V2X (Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2021

V2X and CVIS Industry Report: 5G V2X will be a Standard Configuration for Digital Cockpits

After months of debate, in November 2020, the US Federal Communications Commission (FCC) voted for allocation of 75MHz of the spectrum band (5.850-5.925GHz), which had previously been reserved for Dedicated Short-Range Communications (DSRC) services, to Wi-Fi and C-V2X uses, which means the US has given up DSRC and turned to C-V2X.

In 2021, China government has issued the 14th Five-Year Plan (2021-2025) for National Economic and Social Development and the Long-Range Objectives through the Year 2035, and the National Comprehensive Three-dimensional Transportation Network, indicating that in the 15 years to come, China should lead the world in intelligent connected vehicle (intelligent vehicle, autonomous driving, CVIS) by providing full coverage of spatio-temporal information service and transportation perception, and defining China’s “CVIS + autonomous driving” technology roadmap.

C-V2X technology is in the first phase of implementation, and OEMs tend to explore application scenarios.

In September 2020, the 5G Automotive Association (5GAA) worked out a C-V2X communication technology roadmap.

Based on the current 3GPP’s 5G technology release speed, global deployment of 5G technology, and automotive communication technology supply chain status, combining 5GAA’s prediction and the reality in China, we think the use of C-V2X technology will pass through the following three phases:

2020-2023:

Having become available to mass-produced vehicles, C-V2X now depends on 4G LTE-V2X(R14, R15)technology to offer basic safety functions: LTE-V2X enables higher traffic efficiency and assisted driving safety, and will support other functions such as electronic brake light, left turn assistance, automated valet parking (AVP) in a parking lot, and remote-controlled driving.

In some low- and medium-speed automated driving scenarios (ports, mining areas, parks, etc.), LTE-V2X (R15, composed of 4G core networks + 5G base stations) works for vehicle infrastructure cooperation.

2024-2026:

Based on NR V2X+5G Uu, achieve CVIS-enabled automated driving (R16-released in July 2020), R17-expected to freeze in mid-2022), with available functions including coordinated protection of vulnerable groups in traffic and cooperative automated driving on urban roads;

HD map data (static/semi-static and dynamic) and sensor data (camera, LiDAR, radar, etc.) can be broadcasted to nearby autonomous vehicles for assisted driving decision.

Beyond 2026:

5G NR V2X will be mature enough to be a standard configuration for highly automated vehicles. The combination of NR V2X and 5G eMBB allows for the sharing and collaboration of high-precision perception data between vehicles, and the collaborative interaction between vulnerable traffic participants. By 2029, it will enable collaborative traffic flow management and automated vehicle flow takeover on highways or at intersections.

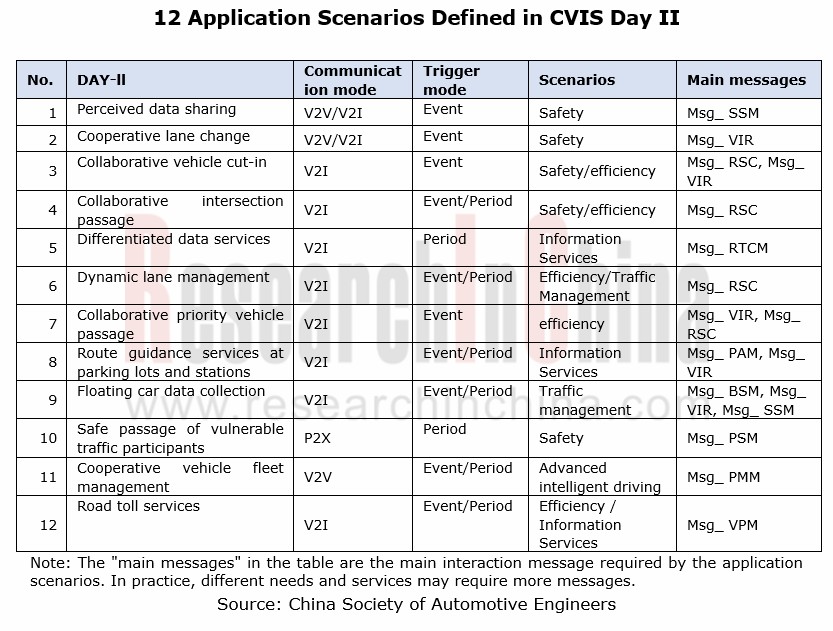

In China’s case, the Cooperative Intelligent Transportation System, Vehicular Communication, Application Layer Specification and Data Exchange Standard (Day II), an association standard, started soliciting opinions in November 2020. Compared with the CVIS DAY I released in 2017, the CVIS Day II underlines the interactions between vehicles, infrastructures and pedestrians and makes the trend to “vehicle-infrastructure cooperation” technology clearer, which means more V2I scenarios will come out and roadside (edge end) capabilities will play a role.

Through the lens of the mass production of OEMs in China, the 17 typical use cases in the CVIS DAY I can already be seen in vehicles; for the typical Day II use cases, the formulation of recommended standards is underway, and development and commercialization is expected to be phased in in 2021.

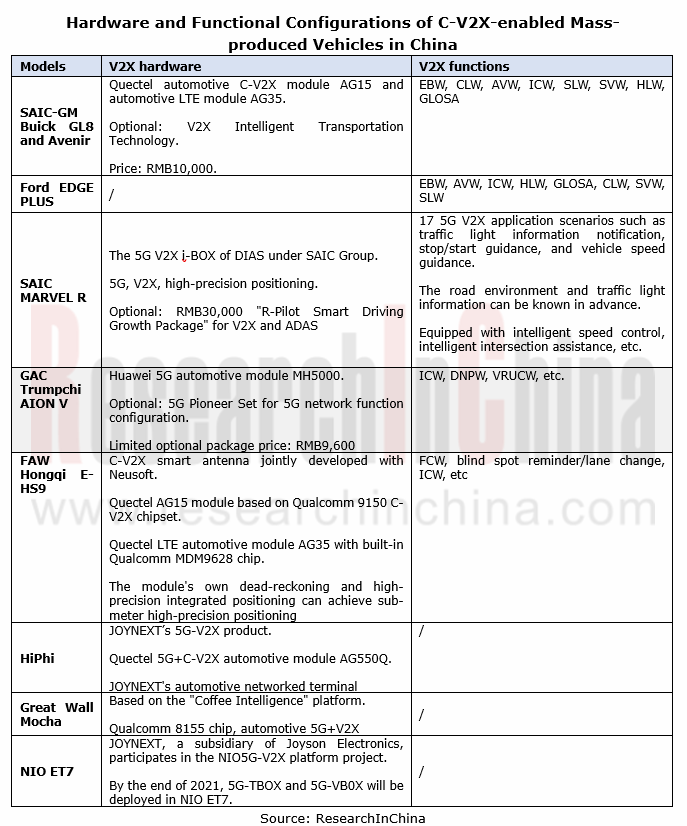

For example, Ford China is testing “direct connection” mode-based V2I and V2V capabilities such as electronic emergency brake light (EEBL) and intersection movement assist (IMA), and will further integrate V2X with Co-Pilot 360 ADAS and push them to users over the air (OTA).

In future 5G V2X may be a standard configuration for digital cockpits

In the next several years, the stronger computing force of chips will come with much more rapid integration of digital cockpits and a disruption in conventional on-board units like T-BOX; smart cockpits that integrate with more functions including ADAS, V2X and cloud services will hold the trend. Qualcomm's third- and fourth- generation Snapdragon automotive digital cockpit platforms both combine C-V2X. In future, 5G V2X may be a standard configuration for digital cockpits.

V2X can fuse with on-board smart terminals like IVI system and T-BOX, as well as ADAS or autonomous driving platform. Tier1s and OEMs have been developing corresponding products. Specifically, C-V2X hardware products have the following forms:

- C-V2X+T-BOX on-board terminals can integrate with such technologies and products as 4G/5G module, C-V2X module, CAN controller and GNSS. PATEO’s 5G C-V2X T-BOX packs Huawei MH5000 module. PATEO has partnered with Huawei closely in communication modules since 2009, with their cooperation extending from Huawei MU203 module at first to 4G, 4.5G C-V2X and 5G C-V2X; at the 2020 C-V2X Cross-industry & Large-scale Pilot Plugfest, the fleet co-built by PATEO, Huawei and BAIC completed dozens of scenario demonstrations like V2I (vehicle to infrastructure) and V2V (vehicle to vehicle) and showed applications, for instance, AR navigation, ADAS and lane-level HD navigation map.

- The further integration of UWB / WIFI / Bluetooth keyless entry and other functional modules into all-in-one intelligent antennas already highly integrated with such as GNSS positioning module, 4G/5G and V2X may be taken into account. Honqqi E-HS9 launched in late 2020 carries the C-V2X intelligent antenna that is jointly developed with Neusoft.

- “ETC+T-BOX+C-V2X” all-in-one terminals. An example is China TransInfo Technology Co., Ltd. which integrates automotive-grade ETC and C-V2X PC5 modules into the existing passenger car 4G/5G T-Box platform to connect ETC and V2X to vehicle navigation system and ADAS.

- AR navigation and AR HUD technology will further enhance the fusion of ADAS, V2V and V2I communication technologies, becoming an important display interface for V2X. Mocha, a mass-produced model under Great Wall WEY, has carried Qualcomm 8155 cockpit chip, 5G+V2X and AR-HUD.

- Autonomous driving DCU that fuse with C-V2X can serve as redundant sensors for autonomous driving. Qualcomm Snapdragon Ride hardware stack incorporates planning, positioning (Qualcomm Vision Enhanced) and perception (camera, radar, LiDAR, sensor fusion, C-V2X). V2X software supports ITS protocol stacks subject to SAE and ETSI standards, as well as third-party ITS protocol stacks.

In general, most of the current models spawned by OEMs adopt the technical solutions integrated with V2X module and T-BOX. At present, 5G+LTE-V2X+WiFi+GNSS functions can be integrated into one module priced at RMB2,000 or so.

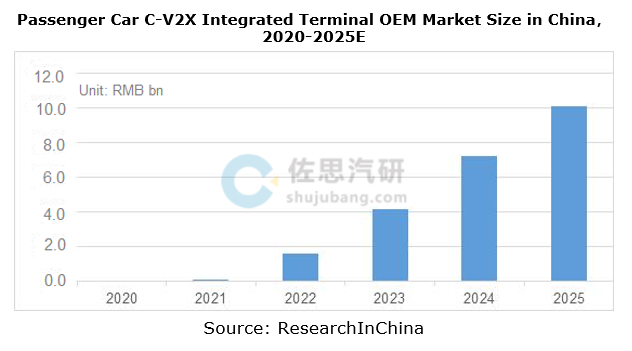

In future, the price will have a further drop to RMB1,000 to RMB1,500, and those based on R16/R17 5G NR will be a bit more expensive. Optimists predict that China’s passenger car C-V2X OEM terminal market will be worth more than RMB10 billion in 2025.

In addition, in an age of software-defined vehicles, Tier1s can provide OEMs with road scenario tests, middleware (ITS protocol stack) and application layer development services and charge them development and license fees, while the value of pure protocol stack providers will be highlighted.

Foreign protocol stack providers are led by Cohda Wireless, Commsignia, Savari, MARBEN and Veniam; in China, typical players are Baidu Apollo, Neusoft VeTalk, Nebula Link and iSmartWays.

Samsung Harman’s buyout of the V2X software provider Savari in March 2021 and its early investment in Autotalks enable Samsung to offer complete V2X TCU software and hardware solutions in an age of 5G. Samsung 5G V2X TCU is to be mounted on BMW iX SUV at the end of 2021.

In China, Nebula Link, an ITS software stack provider rolls out V2X stack software protocols for conventional Tier1s, for example, offering communication protocol stacks and upper application algorithm software to vehicle V2X products of JOYNEXT, a subsidiary of Joyson Electronics, which have been applied to the mass-produced model platform of one OEM in China.

In addition, V2X modules of Morningcore Technology Co., Ltd. under China Information and Communication Technology Group Co., Ltd. (CICT) integrate with CWAVE II, Nebula Link’s C-V2X national standards-compliant protocol stack. 2 million sets of CX7101N, a full-stack software and hardware integrated solution for mass-produced vehicles jointly introduced by Nebula Link and Morningcore Technology, are projected to be used in the next five years.

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...