Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view camera and LIDAR, conducted a complete dismantling, and formed "DJI Automotive Front View Binocular Camera and Innovusion LIDAR Dismantling Report, 2022".

DJI Automotive Front View Binocular Camera

DJI entered intelligent driving field in 2016 with its technological advantage in binocular vision for drones. 2023 Baojun KiWi EV DJI Edition was officially launched in September 2022, announcing that the first mass-produced intelligent driving assistance system project of DJI Automotive was officially landed and delivered to users. Baojun KiWi EV DJI Edition is equipped with "Lingxi Intelligent Driving System" jointly created by SAIC-GM-Wuling and DJI Automotive. The system integrates core hardware such as high stability processor, stereo vision binocular camera, high-definition surround view camera and high-precision radar. Intelligent parking can achieve 360 ° efficient intelligent parking, AI smart exiting and other functions. Intelligent driving can realize intelligent active recommendation, intelligent following, intelligent passing of curves, intelligent lane change, intelligent queue cutting response and other functions to achieve assisted driving in common urban congestion scenarios, urban expressway scenarios, diverse parking scenarios, etc. In many industry media reviews and user real use scenarios, Lingxi Intelligent Driving System has been highly praised.

The DJI front view binocular camera dismantled by ResearchInChina is exactly from Baojun KiWi EV DJI Edition.

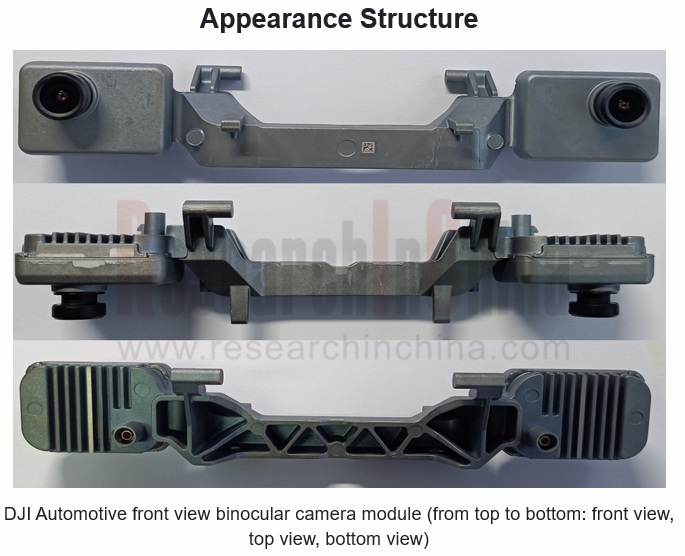

DJI Automotive front view binocular camera, the overall length of the prototype module reaches 215mm, the distance between the center of the left and right two cameras (baseline length) is 180mm, the basic size of monocular module is 49×35×42mm. The appearance structure is symmetrical, and the overall module is made of ADC12 die-casting aluminum, and an integrated back cover is applied. The central bracket structure connects the left and right monocular module together, and the monocular module back cover is integrated with the bracket in a compact structure.

Internal Structure

The single camera module hardware of DJI Automotive binocular camera is mainly concentrated in front shell, which is connected to the back cover by welding on all sides, and the lens is bonded to the front shell by AA glue, while the welding seam gap between the front shell and the back cover has no waterproof treatment. The sensor board of the monocular module is connected to the front shell by three 2.5mm tapping screws, and the sensor board is positioned with the front shell by pins with high positioning accuracy.

For key components, the automotive HDR image sensor adopts Sony IMX390, 2.45MP, CMOS size is 1/2.7-inch, maximum resolution is 1080P, can record 10bit 60fps video, and dynamic sensitivity is 120dB; The serializer uses Maxon MAX96717F GMSL serializer, receives video through MIPI CSI-2 interface, outputs it on GMSL2 serial link transceiver, simultaneously sends and receives bi-directional control channel data through the same GMSL2 link.

Innovusion LIDAR

Currently, domestic LIDAR manufacturers that have achieved OEM mass production include Innovusion, RoboSense, and HESAI, among which Innovusion has R&D layouts both at home and abroad, and its Falcon LIDAR has been pre-installed in NIO ET5/ET7/ES7 models. Innovusion has R&D centers in Silicon Valley, Suzhou and Shanghai, and vehicle-grade LIDAR manufacturing bases in Ningbo and Wuhan.

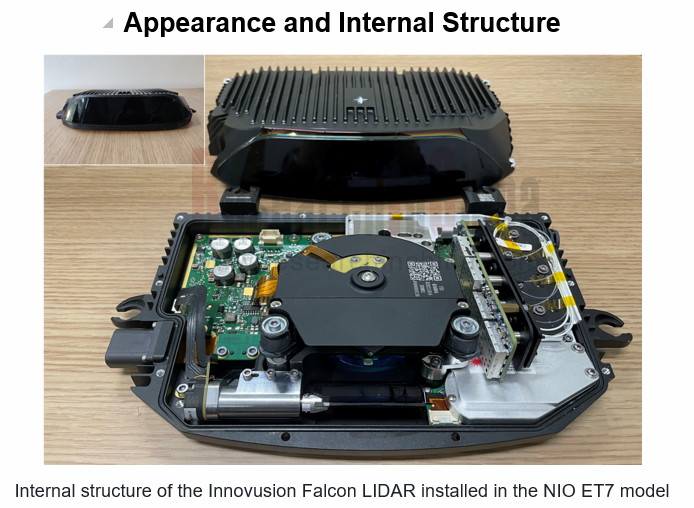

Innovusion Falcon LIDAR dismantled by ResearchInChina comes from NIO ET7 model.

Falcon LIDAR equipped by NIO ET7 uses 1550nm wavelength laser, with a maximum detection distance of 500 meters, and a detection distance of 250 meters under 10% reflectivity, with a horizontal angle of 120 ° and a resolution of 0.06 ° * 0.06 °. The principle of Innovusion Falcon and Luminar LIDAR is almost identical, and the transmitting part is also fiber laser.

The key component of the transmiting part of Falcon LIDAR is fiber laser pump source. The fiber laser pump source is from BWT Beijing, the model is K940EB2HN, and the price is estimated at 2500-3000 yuan. Docked with the pump source is a 1′4′′ WDM wavelength division multiplexer, which is a technology that combines multiple modulated optical signals of different wavelengths (or frequencies) at the sending end through a multiplexer (also called a multiplexer, Mux) and sends them together into the same optical fiber of the optical line (optical fiber transmission link) for transmission. At the receiving end, the demultiplexer (also called a demultiplexer, demux) is used to receive the signals of different wavelengths separately, and then decode them.

The MCU that controls the laser transceiver is located near the pump source. This is Silabs' EFM8 series MCU, which is the most common optical module MCU.

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...