China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from extensive management to refined management. In the automotive industry chain, the upstream parts manufacturers provide all kinds of parts and components to the midstream automakers who are responsible for design, R&D, manufacturing and brand building, while the downstream dealers sell new cars and provide after-sales services for consumers. In the entire industry chain, automakers occupy a dominant position, and they have a strong voice in managing dealers through authorization and rebate measures.

According to data from China Association of Automobile Manufacturers (CAAM), 26.082 million and 26.275 million automobiles were produced and sold respectively in 2021, up 3.4% and 83.8% year-on-year correspondingly. This is the first growth since 2019. The COVID-19 pandemic has brought unprecedented challenges to China's automotive dealership industry which still performs well. According to the data of CAAM, the total revenue and output value of the top 100 automotive dealership groups in 2020 jumped 4.9% year-on-year to RMB1.82 trillion. In 2020, the number of authorized 4S dealers nationwide experienced negative growth for the first time in history. The number of 4S stores in the network dropped to 28,000. A total of 3,920 4S stores withdrew throughout the year, namely over 10 4S stores exited every day averagely.

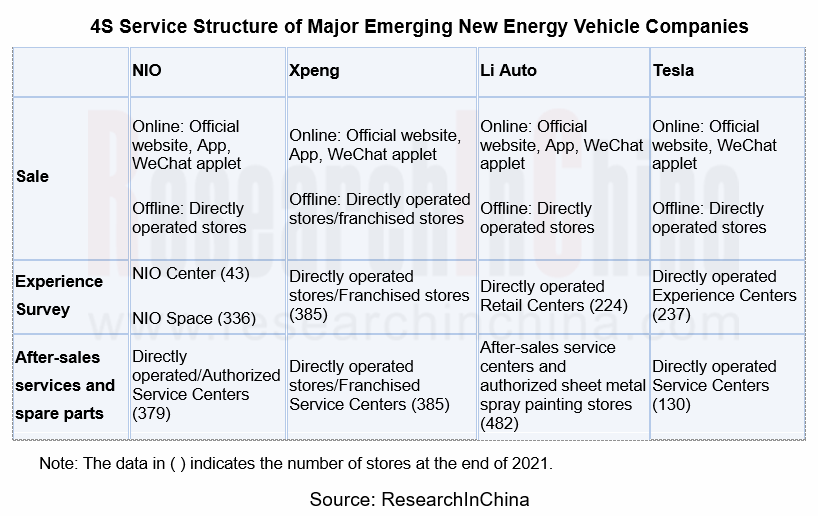

Different from the national dealership model of conventional auto brands, the current sales models and channels of emerging automakers have evolved from the dealership model to the direct operation of chain stores by brand automakers or the cooperative operation with authorized agents. The direct sales model offers users refreshing brand experience through services covering the entire life cycle of products, and avoids many drawbacks (like opaque prices and poor services) of the conventional dealership model. However, it also triggers multiple problems such as huge capital and complex operation, which are not applicable to all new energy vehicle manufacturers. But even if the dealership model is still adopted, the service structure and profit structure of 4S stores will be significantly altered.

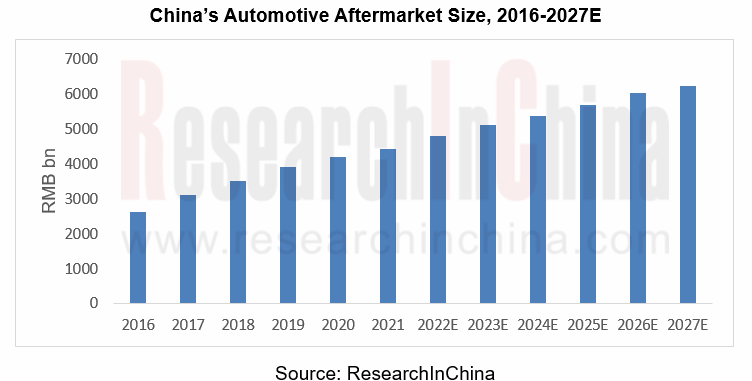

The automotive aftermarket refers to all the services needed by consumers around the use of automobiles after they are sold until being scrapped.

The automotive aftermarket, especially the maintenance market, expands year by year with the increase of automobile age, because the older the automobile, the more worn the accessories, the more repairs per year, and the higher the repair cost. At present, the average age of automobiles in China has reached 6 years. The growth in both automobile age and automobile ownership has driven the booming development of automotive aftermarket which has gradually become a new industrial focus, meaning the industry has seen lucrative opportunities.

The automotive aftermarket mainly includes auto repair and maintenance, auto finance, used cars, car leasing, auto supplies, beauty and modification, car recycling, aftermarket alliance platform integration/automotive e-commerce, etc. Among them, auto finance, auto maintenance and used cars are the top three segments of the automotive aftermarket:

Used Cars

Factors such as consumption upgrade, occupational needs, and consumer preference will allow car owners to swap their existing cars through channels such as used car dealers and used car e-commerce platforms. In recent years, the state and local governments have increased their efforts to promote automobile consumption, and taken favorable measures to drive the consumption of used cars. China's used car market has maintained growth with a wider transaction scale. In 2020, approximately 17.59 million used cars were transacted in China, a spike of 22.6% over the previous year. In the future, the used car market is expected to raise its market share in the automotive aftermarket.

Maintenance

Under the background of high automobile ownership, high automobile age and maintenance concept change, the auto repair and maintenance market size continues to swell. The annual automobile maintenance cost escalates year by year with the increase of automobile age, because the older the automobile, the more worn the accessories, the more repairs per year, and the higher the repair cost. According to the experience of developed countries, China is about to see the maintenance demand hit the peak. In the past ten years, the sales volume of automobiles has been considerable, but the growth rate of new car sales volume has slowed down. In the future, the average automobile age will continue to rise, which will prompt the automotive maintenance industry into a golden age. China's auto maintenance market size had reached about RMB1,533 billion as of 2021, and it is expected to exceed RMB2 trillion by 2027. In the context of anti-monopoly, independent auto repairers are gradually encroaching on the market share of traditional 4S stores; with the help of the "Internet +" model, the independent repair model will further burgeon.

Auto Finance

Pivoting on OEMs, auto finance is the combination of various financial products derived from upstream and downstream of the industry to end consumers. It targets companies, individuals, governments, auto operators and other entities. Typical auto finance products include dealer inventory financing, auto loans, auto leasing, and auto insurance. In recent years, the overall penetration rate of China's new car finance has ticked up year by year. However, compared with mature markets in Europe and the United States, China's new car finance market still lags behind. With consumption upgrade and higher credit acceptance, auto finance will further grow. In 2021, the assets of 25 auto finance companies ascended 15% year-on-year to RMB1.12 trillion.

China Automotive Distribution and Aftermarket Industry Report, 2022-2027 highlights the following:

Definition, classification, industry chain, business models, etc. of the automotive dealership industry and aftermarket;

Definition, classification, industry chain, business models, etc. of the automotive dealership industry and aftermarket;

Market size and forecast of Global and Chinese automobile and dealership industry, including automobile sales volume, dealer network, automobile sales volume by dealers, competition pattern, sales models of the new energy vehicle industry, etc.;

Market size and forecast of Global and Chinese automobile and dealership industry, including automobile sales volume, dealer network, automobile sales volume by dealers, competition pattern, sales models of the new energy vehicle industry, etc.;

Market size, forecast, competition pattern, trends, etc. of automotive aftermarket segments including auto finance, used cars, maintenance and beauty, etc.;

Market size, forecast, competition pattern, trends, etc. of automotive aftermarket segments including auto finance, used cars, maintenance and beauty, etc.;

Profile, business, agency brands, operating network and marketing of major auto dealers in China.

Profile, business, agency brands, operating network and marketing of major auto dealers in China.

Automotive Power Management Integrated Circuits (PMIC) Industry Report, 2023

Automotive PMIC research: the process of domestic automotive PMICs replacing foreign ones in China in the “crisis of chip shortage”.

Automotive power management integrated circuits (PMIC) find broad ...

Automotive Cockpit SoC Research Report, 2023

Cockpit SoC research in 2023: Can X86 solutions returning to cockpit SoC challenge the “ARM+Google” mobile solution?

This report highlights the research on the products and plans of 9 overseas and 8 ...

AI Foundation Model and Autonomous Driving Intelligent Computing Center Research Report, 2023

New infrastructures for autonomous driving: AI foundation models and intelligent computing centers are emerging.

In recent years, the boom of artificial intelligence has actuated autonomous driving, ...

Automotive Microcontroller Unit (MCU) Industry Report, 2023

MCU Industry Research: Automotive high-end MCU will be still in short supply, and how OEMs can break the situation.

ResearchInChina has released "Automotive Microcontroller Unit (MCU) Industry Repor...

Global and China Fuel Cell Market and Trend Research Report, 2023

Fuel Cell Industry Research: Hydrogen energy has been put on the national agenda with scenario application being rolled out.The hydrogen energy industry has been included into the national energy stra...

Global and China Automotive Smart Antenna Research Report, 2022-2023

Smart antenna research: the integration of automotive antennas and intelligent connected terminals tends to accelerate.

The development trend of automotive antennas: tend to be intelligent, diversif...

Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million...

China Autonomous Shuttle Market Report, 2022-2023

Autonomous Shuttle Research: application scenarios further extend amidst policy promotion and continuous exploration

Autonomous shuttles are roughly categorized into minibuses and robobuses. Minibuse...

Intelligent Cockpit Domain Control Unit (DCU) and Head Unit Dismantling Report, 2023 (1)

Dismantling of Head Unit and Cockpit Domain Control Unit (DCU) of NIO, Toyota and Great Wall Motor The report highlights the dismantling of Toyota’s MT2712-based head unit, Fisker’s Intel A2960-based ...

Automotive Vision Algorithm Industry Research Report, 2023

Research on automotive vision algorithms: focusing on urban scenarios, BEV evolves into three technology routes.1. What is BEV?

BEV (Bird's Eye View), also known as God's Eye View, is an end-to-end t...

ADAS Domain Controller Key Component Trends Report, 2022

ResearchInChina researched and summarized China’s current mainstream high computing power ADAS domain controller products such as Huawei MDC and DJI ADAS domain controller prototype, and technical inf...

Automotive High-precision Positioning Research Report, 2023

High Precision Positioning Research: four forms of mass-produced integrated high-precision positioning products

With the continuous development of autonomous driving, the demand for high-precis...

Automotive AUTOSAR Platform Research Report, 2023

AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation ...

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...