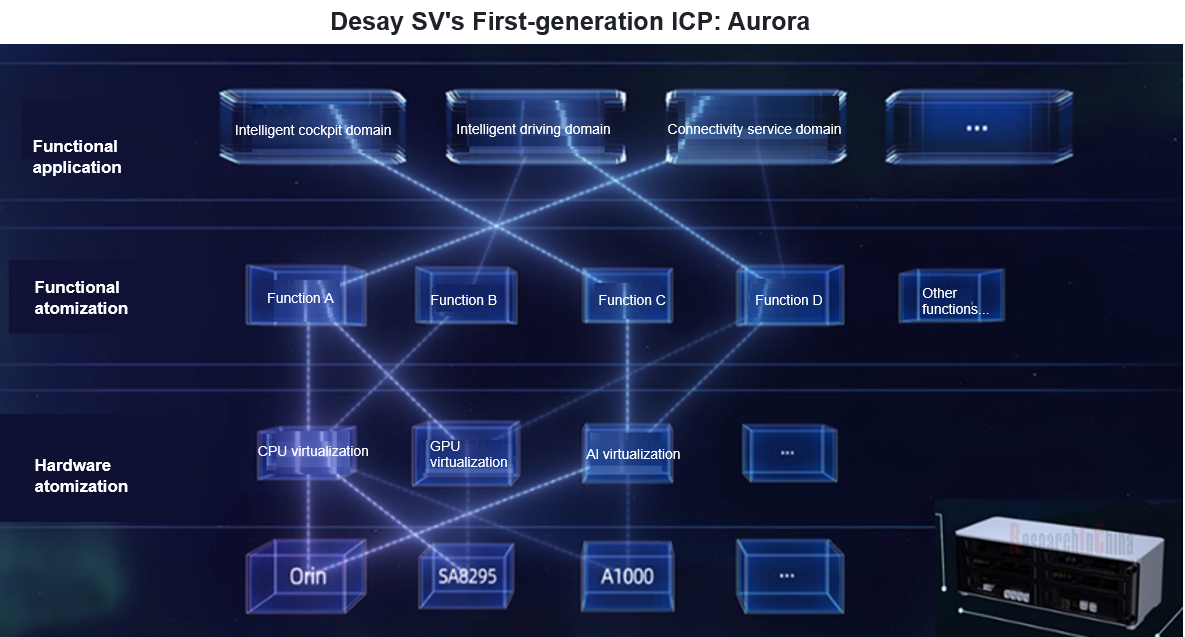

In April 2022, Desay SV released the first-generation mass-produced in-vehicle intelligent computing platform "Aurora", which integrates core functional domains such as intelligent cockpits, intelligent driving and connected services, realizes cross-domain integration from "domain control" to "central computing", and features intelligent computing, multi-domain integration, intelligent expansion (flexible configuration of "building blocks"), intelligent integration (designed for the open SOA platform), ASIL D, environmental protection and sustainability.

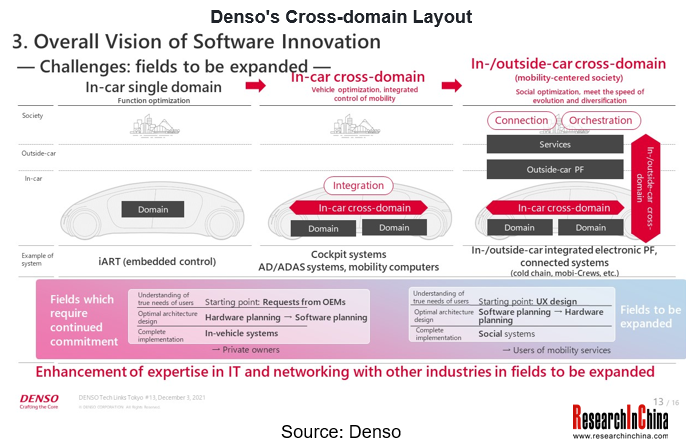

Denso is actively making breakthroughs in the fields of domains, cross-domain and even vehicle-cloud integration. In the future, its business scope will expand to the infrastructure and public sectors, and it will connect vehicles with cloud and infrastructure. In terms of cross-domain controllers, Denso will strengthen software development and cooperate with OEMs and technology companies.

Cockpit software platform: SOA and layered design

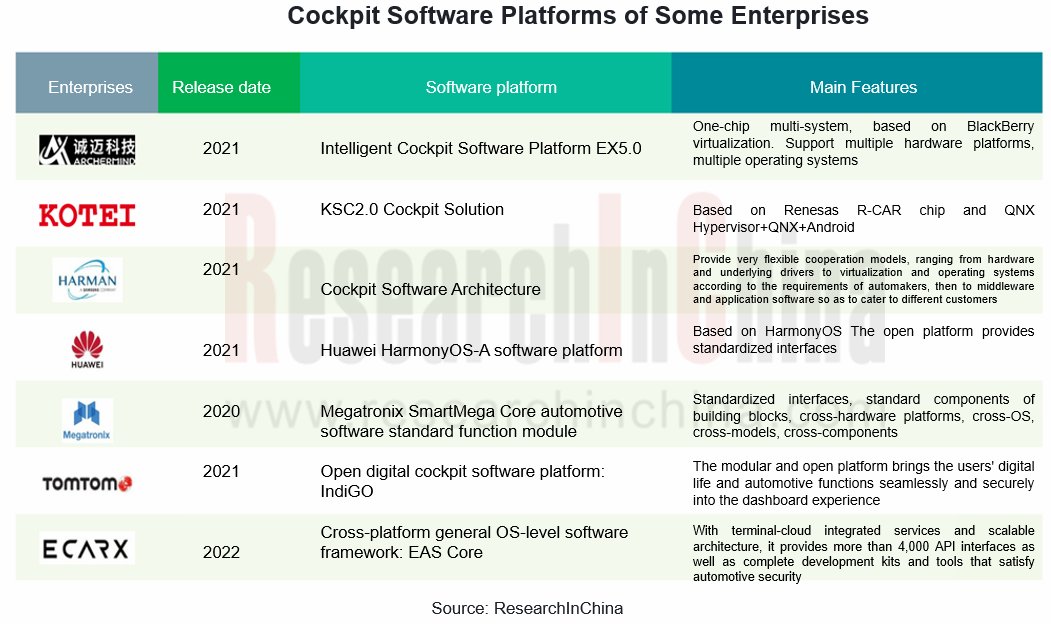

In the context of software-defined vehicles, software and hardware decoupling has become an inevitable trend on the basis of SOA. Cockpit software platforms are gradually evolving from fragmentation to modular platformization, and tending to layered design (that is, OS, middleware, basic software platform, application software platform, and application ecological services are distributed at different levels). Software technology companies have launched cockpit software platforms.

Through the standardization, modularization and reusability of software platforms, the software development cycle can be significantly reduced, and the development process can be simplified. At the same time, application software and services can be customized upon demand, allowing users to enjoy differentiated functions and experience. With the continuous evolution of EEA, software platforms are moving from single-domain to multi-domain/cross-domain and even vehicle-cloud integrated software platforms.

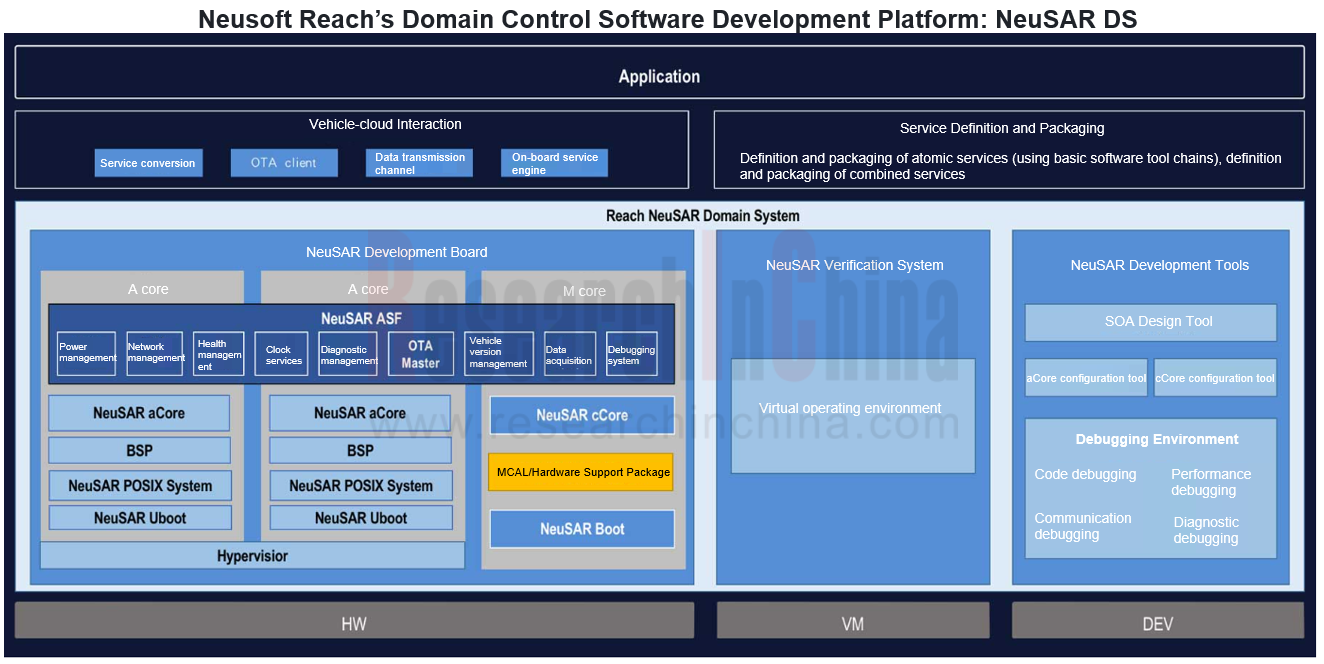

In April 2022, Neusoft Reach released the domain controller software development platform NeuSAR DS (Domain System), which can provide complete underlying software systems and virtualization on the domain controller SOC and MCU. It covers the software stack and tool chain required by the entire development process as well as engineering adaptation for typical chips, so as to realize the SOA design and development from the perspective of the whole vehicle. It allows developers to complete entire development process in a tool chain, and enables upstream and downstream development processes to be more closely coordinated.

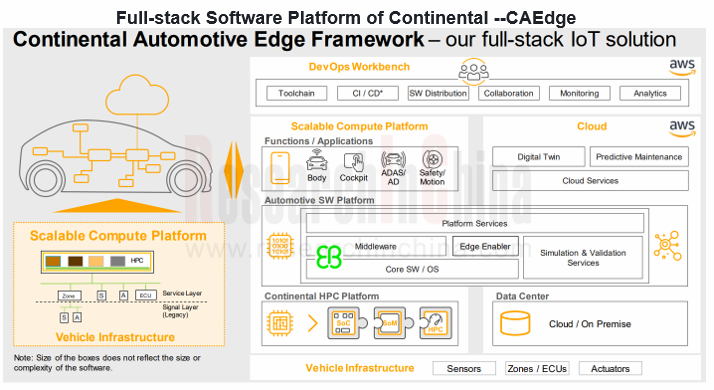

At CES 2022, Continental demonstrated how software and powerful IT infrastructure based on Continental Automotive Edge Framework enable new functions and are transforming mobility. This modular hardware and software platform connects vehicle to cloud and features numerous options to develop, supply and maintain software-intensive system functions. The platform also provides a software-intensive automotive architecture development environment for automakers and partners, greatly shortening development cycles and reducing development costs.

In 2021, ArcherMind launched the intelligent domain control Fusion SOA platform, which deeply customizes AUTOSAR protocol stack based on NXP32G (body domain) and Qualcomm 8155 (intelligent cockpit domain) to achieve cross-domain integration and global SOA services. It is compatible with QNX, Android, Linux, etc.

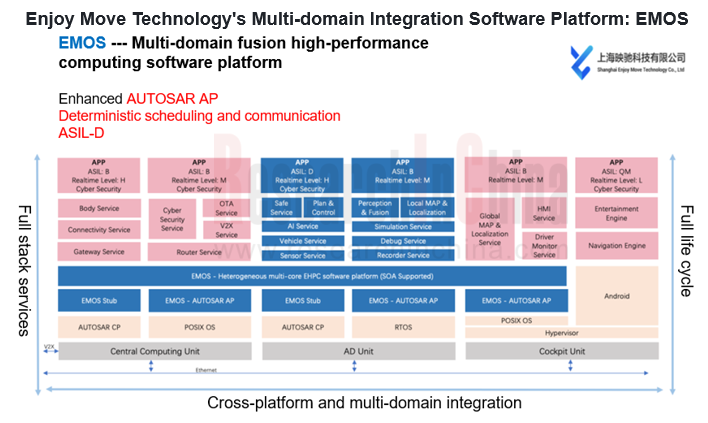

In 2021, Enjoy Move Technology mass-produced multi-domain integration software platform EMOS which integrates the enhanced AutoSAR AP (with self-developed deterministic scheduling and communication) and conventional CP. Covering the vehicle central computing unit, autonomous driving domain control and cockpit domain control (the key functional safety part), the entire architecture is oriented to SOA, and all of its modules and services are developed through a standardized model to maximize compatibility between services and other modules.

OEMs: Enhanced self-research capabilities, improved rights in cockpit development

According to the current layout, OEM cockpit system solutions are transferring from Tier 1 supplies to multi-supplier joint development and flattened cooperation. With the continuous enhancement of self-research capabilities, OEMs will have a greater right to speak in the field of customization such as cockpit system development.

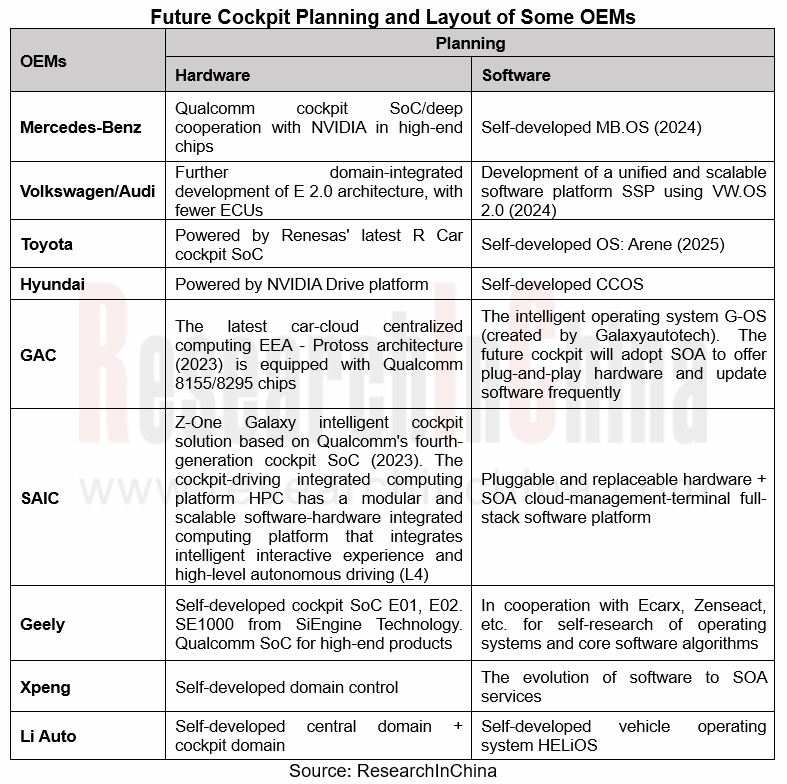

In terms of products, OEM cockpit single-domain control products have been mass-produced and installed. OEMs are vigorously deploying cross-domain integration, central computing platforms and self-developed OS/SOA platform, gradually moving towards SOA-based intelligent cars.

At the software level, OEMs have announced that they will develop automotive operating systems and basic software platforms, such as Volkswagen VW.OS, Mercedes-Benz MB.OS, Hyundai CCOS, Toyota Arene, etc.

For intelligent cockpit suppliers, flexible supply, modularization and standardized platforms will be the future focus of their layout. Bosch has pointed out that it will focus on the common functions below the middle layer in terms of software, adopt a modular approach to iterate layer by layer from the bottom up, and realize the replacement and iteration of chips and applications through software and hardware standardized interfaces.

Automotive Digital Instrument Cluster Operating System Report, 2023

Digital Instrument Cluster Operating System Report: QNX commanded 71% of the Chinese intelligent vehicle cluster operating system market.

Amid the trend for the integration of digital cluster and cen...

800V High Voltage Platform Research Report, 2023

How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehi...

Automotive Intelligent Cockpit Platform Research Report, 2023

Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Resea...

Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

In 2022, 4G modules swept 84.3% of the vehicle communication module market....

Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

At present, automotive electroni...

Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosyst...

China Automotive Digital Key Research Report, 2023

Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina co...

Automotive Camera Tier2 Suppliers Research Report, 2022-2023

1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refractio...

Emerging Carmaker Strategy Research Report, 2023 - NIO

Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier citie...

Nissan CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022-2023

Nissan CASE research: two leverages for Dongfeng Nissan to turn the tables. Introduction: since 2020, the declining sales of Dongfeng Nissan have exposed its problems in brand influence and product co...

China Automotive Gesture Interaction Development Research Report,2022-2023

Vehicle gesture interaction research: in 2022, the installations rocketed by 315.6% year on year.China Automotive Gesture Interaction Development Research Report, 2022-2023 released by ResearchInChina...

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...

Automotive Microcontroller Unit (MCU) Industry Report, 2023

MCU Industry Research: Automotive high-end MCU will be still in short supply, and how OEMs can break the situation.

ResearchInChina has released "Automotive Microcontroller Unit (MCU) Industry Repor...

Global and China Fuel Cell Market and Trend Research Report, 2023

Fuel Cell Industry Research: Hydrogen energy has been put on the national agenda with scenario application being rolled out.The hydrogen energy industry has been included into the national energy stra...

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversif...

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...