Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid rise

Global OEMs and Tier 1 suppliers are racing for the implementation of innovative “smart cockpit" technologies. In the next 2-3 years, we will see the mass production of many innovative intelligent cockpits which will experience a great revolution to HMI modes.

1. Intelligent Cockpit Computing Business: Development Towards Domain Integration and Central Computing

The development trends of intelligent cockpit computing unit: cockpit domain, domain integration, zonal, central computing platform, cloud computing. Judging from their moves in smart cockpit display business, domain integration and central computing will become the new focus of Tier 1 suppliers.

Through the lens of vehicle architecture, domain control unit (DCU) connects traditional cockpit electronic parts, and further integrates ADAS and V2X, beneficial to a better fusion of intelligent driving, in-vehicle connectivity, infotainment, etc. Ultimately, the vehicles will be centrally controlled by central controllers. A total solution turns a smart car into a mobile living space from a means of transportation.

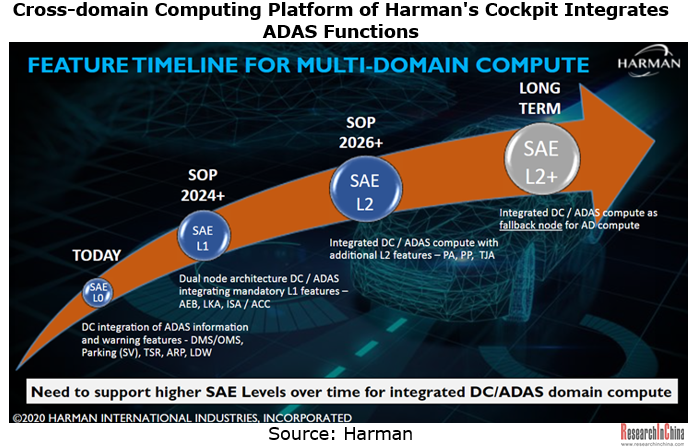

Tier 1 suppliers of intelligent cockpit have started to integrate relevant ADAS functions in cockpit DCU and provide UX customization. Harman now supports the integration of L0 ADAS functions (including AR navigation, 360° surround view, DMS/OMS and E-mirror) into smart cockpit.

In the future, Harman will support L1-L2+ functions through the fusion of intelligent cockpit DCU and ADAS DCU, offering OEMs with opportunities to reduce costs and system complexity. Without additional hardware, intelligent cockpit platforms can be provided to automakers as standalone products through ADAS ECUs. Harman envisages the level 1 and 2 dual node concept being introduced into vehicles from 2024/2025 onwards.

Viewed from the deployment of chip vendors, Qualcomm prioritizes the chip fabrication process in both the 4th-Gen Snapdragon Cockpit Platform and the Snapdragon Ride Platform for Autonomous Driving simultaneously, so that the Snapdragon Ride SoC and the fourth-generation Snapdragon cockpit chip will achieve cross-domain converged computing. The L2+ version of NVIDIA DRIVE Hyperion 8.1 uses two Orin SoCs, one for autonomous driving and the other for in-cabin applications. Besides, NVIDIA has launched the DRIVE Concierge cockpit software solution and the DRIVE IX software stack enabling integration of in-cabin algorithms.

2. Intelligent Cockpit Display Business: Emerging Product Innovations, General Availability of New Technologies

The cockpit display business layout of leading Tier 1 suppliers reveals innovations in automotive display products. In the next 3-5 years, new technologies such as the integration of instrument cluster and HUD, A pillar -to- A pillar integrated console display, AR-HUD, curved display and glasses-free 3D will accelerate to be installed and available massively, with its penetration on a rapid rise.

(1) Application trend of cluster display technology: Instrument cluster will be further integrated with HUD (AR-HUD)

Pioneers represented by Tesla Model 3 and Model Y have “forcibly” removed the independent cluster in front of the steering wheel and display all information on the central screen. Volkswagen is also deliberately ignoring the clusters of its ID. series, from which it is showed that instrument cluster gets increasingly combined with HUD, especially AR-HUD.

In the second half of 2021, Hyundai Mobis successfully launched the world's first "Clusterless HUD" that integrates cluster and HUD functions. Patent registrations have been completed in South Korea, China, the United States, and Germany. The product is being vigorously promoted to OEMs;

In March 2022, the intelligent cockpit diagram of Li Auto L9 revealed that the L9 may use AR-HUD in lieu of the cluster, which is likely to represent the future trend of cockpit design.

The intelligent cockpit of Neta S has a hidden full LCD cluster which is embedded (with a moderate size) in the center console. Through AR-HUD, it provides richer vehicle information and enables AR navigation and other functions.

(2) Application trend of center console display technology: From multi-screen integrated center console to "pillar-to-pillar integrated center console screen"

The automotive display has extended from the original independent cluster + center console to multi-screen, integrated, curved OLED, pillar-to-pillar and from-left-to-right display, accompanied by a deeper fusion of touch feedback, voice control, gesture control, biometrics identification and other new technologies.

The integrated center console display in support of the liftable mode has been seen on Voyah, IM L7 and other models. Continental intends to offer pillar-to-pillar "integrated center console screen" for a high-volume production model in 2024. The integrated display solution from one A-pillar to another features lower cost and stronger controllability compared with the "multi-screen" commonly used by automakers. It will be installed in the Mercedes-Benz E/S Class first.

(3) Application trend of HUD technology: HUD installations soar, and AR-HUD will be widely used in battery-electric vehicles

HUD falls into C-HUD, W-HUD and AR-HUD. C-HUD was the first to be popularized, but with limited market coverage, and it has been shrinking, finding application in the aftermarket. W-HUD prevails in the Chinese new car market as a standard or option for medium and high-end models. AR-HUD, a kind of frontier technology pursued by OEMs and Tier1 in recent years, is also the main orientation of HUD technology.

In China, the HUD penetration rate in passenger cars exceeded 5% in 2021, with installations totaling 1,037,000 units which grew by over 60%. By 2025, HUD penetration will reach 20%, of which AR-HUD will account for 25-30%, according to ResearchInChina.

The technology route of HUD with PGU using geometric optics mainly includes:

TFT-LCD roadmap. TFT solution is mostly used in W-HUD, but some vendors such as Continental, ADAYO, etc. use TFT-LCD in AR-HUD. The current unit cost of W-HUD using TFT technology remains at about RMB1,000, whereas the unit cost of AR-HUD using TFT technology is between RMB2,000 - RMB2,500.

The PGU of TFT-LCD is largely supplied by Japan-based JDI and Kyocera. Besides, Panasonic can produce PGUs by itself. Taiwan-based AUO and Innolux as well as China-based BOE and Tianma Microelectronics also offer TFT-LCD PGUs.

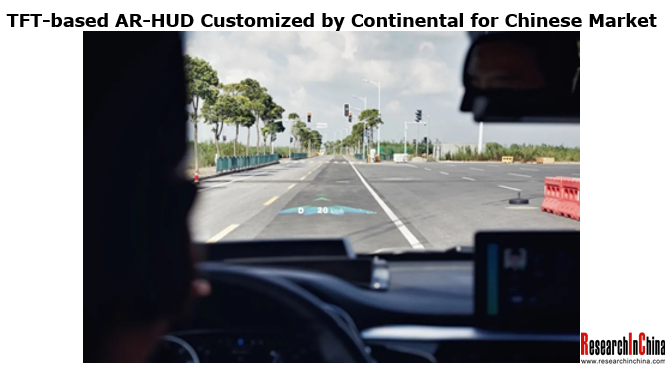

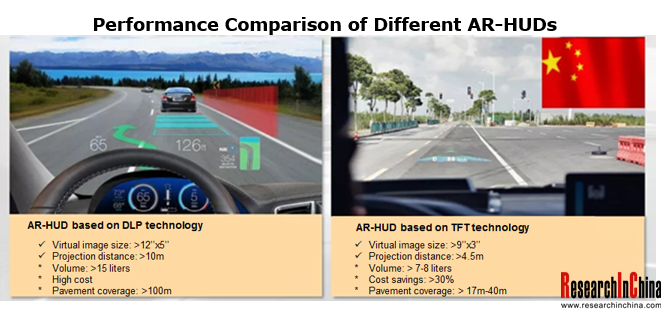

Continental will mainly promote TFT-based AR-HUDs in the Chinese market. The size is optimized to 7-8 liters, which saves more than 30% cost compared to DLP solutions. The virtual image size is 9°x3° (equivalent to a projection range of 29 inches and a projection distance of 4.5 meters). When the projection distance is above 4.5m, the road coverage will be 17-40m. In China, 70-80% of driving scenarios are seen on urban roads, so most of the needs are in the pavement area within 40 meters, which can be met basically.

The unit cost of AR-HUD using DLP technology is as high as RMB3,000-4,000. In the next 3-5 years, traditional low-cost TFT solutions and high-end DLP solutions will develop in parallel in the field of passenger car HUDs.

The AR-HUD based on DLP technology has a larger virtual image size and farther projection distance, and covers a wider pavement (about 100 meters), but it is still difficult to solve the problems about volume and cost.

Although it is similar to DLP technology in the display mode, the liquid crystal on silicon (LCoS) technology solution can achieve higher resolution, namely 1080x1920. Tier1 suppliers such as Hardstone, Huawei and Beijing ASU Tech have begun to work on LCoS solutions; Will Semiconductor, Nanjing SmartVision Electronics, etc. have realized the localization of LCoS chips.

MEMS laser projection technology does not suffice for automotive requirements for the time being, but it may be applied to L4/L5 autonomous vehicles in the future.

At present, the mass-produced AR-HUDs basically follow the geometric optical projection solution of W-HUDs, which requires a super large aspherical mirror to increase the projection distance (the AR-HUD VID should be above 10m), resulting in the package size being too large to meet the requirements of OEMs. Holographic technology (holographic optical waveguide, HOE, CGH, etc.) so far has become the focus of automakers and suppliers now that it can not only slash volume, but also widen the FOV.

Holographic optical waveguide and HOE are two routes of static holography. Within the scope of dynamic holography, CGH (Computer Generated Holography) is the real holographic technology that can be defined by software. SeeReal, CY Vision, Envisics, etc. master the core technology of CGH. Denso is also deploying CGH. In a nutshell, there is still a window of 3-5 years before the mass production of next-generation AR HUDs based on optical waveguide, HOE and other technologies.

(4) Application trend of curved display technology: Still confined to luxury models due to extremely high costs

At present, vehicles basically use 2D flat glass covers. Only a handful of production models employ large-curved 3D glass covers. For example, the new Cadillac Escalade is equipped with a curved OLED display, and the Mercedes-Benz EQS adopts a special-shaped multi-screen.

3D cover glass will be an eye-catching new trend. For instance, Cadillac’s curved OLED display is made up of three separate screens, which are integrated as a one-piece 38-inch huge display system with the help of two pieces of AGC's curved cover glass.

The automotive OLED display market is mainly dominated by LG Display, Samsung Display and BOE. LG Display and Samsung Display are scheduled to provide OLED products with high brightness and longer service life after 2022. Denso has invested in JOLED, the only Japanese OLED supplier, to accelerate the development and mass production of automotive OLED displays.

Denso will integrate with JOLED's organic EL display panel printing technology, for faster development and production of various organic EL panels such as clusters and central displays.

(5) Application trend of glasses-free 3D technology: Glasses-free 3D curved clusters + glasses-free 3D navigation

A glasses-free 3D cluster uses parallax barrier technology to split images, forming two different, slightly offset viewing angles for the left and right eyes respectively, thus producing 3D images. Based on a camera built in the display, the technology detects the driver's line of sight and adjusts the position of the 3D view to precisely aim at the driver's head. Continental is launching its volume-production display featuring autostereoscopic 3D technology on the market in the HMC Genesis GV80 high-line variant.

Continental is developing an innovative cockpit solution, the Natural 3D Lightfield Instrument Cluster, in cooperation with Silicon Valley-based Leia Inc. The 3D-image produced by the Lightfield display is made up of a total of eight perspectives of the same object that subtly vary according to the point-of-view. There is no need to change the overall structure, just placing a light guide plate on its rear layer can achieve the desired effect.

In July 2021, Continental, HERE and Leia Inc partnered to bring 3D navigation into display solutions for vehicle cockpits. HERE’s 3D depiction of buildings and topography are displayed in Continental’s Natural 3D Display with Leia’s Lightfield technology.

3. Intelligent Cockpit Communication Business

In the future, suppliers that simply provide T-Box hardware will not be competitive. Some T-Box vendors are trying to master software and operating system, and gearing towards central gateway and communication domain computing platform solutions.

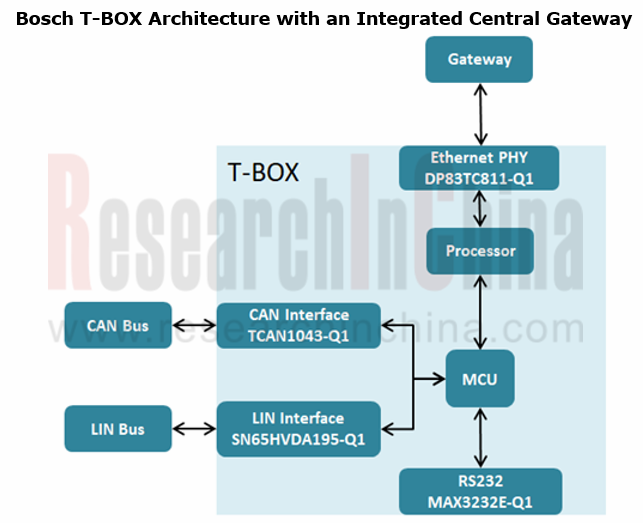

In 2021, Bosch launched the "automotive communication computing platform" to provide customers with a safe and reliable high-performance software innovation platform with multi-domain control and super computing power. Besides, it is integrated with a multitude of communication architectures such as in-vehicle communication, wireless communication, and OTA. The automotive computing platform also in possession of rich communication resources and storage resources can act as an in-vehicle data center and provide a robust hardware foundation for automotive APP services.

Bosch T-Box integrates Ethernet, external antennas (OTA required) and embedded Linux.

In addition, T-BOX's further integration with high-performance smart antennas is the crucial technology for the integrated vehicle connectivity. For remote access keys, navigation systems and intelligent communication technologies, there are a large number of wireless communication interfaces inside and outside vehicle, which can integrate 5G and V2X technologies.

4. “Cockpit Integrated with DMS/OMS” Business

New cars in the European market must be equipped with driver monitoring systems (DMS) from July 2022 pursuant to the roadmap previously released by Euro NCAP. From 2022, new cars should be outfitted with occupant monitoring systems (OMS), especially a reward is given to Child Presence Detection. OMS will be included as a standard configuration from 2024.

Features of Continental's integrated driver & occupant monitoring system solution (DMS and OMS):

For the first time, cameras are directly integrated into displays (akin to the concept of under-display cameras of mobile phones), instead of being integrated into steering wheels, clusters, rearview mirrors or A-pillars.

The precise positioning of radar sensors ensures that all areas of cockpits are covered evenly. In contrast, traditional camera OMS solutions have problems in blind spots, light effects, and complex configuration of multiple cameras.

Based on this integrated system, Continental hopes to continuously add more new functions in the future. For example, it expects to record and evaluate the health indicators such as pulse, respiratory rate or body temperature of drivers and occupants.

In addition, the gesture information of the cockpit sensing system will be combined with biological parameter analysis information to detect pivotal physiological data, improve driver monitoring technology, and enhance the safety and comfort of occupants.

5. Intelligent Cockpit Information Security Business

Automotive remote upgrade solutions are evolving with the demand of the industry, from SOTA (Software Over the Air) updates of the cockpit infotainment system and FOTA updates of all ECUs on vehicles to comprehensive solutions for remote measurement, remote cloud diagnosis, big data platforms and algorithms covering the entire life cycle of vehicle.

As a network communication hub in vehicles and a bridge between the networks inside and outside vehicle, automotive gateways function as a "firewall" of the automotive cybersecurity to greatly reduce the risk of cyber-attacks.

Three Development Stages of FOTA

FOTA 1.0

In this stage, upgrades of non-safety-related components (infotainment system upgrades, such as T-Box, head unit, APPs, OS, etc.) are implemented, which are easy since functional safety is not involved.

FOTA 2.0

FOTA involves all ECUs in the CAN bus network, that is, it contains non-safety-related and safety-related ECUs, including engine, chassis and so on. The biggest challenge at this stage is security. In Bosch's system, all components of FOTA 2.0 can meet the requirements for ECU data programming above ASIL B, and implement ECU upgrade and rollback strategies while ensuring functional safety.

FOTA 3.0

Besides the remote upgrade of ECUs, FOTA 3.0 supports the scalability of more functions, such as:

1. Remote diagnosis, remote calibration, remote measurement;

2. Predictive diagnosis and edge computing algorithms based on big data;

3. ECU upgrade and parallel writing for the next-generation EEA (Ethernet). The biggest challenge at this stage lies in in-depth understanding of the electrical architecture of automotive electronics, components and operating systems in the technological reform.

Bosch's automotive security OTA software management solution combines a software management system and ESCRYPT's Key Management Solution Secure Software Updates to address end-to-end and embedded security, managing all the certificates and keys for ECUs and efficient and secure OTA updates.

Harman strategically acquired Symphony Teleca and Redbend in 2015, and established a fourth division, i.e., Connected Services, to provide OTA services for OEMs. In 2016, Harman acquired TowerSec, a global automotive cybersecurity company and launched the end-to-end automotive cybersecurity platform Harman Shield.

Global and China Tier1 Intelligent Cockpit Research Report 2022 has two volumes:

The first volume researches six Tier 1 suppliers (Bosch, Continental, Denso, Valeo, Faurecia, and Panasonic) with a total of 420 pages;

The first volume researches six Tier 1 suppliers (Bosch, Continental, Denso, Valeo, Faurecia, and Panasonic) with a total of 420 pages;

The second volume studies seven Tier 1 suppliers (Aptiv, Visteon, LG Electronics, HELLA, Samsung Harman, Desay SV, and Joyson Electronics) with a total of 430 pages.

The second volume studies seven Tier 1 suppliers (Aptiv, Visteon, LG Electronics, HELLA, Samsung Harman, Desay SV, and Joyson Electronics) with a total of 430 pages.